Three Value Stocks Priced Below Estimated Worth In November 2024

Reviewed by Simply Wall St

As global markets navigate a period of heightened economic activity and mixed signals from earnings reports, investors are keenly observing the performance of major indices, which have seen fluctuations amid busy data weeks. With value stocks showing resilience compared to their growth counterparts, this environment presents an opportunity to identify stocks that may be trading below their intrinsic worth. In such a climate, finding undervalued stocks requires a focus on strong fundamentals and potential for recovery or growth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.85 | US$37.47 | 49.7% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.47 | 50% |

| Arteche Lantegi Elkartea (BME:ART) | €6.10 | €12.20 | 50% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 50% |

| Bangkok Genomics Innovation (SET:BKGI) | THB2.68 | THB5.35 | 49.9% |

| BayCurrent Consulting (TSE:6532) | ¥4902.00 | ¥9762.93 | 49.8% |

| Redcentric (AIM:RCN) | £1.20 | £2.39 | 49.8% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.72 | CN¥9.39 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.91 | US$546.14 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

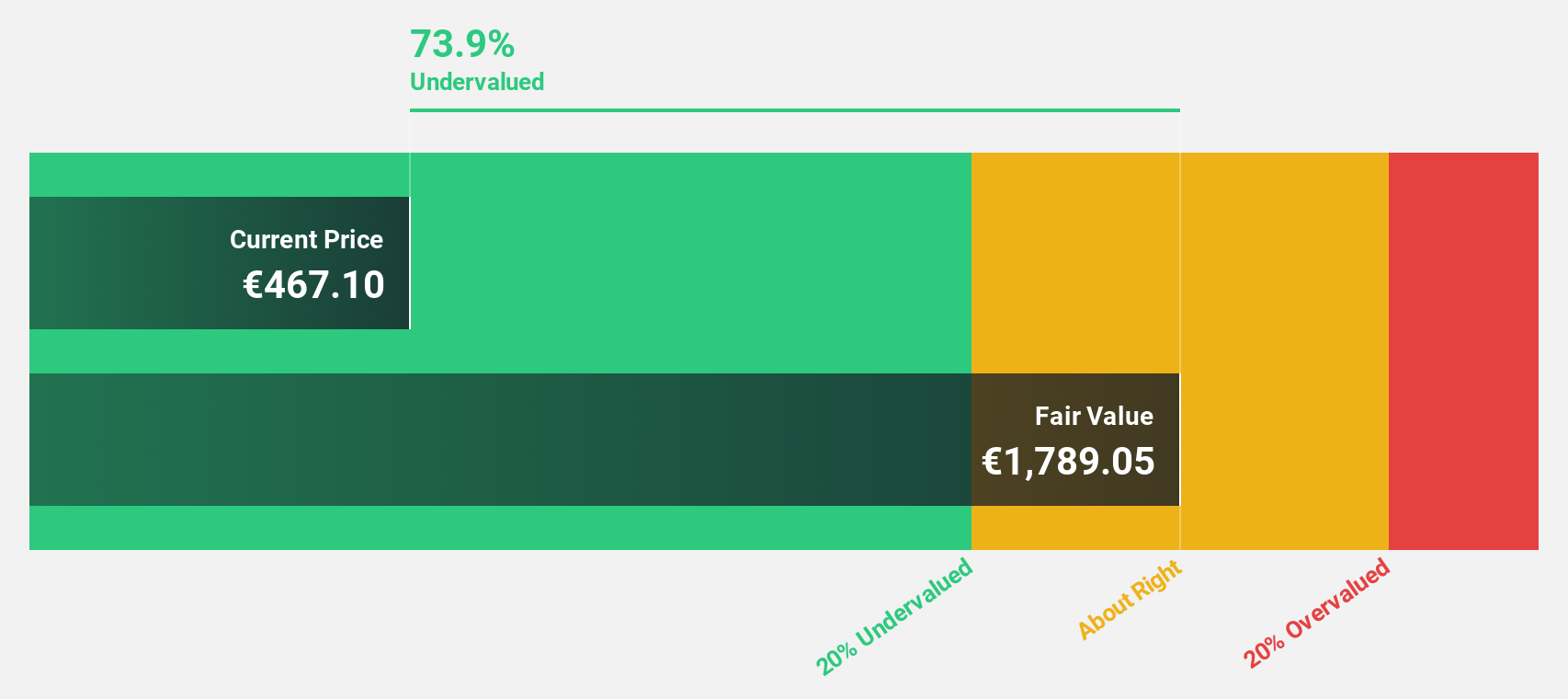

argenx (ENXTBR:ARGX)

Overview: argenx SE is a biotechnology company focused on developing therapies for autoimmune diseases across the United States, Japan, Europe, the Middle East, Africa, and China with a market cap of €32.98 billion.

Operations: The company generates revenue from its biotechnology segment, amounting to $1.91 billion.

