- Australia

- /

- Professional Services

- /

- ASX:C79

3 ASX Growth Stocks With Insider Ownership And Up To 71% Earnings Growth

Reviewed by Simply Wall St

As the ASX 200 closes on a positive note, buoyed by sectors like Real Estate and Healthcare, investors are keeping a close eye on inflation concerns highlighted in the recent RBA minutes. In this climate of cautious optimism, growth companies with high insider ownership can offer unique insights into potential earnings expansion, making them noteworthy considerations for those navigating the Australian market.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Emerald Resources (ASX:EMR) | 18% | 38.9% |

| Acrux (ASX:ACR) | 20.2% | 91.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 77.3% |

| IperionX (ASX:IPX) | 19% | 67% |

| Pointerra (ASX:3DP) | 20.8% | 126.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here's a peek at a few of the choices from the screener.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited develops and supplies mining technology, with a market capitalization of A$546.98 million.

Operations: Chrysos Corporation Limited generates revenue of A$45.36 million from its mining services segment.

Insider Ownership: 20.1%

Earnings Growth Forecast: 49.2% p.a.

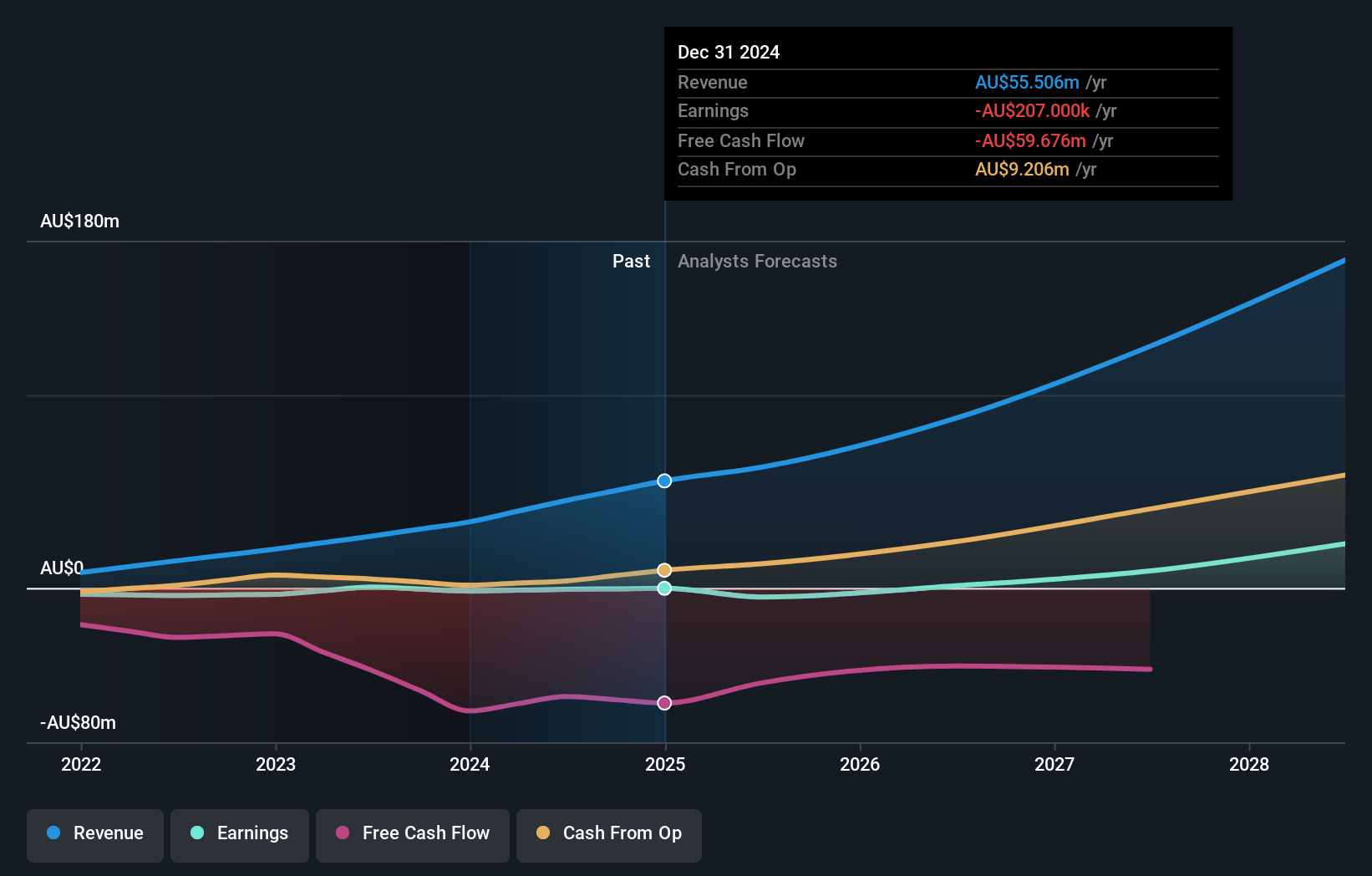

Chrysos Corporation Limited, with substantial insider ownership, is positioned for significant growth. The company reaffirmed its fiscal year 2025 guidance, projecting revenue between A$60 million and A$70 million. Analysts anticipate a 28.4% annual revenue growth rate, outpacing the broader Australian market. Despite previous shareholder dilution and low forecasted return on equity (6%), Chrysos is expected to become profitable within three years, with earnings projected to grow by 49.24% annually.

- Click here to discover the nuances of Chrysos with our detailed analytical future growth report.

- Our expertly prepared valuation report Chrysos implies its share price may be too high.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate clients across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and other international markets with a market cap of A$3.64 billion.

