The Australian market has shown mixed performance, with the ASX200 closing slightly up by 0.08% at 8,257 points, while sectors like IT and Real Estate have been leading gains. In this context of fluctuating sector performances and economic uncertainties, investors often seek opportunities in penny stocks—smaller or newer companies that can offer unique growth prospects at lower price points. Despite being an older term, penny stocks remain relevant for those looking to uncover hidden gems with strong financials that might not be immediately apparent in larger firms.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.96 | A$109.06M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.09 | A$346.8M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$218.54M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.285 | A$110.99M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$838.04M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.98 | A$484.45M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Fleetwood (ASX:FWD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fleetwood Limited operates in Australia and New Zealand, focusing on the design, manufacture, sale, and installation of modular accommodation and buildings with a market cap of A$177.13 million.

Operations: Fleetwood's revenue is derived from three main segments: RV Solutions contributing A$75.50 million, Building Solutions generating A$309.61 million, and Community Solutions adding A$33.70 million.

Market Cap: A$177.13M

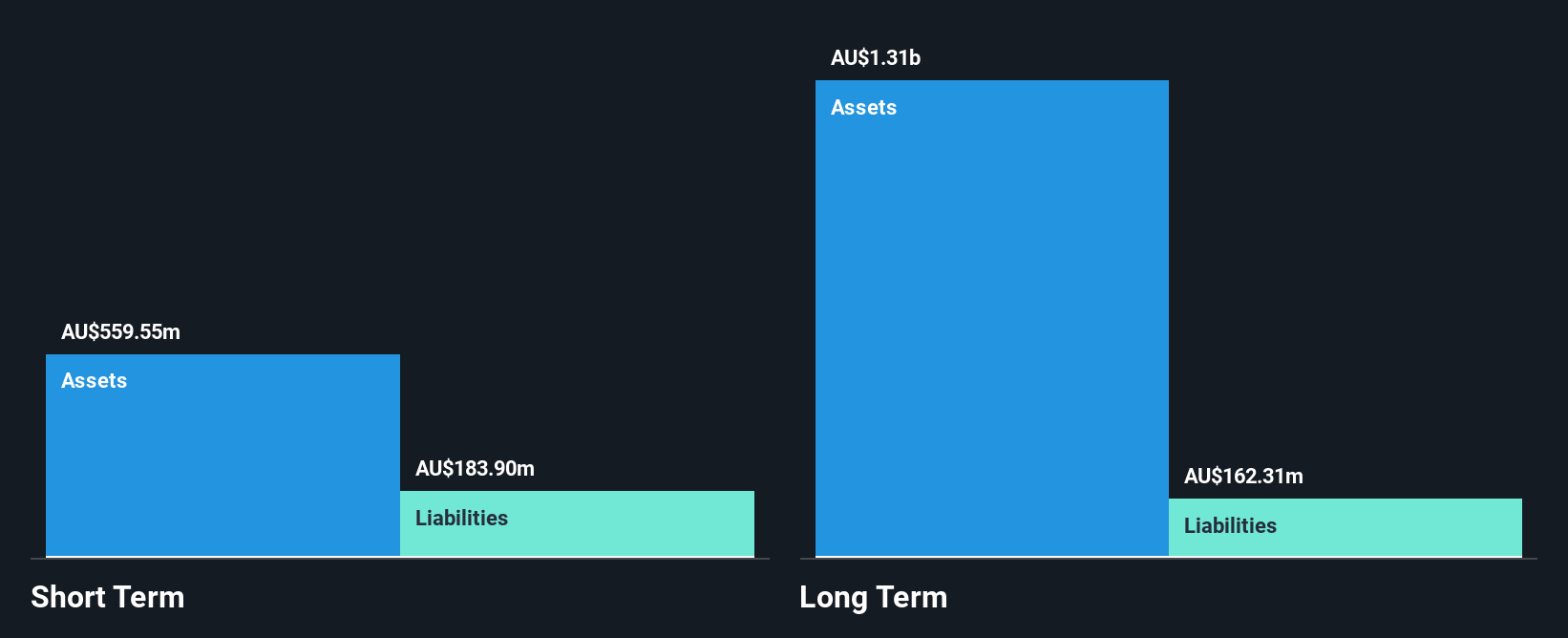

Fleetwood Limited, with a market cap of A$177.13 million, has shown significant growth in earnings over the past year at 85.2%, surpassing both its five-year average and the Consumer Durables industry growth rate. The company is debt-free, with short-term assets comfortably covering both short and long-term liabilities. Despite these strengths, Fleetwood's return on equity remains low at 2.3%, and its dividend yield of 2.69% is not well covered by earnings or free cash flow. Additionally, shares are trading significantly below estimated fair value, presenting potential opportunities for investors mindful of risks associated with low profitability margins currently at 0.9%.

- Take a closer look at Fleetwood's potential here in our financial health report.

- Learn about Fleetwood's future growth trajectory here.