Estimated Discount To Fair Value: 44.8%

argenx is trading significantly below its estimated fair value, with a valuation gap exceeding 20% based on discounted cash flow analysis. Recent FDA approval of VYVGART Hytrulo for CIDP and strong clinical trial results bolster its growth prospects. Despite notable insider selling, revenue is forecast to grow at 26.2% annually, outpacing the Belgian market's average, and earnings are expected to increase by 58.04% per year as profitability approaches within three years.

- According our earnings growth report, there's an indication that argenx might be ready to expand.

- Navigate through the intricacies of argenx with our comprehensive financial health report here.

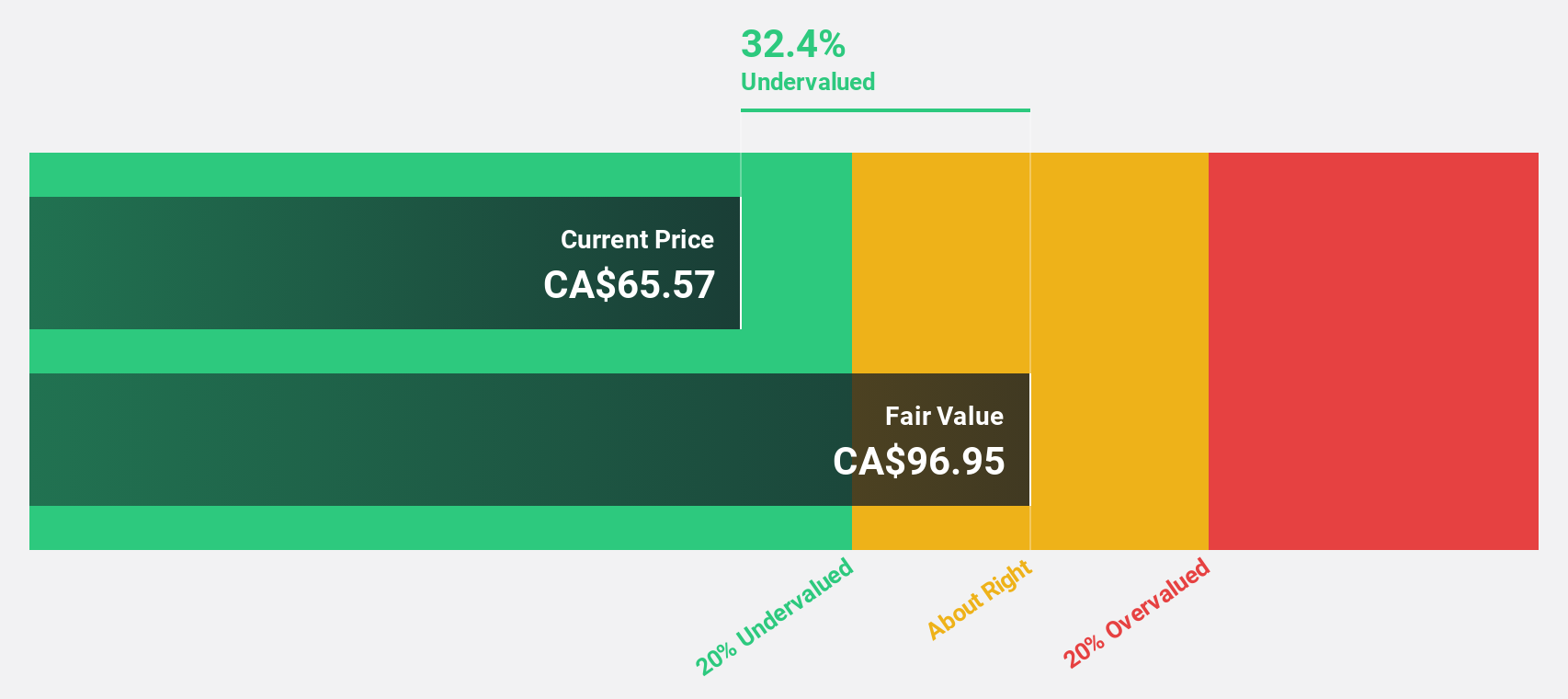

GFL Environmental (TSX:GFL)

Overview: GFL Environmental Inc. provides non-hazardous solid waste management and environmental services in Canada and the United States, with a market cap of CA$22.84 billion.

Operations: The company's revenue segments consist of CA$4.79 billion from U.S. solid waste, CA$2.16 billion from Canadian solid waste, and CA$1.67 billion from environmental services.

Estimated Discount To Fair Value: 28.5%

GFL Environmental is trading 28.5% below its estimated fair value of CA$81.21, based on discounted cash flow analysis. The company aims to enhance its capital structure by transitioning more debt from secured to unsecured through a US$210 million bond offering, which was significantly oversubscribed. Despite recent insider selling and past shareholder dilution, GFL's earnings are forecasted to grow substantially at 117.13% annually as it moves toward profitability within three years.

