- Canada

- /

- Residential REITs

- /

- TSX:MHC.UN

Cascades And 2 Other Canadian Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

The Canadian market has experienced notable volatility in recent months, with a near 5% pullback in August followed by a strong recovery supported by an expanding economy and positive earnings growth. As the focus shifts from inflation to growth, investors are increasingly looking at undervalued small-cap stocks that could benefit from these evolving conditions. In this article, we will explore Cascades and two other Canadian small-cap companies that have shown promise through insider buying and potential for value appreciation amidst the current market landscape.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Calfrac Well Services | 2.5x | 0.2x | 37.69% | ★★★★★★ |

| Trican Well Service | 7.6x | 0.9x | 13.44% | ★★★★★☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 23.11% | ★★★★★☆ |

| Rogers Sugar | 15.1x | 0.6x | 49.19% | ★★★★★☆ |

| Flagship Communities Real Estate Investment Trust | 3.6x | 3.7x | 46.21% | ★★★★★☆ |

| VersaBank | 9.7x | 4.0x | 14.09% | ★★★★☆☆ |

| Goodfellow | 9.1x | 0.2x | 22.54% | ★★★★☆☆ |

| Hemisphere Energy | 5.7x | 2.2x | 14.87% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -41.33% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 11.8x | 3.2x | 42.36% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Cascades (TSX:CAS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Cascades operates in the production and sale of tissue papers, containerboard packaging products, specialty packaging products, and engages in corporate recovery and recycling activities with a market cap of CA$1.12 billion.

Operations: The company generates revenue primarily from Tissue Papers (CA$1.58 billion), Packaging Products - Containerboard (CA$2.30 billion), and Packaging Products - Specialty Products (CA$644 million). The gross profit margin has shown variability, with a recent value of 35.83% as of September 2023.

PE: -22.2x

Cascades, a Canadian small-cap stock, shows potential for investors seeking undervalued opportunities. Recent insider confidence is evident with Alain Lemaire purchasing 26,500 shares valued at C$255,135 in August 2024. Despite a net loss of C$19 million for the first half of 2024 and challenges in the Tissue Papers segment due to higher pulp prices, Cascades expects improved results from Containerboard and Specialty Packaging. The company declared a quarterly dividend of C$0.12 per share on September 5, 2024.

- Click to explore a detailed breakdown of our findings in Cascades' valuation report.

Explore historical data to track Cascades' performance over time in our Past section.

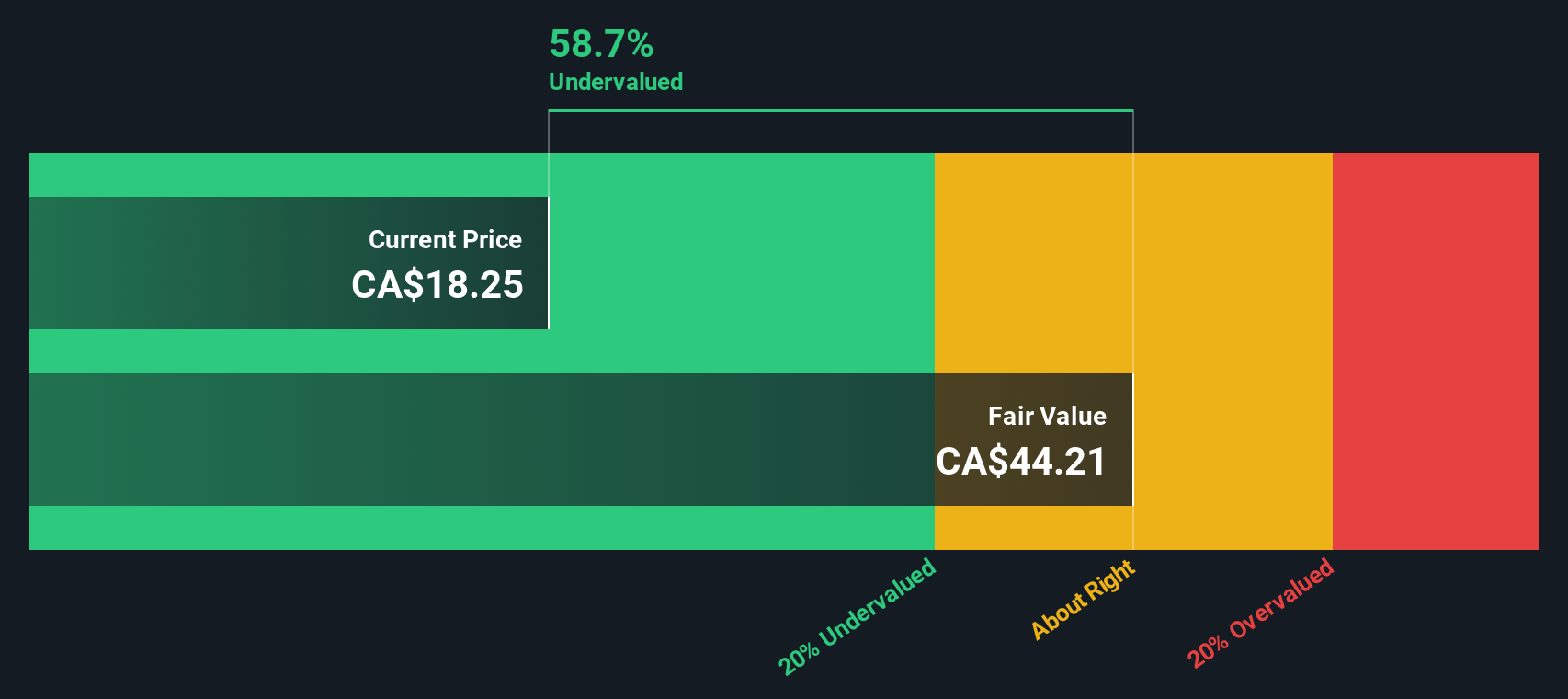

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flagship Communities Real Estate Investment Trust operates in the residential real estate sector and has a market cap of approximately CA$0.53 billion.

Operations: Flagship Communities Real Estate Investment Trust generates revenue primarily from its residential REIT segment, with a notable gross profit margin trend, reaching 66.82% as of Q1 2022. The company incurs costs including COGS and operating expenses, which have impacted its net income margins over various periods.

PE: 3.6x

Flagship Communities Real Estate Investment Trust has shown significant growth, with Q2 2024 earnings of US$43.46 million, up from US$21.39 million a year ago. Basic earnings per share increased to US$2.37 from US$1.39 in the same period last year. Despite this, revenue is expected to grow by only 8.9% annually while future earnings may decline by an average of 46.1% over the next three years due to large one-off items impacting financial results and high-risk external borrowing as their primary funding source.