IVE Group (ASX:IGL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IVE Group Limited operates in the marketing sector in Australia, with a market capitalization of A$325.27 million.

Operations: The company generates revenue from its Advertising segment, amounting to A$972.82 million.

Market Cap: A$325.27M

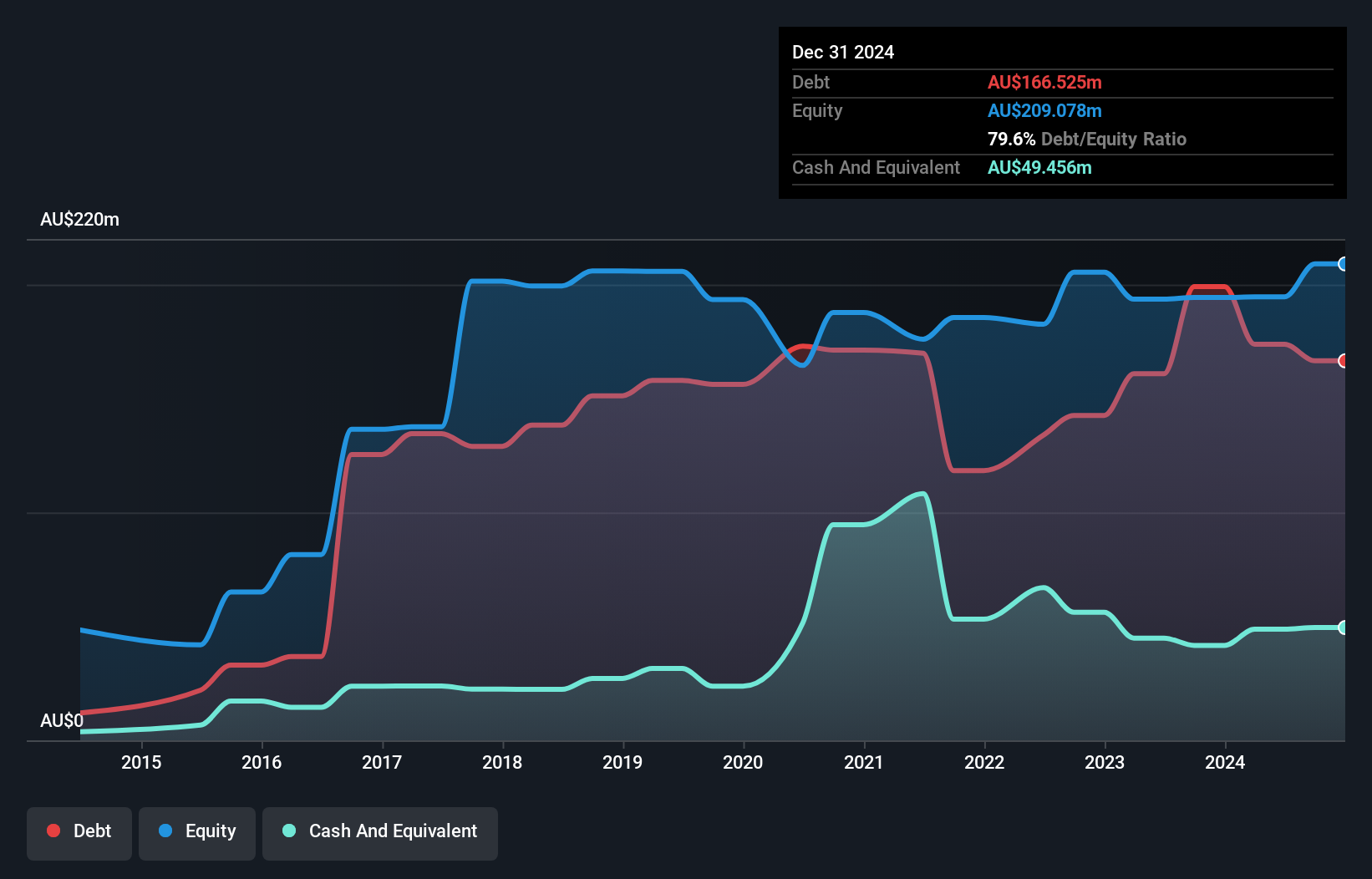

IVE Group Limited, with a market cap of A$325.27 million, has demonstrated robust earnings growth of 61% over the past year, outpacing its five-year average and the broader Media industry. Despite this growth, the company faces challenges with a high net debt to equity ratio of 64.2%, though interest payments are well covered by EBIT at 3.4 times coverage. Its short-term assets exceed both short-term and long-term liabilities, indicating sound liquidity management. However, while trading significantly below estimated fair value and having high-quality earnings, IVE Group's dividend yield is not well covered by current earnings levels.

- Get an in-depth perspective on IVE Group's performance by reading our balance sheet health report here.

- Examine IVE Group's earnings growth report to understand how analysts expect it to perform.

Ramelius Resources (ASX:RMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ramelius Resources Limited is involved in the exploration, evaluation, mine development and operation, production, and sale of gold with a market cap of A$2.44 billion.