- The analysis detailed in our GFL Environmental growth report hints at robust future financial performance.

- Get an in-depth perspective on GFL Environmental's balance sheet by reading our health report here.

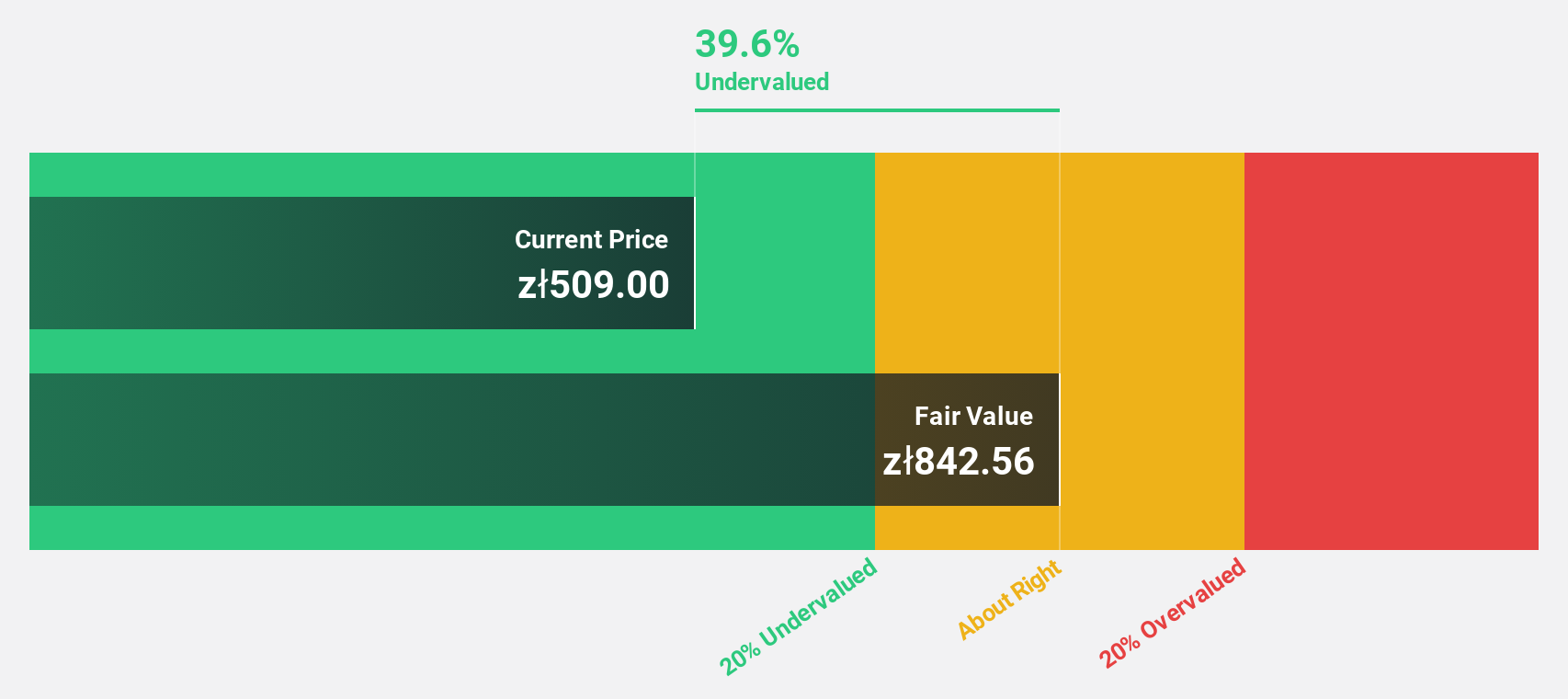

Dino Polska (WSE:DNP)

Overview: Dino Polska S.A. operates a network of mid-sized grocery supermarkets under the Dino brand in Poland, with a market capitalization of PLN32.52 billion.

Operations: The company's revenue is primarily generated from its network of mid-sized grocery supermarkets in Poland.

Estimated Discount To Fair Value: 30.6%

Dino Polska is trading at PLN 331.7, significantly below its estimated fair value of PLN 478.23, suggesting undervaluation based on cash flows. Despite a recent dip in quarterly net income to PLN 347.87 million from PLN 362.19 million, earnings have consistently grown over the past five years and are forecasted to grow faster than the Polish market at 17.4% annually, supported by robust revenue growth projections of 14.7% per year.

- In light of our recent growth report, it seems possible that Dino Polska's financial performance will exceed current levels.

- Dive into the specifics of Dino Polska here with our thorough financial health report.

Key Takeaways

- Get an in-depth perspective on all 955 Undervalued Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ARGX

argenx

A biotechnology company, engages in the developing of various therapies for the treatment of autoimmune diseases in the United States, Japan, Europe, Middle East, Africa, and China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives