- Australia

- /

- Diversified Financial

- /

- ASX:HLI

Undiscovered Gems In Australia With Strong Fundamentals December 2025

Reviewed by Simply Wall St

As the Australian market navigates a complex landscape marked by fluctuations in material prices and sector-specific volatility, small-cap stocks have captured attention with their potential for growth amid broader economic shifts. In this environment, identifying companies with strong fundamentals becomes crucial; these undiscovered gems can offer resilience and opportunity even when larger indices face headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Helia Group (ASX:HLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Helia Group Limited, along with its subsidiaries, operates in the loan mortgage insurance sector mainly in Australia, with a market capitalization of A$1.56 billion.

Operations: Helia Group generates revenue primarily from its loan mortgage insurance business, amounting to A$559.63 million. The company's financial performance is reflected in its net profit margin, which stands at 59.78%.

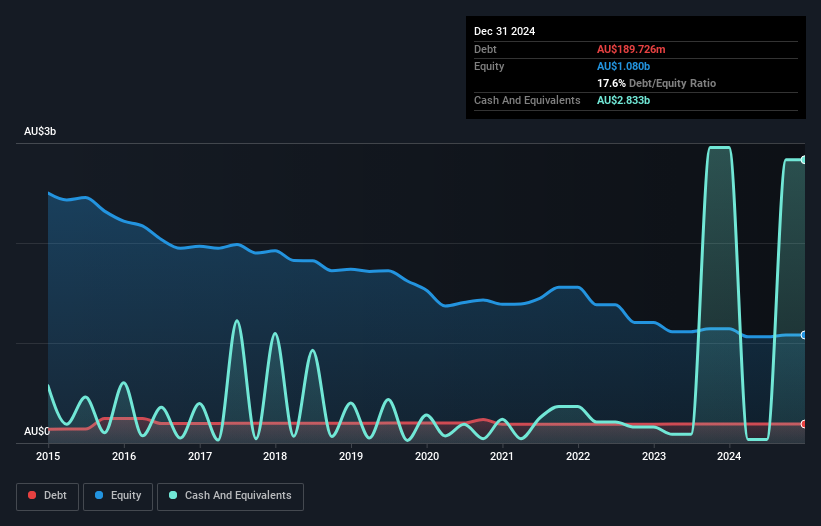

Helia Group, a smaller player in the Australian market, offers a compelling mix of value and growth potential. Trading at 67.7% below its estimated fair value, it seems to be an attractive option for investors looking for undervalued opportunities. Over the past year, earnings have grown by 19.4%, outpacing the diversified financial industry average of -6%. Despite an increase in its debt to equity ratio from 14.2% to 18.6% over five years, Helia's interest payments are comfortably covered with EBIT at 6.1x coverage, showcasing financial stability amidst forecasted future earnings challenges.

- Delve into the full analysis health report here for a deeper understanding of Helia Group.

Evaluate Helia Group's historical performance by accessing our past performance report.

Macmahon Holdings (ASX:MAH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Macmahon Holdings Limited operates in the mining and civil infrastructure sectors, offering surface and underground mining services as well as mining support to companies in Australia and Southeast Asia, with a market capitalization of A$1.23 billion.

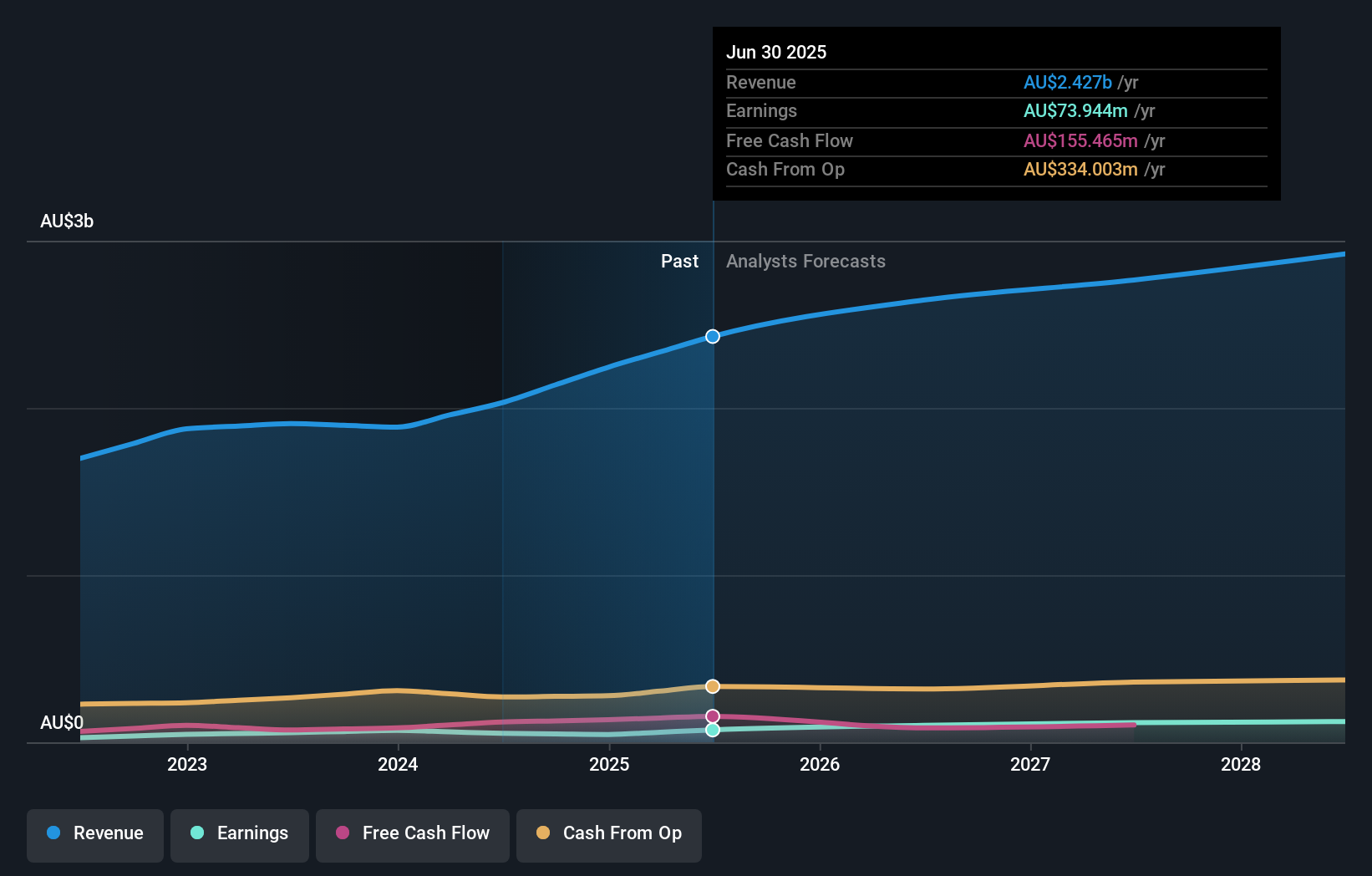

Operations: Macmahon Holdings generates revenue primarily from its mining segment, which accounts for A$1.97 billion, and its civil segment, contributing A$436.97 million. The company's net profit margin reflects the overall profitability of these operations in the competitive mining and infrastructure sectors.

Macmahon Holdings, a nimble player in the mining services sector, has shown impressive earnings growth of 38.9% over the past year, outpacing the industry average of 10.1%. Trading at a value 26.8% below its estimated fair value, it presents an attractive proposition for those eyeing undervalued opportunities. The company maintains a satisfactory net debt to equity ratio of 5.7%, indicating prudent financial management despite its debt rising from 3.7% to 43.9% over five years. With EBIT covering interest payments by more than four times, Macmahon's financial health seems robust amidst strategic diversification efforts into underground mining and infrastructure projects.

MyState (ASX:MYS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MyState Limited operates in Australia offering banking, trustee, equipment finance, and managed fund products and services through its subsidiaries, with a market capitalization of A$772.08 million.

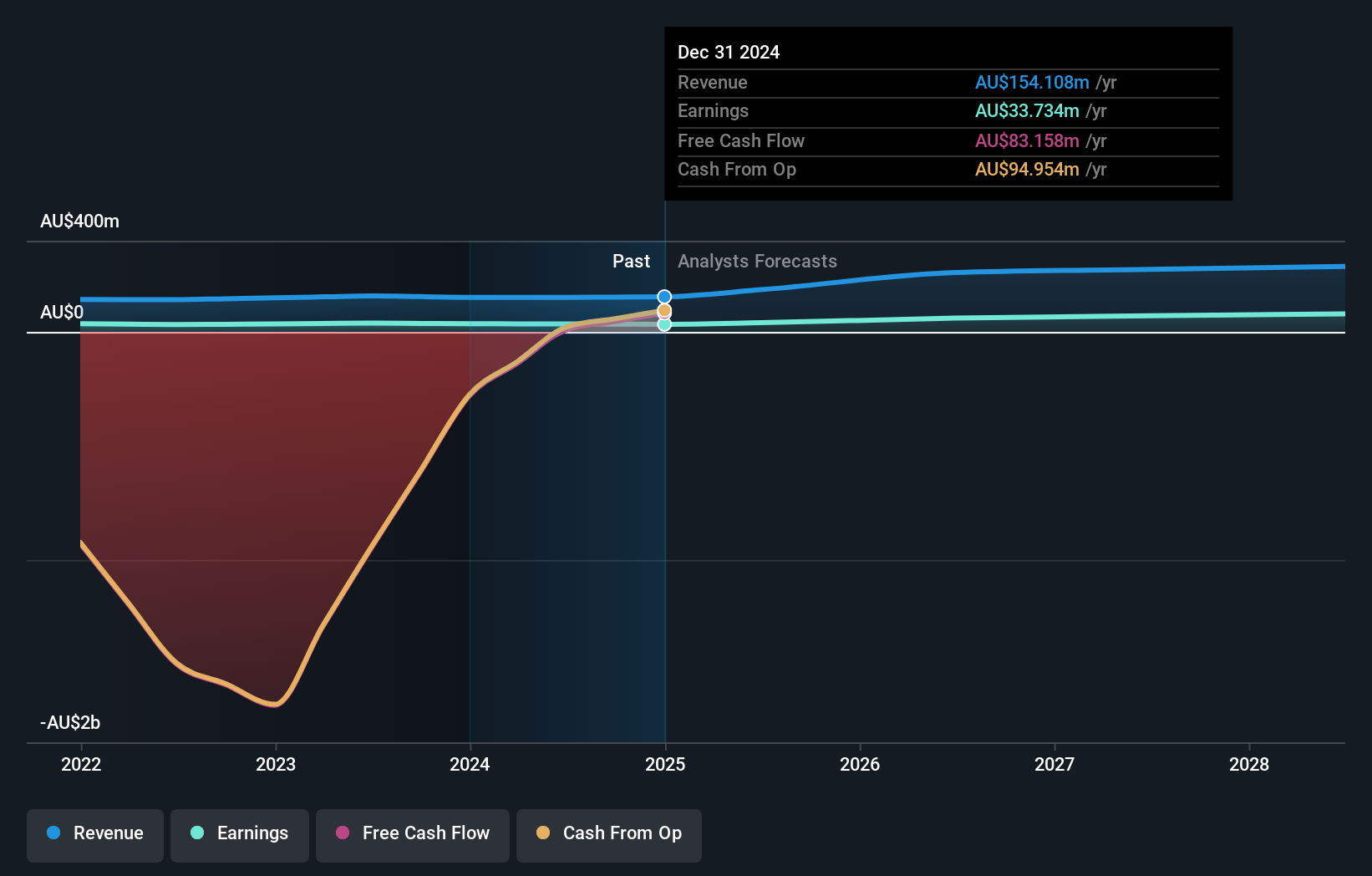

Operations: MyState generates revenue primarily from its MyState Bank segment, contributing A$140.27 million, followed by Auswide Bank at A$30.98 million and Wealth Management at A$14.82 million. The company's net profit margin is a key indicator of financial performance, reflecting the efficiency of its operations in converting revenue into actual profit.

MyState, with total assets of A$15.3 billion and equity of A$736 million, stands out for its robust foundation in customer deposits, which make up 76% of its liabilities. Total loans amount to A$13.2 billion and deposits are at A$11.1 billion, indicating a solid loan-to-deposit ratio. While earnings grew by 0.8%, surpassing the industry average of 0.2%, shareholders faced significant dilution recently. An allowance for bad loans is set at a low 14%, yet non-performing loans remain manageable at 0.7%. Future earnings growth is anticipated at an impressive rate of 16% annually, reflecting potential upside despite past challenges.

Make It Happen

- Gain an insight into the universe of 57 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLI

Helia Group

Helia Group Limited, together with its subsidiaries, is involved in the loan mortgage insurance business primarily in Australia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)