- Australia

- /

- Metals and Mining

- /

- ASX:S32

Codan And Two More ASX Stocks Considered Below Estimated Value

Reviewed by Simply Wall St

The Australian stock market has shown modest activity recently, remaining flat over the last week but gaining 6.2% over the past year, with earnings projected to grow by 14% annually. In this context, identifying stocks that are trading below their estimated value could offer attractive opportunities for investors looking for potential growth in a steadily advancing market.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.695 | A$1.21 | 42.4% |

| Smart Parking (ASX:SPZ) | A$0.48 | A$0.96 | 49.9% |

| COSOL (ASX:COS) | A$1.25 | A$2.43 | 48.6% |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$3.13 | 40% |

| Charter Hall Group (ASX:CHC) | A$12.44 | A$22.79 | 45.4% |

| ReadyTech Holdings (ASX:RDY) | A$3.22 | A$5.96 | 45.9% |

| Mader Group (ASX:MAD) | A$6.51 | A$12.62 | 48.4% |

| hipages Group Holdings (ASX:HPG) | A$1.035 | A$1.94 | 46.7% |

| IPH (ASX:IPH) | A$6.16 | A$11.35 | 45.7% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

Let's take a closer look at a couple of our picks from the screened companies

Codan (ASX:CDA)

Overview: Codan Limited specializes in developing technology solutions for a diverse range of clients including United Nations organizations, mining companies, and security forces, with a market capitalization of approximately A$2.07 billion.

Operations: The company generates revenue primarily through its Communications and Metal Detection segments, earning A$291.50 million and A$212.20 million respectively.

Estimated Discount To Fair Value: 24.5%

Codan, currently priced at A$11.42, appears undervalued by over 20% compared to its estimated fair value of A$15.13 based on discounted cash flows. The company's return on equity is expected to be robust at 21.5% in three years, outpacing the Australian market forecast of 5.4%. With earnings projected to expand by 16.2% annually, Codan's growth trajectory exceeds the average market prediction of 13.7%, highlighting its potential despite not being significantly above a 20% growth threshold.

- Our comprehensive growth report raises the possibility that Codan is poised for substantial financial growth.

- Dive into the specifics of Codan here with our thorough financial health report.

