ASX Stocks Estimated To Be Up To 48.5% Below Intrinsic Value

Reviewed by Simply Wall St

As the ASX200 edges up slightly by 0.08% to 8,257 points, the Australian market is witnessing a mixed performance with IT and Real Estate sectors leading gains, while Materials struggle amid declining iron ore prices. In this environment of fluctuating sector performances and economic uncertainties, identifying undervalued stocks can provide investors with opportunities to capitalize on potential growth when these stocks are trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$6.31 | A$12.25 | 48.5% |

| SKS Technologies Group (ASX:SKS) | A$1.95 | A$3.80 | 48.7% |

| MLG Oz (ASX:MLG) | A$0.58 | A$1.15 | 49.4% |

| Atlas Arteria (ASX:ALX) | A$4.84 | A$9.54 | 49.3% |

| Ingenia Communities Group (ASX:INA) | A$4.66 | A$9.17 | 49.2% |

| Charter Hall Group (ASX:CHC) | A$14.78 | A$28.58 | 48.3% |

| Vault Minerals (ASX:VAU) | A$0.33 | A$0.66 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.15 | A$6.25 | 49.6% |

| Gold Road Resources (ASX:GOR) | A$2.11 | A$4.13 | 49% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

Here's a peek at a few of the choices from the screener.

Data#3 (ASX:DTL)

Overview: Data#3 Limited provides information technology solutions and services across Australia, Fiji, and the Pacific Islands, with a market capitalization of A$982.12 million.

Operations: The company's revenue is primarily derived from its role as a value-added IT reseller and IT solutions provider, generating A$805.75 million.

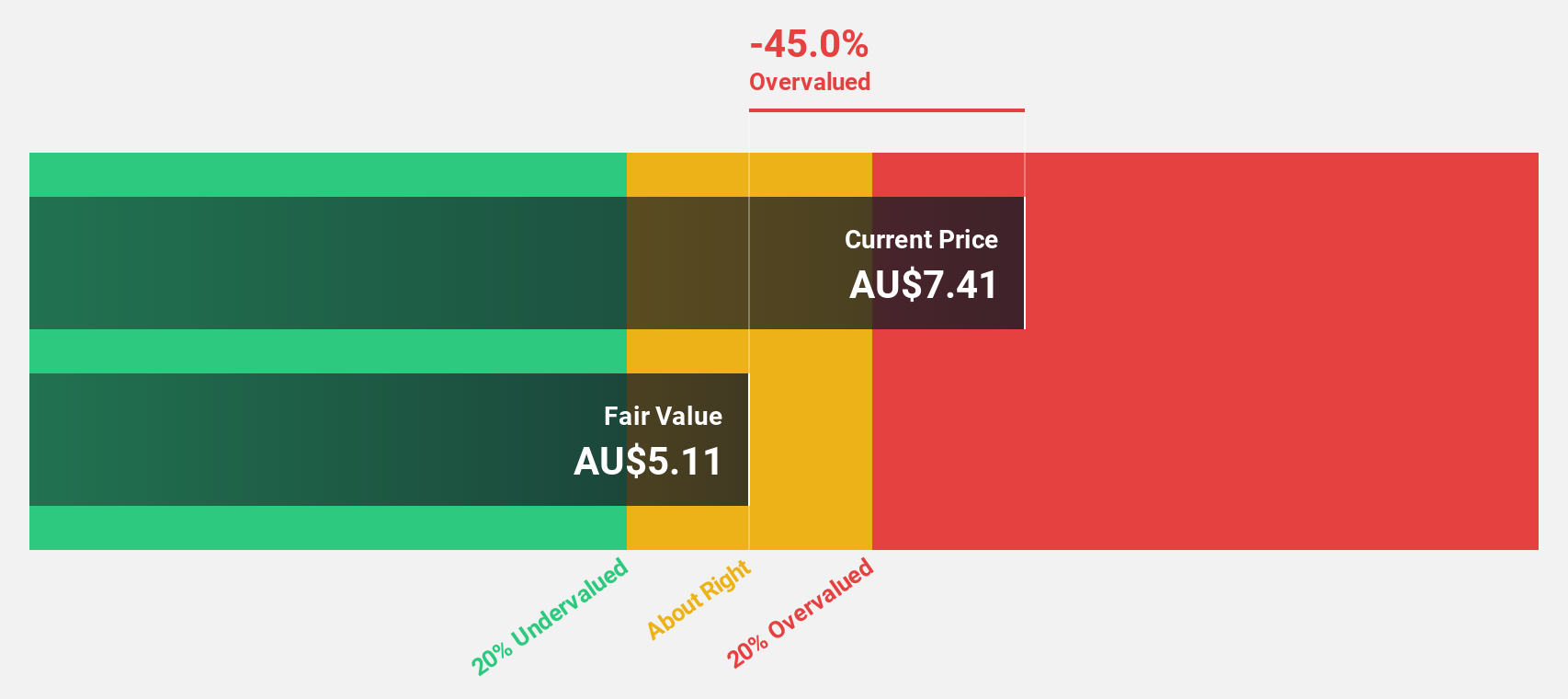

Estimated Discount To Fair Value: 48.5%

Data#3 is trading at A$6.31, significantly below its estimated fair value of A$12.25, suggesting it may be undervalued based on cash flows. The company is expected to see revenue growth of 23.8% per year, outpacing the broader Australian market's 5.9%. However, while earnings are forecast to grow at 9.6% annually, this lags behind the market average of 12.5%. Recent board changes include Bronwyn Morris's appointment as Chair of the Audit and Risk Committee, bringing extensive financial expertise to the role.

- In light of our recent growth report, it seems possible that Data#3's financial performance will exceed current levels.

- Click here to discover the nuances of Data#3 with our detailed financial health report.

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited is involved in the exploration, production, and development of gold deposits in Western Australia with a market cap of A$2.86 billion.

Operations: The company generates revenue of A$438.59 million from its activities in mineral production, exploration, and development.

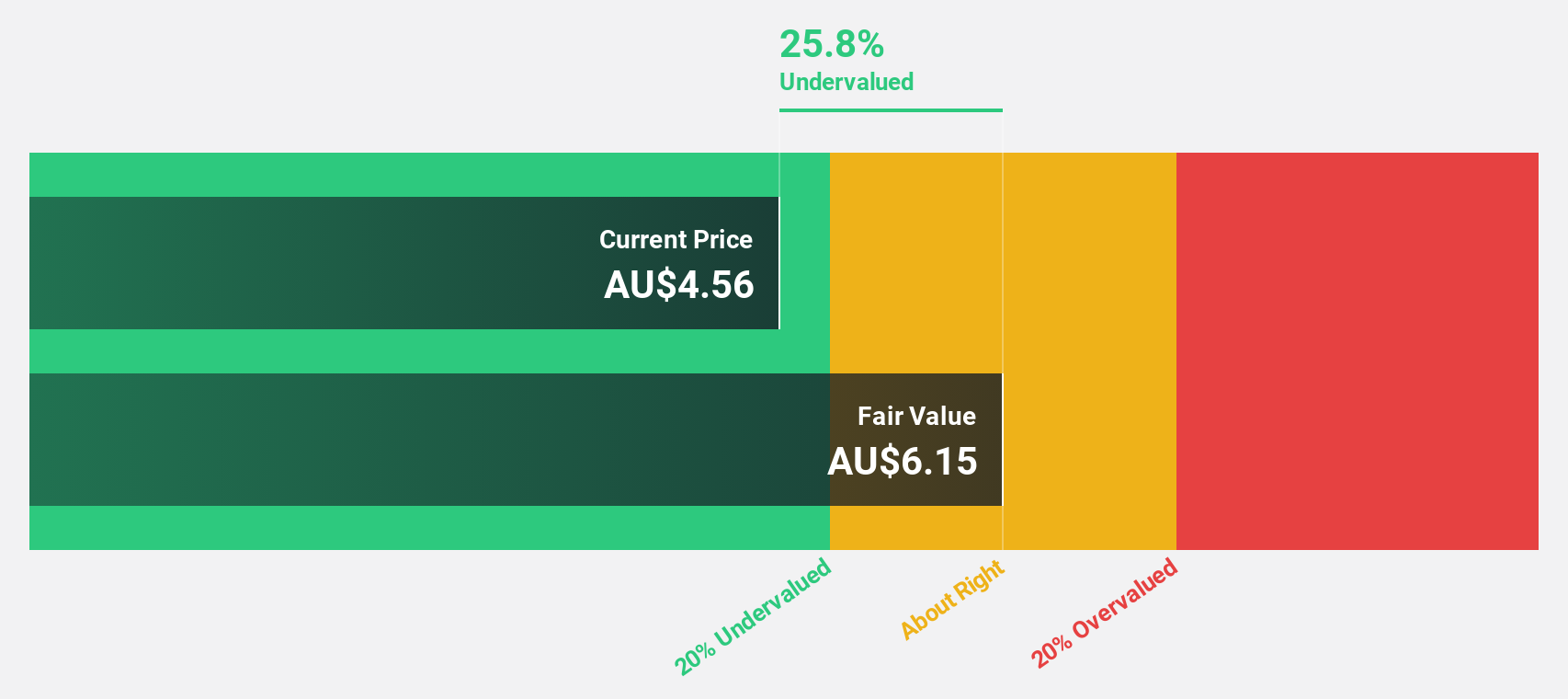

Estimated Discount To Fair Value: 46.9%

Genesis Minerals is trading at A$2.58, well below its estimated fair value of A$4.86, highlighting potential undervaluation based on cash flows. The company recently became profitable and is forecast to achieve significant earnings growth of 22.8% per year, surpassing the Australian market's average. Despite this positive outlook, revenue growth at 18.5% annually remains below the 20% benchmark but still exceeds the market rate of 5.9%.

- Our comprehensive growth report raises the possibility that Genesis Minerals is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Genesis Minerals' balance sheet health report.

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited is an infection prevention company operating globally with a market cap of A$904.57 million.

Operations: The company's revenue primarily comes from its Healthcare Equipment segment, generating A$170.01 million.

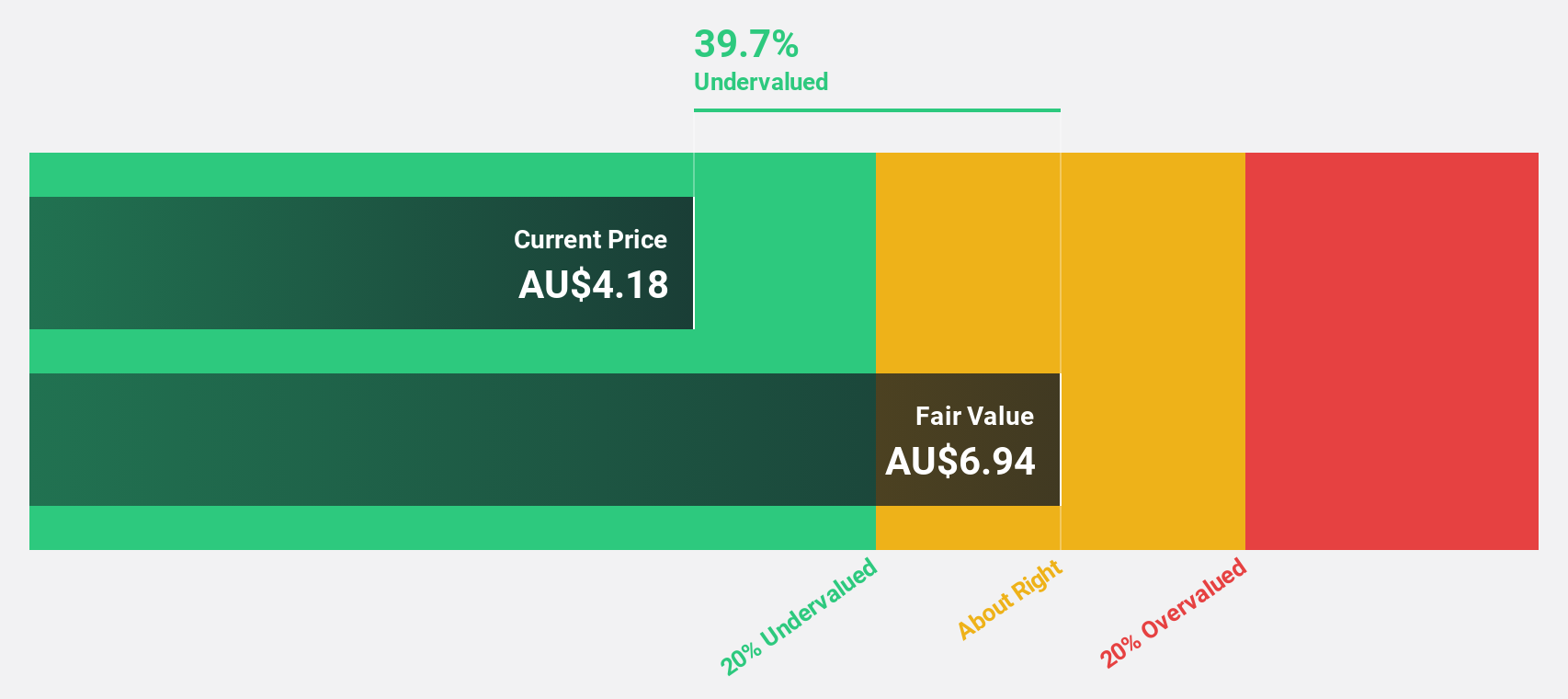

Estimated Discount To Fair Value: 39.3%

Nanosonics is trading at A$3.02, significantly below its estimated fair value of A$4.98, suggesting potential undervaluation based on cash flows. The company's earnings are projected to grow substantially at 24% annually, outpacing the Australian market average of 12.5%. However, revenue growth is expected to be moderate at 8.7% per year. Recent board changes might impact strategic direction but do not overshadow the strong earnings growth outlook despite a lower profit margin compared to last year.

- Insights from our recent growth report point to a promising forecast for Nanosonics' business outlook.

- Navigate through the intricacies of Nanosonics with our comprehensive financial health report here.

Where To Now?

- Delve into our full catalog of 45 Undervalued ASX Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DTL

Data#3

Engages in the provision of information technology (IT) solutions and services in Australia, Fiji, and the Pacific Islands.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives