- Australia

- /

- Oil and Gas

- /

- ASX:STO

Top ASX Dividend Stocks For January 2025

Reviewed by Simply Wall St

As the ASX200 experiences a slight uptick of 0.11% to 8,240 points, buoyed by strong performances in the Discretionary and Real Estate sectors, investors are keenly observing how dividend stocks can offer stability amid fluctuating sector performances. In this environment, selecting dividend stocks that demonstrate consistent yield and resilience can be an attractive strategy for those seeking income generation within the Australian market.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.37% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.47% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.73% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.02% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 5.11% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.74% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.88% | ★★★★☆☆ |

| Sugar Terminals (NSX:SUG) | 7.77% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 5.49% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 10.00% | ★★★★☆☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

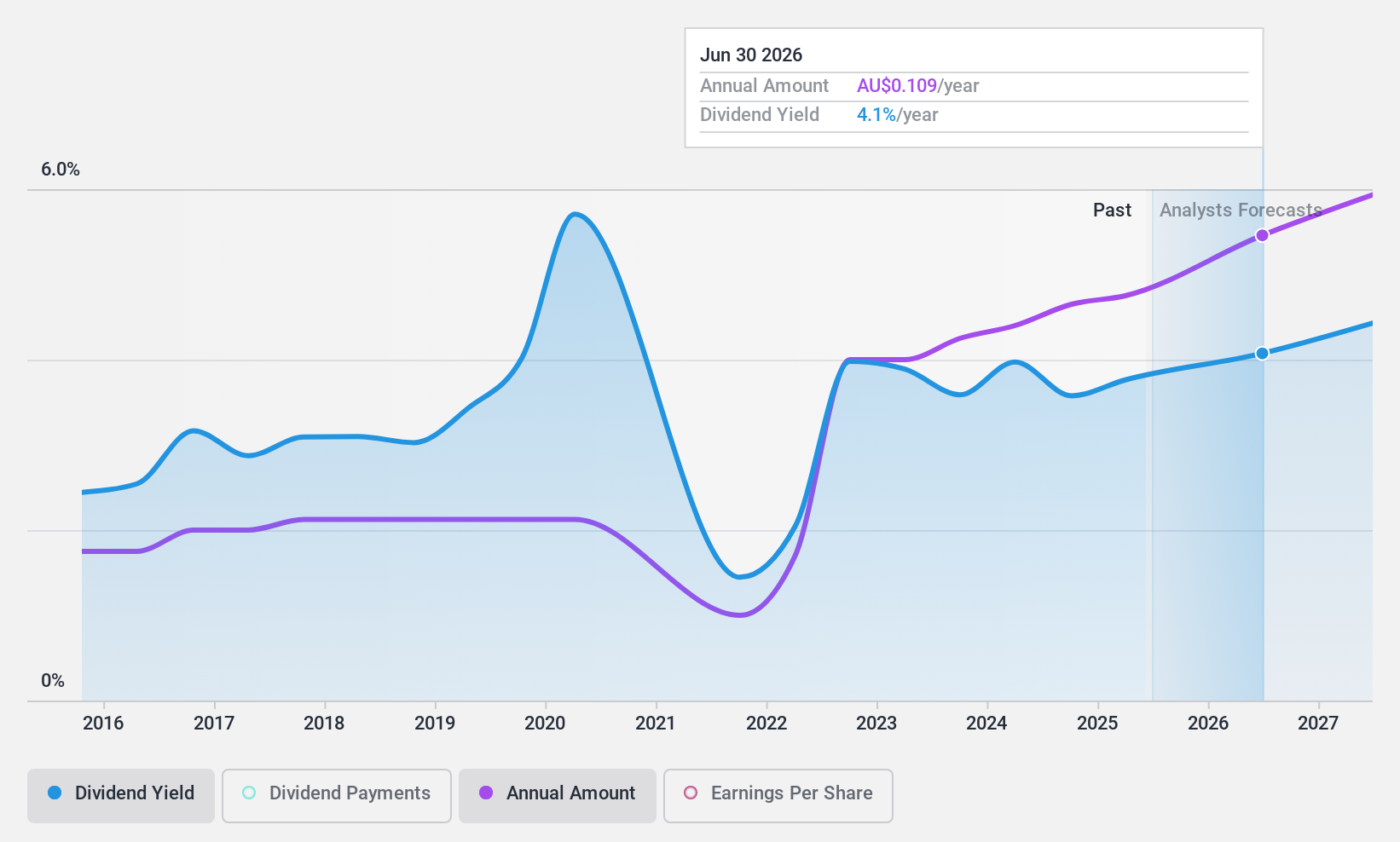

Ridley (ASX:RIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ridley Corporation Limited, with a market cap of A$859.39 million, operates in Australia providing animal nutrition solutions through its subsidiaries.

Operations: Ridley Corporation Limited generates revenue through its Bulk Stockfeeds segment, amounting to A$886.59 million, and its Packaged/Ingredients segment, totaling A$376.31 million.

Dividend Yield: 3.5%

Ridley Corporation's dividend payments are well covered by both earnings and cash flows, with a payout ratio of 71.7% and a cash payout ratio of 41.3%. However, the dividend yield of 3.46% is relatively low compared to top-tier Australian dividend stocks, and the company's dividend history has been volatile over the past decade. Despite trading at a significant discount to its estimated fair value, Ridley's dividends have not consistently grown or remained stable in recent years.

- Take a closer look at Ridley's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Ridley is trading behind its estimated value.

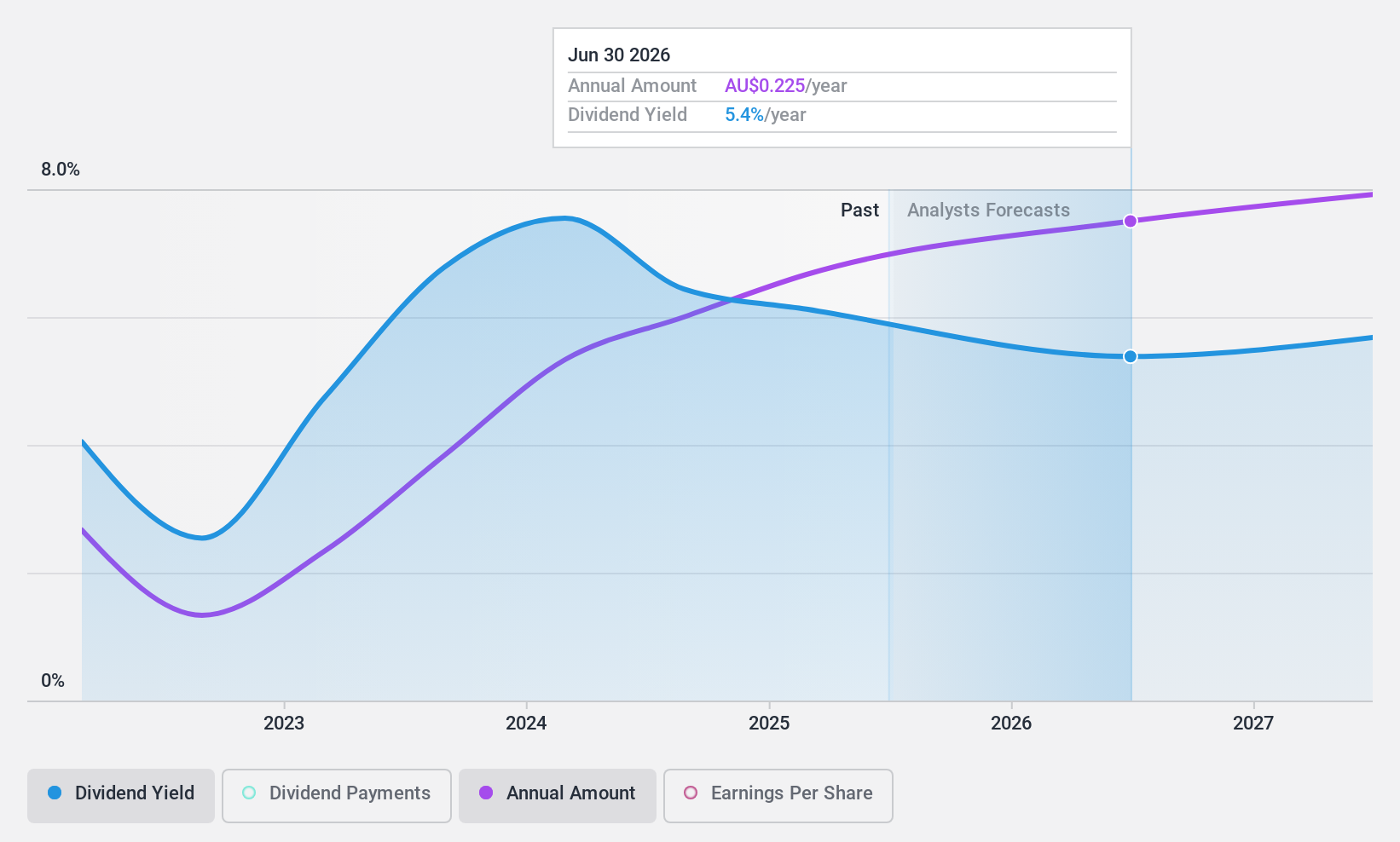

SHAPE Australia (ASX:SHA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SHAPE Australia Corporation Limited operates in the construction, fitout, and refurbishment of commercial properties across Australia, with a market cap of A$241.27 million.

Operations: SHAPE Australia's revenue primarily comes from its heavy construction segment, amounting to A$839.00 million.

Dividend Yield: 6.2%

SHAPE Australia's dividend yield of 6.19% ranks among the top 25% in the Australian market, supported by earnings and cash flows with payout ratios of 88.3% and 53.2%, respectively. However, its dividends have been unreliable over the past three years, with volatility in payments despite recent growth. The company trades at a discount to its estimated fair value and is exploring acquisitions to diversify and enhance shareholder value further.

- Get an in-depth perspective on SHAPE Australia's performance by reading our dividend report here.

- The analysis detailed in our SHAPE Australia valuation report hints at an deflated share price compared to its estimated value.

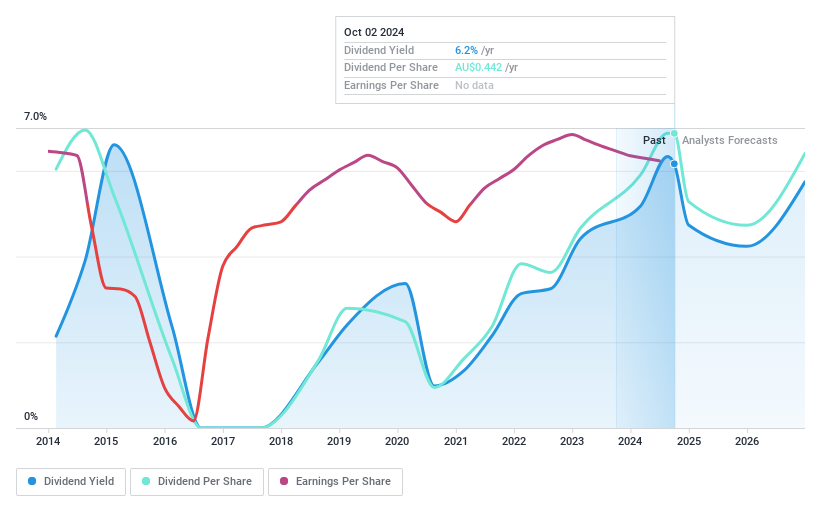

Santos (ASX:STO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Santos Limited explores, develops, produces, transports, and markets hydrocarbons in Australia and Papua New Guinea with a market cap of A$23.13 billion.

Operations: Santos Limited generates revenue from several segments, including Cooper Basin ($612 million), Queensland & NSW ($1.31 billion), Western Australia ($881 million), Papua New Guinea (PNG) ($2.71 billion), and Northern Australia & Timor-Leste ($84 million).

Dividend Yield: 6.9%

Santos offers a high dividend yield of 6.91%, ranking in the top 25% in Australia, but its dividends have been volatile and not well covered by cash flows, with a cash payout ratio of 164.4%. Despite trading at a significant discount to its estimated fair value, the sustainability of its dividend is questionable given that it isn't fully supported by earnings or free cash flow. Earnings are projected to grow annually by 10.07%.

- Unlock comprehensive insights into our analysis of Santos stock in this dividend report.

- Upon reviewing our latest valuation report, Santos' share price might be too pessimistic.

Next Steps

- Click here to access our complete index of 33 Top ASX Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STO

Santos

Explores, develops, produces, transports, and markets hydrocarbons in Australia and Papua New Guinea.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives