- Canada

- /

- Commercial Services

- /

- TSX:BYD

3 Stocks That May Be Trading Up To 40.9% Below Estimated Intrinsic Value

Reviewed by Simply Wall St

Amidst a choppy start to the year for global markets, characterized by stronger-than-expected U.S. labor data and persistent inflation concerns, investors are navigating an environment where equities have faced downward pressure. As value stocks continue to hold up better than their growth counterparts, identifying undervalued stocks becomes increasingly important for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Turkcell Iletisim Hizmetleri (IBSE:TCELL) | TRY95.20 | TRY190.03 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.34 | 50% |

| Bank BTPN Syariah (IDX:BTPS) | IDR860.00 | IDR1715.86 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | US$39.26 | US$78.06 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.98 | 49.7% |

| Shinko Electric Industries (TSE:6967) | ¥5865.00 | ¥11696.09 | 49.9% |

| AK Medical Holdings (SEHK:1789) | HK$4.28 | HK$8.52 | 49.8% |

| TSE (KOSDAQ:A131290) | ₩43400.00 | ₩86241.99 | 49.7% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.20 | CN¥18.40 | 50% |

| Coeur Mining (NYSE:CDE) | US$6.35 | US$12.63 | 49.7% |

Here's a peek at a few of the choices from the screener.

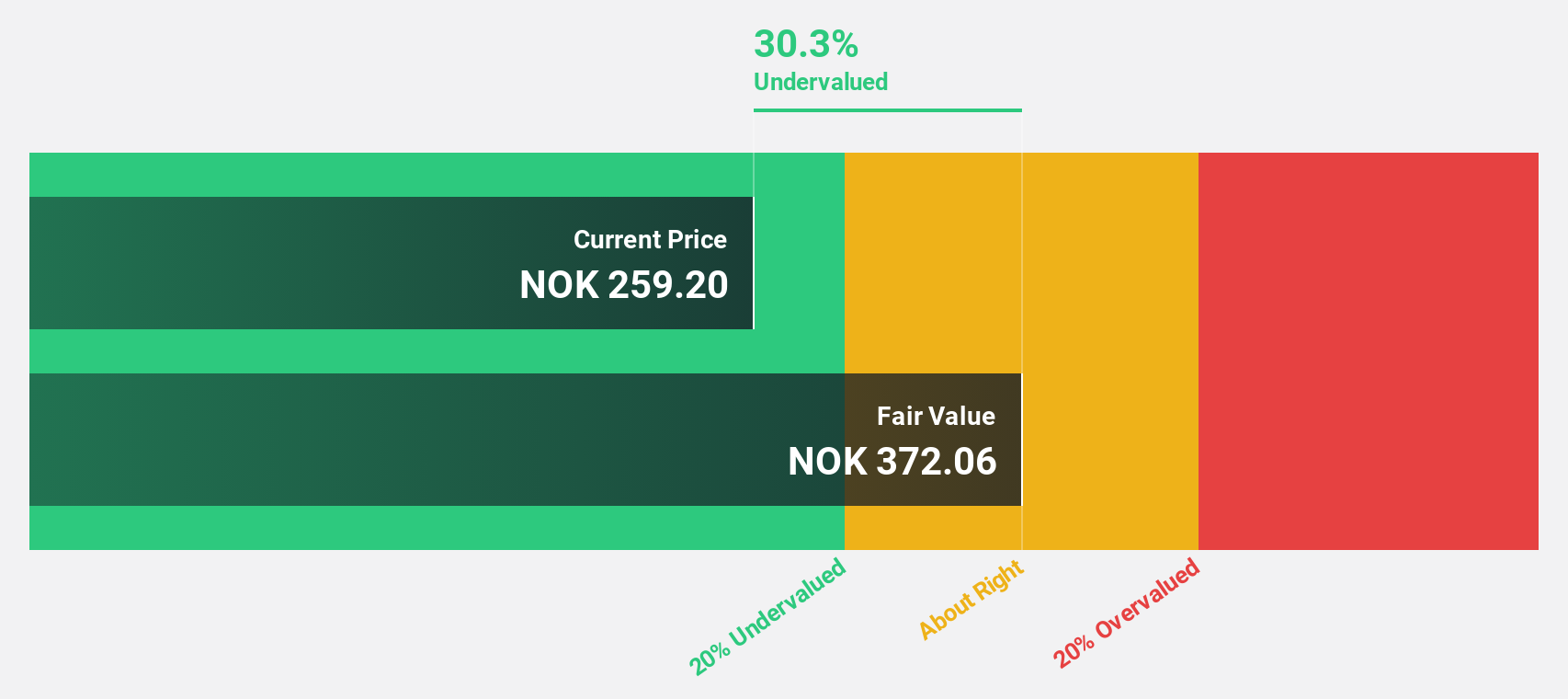

Gjensidige Forsikring (OB:GJF)

Overview: Gjensidige Forsikring ASA provides general insurance and pension products across Norway, Sweden, Denmark, Latvia, Lithuania, and Estonia with a market cap of NOK103.89 billion.

Operations: The company's revenue segments include General Insurance Private at NOK14.80 billion, General Insurance Commercial at NOK20.44 billion, General Insurance Sweden at NOK1.97 billion, and Pension products at NOK1.10 billion.

Estimated Discount To Fair Value: 40.9%

Gjensidige Forsikring is trading at NOK 207.8, significantly below its estimated fair value of NOK 351.34, suggesting it is undervalued based on cash flows. Despite a slower revenue growth forecast of 2.6% annually, earnings are expected to grow by 14.1%, outpacing the Norwegian market's average growth rate of 8.3%. Recent fixed-income offerings totaling NOK 900 million indicate strategic financial maneuvers to strengthen capital structure amidst robust net income growth in recent quarters.

- Our earnings growth report unveils the potential for significant increases in Gjensidige Forsikring's future results.

- Click here to discover the nuances of Gjensidige Forsikring with our detailed financial health report.

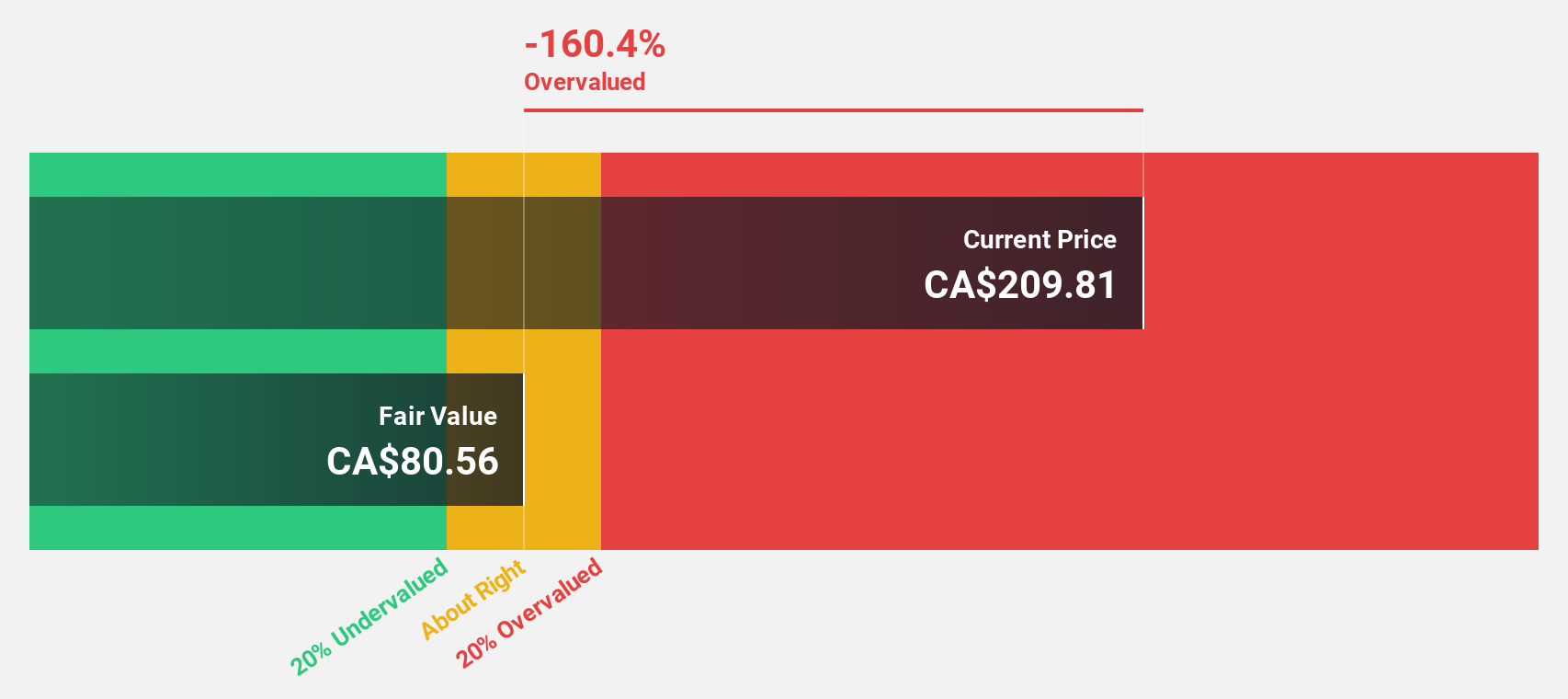

Boyd Group Services (TSX:BYD)

Overview: Boyd Group Services Inc. operates non-franchised collision repair centers across North America and has a market cap of CA$4.59 billion.

Operations: The company generates revenue of $3.06 billion from automotive collision repair and related services in North America.

Estimated Discount To Fair Value: 29.1%

Boyd Group Services, trading at CA$213.54, is undervalued based on cash flows with an estimated fair value of CA$301.02, representing a 29.1% discount. Despite recent challenges in net profit margins and interest coverage, the company's earnings are forecast to grow significantly at 66.5% annually over the next three years, outpacing the Canadian market's average growth rate of 15.5%. Revenue growth is also expected to be slightly above the market average.

- Upon reviewing our latest growth report, Boyd Group Services' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Boyd Group Services stock in this financial health report.

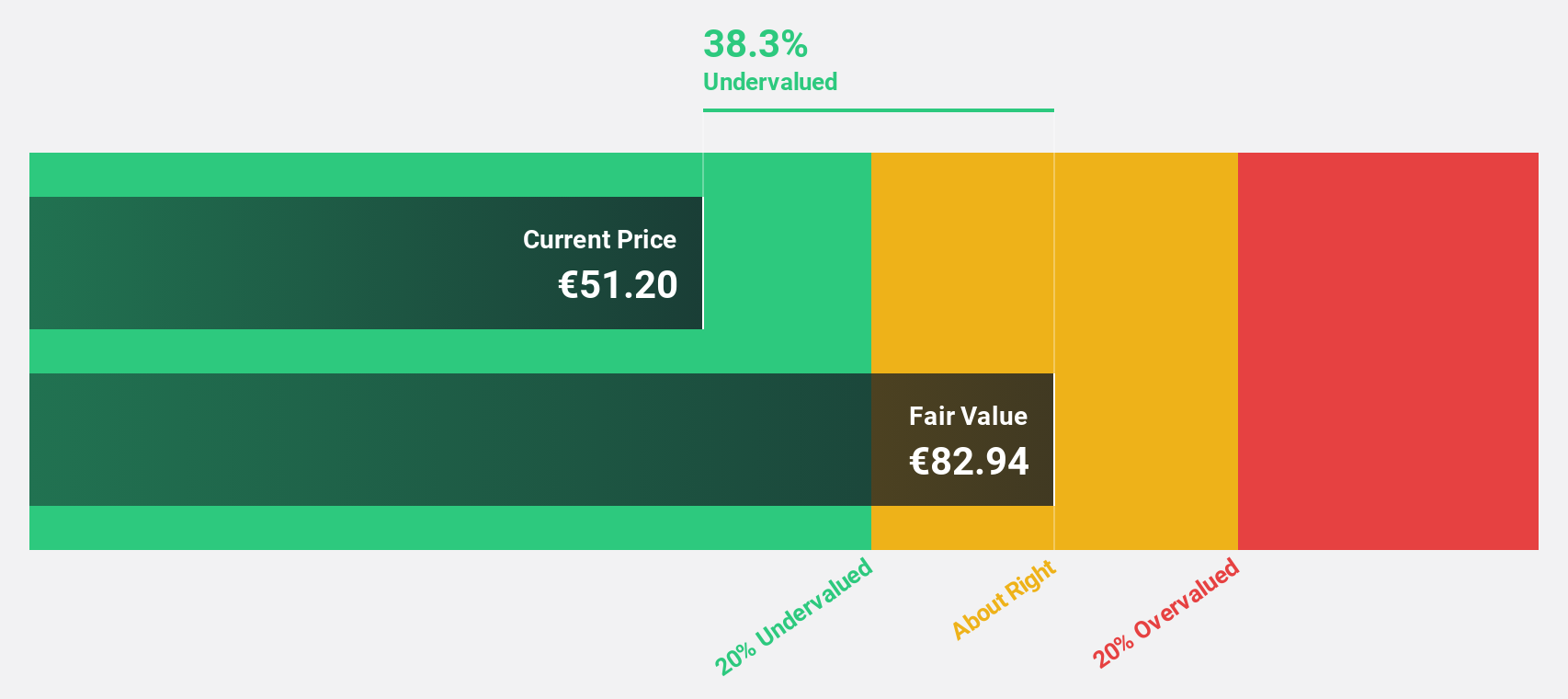

Ströer SE KGaA (XTRA:SAX)

Overview: Ströer SE & Co. KGaA operates in the out-of-home media and online advertising sectors both in Germany and internationally, with a market cap of approximately €3.07 billion.

Operations: The company's revenue is derived from three main segments: Daas & E-Commerce (€352.26 million), Out-Of-Home Media (€941.99 million), and Digital & Dialog Media (€867.49 million).

Estimated Discount To Fair Value: 40%

Ströer SE KGaA, trading at €56.15, is significantly undervalued based on cash flows with a fair value estimate of €91.7, reflecting a 40% discount. Despite high debt levels and unsustainable dividend coverage, earnings are projected to grow substantially by 27.23% annually over the next three years, surpassing the German market's growth rate. Recent talks of divesting its advertising business could impact future valuations as offers exceed current market capitalization (€3.12 billion).

- Our comprehensive growth report raises the possibility that Ströer SE KGaA is poised for substantial financial growth.

- Navigate through the intricacies of Ströer SE KGaA with our comprehensive financial health report here.

Taking Advantage

- Reveal the 874 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boyd Group Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BYD

Boyd Group Services

Operates non-franchised collision repair centers in North America.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives