The Australian market has shown positive investor sentiment, with the ASX200 up slightly at 8,240 points, driven by gains in the Discretionary, Real Estate, and Financial sectors. Though often seen as a relic of past trading days, penny stocks remain relevant for investors seeking opportunities in smaller or newer companies that can offer significant potential when backed by strong financials. This article explores three such penny stocks on the ASX that stand out for their balance sheet strength and promise of hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.91 | A$241.27M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.33 | A$107.55M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.89 | A$105.98M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$245.43M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.96 | A$319.12M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.285 | A$109.71M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.93 | A$486.42M | ★★★★☆☆ |

Click here to see the full list of 1,025 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion-resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$173.41 million.

Operations: The company's revenue is primarily generated from Australia (A$111.84 million), followed by Indonesia (A$24.41 million), Thailand (A$5.68 million), and other foreign countries (A$10.93 million).

Market Cap: A$173.41M

Bisalloy Steel Group demonstrates strong financial health with a market cap of A$173.41 million and significant revenue streams primarily from Australia (A$111.84 million). The company has experienced earnings growth of 23% over the past year, surpassing industry averages, and maintains high-quality earnings. Its debt is well covered by operating cash flow, and it holds more cash than total debt. Recent announcements include a fully franked special dividend of A$0.13 per share, highlighting shareholder returns despite an unstable dividend track record. The management team and board are considered experienced, supporting stable governance amidst low volatility in stock performance.

- Jump into the full analysis health report here for a deeper understanding of Bisalloy Steel Group.

- Understand Bisalloy Steel Group's track record by examining our performance history report.

Reef Casino Trust (ASX:RCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reef Casino Trust operates as an owner and lessor of the Reef Hotel Casino complex in Cairns, North Queensland, Australia, with a market cap of A$69.22 million.

Operations: The company generates revenue of A$26.20 million from its Casinos & Resorts segment.

Market Cap: A$69.22M

Reef Casino Trust, with a market cap of A$69.22 million, faces challenges despite its high-quality earnings and outstanding return on equity at 49%. The company reported negative earnings growth over the past year and has net profit margins declining from 27.2% to 19.8%. Its dividend yield of 7.22% is not well covered by earnings, raising sustainability concerns following a recent dividend decrease announcement. While short-term assets cover short-term liabilities, long-term liabilities remain uncovered by current assets (A$6.3M vs A$85.1M). Despite these issues, the stock trades significantly below estimated fair value and debt levels have been reduced over time.

- Get an in-depth perspective on Reef Casino Trust's performance by reading our balance sheet health report here.

- Assess Reef Casino Trust's previous results with our detailed historical performance reports.

Starpharma Holdings (ASX:SPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Starpharma Holdings Limited is a biopharmaceutical company focused on the research, development, and commercialization of dendrimer products for pharmaceutical and life science applications globally, with a market cap of A$50.17 million.

Operations: The company generates revenue of A$9.76 million from the discovery, development, and commercialization of dendrimer products.

Market Cap: A$50.17M

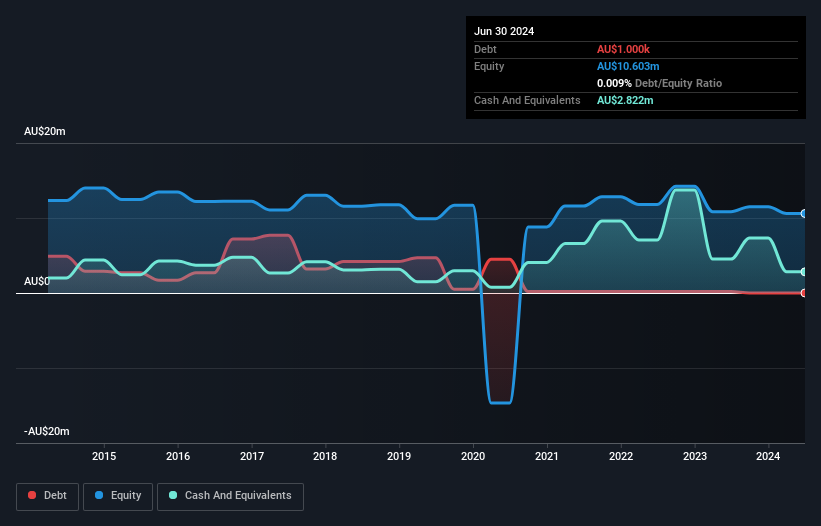

Starpharma Holdings Limited, with a market cap of A$50.17 million, remains unprofitable but has demonstrated progress by reducing losses at 6.5% annually over the past five years. The company maintains a stable weekly volatility of 10% and has not significantly diluted shareholders recently. Starpharma's board is considered experienced, with an average tenure of 3.1 years. Financially, it holds more cash than debt and covers both short-term and long-term liabilities effectively with its assets (A$32.9M). With sufficient cash runway for over three years based on current free cash flow trends, the company continues to manage its resources prudently amidst ongoing development efforts in dendrimer products.

- Unlock comprehensive insights into our analysis of Starpharma Holdings stock in this financial health report.

- Review our historical performance report to gain insights into Starpharma Holdings' track record.

Make It Happen

- Gain an insight into the universe of 1,025 ASX Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SPL

Starpharma Holdings

A biopharmaceutical company, engages in the research, development, and commercialization of dendrimer products for pharmaceutical, life science, and other applications worldwide.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives