- Australia

- /

- Metals and Mining

- /

- ASX:LTR

3 ASX Penny Stocks With Market Caps Up To A$2B

Reviewed by Simply Wall St

The Australian market is showing signs of resilience, with the ASX 200 futures indicating a potential gain despite global economic uncertainties and recent geopolitical developments. In such an environment, investors often seek out stocks that combine value with growth potential, which can sometimes be found in smaller or newer companies known as penny stocks. While the term may seem outdated, these stocks can still offer significant opportunities when backed by strong financials and clear growth trajectories.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.5425 | A$106.53M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.93 | A$106.76M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.99 | A$492.38M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.15 | A$333.01M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.325 | A$64.64M | ★★★★★☆ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Image Resources (ASX:IMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Image Resources NL is a mineral sands mining company operating in Western Australia with a market cap of A$105.82 million.

Operations: No revenue segments have been reported.

Market Cap: A$105.82M

Image Resources NL, with a market cap of A$105.82 million, is pre-revenue and currently unprofitable. The company has managed to eliminate its debt over the past five years, improving its financial position significantly. Short-term assets of A$43.8 million comfortably cover short-term liabilities of A$4.1 million but fall short against long-term liabilities totaling A$51.5 million. Despite an experienced management team averaging 9.4 years in tenure and stable weekly volatility at 8%, the company's profitability remains a concern as losses have increased by 33.2% annually over the past five years without meaningful shareholder dilution recently observed.

- Navigate through the intricacies of Image Resources with our comprehensive balance sheet health report here.

- Learn about Image Resources' historical performance here.

Liontown Resources (ASX:LTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Liontown Resources Limited is an Australian company focused on the exploration, evaluation, and development of mineral properties, with a market capitalization of A$1.60 billion.

Operations: Liontown Resources Limited does not report any revenue segments.

Market Cap: A$1.6B

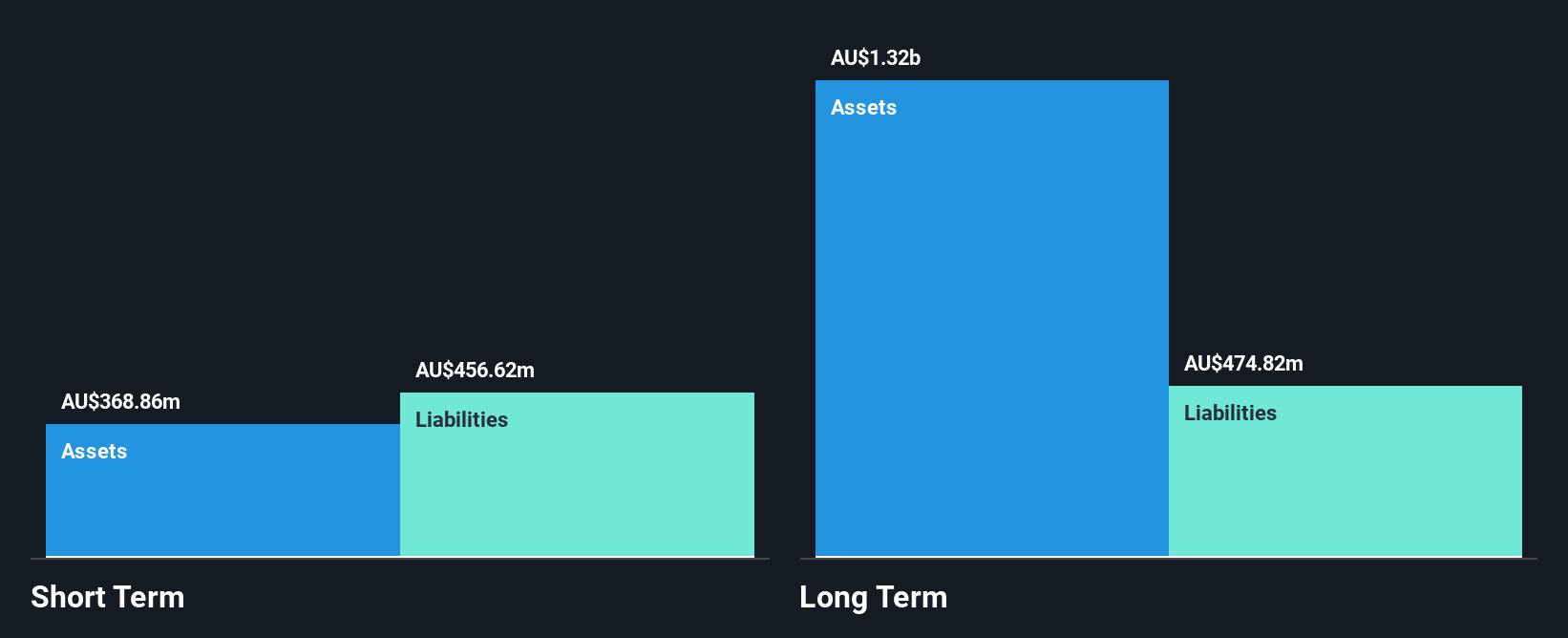

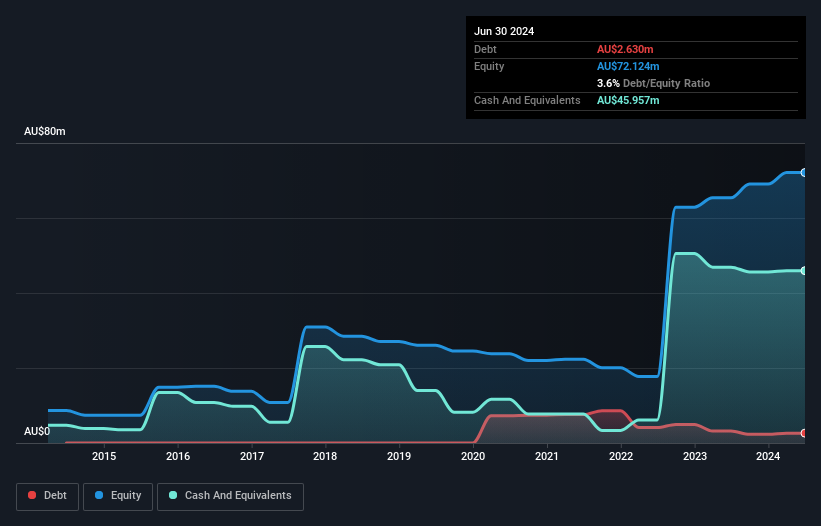

Liontown Resources Limited, with a market cap of A$1.60 billion, remains pre-revenue and unprofitable. The company has seen its debt to equity ratio rise to 41.3% over five years, though it maintains a satisfactory net debt to equity ratio of 25.3%. Short-term assets of A$180.5 million exceed short-term liabilities but fall short against long-term liabilities of A$477.3 million. Despite an inexperienced board with an average tenure of 2.7 years, the management team is relatively seasoned at 3.7 years on average tenure and has avoided significant shareholder dilution recently while raising additional capital for operations.

- Unlock comprehensive insights into our analysis of Liontown Resources stock in this financial health report.

- Assess Liontown Resources' future earnings estimates with our detailed growth reports.

PolyNovo (ASX:PNV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across the United States, Australia, New Zealand, and internationally with a market cap of A$1.58 billion.

Operations: The company generates revenue of A$103.23 million from the development, manufacturing, and commercialisation of NovoSorb Technology.

Market Cap: A$1.58B

PolyNovo Limited, with a market cap of A$1.58 billion, has demonstrated strong financial stability and growth potential. Recent unaudited results show a significant revenue increase to A$59.9 million for the first half of fiscal 2025, up from A$48.8 million in the same period last year. The company has become profitable recently, with its earnings forecasted to grow by 38.24% annually. PolyNovo's short-term assets comfortably cover both short- and long-term liabilities, and it maintains more cash than debt, indicating sound financial health despite a relatively new management team with an average tenure of 1.3 years.

- Click to explore a detailed breakdown of our findings in PolyNovo's financial health report.

- Gain insights into PolyNovo's future direction by reviewing our growth report.

Taking Advantage

- Reveal the 1,026 hidden gems among our ASX Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

High growth potential with adequate balance sheet.