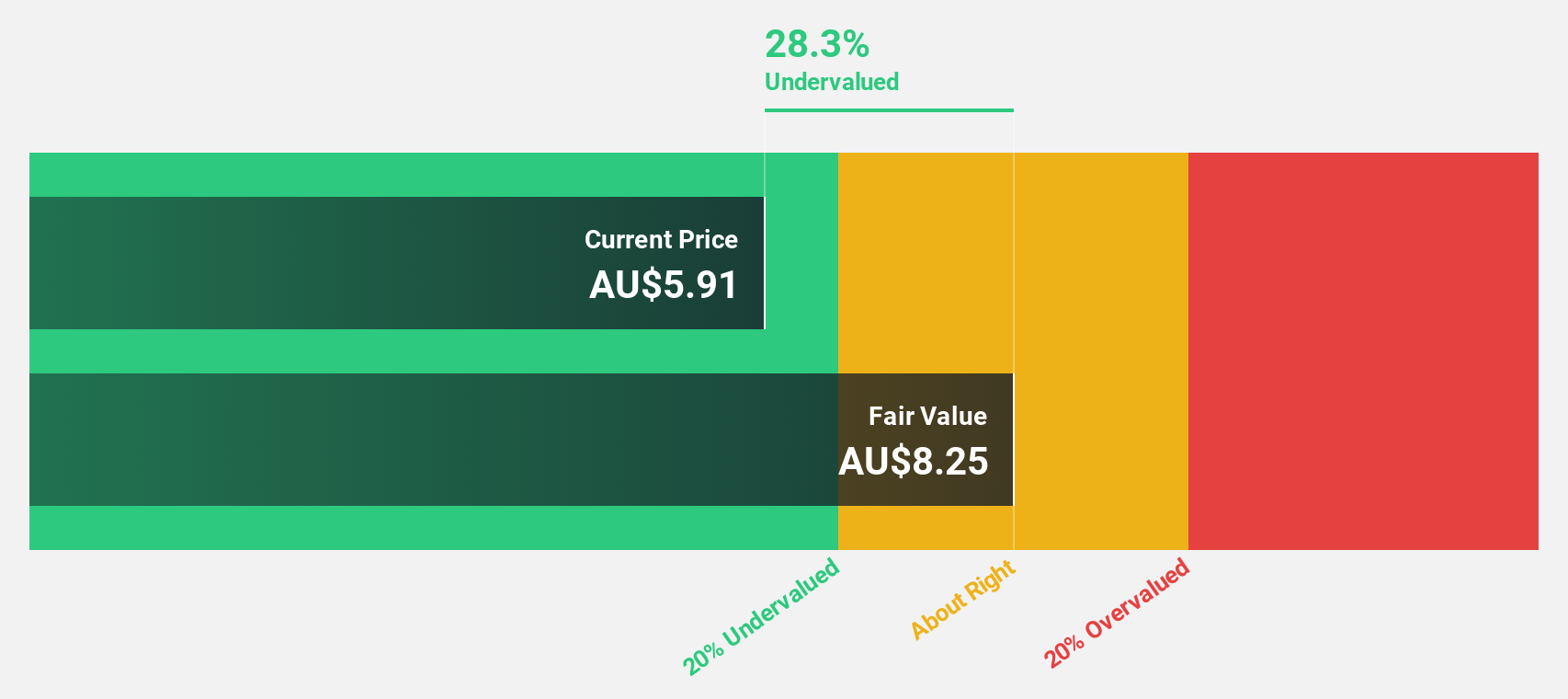

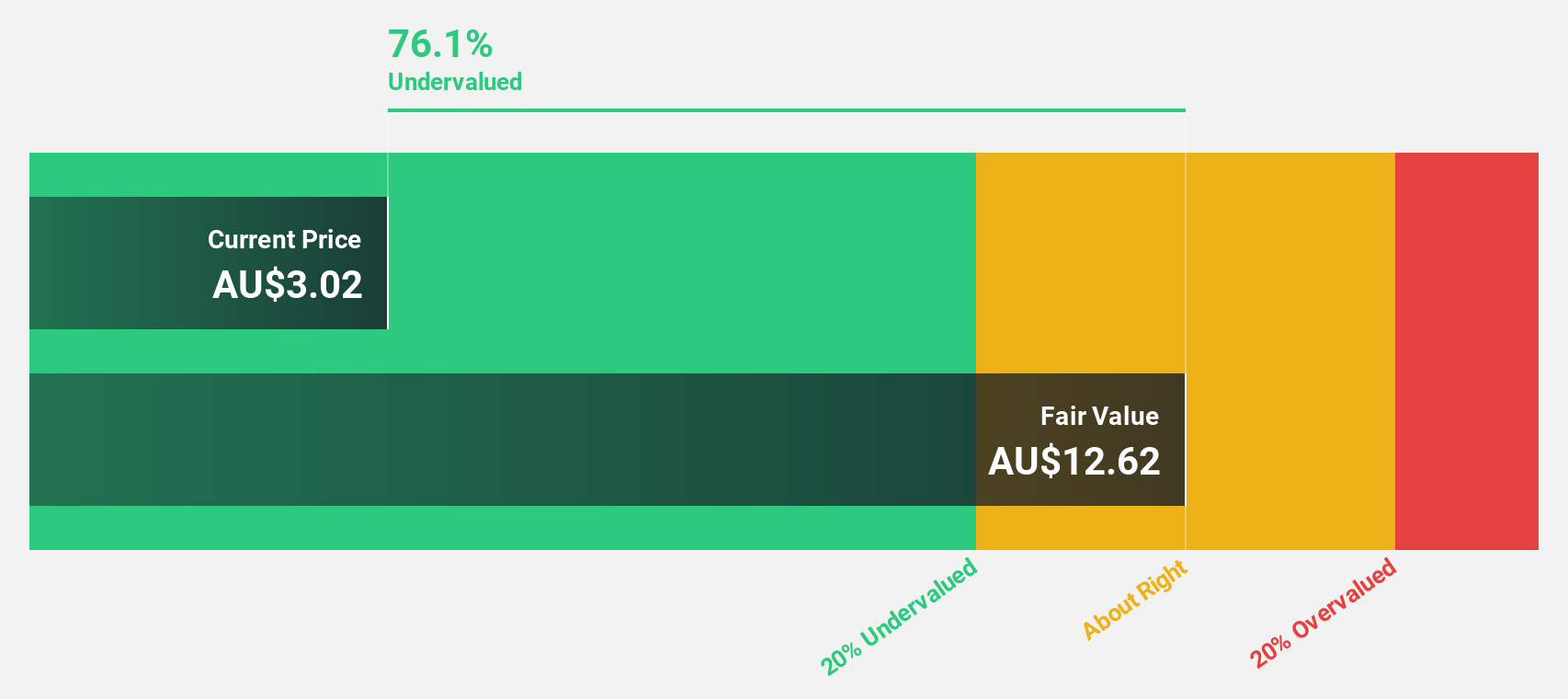

Mader Group (ASX:MAD)

Overview: Mader Group Limited is a contracting company offering specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market capitalization of approximately A$1.30 billion.

Operations: The company generates its revenue primarily through staffing and outsourcing services, amounting to A$702.87 million.

Estimated Discount To Fair Value: 48.4%

Mader Group, priced at A$6.51, is significantly undervalued, with a DCF-based fair value estimate of A$12.62, indicating a 48.4% undervaluation. Its earnings growth is expected to be robust at 17.56% annually, surpassing the Australian market's average of 13.7%. Additionally, Mader's revenue growth forecast at 15.3% per year outstrips the broader market prediction of 5.4%, reinforcing its potential in a competitive landscape despite not reaching extremely high growth rates.

- According our earnings growth report, there's an indication that Mader Group might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Mader Group.

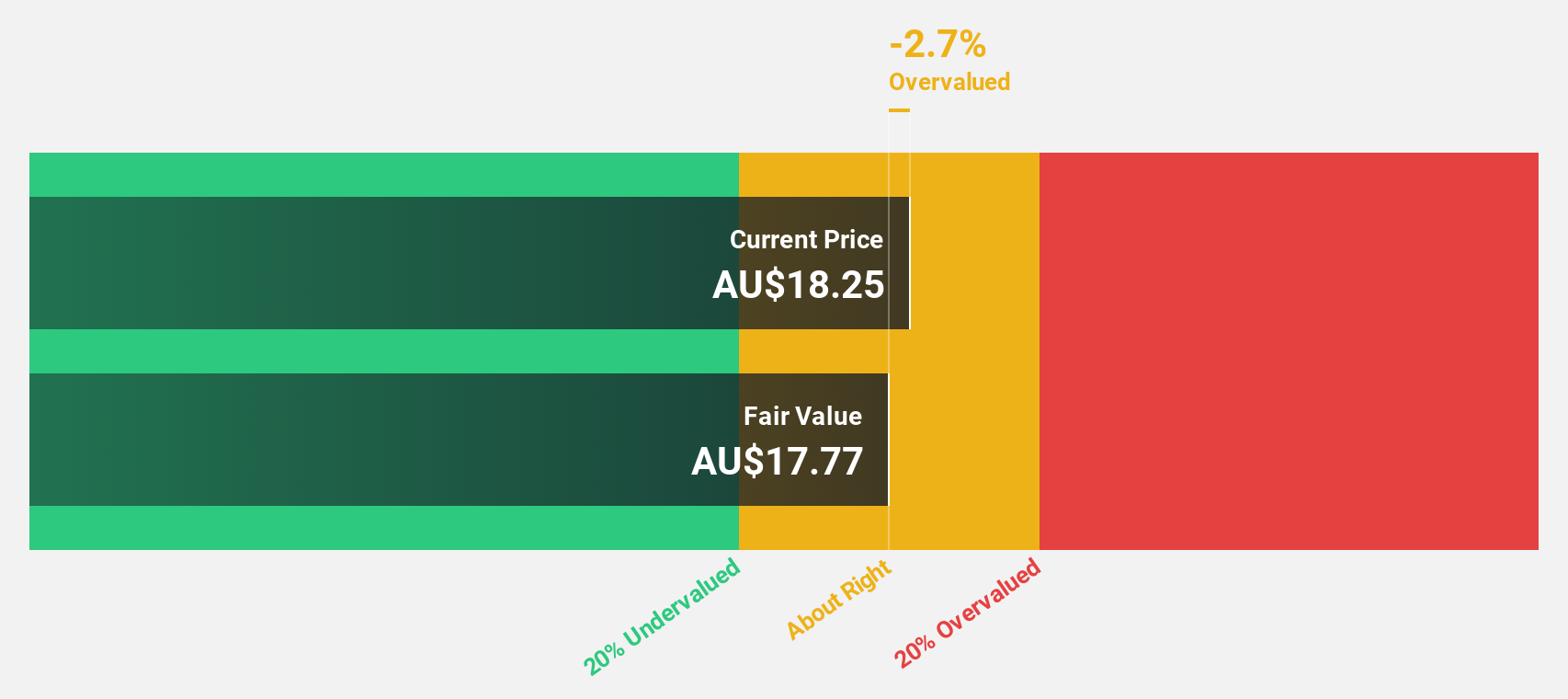

South32 (ASX:S32)

Overview: South32 Limited is a diversified metals and mining company with operations across multiple countries including Australia, India, and the United States, boasting a market cap of approximately A$16.52 billion.

Operations: South32's revenue is primarily derived from its Hillside Aluminium at A$1.72 billion, followed by Illawarra Metallurgical Coal at A$1.36 billion, Worsley Alumina at A$1.36 billion, and other segments including Mozal Aluminium (A$801 million), Sierra Gorda (A$649 million), Australia Manganese (A$651 million), Cannington (A$588 million), Cerro Matoso (A$541 million), South Africa Manganese (A$321 million), Brazil Alumina (A$443 million), and Brazil Aluminium (BA) at A$210 million.

Estimated Discount To Fair Value: 40%

South32, currently priced at A$3.66, trades 40% below its estimated fair value of A$6.1, suggesting substantial undervaluation based on discounted cash flows. Expected to turn profitable within three years, its forecasted revenue growth rate of 7.5% per year is higher than the Australian market average of 5.4%. However, its projected Return on Equity in three years is relatively low at 10.9%, tempering some optimism about its future financial performance.

- The analysis detailed in our South32 growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of South32.

Turning Ideas Into Actions

- Investigate our full lineup of 49 Undervalued ASX Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:S32

Excellent balance sheet with reasonable growth potential.