- Canada

- /

- Real Estate

- /

- TSX:CIGI

Top TSX Growth Stocks With High Insider Ownership In September 2024

Reviewed by Simply Wall St

The Canadian market has climbed 2.0% in the last 7 days and 13% over the past year, with earnings forecast to grow by 15% annually. In this favorable environment, growth companies with high insider ownership can offer compelling opportunities for investors seeking to align their interests with those of company insiders.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.5% | 70.7% |

| Allied Gold (TSX:AAUC) | 22.5% | 73.5% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Propel Holdings (TSX:PRL) | 40% | 37.2% |

| Amerigo Resources (TSX:ARG) | 12% | 36.8% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17.9% | 69.5% |

| ROK Resources (TSXV:ROK) | 16.6% | 161.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc., with a market cap of CA$2.03 billion, focuses on the exploration, evaluation, and development of precious metals projects in Morocco.

Operations: Aya Gold & Silver generates revenue primarily from the production at its Zgounder Silver Mine in Morocco, amounting to $41.54 million.

Insider Ownership: 10.2%

Revenue Growth Forecast: 46.2% p.a.

Aya Gold & Silver, a growth company with significant insider ownership, is forecasted to grow earnings by 71.33% annually, outpacing the Canadian market. Recent substantial insider buying and no major selling indicate strong internal confidence. Despite past shareholder dilution and low future return on equity projections (17.9%), Aya's revenue is expected to rise significantly at 46.2% per year. Notably, Aya recently announced a spinout of its Amizmiz Gold Project and Tijirit Project to Mx2 Mining in North Africa, reinforcing its strategic expansion efforts.

- Click here to discover the nuances of Aya Gold & Silver with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Aya Gold & Silver shares in the market.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. offers commercial real estate professional and investment management services to corporate and institutional clients across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of CA$9.73 billion.

Operations: The company's revenue segments include $2.59 billion from the Americas, $614.55 million from Asia Pacific, $496.42 million from Investment Management, and $734.93 million from Europe, Middle East & Africa (EMEA).

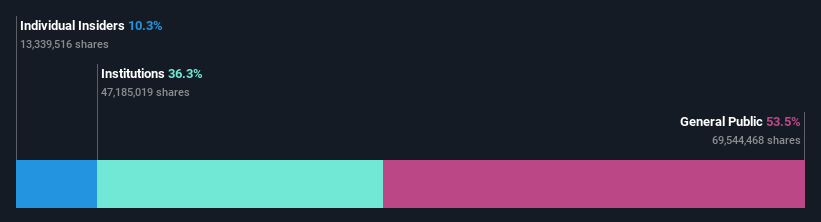

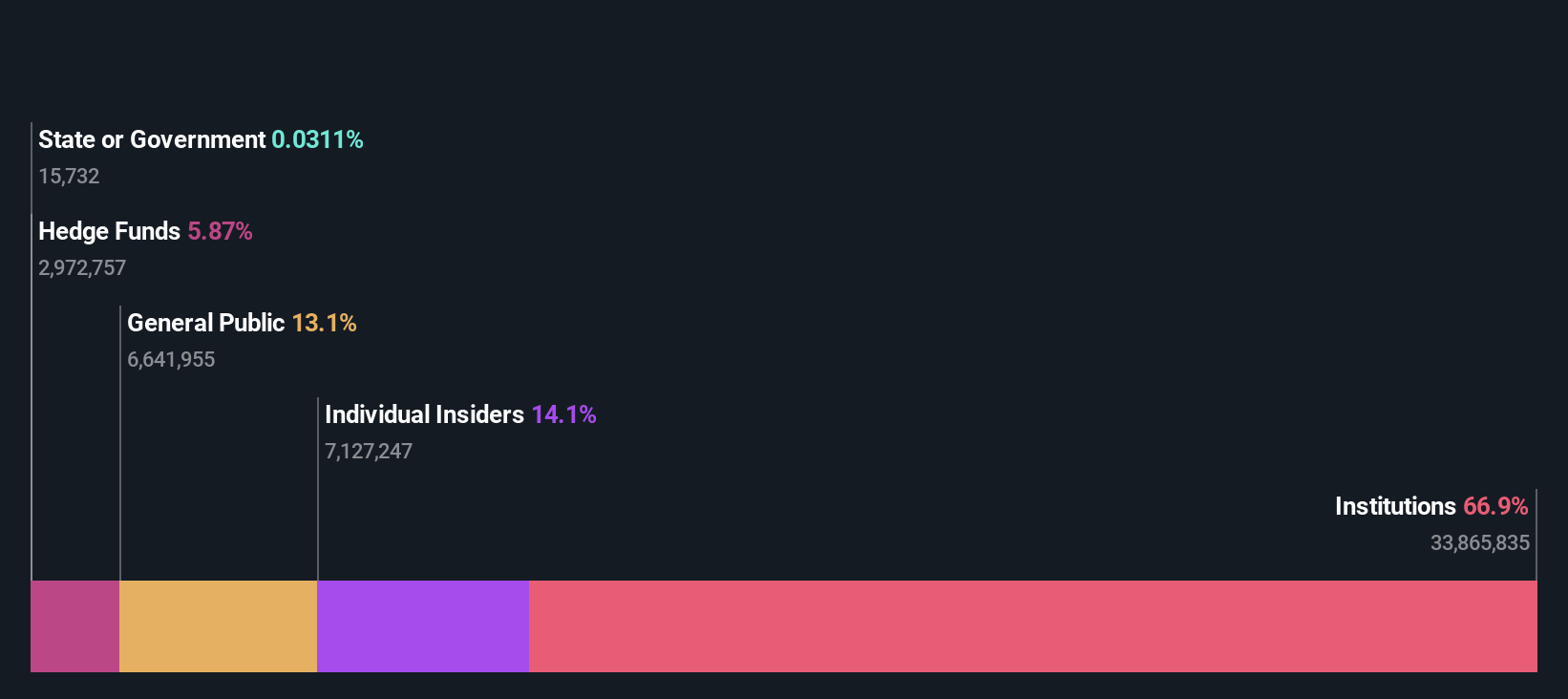

Insider Ownership: 14.2%

Revenue Growth Forecast: 11% p.a.

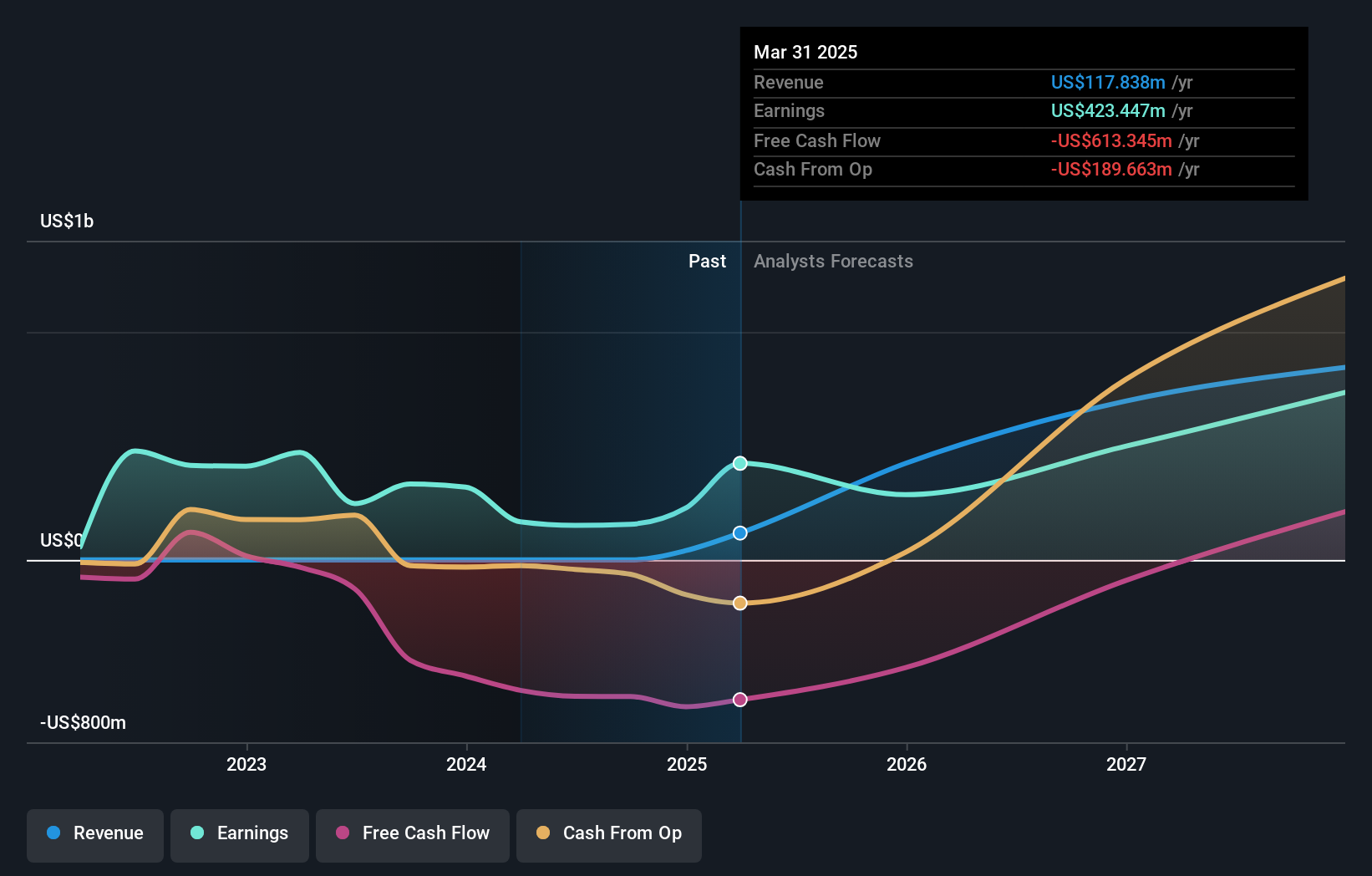

Colliers International Group, with high insider ownership, is forecasted to grow earnings by 20.81% annually, outpacing the Canadian market. Despite past shareholder dilution and slower revenue growth (11% per year), recent earnings surged significantly from a net loss to a net income of US$36.72 million for Q2 2024. Noteworthy insider buying over the past three months suggests internal confidence. Colliers' strategic European expansion through SPGI Zurich AG highlights its growth trajectory.

- Delve into the full analysis future growth report here for a deeper understanding of Colliers International Group.

- The analysis detailed in our Colliers International Group valuation report hints at an inflated share price compared to its estimated value.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$21.71 billion.

Operations: Ivanhoe Mines generates revenue from the mining, development, and exploration of minerals and precious metals mainly in Africa.

Insider Ownership: 12.4%

Revenue Growth Forecast: 83% p.a.

Ivanhoe Mines, a growth company with high insider ownership, is expected to see annual earnings grow significantly at 71.6%, outpacing the Canadian market. Despite past shareholder dilution and recent substantial insider selling, its revenue is forecasted to grow rapidly at 83% per year. Recent milestones include an MOU with Zambia's Ministry of Mines for exploration activities and record copper production at the Kamoa-Kakula Copper Complex in the DRC.

- Click here and access our complete growth analysis report to understand the dynamics of Ivanhoe Mines.

- According our valuation report, there's an indication that Ivanhoe Mines' share price might be on the cheaper side.

Next Steps

- Gain an insight into the universe of 37 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate professional and investment management services to corporate and institutional clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

High growth potential with solid track record.