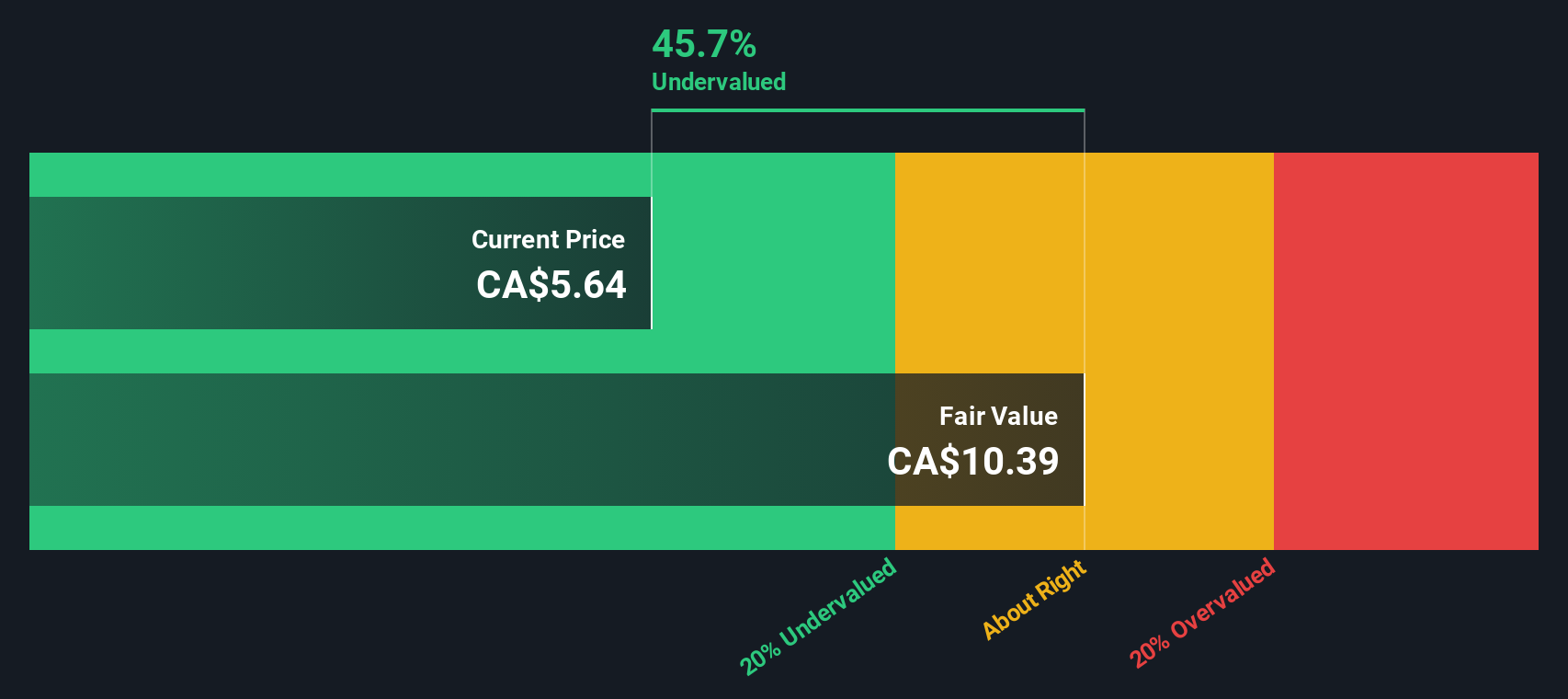

Rogers Sugar (TSX:RSI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rogers Sugar operates in the production and distribution of sugar and maple products, with a focus on the Canadian market, and has a market cap of CA$0.57 billion.

Operations: Rogers Sugar generates revenue primarily from its Sugar and Maple Products segments, with recent revenues reaching CA$1.21 billion. The company's gross profit margin has shown variability, recently standing at 13.87%.

PE: 15.1x

Rogers Sugar, a small cap in Canada, reported CAD 309.09 million sales for Q3 2024, up from CAD 262.29 million the previous year. Despite this growth, net income dropped to CAD 7.38 million from CAD 14.18 million last year. Over nine months, sales reached CAD 898.73 million with net income at CAD 35.17 million compared to the prior year's figures of CAD 796.68 and CAD 39.91 respectively; indicating some operational challenges but also potential for recovery given their consistent dividend payout of $0.09 per share and insider confidence through recent share purchases in July and August of this year.

- Click here to discover the nuances of Rogers Sugar with our detailed analytical valuation report.

Evaluate Rogers Sugar's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock more gems! Our Undervalued TSX Small Caps With Insider Buying screener has unearthed 20 more companies for you to explore.Click here to unveil our expertly curated list of 23 Undervalued TSX Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MHC.UN

Flagship Communities Real Estate Investment Trust

An internally managed, unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario.

Undervalued slight.