Operations: The company's revenue is primarily derived from its leisure segment, which accounts for A$1.35 billion, and its corporate segment, contributing A$1.11 billion.

Insider Ownership: 13.5%

Earnings Growth Forecast: 19% p.a.

Flight Centre Travel Group demonstrates growth potential with forecasted earnings growth of 19% annually, surpassing the Australian market's 12.5%. Despite trading at a 36.3% discount to its estimated fair value, revenue growth is moderate at 7.2%, yet exceeds the market average of 5.8%. Recent private placements raised A$140 million through convertible notes due in 2028, indicating strategic financial moves. Insider transactions show more buying than selling recently, suggesting confidence in future performance.

- Click here and access our complete growth analysis report to understand the dynamics of Flight Centre Travel Group.

- The analysis detailed in our Flight Centre Travel Group valuation report hints at an deflated share price compared to its estimated value.

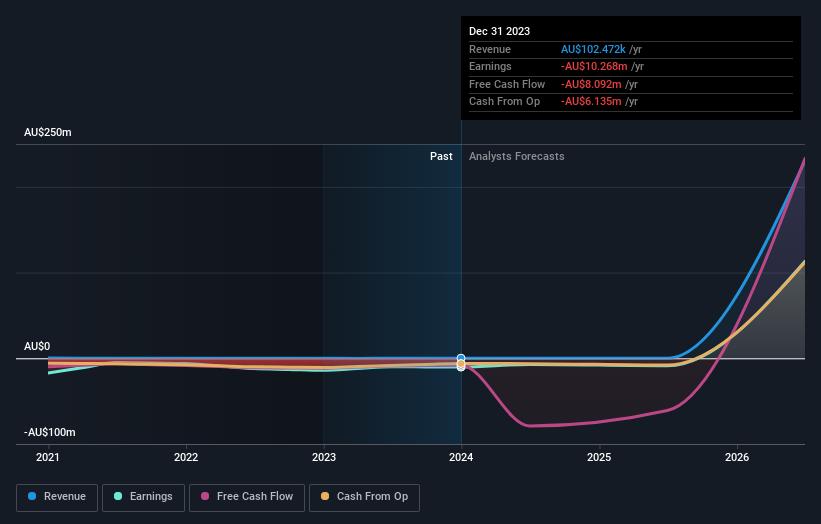

Lotus Resources (ASX:LOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotus Resources Limited is involved in the exploration, evaluation, and development of uranium properties in Africa with a market cap of A$411.51 million.

Operations: The company's revenue segments are not specified in the provided text.

Insider Ownership: 10.1%

Earnings Growth Forecast: 71.3% p.a.

Lotus Resources is poised for significant growth, with earnings projected to increase by 71.28% annually and a very high forecasted return on equity of 52.7% in three years. Despite recent shareholder dilution and volatile share prices, the company trades at 87.4% below its estimated fair value. Recent board changes and substantial follow-on equity offerings, totaling A$130 million and A$15 million respectively, support its strategic shift towards uranium production profitability within three years.

- Take a closer look at Lotus Resources' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Lotus Resources' current price could be inflated.

Taking Advantage

- Investigate our full lineup of 95 Fast Growing ASX Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:C79

Flawless balance sheet with high growth potential.