The ASX200 is set to open just under 1% higher today, reflecting Wall Street’s slight rally as it recovered from last week’s notable losses and as investors look ahead to a potential rate cut from the Federal Reserve. This positive momentum in the market underscores the importance of identifying growth companies with strong insider ownership, which can be a key indicator of confidence in their long-term potential.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 61.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Acrux (ASX:ACR) | 14.6% | 91.6% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.5% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited, with a market cap of A$1.12 billion, offers telecommunications and technology services in Australia.

Operations: The company's revenue segments include Business (A$96.97 million), Wholesale (A$159.73 million), Residential (A$585.07 million), Symbio Group (A$69.93 million), and Enterprise and Government (A$88.04 million).

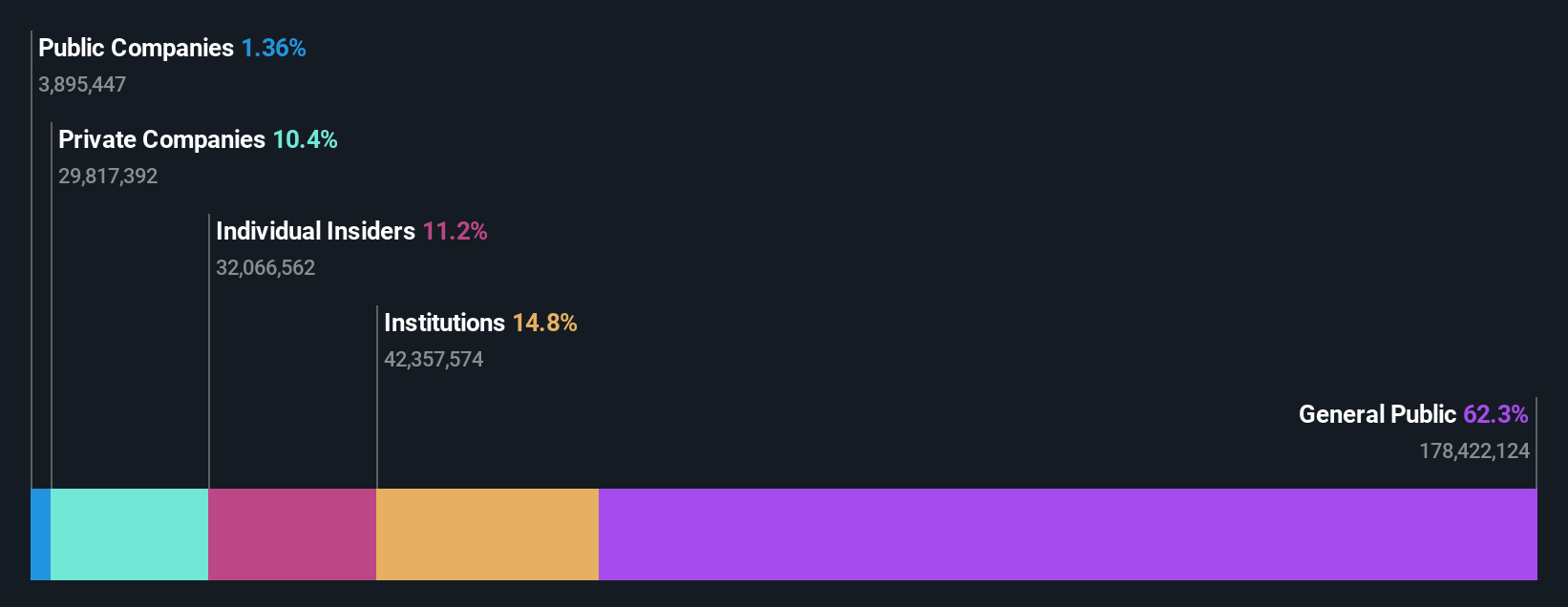

Insider Ownership: 10.8%

Aussie Broadband, with strong insider ownership, demonstrates significant growth potential. The company's earnings grew by 21.5% last year and are forecast to grow at 27.3% annually, outpacing the Australian market's 12.1%. Despite a recent leadership change with the retirement of Co-founder John Reisinger and appointment of Andy Giles Knopp as CFO, ABB reported A$999.75 million in sales and A$26.38 million net income for FY2024. However, shareholders experienced dilution over the past year.

- Unlock comprehensive insights into our analysis of Aussie Broadband stock in this growth report.

- According our valuation report, there's an indication that Aussie Broadband's share price might be on the expensive side.

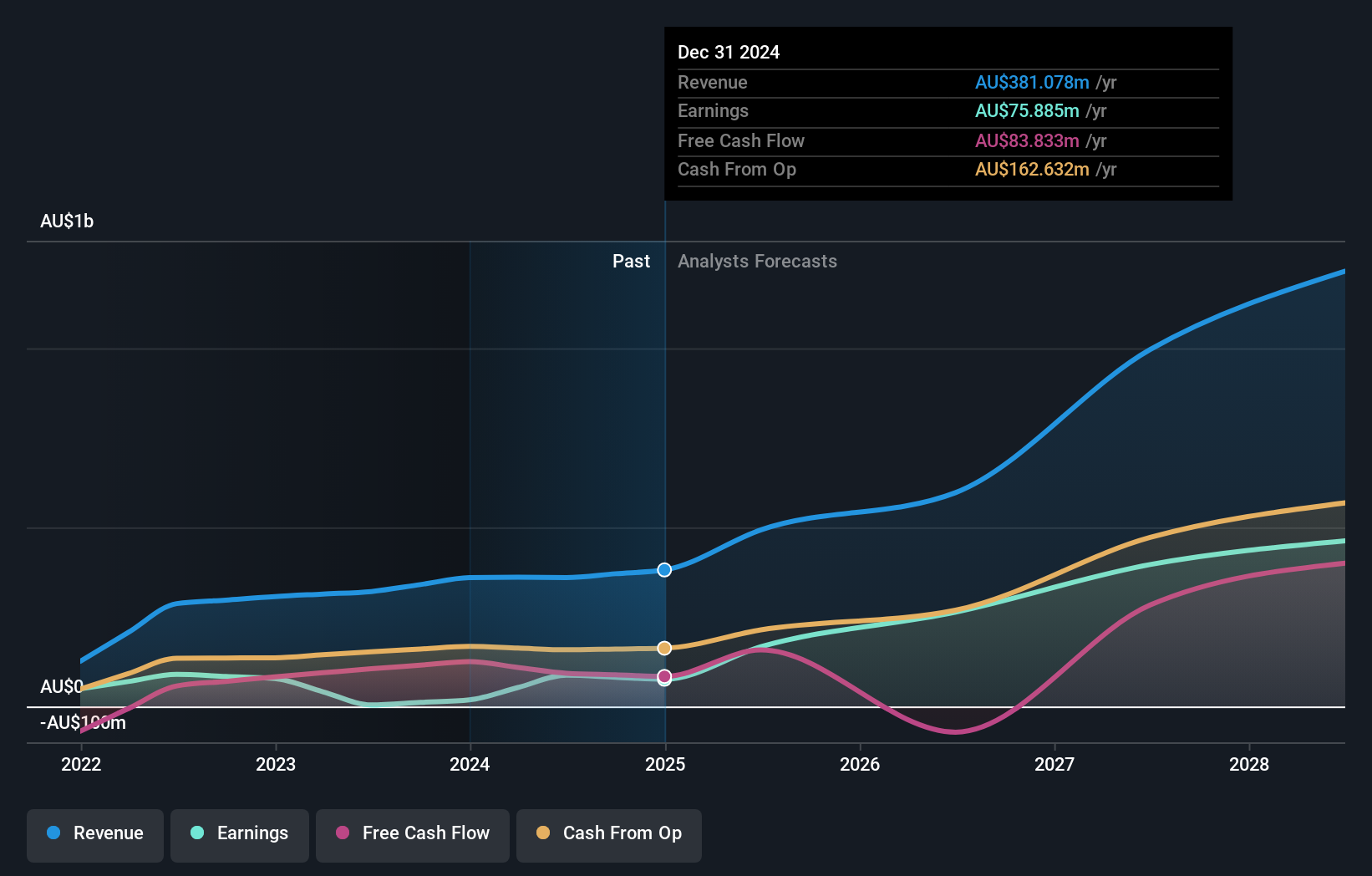

Capricorn Metals (ASX:CMM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd focuses on the evaluation, exploration, development, and production of gold properties in Australia and has a market cap of approximately A$2.05 billion.

Operations: Capricorn Metals Ltd generates revenue primarily from its Karlawinda gold project, amounting to A$359.73 million.

Insider Ownership: 11.9%

Capricorn Metals, with substantial insider ownership, has shown impressive growth. The company reported a significant increase in net income to A$87.14 million for FY2024 from A$4.4 million the previous year. Recent updates include a major expansion study at the Karlawinda Gold Project, which increased Mineral Reserves by 27% to 57.7 Mt of Probable Reserves containing 1,428 koz gold. Earnings are forecast to grow significantly over the next three years, outpacing market expectations.

- Delve into the full analysis future growth report here for a deeper understanding of Capricorn Metals.

- Our expertly prepared valuation report Capricorn Metals implies its share price may be lower than expected.

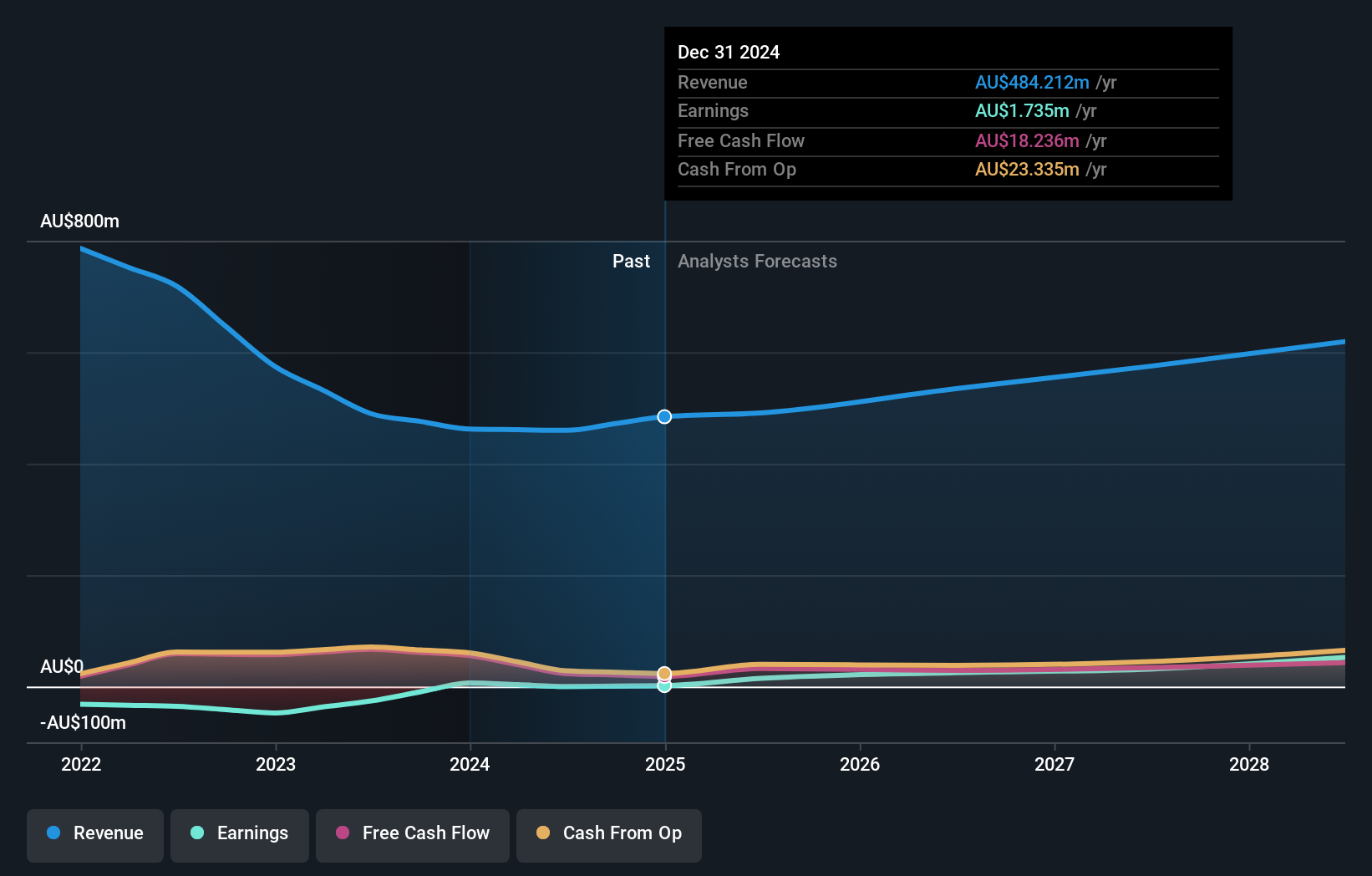

Kogan.com (ASX:KGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kogan.com Ltd is an online retailer based in Australia with a market cap of A$453.69 million.

Operations: Kogan.com Ltd generates revenue from its Australian operations through Kogan Parent (A$277.82 million) and Mighty Ape (A$11.20 million), and from its New Zealand operations via Kogan Parent (A$35.35 million) and Mighty Ape (A$135.34 million).

Insider Ownership: 20%

Kogan.com, with high insider ownership, has shown resilience by returning to profitability with a net income of A$0.083 million for FY2024 after a significant loss the previous year. Despite a decline in sales to A$459.7 million, earnings are expected to grow 30.61% annually over the next three years, outpacing market growth. The stock is trading at 77.8% below its estimated fair value, although its dividend sustainability remains questionable given current earnings coverage.

- Click to explore a detailed breakdown of our findings in Kogan.com's earnings growth report.

- Our expertly prepared valuation report Kogan.com implies its share price may be too high.

Next Steps

- Gain an insight into the universe of 97 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABB

Aussie Broadband

Provides telecommunications and technology services in Australia.

Excellent balance sheet with reasonable growth potential.