Operations: The company generates revenue from its Edna May operations amounting to A$399.34 million and Mt Magnet operations totaling A$483.23 million.

Market Cap: A$2.44B

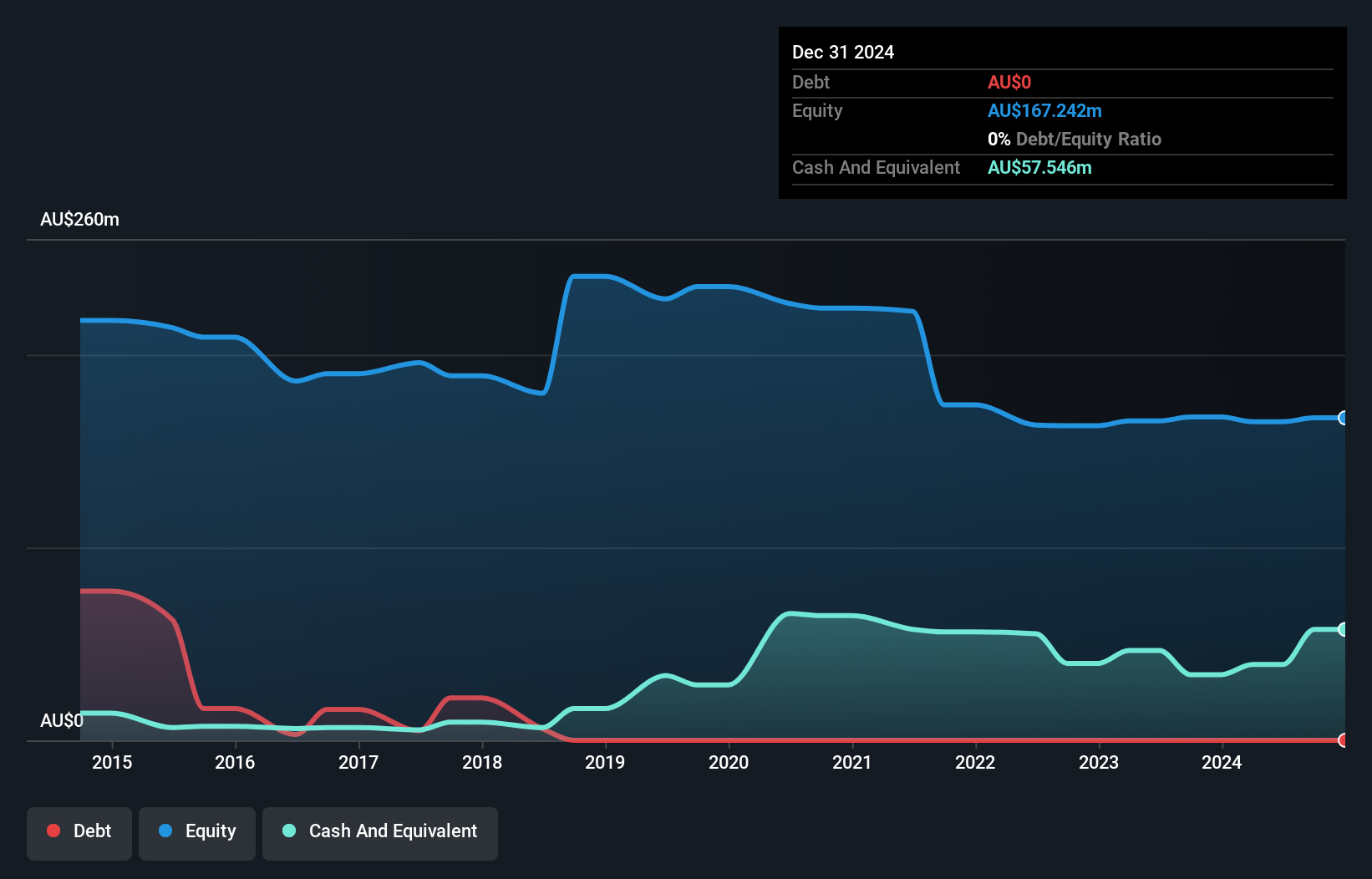

Ramelius Resources Limited, with a market cap of A$2.44 billion, has shown significant earnings growth of 251.8% over the past year, surpassing both its five-year average and industry standards. The company operates without debt, enhancing financial stability and flexibility for potential acquisitions like Northern Star's Carosue Dam Operations. Recent executive changes include appointing Tim Hewitt as COO and promoting Alan Thom to Chief Development Officer, which could bolster strategic initiatives such as the Rebecca-Roe project. Despite a low return on equity at 16.3%, Ramelius maintains strong liquidity with short-term assets covering all liabilities effectively.

- Dive into the specifics of Ramelius Resources here with our thorough balance sheet health report.

- Explore Ramelius Resources' analyst forecasts in our growth report.

Seize The Opportunity

- Get an in-depth perspective on all 1,050 ASX Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGL

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success