ASX Growth Leaders With Strong Insider Ownership For November 2024

Reviewed by Simply Wall St

As the Australian market navigates a slight downturn with the ASX200 down 0.25% at 8178 points, investors are closely watching global influences like Wall Street's record highs following Donald Trump's re-election. In this environment, growth companies with strong insider ownership can offer unique insights and potential stability, making them intriguing prospects for those looking to align with well-supported leadership strategies.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Medallion Metals (ASX:MM8) | 12.9% | 72.7% |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| Catalyst Metals (ASX:CYL) | 14.8% | 33.1% |

| Acrux (ASX:ACR) | 18.4% | 91.6% |

| AVA Risk Group (ASX:AVA) | 15.7% | 77.3% |

| Pointerra (ASX:3DP) | 20.8% | 126.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

Let's review some notable picks from our screened stocks.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★★

Overview: IperionX Limited focuses on the exploration and development of mineral properties in the United States, with a market capitalization of A$963.68 million.

Operations: IperionX Limited does not currently report any revenue segments.

Insider Ownership: 17.7%

IperionX's growth potential is underscored by its forecasted revenue increase of 102% annually, outpacing the Australian market. Despite a recent A$100 million equity offering causing shareholder dilution, the company is trading significantly below estimated fair value. Recent developments include a contract with Ford for titanium components and technological advancements in titanium production. While currently unprofitable, IperionX's projected high return on equity and anticipated profitability within three years highlight its growth trajectory.

- Navigate through the intricacies of IperionX with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that IperionX is trading beyond its estimated value.

Kogan.com (ASX:KGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kogan.com Ltd is an online retailer based in Australia with a market capitalization of A$486.91 million.

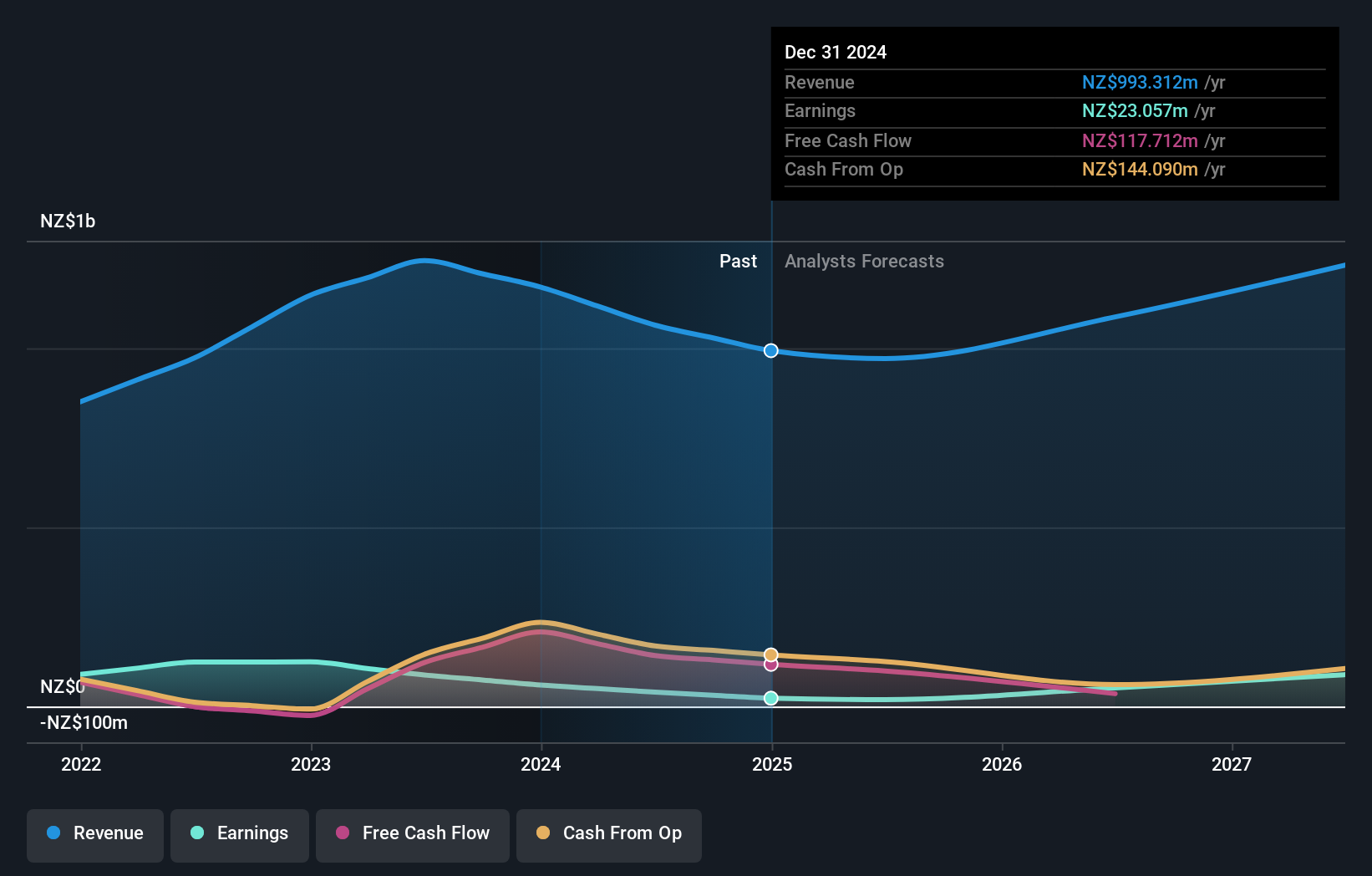

Operations: The company's revenue segments include A$11.20 million from Mighty Ape in Australia, A$277.82 million from Kogan Parent in Australia, A$135.34 million from Mighty Ape in New Zealand, and A$35.35 million from Kogan Parent in New Zealand.

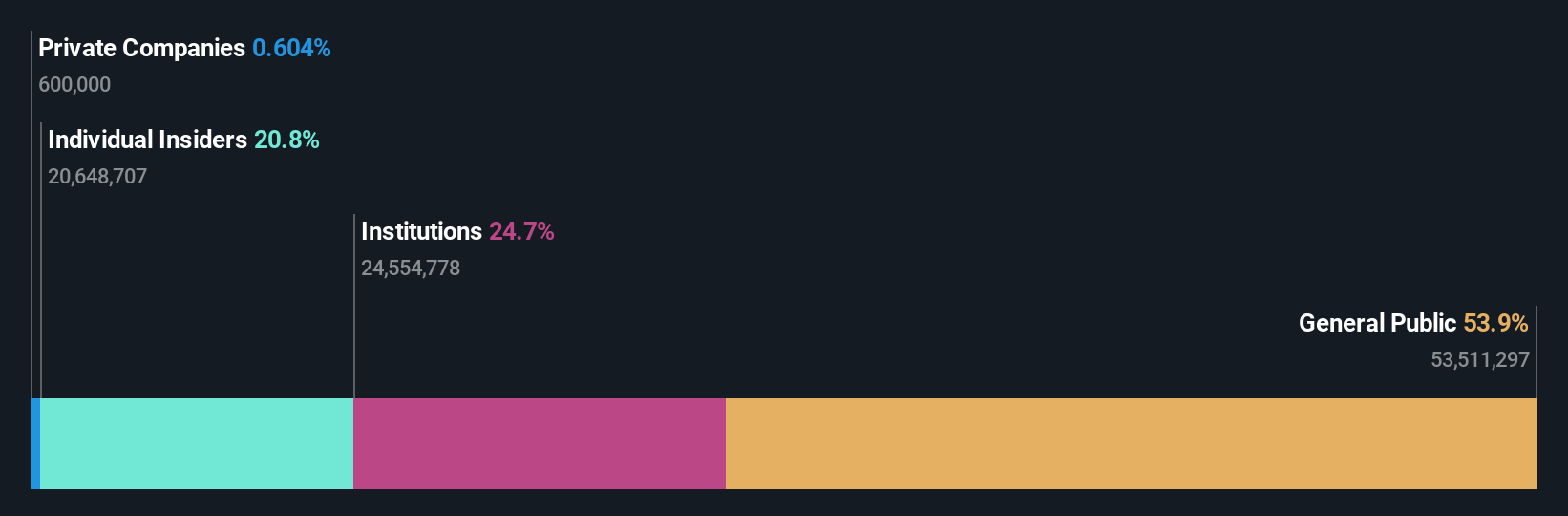

Insider Ownership: 19.6%

Kogan.com has become profitable, reporting a net income of A$0.083 million for the year ending June 2024, contrasting with a loss the previous year. Its stock is trading significantly below estimated fair value, with earnings projected to grow at 30.18% annually—outpacing the Australian market. Despite recent share buybacks totaling A$51.8 million and completed auditor changes, its dividend yield of 3.08% remains inadequately covered by earnings forecasts.

- Dive into the specifics of Kogan.com here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Kogan.com's current price could be inflated.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vulcan Steel Limited operates in the sale and distribution of steel and metal products across New Zealand and Australia, with a market capitalization of A$1.03 billion.

Operations: The company's revenue segments include NZ$471.29 million from steel and NZ$593.04 million from metals.

Insider Ownership: 37.2%

Vulcan Steel's earnings are projected to grow significantly at 22.9% annually, surpassing the Australian market average. Despite this growth, its profit margins have declined from 7.1% to 3.8%. The company is seeking acquisitions and investments, indicating a strategic expansion focus. Recent leadership changes include appointing Gavin Street as Chief Commercial Officer and Lou Cadman as New Zealand leader, potentially strengthening operational capabilities amidst an unstable dividend track record and high insider ownership since incorporation in 1995.

- Click here and access our complete growth analysis report to understand the dynamics of Vulcan Steel.

- The analysis detailed in our Vulcan Steel valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Navigate through the entire inventory of 91 Fast Growing ASX Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Kogan.com, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kogan.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KGN

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives