- Canada

- /

- Metals and Mining

- /

- TSXV:NPR

Graphano Energy And 2 Other TSX Penny Stocks Worth Watching

Reviewed by Simply Wall St

As 2025 begins, the Canadian market is navigating a landscape marked by political shifts and economic fundamentals, with central bank policies and labor markets playing pivotal roles. Amidst this backdrop, penny stocks—though an outdated term—remain a relevant investment area for those seeking growth opportunities at lower price points. These smaller or newer companies can offer significant potential when supported by strong financials and solid fundamentals, making them worth watching in today's market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$392.54M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.41 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.55 | CA$948.57M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$629.3M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$225.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.14 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$180.43M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.01 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Graphano Energy (TSXV:GEL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Graphano Energy Ltd. is engaged in evaluating, acquiring, and developing graphite resources in Canada, with a market cap of CA$1.72 million.

Operations: Graphano Energy Ltd. currently does not report any revenue segments.

Market Cap: CA$1.72M

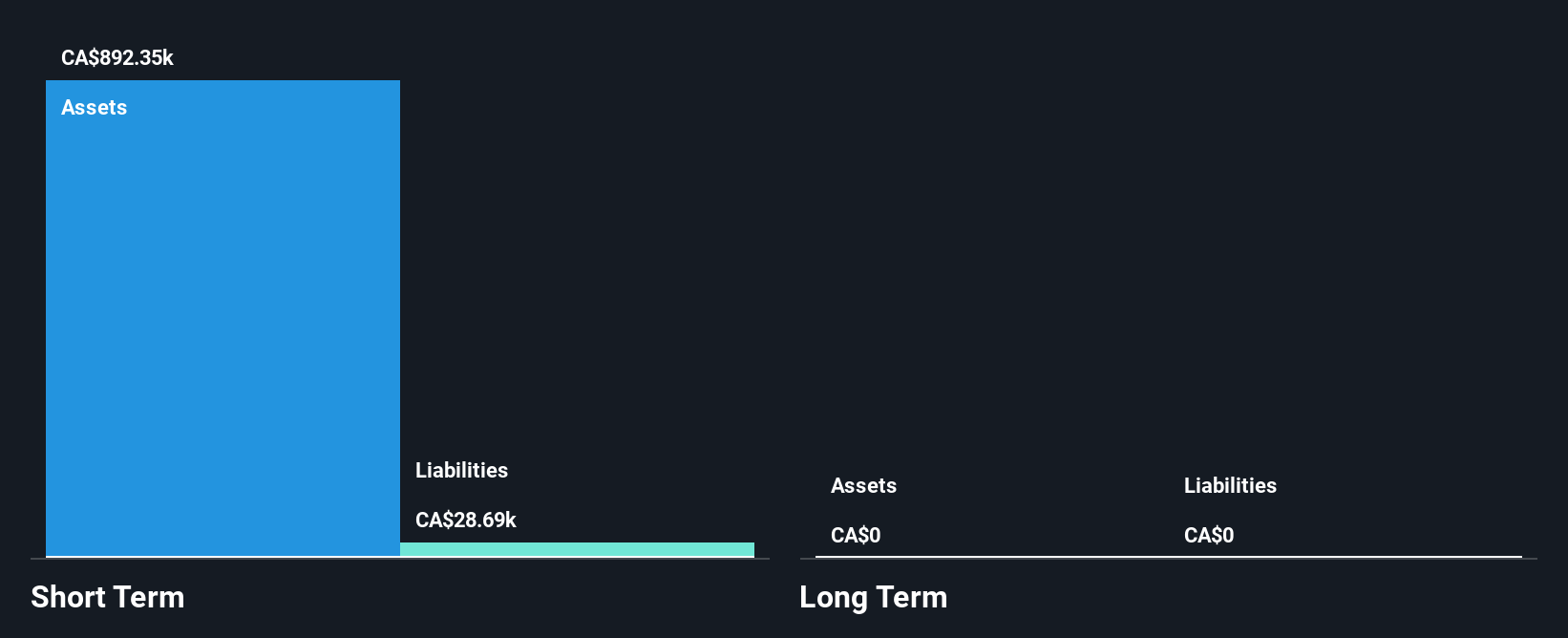

Graphano Energy Ltd., with a market cap of CA$1.72 million, is pre-revenue and unprofitable, reporting increased losses over the past five years. It remains debt-free and has sufficient cash runway for over a year based on its current free cash flow. Despite an experienced management team and board, the company faces challenges such as high share price volatility and negative return on equity (-110.5%). Recent earnings announcements highlighted continued net losses, with auditors expressing doubts about its ability to continue as a going concern, underscoring significant risks associated with investing in this penny stock.

- Navigate through the intricacies of Graphano Energy with our comprehensive balance sheet health report here.

- Gain insights into Graphano Energy's historical outcomes by reviewing our past performance report.

North Peak Resources (TSXV:NPR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: North Peak Resources Ltd. focuses on the exploration and development of gold and silver properties, with a market cap of CA$18.43 million.

Operations: There are no reported revenue segments for North Peak Resources Ltd.

Market Cap: CA$18.43M

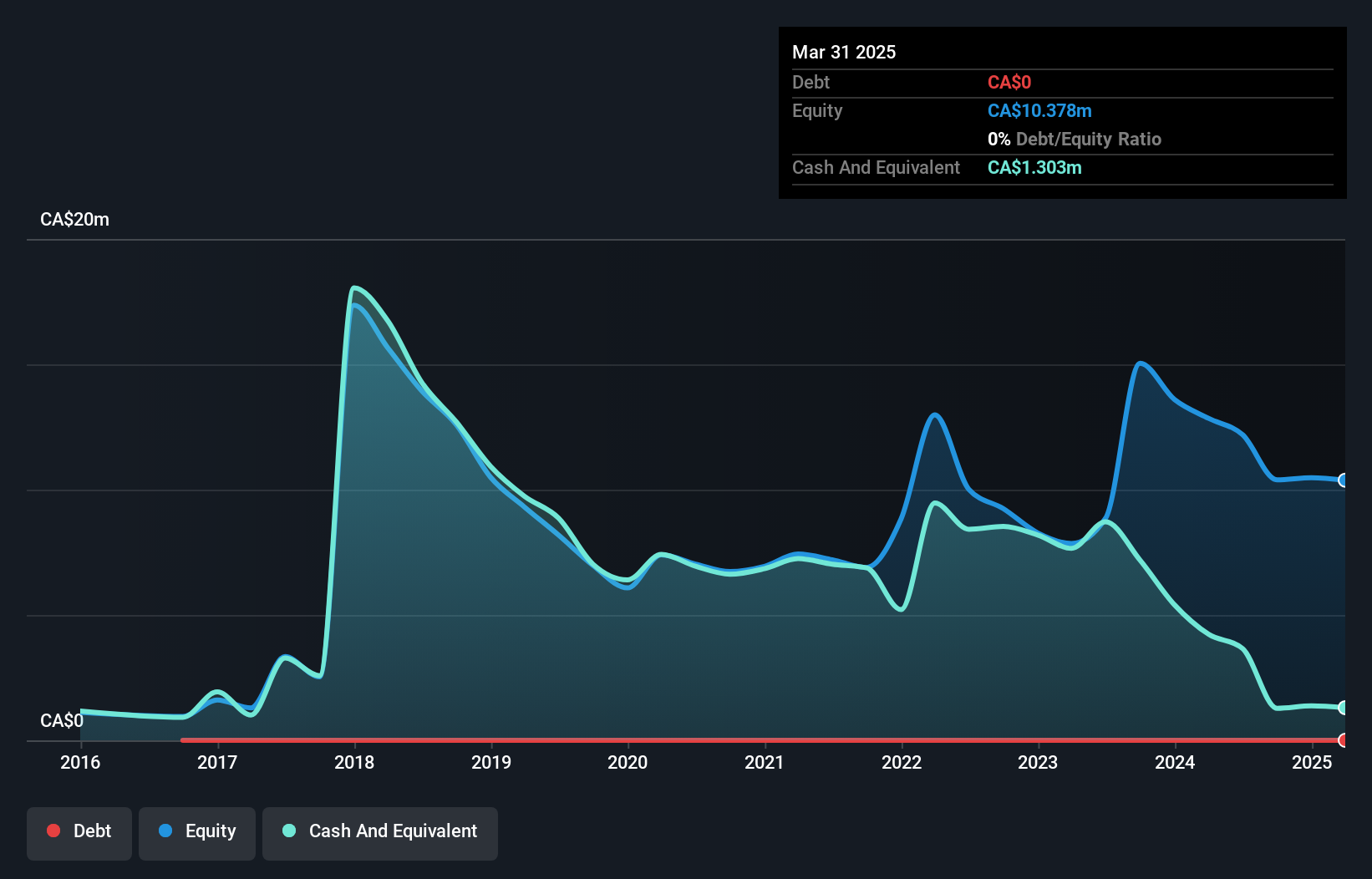

North Peak Resources Ltd., with a market cap of CA$18.43 million, is pre-revenue and focuses on gold exploration. Recent drilling at Prospect Mountain in Nevada yielded promising gold grades, suggesting potential mineralized trends. Despite these encouraging results, the company remains unprofitable with increasing losses and high share price volatility. North Peak has no debt but recently diluted shareholders to raise capital, improving its short-term cash position. The management team is relatively experienced, yet the company faces challenges such as limited cash runway and negative return on equity (-56.26%), highlighting risks typical of penny stocks in the mining sector.

- Dive into the specifics of North Peak Resources here with our thorough balance sheet health report.

- Gain insights into North Peak Resources' past trends and performance with our report on the company's historical track record.

Stuhini Exploration (TSXV:STU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stuhini Exploration Ltd. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and the United States, with a market cap of CA$5.58 million.

Operations: Stuhini Exploration Ltd. does not report any revenue segments.

Market Cap: CA$5.58M

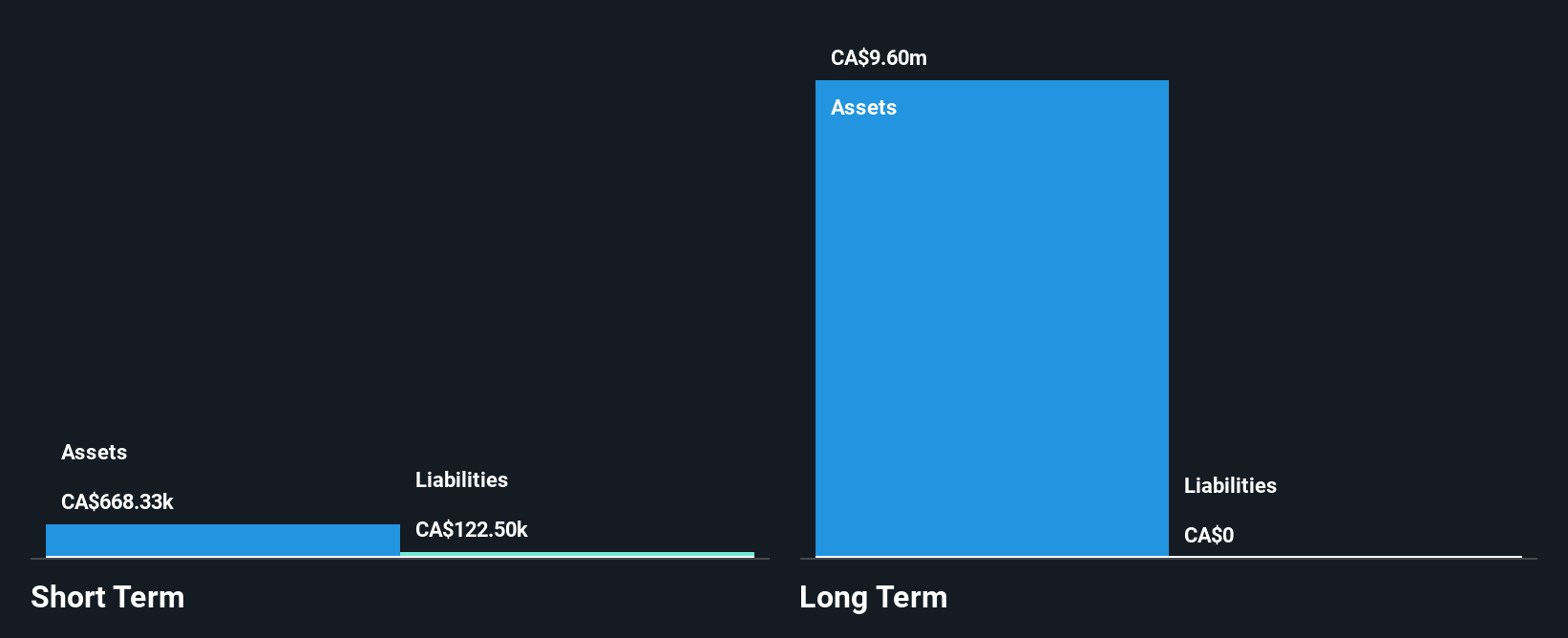

Stuhini Exploration Ltd., with a market cap of CA$5.58 million, is pre-revenue and focuses on mineral exploration in Canada and the U.S. The company has entered into option agreements for gold projects in Nevada, including Jersey Valley and Red Hills, expanding its exploration footprint. Despite being debt-free and having sufficient short-term assets to cover liabilities, Stuhini faces challenges typical of penny stocks such as high share price volatility and negative return on equity (-6.63%). The experienced management team provides stability, but the company remains unprofitable with increasing losses over the past five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Stuhini Exploration.

- Review our historical performance report to gain insights into Stuhini Exploration's track record.

Seize The Opportunity

- Access the full spectrum of 928 TSX Penny Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if North Peak Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NPR

North Peak Resources

Operates as a gold exploration and development company.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026