3 TSX Stocks Estimated To Be Trading At Discounts Of Up To 50%

Reviewed by Simply Wall St

The Canadian market has experienced a robust 23% increase over the last 12 months, with earnings projected to grow by 15% annually. In this thriving environment, identifying stocks that are potentially undervalued can offer opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$188.17 | CA$360.32 | 47.8% |

| Computer Modelling Group (TSX:CMG) | CA$12.05 | CA$21.88 | 44.9% |

| VersaBank (TSX:VBNK) | CA$20.69 | CA$41.31 | 49.9% |

| Trisura Group (TSX:TSU) | CA$43.92 | CA$87.82 | 50% |

| Kinaxis (TSX:KXS) | CA$158.07 | CA$283.54 | 44.3% |

| Endeavour Mining (TSX:EDV) | CA$31.52 | CA$55.96 | 43.7% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Sandstorm Gold (TSX:SSL) | CA$8.10 | CA$13.79 | 41.3% |

| Blackline Safety (TSX:BLN) | CA$6.38 | CA$10.98 | 41.9% |

| Boyd Group Services (TSX:BYD) | CA$212.00 | CA$343.04 | 38.2% |

Let's dive into some prime choices out of the screener.

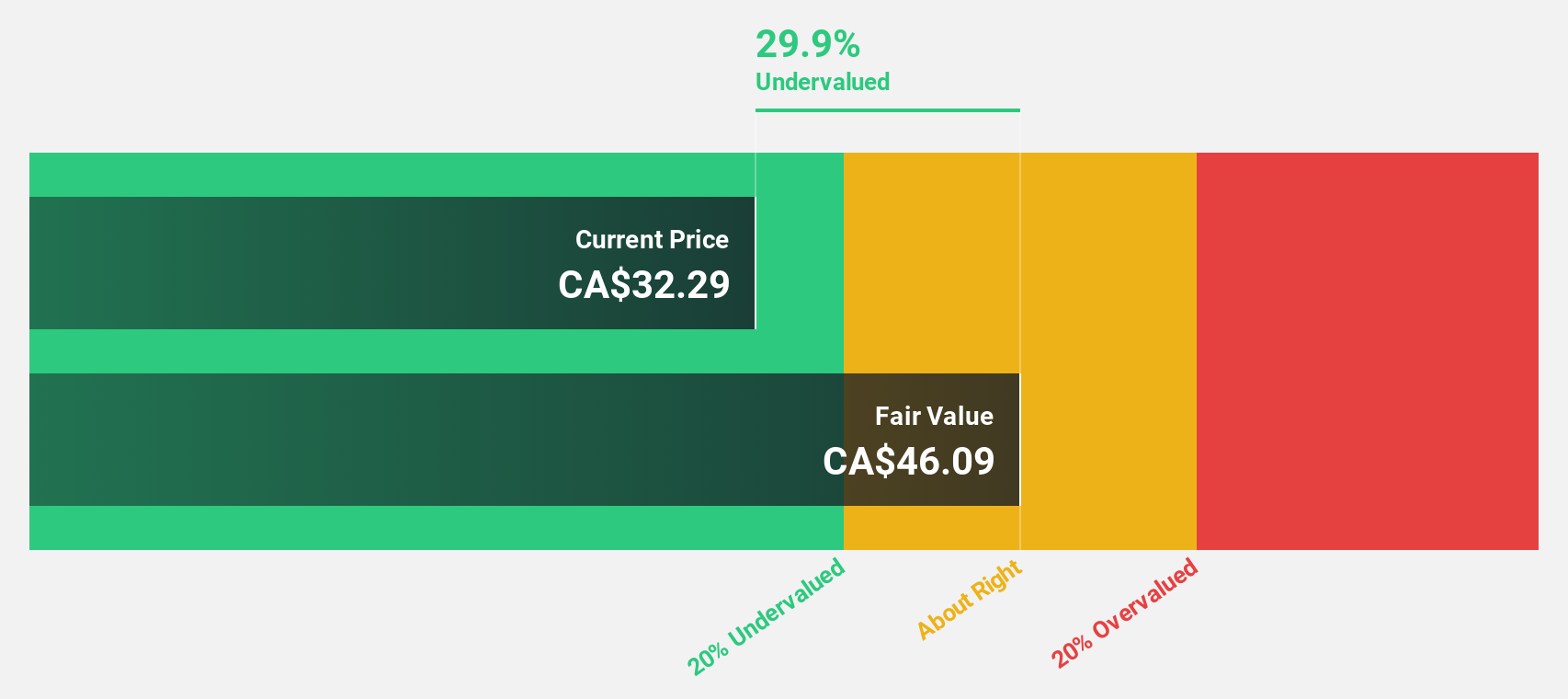

Triple Flag Precious Metals (TSX:TFPM)

Overview: Triple Flag Precious Metals Corp. is a streaming and royalty company that focuses on acquiring and managing precious metals interests across various countries, with a market cap of approximately CA$4.55 billion.

Operations: The company's revenue segment primarily consists of acquiring and managing precious metal and other high-quality streams and royalties, generating $222.27 million.

Estimated Discount To Fair Value: 26.8%

Triple Flag Precious Metals is trading at a significant discount to its estimated fair value of CA$30.83, with its current price at CA$22.58. Despite recent insider selling, the company shows potential for profitability within three years, outpacing average market growth forecasts. Recent quarterly revenue of US$73.7 million from record metal sales highlights robust cash flow generation, bolstered by strategic acquisitions like the 3% gold streams on Agbaou and Bonikro mines for US$53 million.

- Insights from our recent growth report point to a promising forecast for Triple Flag Precious Metals' business outlook.

- Dive into the specifics of Triple Flag Precious Metals here with our thorough financial health report.

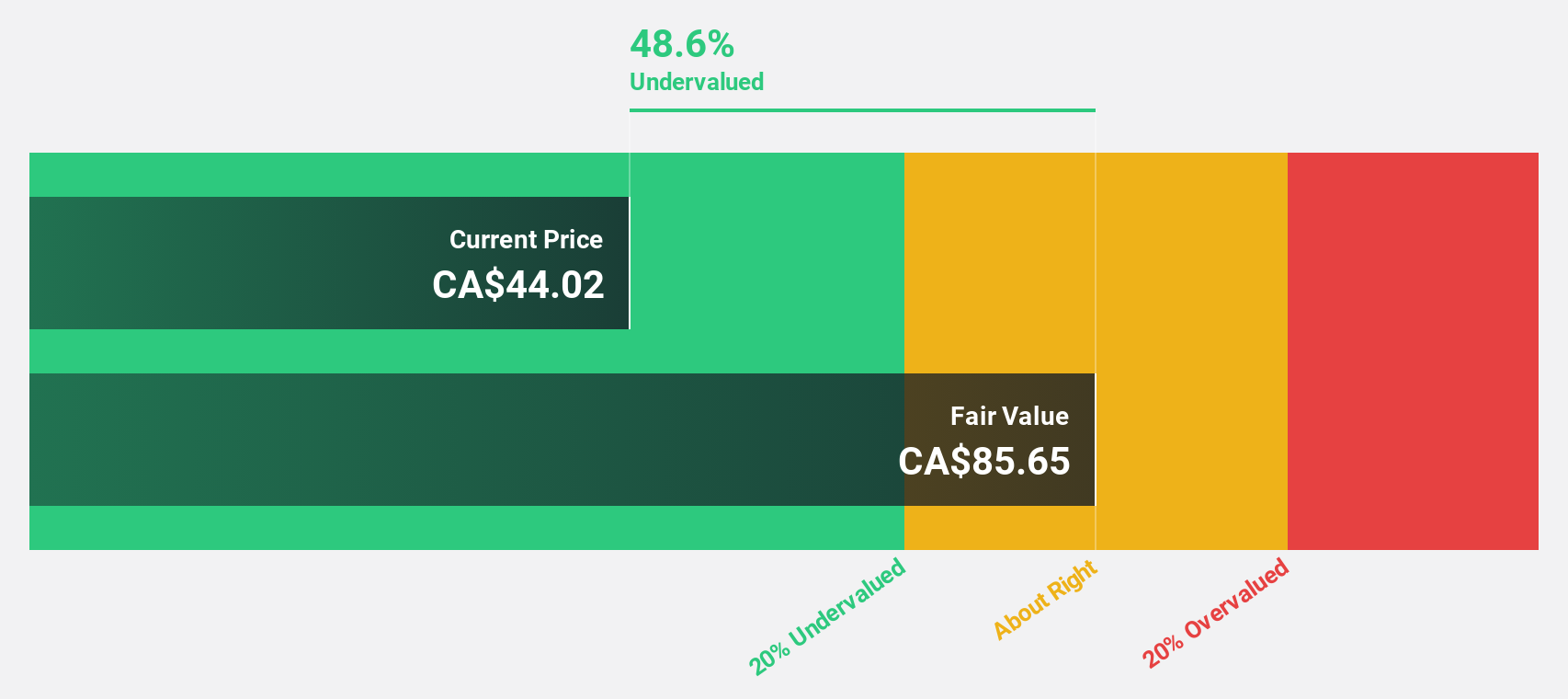

Trisura Group (TSX:TSU)

Overview: Trisura Group Ltd. is a specialty insurance company engaged in surety, risk solutions, corporate insurance, and reinsurance across Canada, the United States, and internationally with a market cap of CA$2.09 billion.

Operations: The company's revenue is primarily derived from Trisura Specialty, generating CA$935.87 million, and Trisura US Programs, contributing CA$2.03 billion.

Estimated Discount To Fair Value: 50%

Trisura Group is trading at a substantial discount, with its current price of CA$43.92 significantly below the estimated fair value of CA$87.82. The company reported a strong increase in net income for the first half of 2024, reaching CAD 63.57 million from CAD 40.78 million last year, highlighting robust cash flow generation. Earnings are expected to grow by over 25% annually, outpacing the Canadian market's growth forecast of 14.7%.

- According our earnings growth report, there's an indication that Trisura Group might be ready to expand.

- Navigate through the intricacies of Trisura Group with our comprehensive financial health report here.

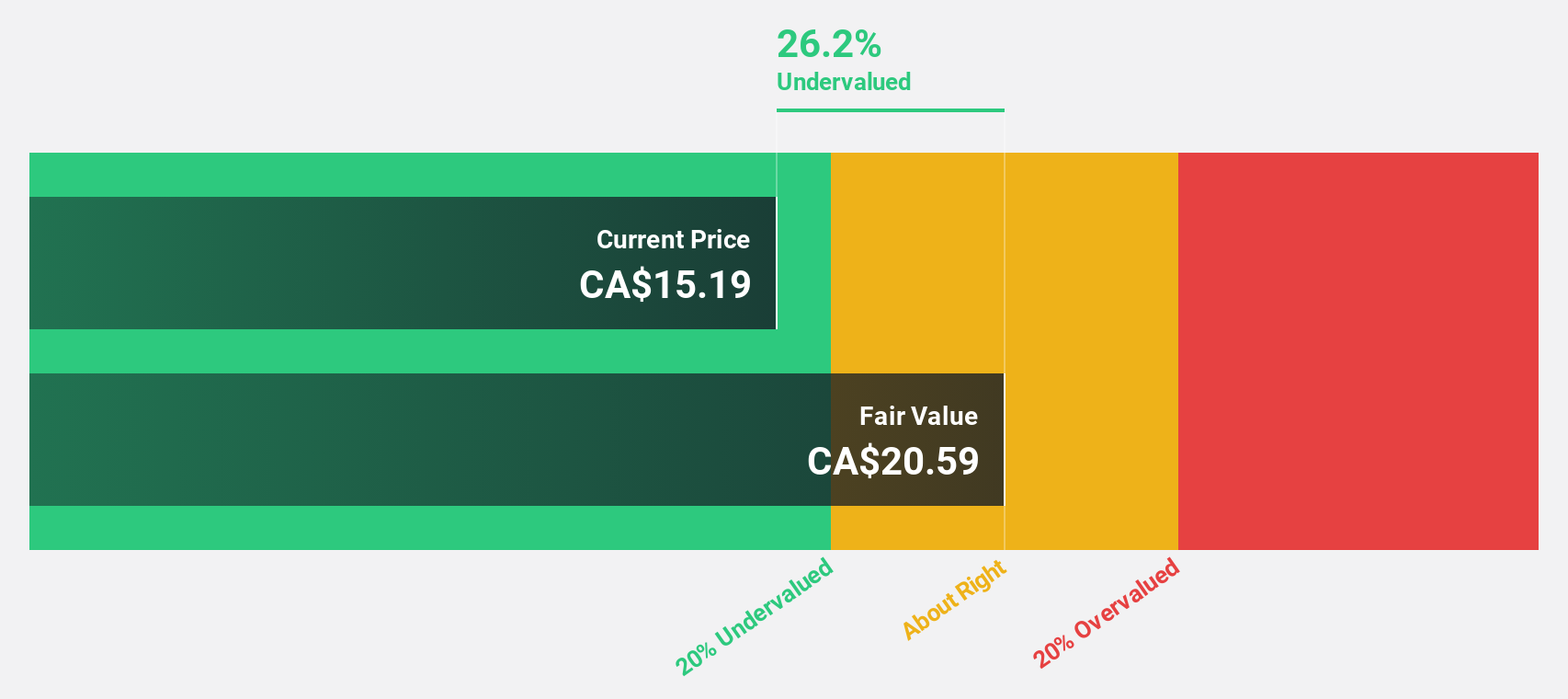

VersaBank (TSX:VBNK)

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$537.24 million.

Operations: The company's revenue segments include CA$105.16 million from Digital Banking and CA$10.75 million from DRTC, which encompasses cybersecurity services and banking and financial technology development.

Estimated Discount To Fair Value: 49.9%

VersaBank is trading at CA$20.69, significantly below its estimated fair value of CA$41.31, reflecting a potential undervaluation based on cash flows. The bank's earnings are projected to grow over 30% annually, surpassing the Canadian market's growth rate of 14.7%. Recent quarterly results show stable net interest income and increased nine-month net income to CA$34.23 million from CA$29.68 million last year, supporting its strong cash flow profile amidst competitive industry positioning.

- Our comprehensive growth report raises the possibility that VersaBank is poised for substantial financial growth.

- Get an in-depth perspective on VersaBank's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 26 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VBNK

VersaBank

Provides various banking products and services in Canada and the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives