Quote of the week: “Markets can remain irrational longer than you can remain solvent.” ― John Maynard Keynes

A flurry of deals between a handful of AI companies has prompted an avalanche of market pundits to declare the market an AI-fuelled bubble.

Of course, the AI bubble talk has been going on for months, if not years. But recent deals have been compared to 1999 and even 1929.

Since we don’t have a crystal ball (would be nice though), we’re not going to try to predict what happens next.

However, what we can do is have a look at a few scenarios and some of the ways you can prepare your portfolio for the range of possible outcomes.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

💵 The ‘debasement trade” is Wall Street's latest obsession ( Bloomberg )

- Investors are looking for somewhere to store their wealth amidst a world of monetary debasement. That’s fueling the “debasement trade”: ditching bonds and major currencies, and piling into gold, silver, and bitcoin.

- Gold has grown a whopping $16 trillion since October 2023 to reach an estimated market cap just shy of $30 trillion. Meanwhile, silver’s wild run triggered arbitrage flights across the Atlantic to profit from higher prices in London.

- Investors are betting that the value of sovereign debt (and their currencies) will erode in purchasing power over time as governments continue adding to their massive debt burdens with growing deficits.

- Political instability in France, dovish candidates in Japan, and fiscal jitters in the UK are only accelerating this trend. Meanwhile, the Fed’s softening stance on bank capital rules could also add fuel to inflation fears.

- If debt keeps ballooning and central banks have their hands tied , hard assets are likely to continue receiving inflows from this trend.

😠 US officials blast China's actions on rare earths, urge Beijing to back down ( Reuters )

- China’s tightening of rare earth exports is rattling markets, as U.S. officials warn it’s a strategic play to control critical supply chains. Rare earths power everything from EVs to defense tech, so this isn't just political noise.

- If Beijing follows through, the U.S. may retaliate with steep tariffs or broader decoupling measures. These are risks that could hit manufacturers, especially in auto, tech, and aerospace.

- As we mentioned two weeks ago , keep an eye on alternative rare earth sources (Australia, Canada) or U.S. subsidies to domestic miners like MP Materials.

- China’s tough talk might end up speeding up the global shift away from relying on its rare earth supply.

🛍️ Walmart teams up with OpenAI to allow purchases directly in ChatGPT ( CNBC )

- It appears Walmart is aiming to catch up with how people shop these days, through social media, AI searches, and quick recommendations.

- The feature could shift impulse buying into overdrive, especially during gifting season, as consumers use ChatGPT to hunt for deals or ideas.

- This move could deepen Walmart’s moat, and shows it’s serious about growing its ecommerce business, which is key for competing with Amazon over the long haul.

- The stock jumped 5% on the news, hitting a 52-week high, so investors are clearly excited about its digital push.

- Keep an eye on Walmart’s online sales stats, because this move could be a long-term e-commerce tailwind for the business.

🛢️ Trump says Modi committed to stop Russian oil purchases ( Bloomberg )

- This development hints at a thawing in U.S.-India trade tensions that have been heated by tariffs and visa restrictions.

- If India follows through, it could help reset diplomatic ties and pave the way for trade agreements or relaxed tech visa rules, which are both bullish signals for Indian equities and U.S. firms with Indian exposure.

- Energy markets may also feel the ripple. India will need to replace Russian barrels, potentially boosting demand (and prices) for U.S. or Middle Eastern crude.

- So watch for signs of real policy follow-through, because this could reopen a major growth corridor between the U.S. and India.

🚗 Tesla demand in focus after Trump policies lead GM, Ford to retreat from EV ambitions ( CNBC )

- Legacy automakers are slamming the brakes on EV plans as Trump-era policies gut tax credits and funding. Tesla , while not immune, is suddenly looking like the last brand standing in a shrinking market.

- With Ford , GM , and Stellantis backing off, Tesla could reclaim some U.S. market share, but likely in a smaller, less profitable EV landscape, especially post-incentive.

- Stripped-down Model 3 and Y variants aim to soften the blow, but analysts see margin compression ahead. And with BEV demand likely to dip in Q4, Tesla could face a tough earnings stretch.

- Musk’s moonshot bets on robots and robotaxis remain a sideshow. For now, EVs still carry the weight, even as foreign rivals eat into international market share.

- There might be short-term pain, but keep an eye on Tesla’s U.S. market share figures. If it can grow market share while rivals lose ground, that’s a promising sign in a messy market reset.

🌊 Are AI Leaders Riding a Wave… or a Bubble?

The stock market is putting all of its chips on a few squares.

We’re talking about a level of top-heaviness we haven't seen since the peak of the dot-com era.

A handful of AI giants are fueling a massive capex boom and dominating the entire market narrative. This concentration is creating jaw-dropping opportunities… and equally eye-watering risks.

It’s beginning to look like the entire market hinges on one thing: what AI delivers next.

To be fair, the AI trade is massive. It dwarfs any tech cycle in recent memory.

However, central banks and big financial institutions are whispering the 'B' word (bubble, that is), and for good reason. AI stocks account for 75% of gains, 80% of profits, and 90% of capex spending .

While the stock market has been massively impacted by this trend, the real-world effect on jobs and productivity has yet to gain as much steam.

You know the crew: NVIDIA , Microsoft , Apple , Alphabet , Amazon , Meta , and Tesla .

They’re not just big; they are the market right now. Their spending is literally the engine of economic growth, with almost 40% of the US real GDP growth last quarter coming just from tech capex.

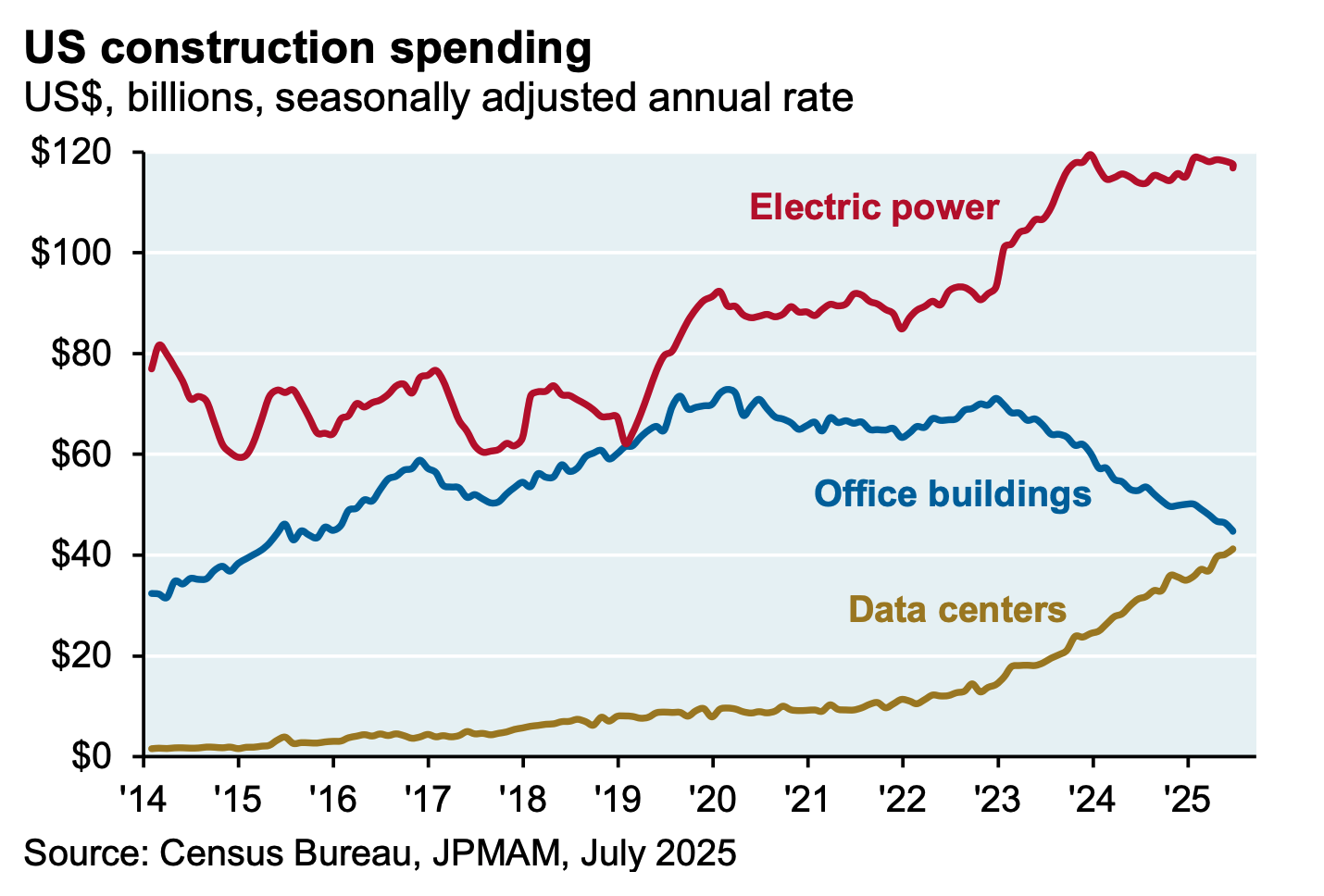

This chart from JP Morgan tells a similar story…

US Construction Spending - JP Morgan

This level of dominance brings two things:

- 🚀 Upside : When they win, the whole index wins.

- 📉 Downside : If they stumble, well… things gets messy.

✨ Valuations: Pricing in Perfection

Current prices aren’t just betting on success; they’re betting on flawless execution for years to come.

NVIDIA’s epic rise to the top epitomizes this frenzy. But since mid-2024, something weird happened: some AI-linked stocks kept climbing even as their fundamentals (like free cash flow) started to trend down.

As the Bank of England gently warned : if the AI optimism fades, this could get bumpy. It's not that AI won't deliver, it's that the market is pricing in a near-perfect, linear rollout. And since when does anything go perfectly? High expectations are a hard bar to pass.

🕸️ A Web of Circular Deals

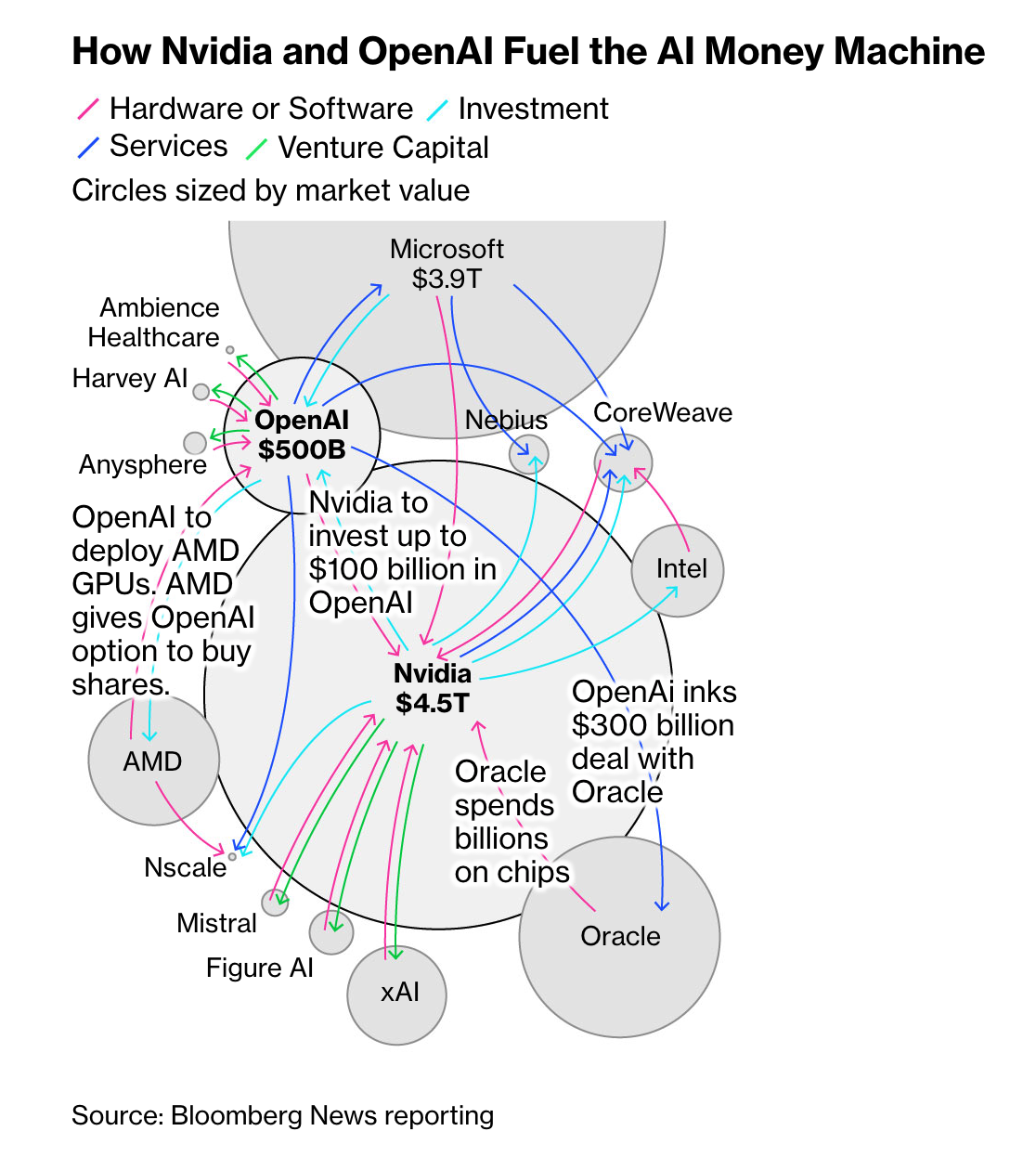

Peek under the hood, and the AI ecosystem looks like a game of financial Jenga.

- NVIDIA invests in AI startups… who then commit to buying NVIDIA chips.

- AMD issues warrants to its biggest customers.

- Hyperscalers (AMZN, GOOG, MSFT, etc) build clouds packed with these chips.

This visual contains plenty of information outlining how intertwined they are.

Nvidia and OpenAI’s Web of Deals - Bloomberg

So is this creative accounting or a smart strategy? Well, it’s what’s called " circular financing."

This is where suppliers fund their customers, who then turn around and buy the suppliers' products. And no, it’s not illegal. In fact, it can be a savvy way to kickstart an ecosystem.

Take Oracle's AI cloud, for example.

It’s competing hard but reporting thin margins. This AI infrastructure game is incredibly capital-intensive, and while that's fine in a land-grab phase, it’s much less fun if borrowing costs stay high.

✨ But … It can also blur the line between real, organic demand and… well, clever dealmaking. For those who saw this movie in the dot-com era, you know how it ended.

For those who didn’t catch it, in the late 1990s, telco equipment companies like Cisco and Lucent offered generous financing to early-stage start-ups . These loans boosted sales on the way up - fuelling the bubble in the process - but had to be written off when those start-ups went bust.

Similar ‘vendor financing’ arrangements are becoming a feature of the AI space. So, with that in mind, there are a few warning signs that need further investigation:

- Revenue is concentrated amongst a few customers (OpenAI, etc), being financed by the vendor (Nvidia, etc).

- Pre-sold capacity at razor-thin margins (eg. Oracle’s cloud margins are under pressure as capacity increases ).

- Strange, non-standard financing arrangements. xAI’s latest deal with Nvidia includes $12.5 billion in debt held in a special purpose vehicle rather than on the company’s own balance sheet. This allows xAI to lease the chips, rather than buying them.

✨ The risk isn’t that these deals can't work. It's that they can make adoption look much stronger than it actually is.

🐂 There Is Still A Bull Case

With all the fear-mongering going on, the bulls now seem to be the contrarians. Let’s consider a few bullish arguments…

- 📅 Too Soon To Disprove Valuations

- Valuations might look lofty - but we won’t really know if they are too high for a few years.

- 🗺️ Alternative Opportunities are Scarce

- Since growth is scarce, AI is one of the few compelling narratives with real momentum, and as a result, capital is naturally flocking to it.

