- Australia

- /

- Oil and Gas

- /

- ASX:BKY

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The Australian market is showing signs of resilience, with ASX 200 futures indicating a modest gain, despite recent global economic uncertainties. As investors navigate these fluctuating conditions, the allure of penny stocks remains significant due to their potential for growth and value discovery. Although the term "penny stock" may seem outdated, these smaller or newer companies can still offer substantial opportunities when they possess strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.5425 | A$106.53M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.93 | A$106.76M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.99 | A$492.38M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.15 | A$333.01M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.325 | A$64.64M | ★★★★★☆ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Berkeley Energia (ASX:BKY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Berkeley Energia Limited is involved in the exploration and development of mineral properties in Spain, with a market capitalization of A$151.57 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: A$151.57M

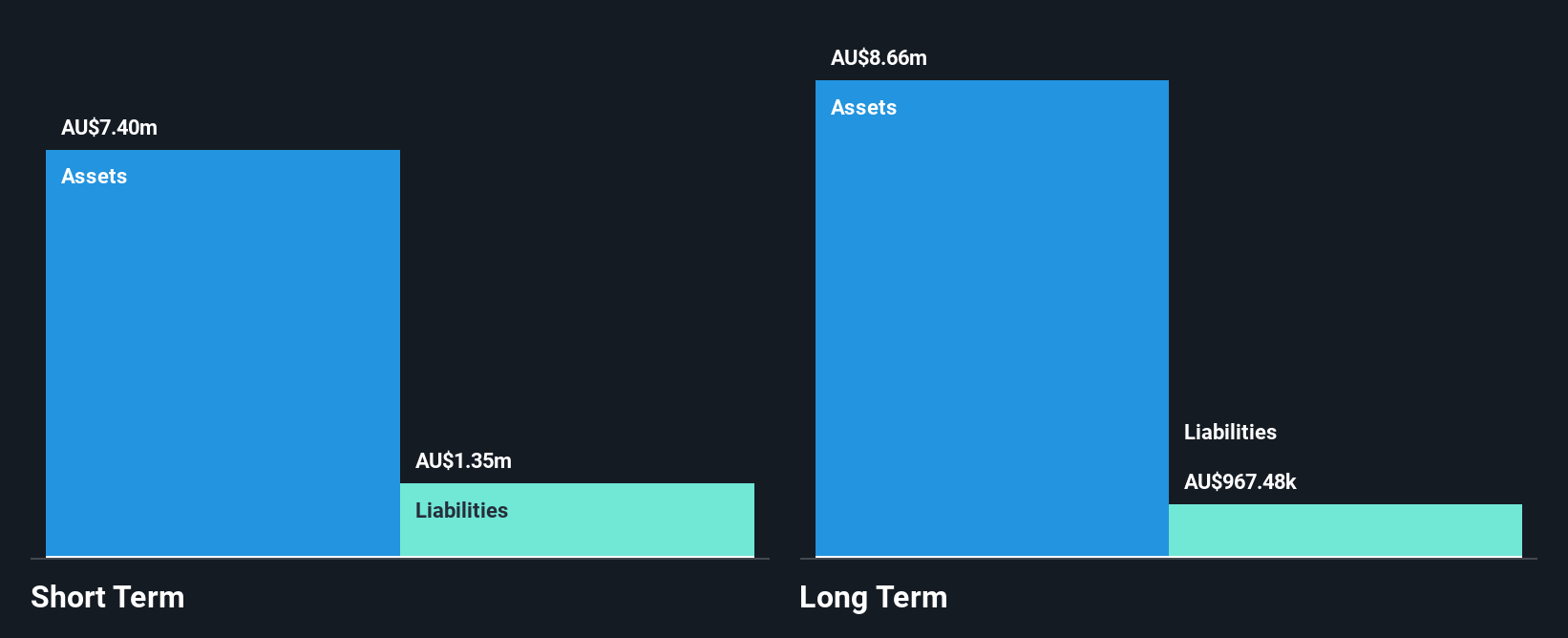

Berkeley Energia, with a market cap of A$151.57 million, is currently pre-revenue and unprofitable but has shown a significant reduction in losses over the past five years. The company benefits from a strong balance sheet with no debt and sufficient cash runway for more than three years if free cash flow continues to grow at historical rates. Its short-term assets significantly exceed its short-term liabilities, indicating financial stability. The management team and board are experienced, which may provide strategic advantages as the company progresses in its mineral exploration activities in Spain.

- Jump into the full analysis health report here for a deeper understanding of Berkeley Energia.

- Examine Berkeley Energia's past performance report to understand how it has performed in prior years.

DevEx Resources (ASX:DEV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DevEx Resources Limited, with a market cap of A$42.40 million, is involved in the exploration and evaluation of mineral properties in Australia through its subsidiaries.

Operations: The company generates revenue from its exploration and evaluation activities, amounting to A$0.1 million.

Market Cap: A$42.4M

DevEx Resources, with a market cap of A$42.40 million, is pre-revenue and unprofitable, with losses increasing over the past five years. The company maintains financial stability through short-term assets of A$17.5 million exceeding both short-term and long-term liabilities. Despite being debt-free, DevEx faces volatility in its share price and has less than a year of cash runway if free cash flow continues to decline at historical rates. Recent presentations in Melbourne and Sydney by the management team highlight ongoing exploration activities, but the company's high weekly volatility remains a concern for investors seeking stability in penny stocks.

- Click here to discover the nuances of DevEx Resources with our detailed analytical financial health report.

- Explore historical data to track DevEx Resources' performance over time in our past results report.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia, with a market capitalization of A$387.97 million.

Operations: The company's revenue is derived from three primary segments: Workforce Solutions (A$30.74 million), Government and Justice (A$42.51 million), and Education and Work Pathways (A$40.55 million).

Market Cap: A$387.97M

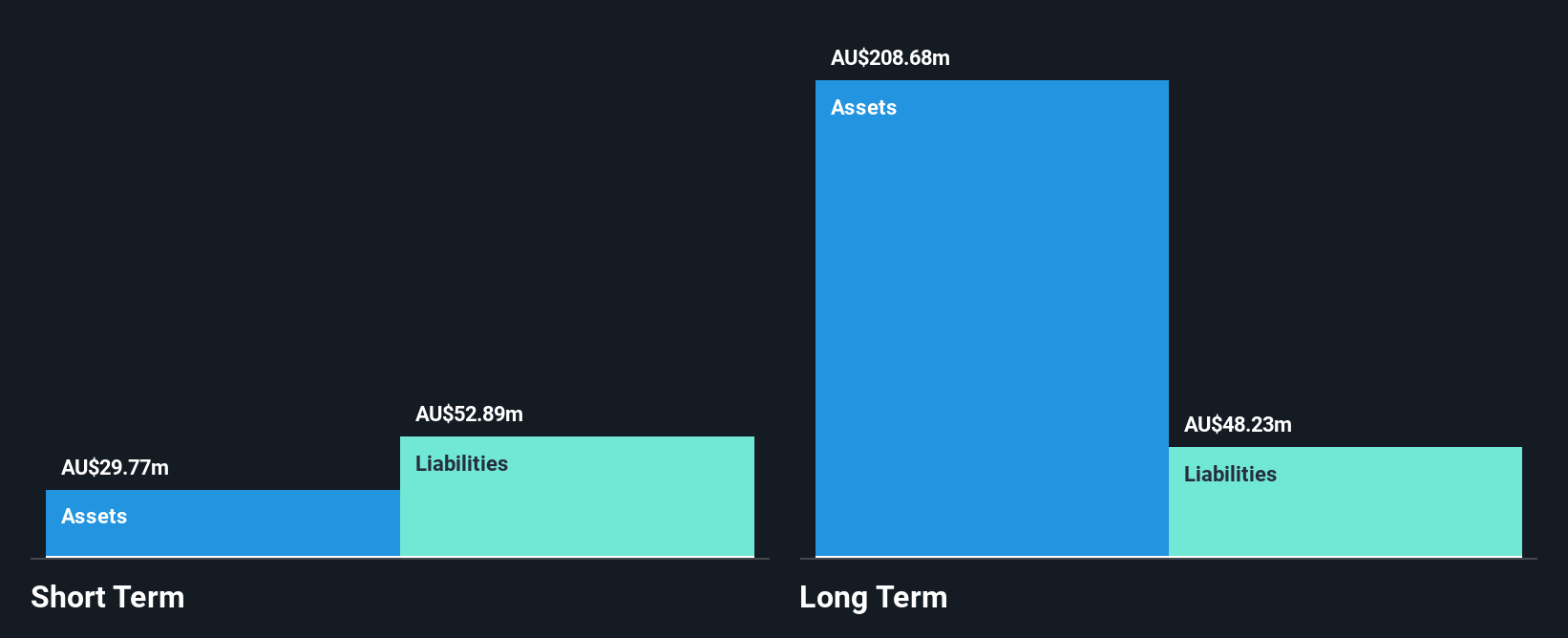

ReadyTech Holdings, with a market cap of A$387.97 million, has demonstrated profitability over the past five years with earnings growing at 26.8% annually. However, its recent annual earnings growth of 9.8% is below this average. The company's short-term assets (A$41.1M) are insufficient to cover both short-term (A$62.5M) and long-term liabilities (A$47.7M). Despite this, ReadyTech's debt-to-equity ratio has improved significantly from 73.6% to 27.7%, supported by well-covered interest payments and operating cash flow covering debt at 75%. Analysts expect further stock price appreciation by 25.8%.

- Navigate through the intricacies of ReadyTech Holdings with our comprehensive balance sheet health report here.

- Gain insights into ReadyTech Holdings' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Embark on your investment journey to our 1,026 ASX Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Berkeley Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BKY

Berkeley Energia

Engages in the exploration and development of mineral properties in Spain.

Flawless balance sheet very low.