- 💰 They’re Spending Their Own Cash

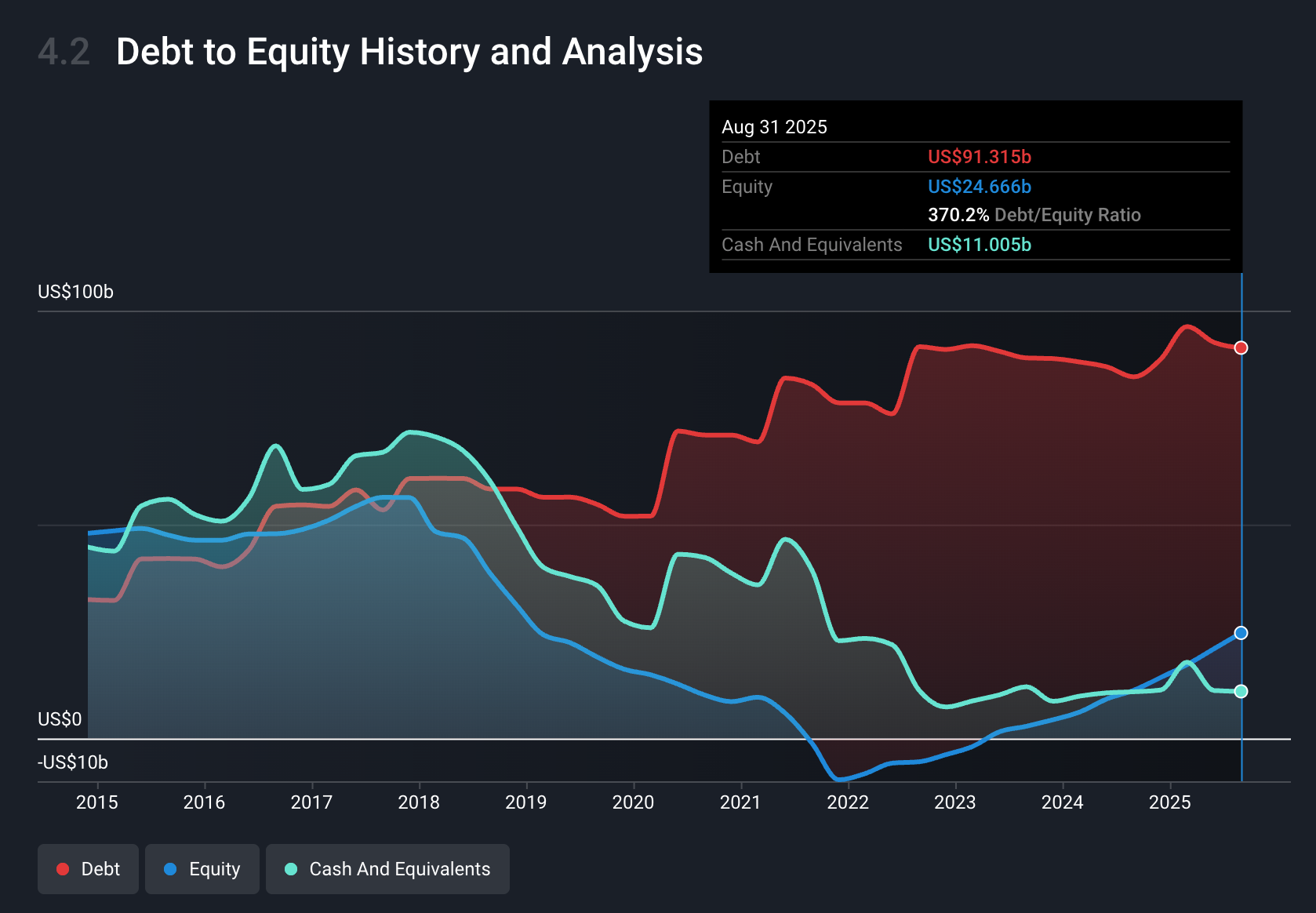

- Unlike the dot-com bubble, most of the really big AI capex is being funded by the megacaps' own massive cash flows and reserves - not risky debt or dilutive stock offerings. However, this isn’t the case across the board, and debt offerings in the tech sector have shot up in 2025 :

- Oracle’s debt is rising as it finances infrastructure to support its deal with OpenAI. As JP Morgan pointed out , “ Oracle is counting on $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants.”

- Unlike the dot-com bubble, most of the really big AI capex is being funded by the megacaps' own massive cash flows and reserves - not risky debt or dilutive stock offerings. However, this isn’t the case across the board, and debt offerings in the tech sector have shot up in 2025 :

Oracle Debt, Cash and Equity - Simply Wall St

👀Looking Ahead

What could kick the AI trade into its next chapter?

In the next 1-2 years:

- 📈The Good

- The most likely positive catalyst would be clear, quantifiable evidence that major corporations are adopting AI tools like Microsoft Copilot and Google’s Gemini at scale and seeing significant productivity gains or cost savings.

- This would validate the spending, but whether it would validate current valuations or not would depend on the actual numbers.

- 📉 The Bad

- Unfortunately, the list of potential negative catalysts is longer:

- An earnings miss or guidance cut from a major supplier or hyperscaler.

- A high-profile AI project failure that dampens corporate enthusiasm.

- A renewal of sticky inflation, forcing the Federal Reserve to hold rates higher for longer, which pressures equity valuations.

- Unfortunately, the list of potential negative catalysts is longer:

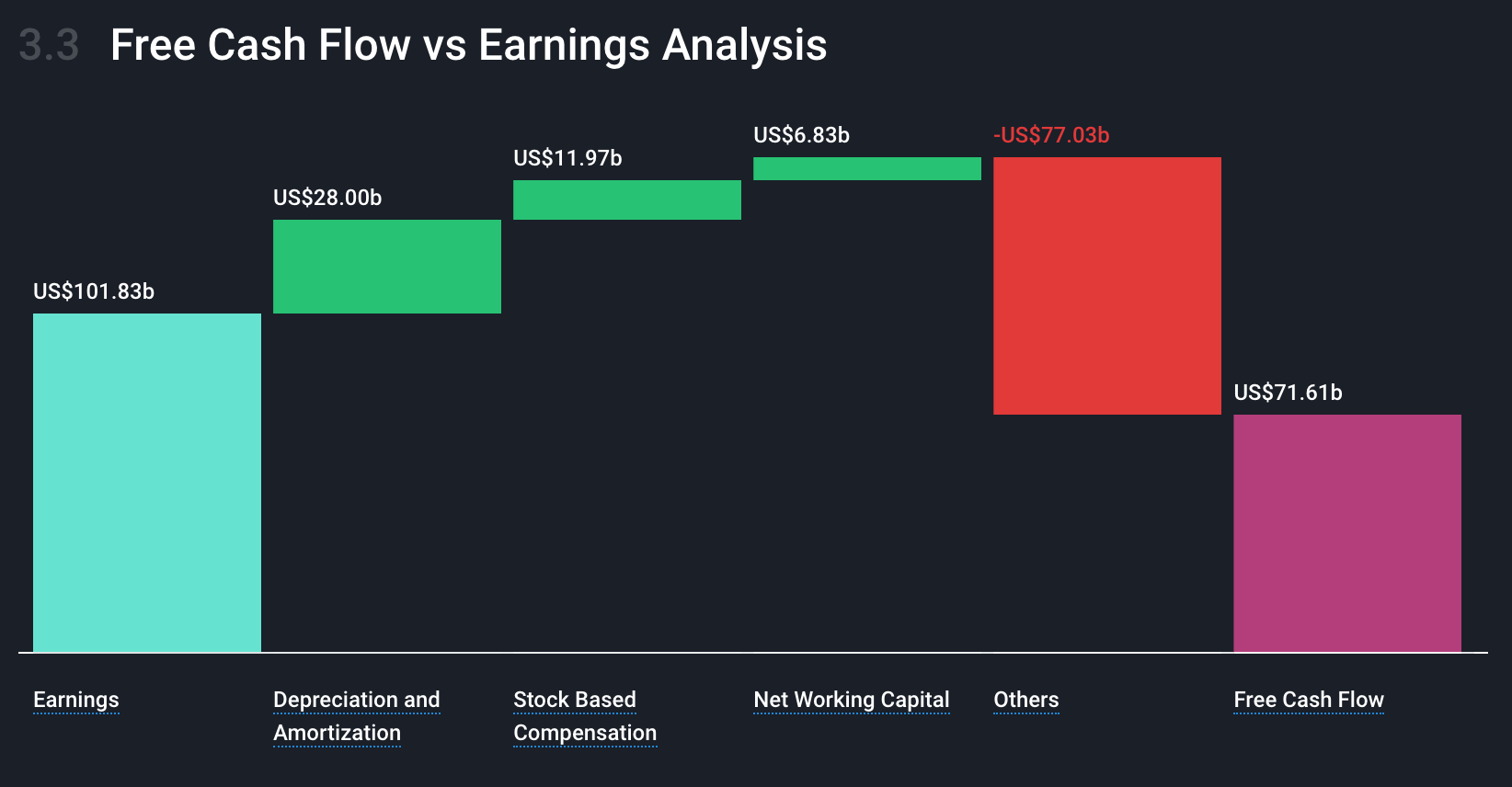

Watch the impact of depreciation on earnings

As mentioned, companies like Microsoft and Alphabet are investing their immense cash reserves. That means no dilution, no new debt, and no impact on earnings - but only in the short term.

Those investments must ultimately be depreciated , which is then reflected on the income statement.

Below, you can see the difference between Microsoft’s earnings and cash flow on the Company Report. The second bar is depreciation, which is a non-cash expense, while the red bar (‘Other’) is mostly Capex, which affects free cash flow.

Microsoft: Earnings vs Cash Flow - Simply Wall St

And, if you click on ‘ Data ’ (bottom right), you can see how the different components have trended over the last 4 years as Capex was added. Microsoft’s depreciation and amortization have nearly doubled….

Microsoft: Earnings vs Cash Flow - Simply Wall St

In the longer term (3-5+ years), things could diverge even more…

- 🏗️ The Boom

- AI delivers a huge productivity boom, optimizing everything from logistics to drug discovery. The infrastructure built today becomes the foundation of a new economy.

- The massive investments being made today mean a few massive winners will dominate the infrastructure layer.

- But, hopefully, new industries and new companies will also emerge further up the value chain.

- ❄️ The Bust

- The "AI Winter." Monetization is slower and weaker than hoped. Overbuilt infrastructure leads to a sector-specific recession in tech as circular financing unravels.

- It’s possible that returns could eventually be realized, but if that takes a decade or more, sentiment could remain weak for years.

✅ The Insight: Hope for the Best, Plan for the Worst

Regardless of your view on the medium or long-term outlook for AI, it would be difficult to assume there definitely won’t be a correction at some point.

And if that happens, given its influence, it’ll probably affect the entire market, and quite likely the entire global economy.

So it’s probably best to be prepared for that outcome - as well as the more optimistic alternative. Heads, you win. Tails, you don’t lose much.

How can you do that? Here are a few ideas:

- ⚠️ Limit your exposure in line with your risk tolerance

- Don’t put yourself in a position where you end up panic-selling after a big decline. Having some cash on the sidelines would also give you buying power if or when prices are lower.

- 💸 Follow the Real Money

- Prioritize companies with diversified, organic demand. Be skeptical of those relying on circular deals for growth.

- 💵 Keep an eye on balance sheets

- Well-capitalized companies stand out for two reasons. Not only do they have a better chance of surviving an AI winter, but they’ll be able to pick up assets on the cheap if things go pear-shaped.

- 👑 Cashflow is King

- Watch free cash flow trends like a hawk. If capex is skyrocketing but revenue and margins aren’t following, it may be a warning sign.

- 🤓 Diversify or Know your Stuff

- Performance is diverging as investors start to bet on the big winners. That could be a good strategy if you’ve really done your homework. The safer option for those less knowledgeable on the specifics is to diversify across the value chain.

- 🔍 Seek out different points of view

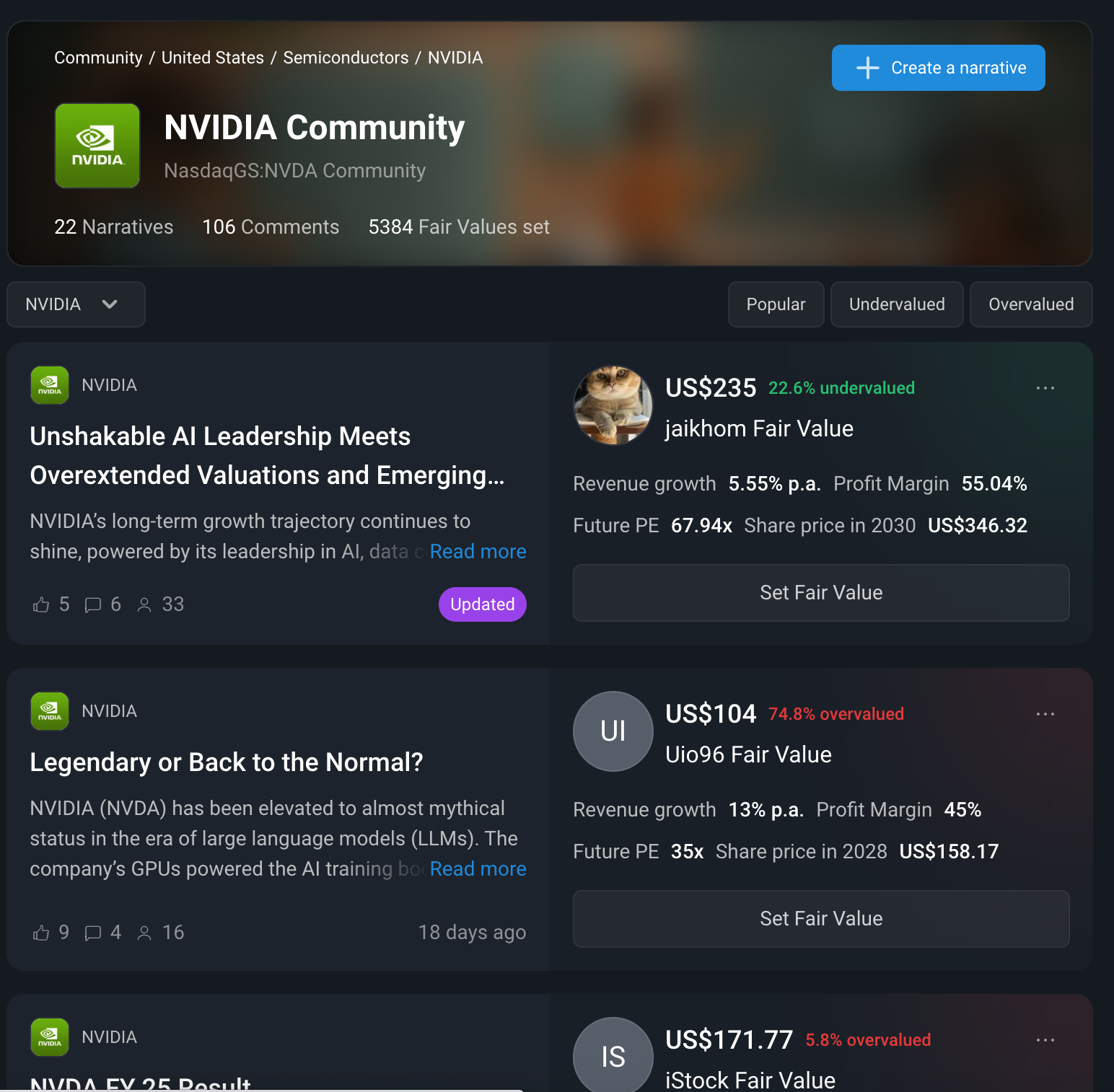

- The Simply Wall Street Community is a great place to find narratives that differ from yours. Check out the NVIDIA community page below:

NVIDIA Community Narratives - Simply Wall St

Key Events During the Next Week

Monday

🇨🇳 GDP Growth (Quarterly/Annualized)

- 📈 Forecast : 5.40%, Previous: 5.20%

- ➡️ Why it matters : The forecast increase in GDP growth suggests China’s recovery remains on track.

Tuesday

🇨🇦 Inflation Rate

- 📈 Forecast : 2.2%, Previous: 1.9%

- ➡️ Why it matters : Inflation is forecast to rise, but remain close to the Bank of Canada’s target - so it’s unlikely to affect policy.

Wednesday

🇬🇧 Inflation Rate

- 📈 Forecast : 4.00%, Previous: 3.80%

- ➡️ Why it matters : UK inflation remains higher than other G7 nations, keeping pressure on the Bank of England to hold rates at relatively high levels.

Friday

🇺🇸 Inflation Rate (Year-over-Year)

- 📈 Forecast : 3.0%, Previous: 2.9%

- ➡️ Why it matters : The Fed’s dovish stance should remain intact unless inflation increases more than the expected 0.1%.

It’s week 2 of Q3 earnings season, with two of the Mag7, a few chip makers, and large caps in most sectors due to report:

- Amazon

- Tesla

- Netflix

- Procter & Gamble

- GE Aerospace

- Coca-Cola

- IBM

- T-Mobile

- Philip Morris

- RTX Corp

- Intel

- Texas Instruments

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.