- United States

- /

- Banks

- /

- NasdaqGS:BUSE

First Busey And 2 Other Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

In the midst of a volatile market session, where major indices like the Nasdaq and S&P 500 have experienced fluctuations due to U.S.-China trade tensions and impressive bank earnings, investors are keenly observing opportunities that may arise from these shifts. Identifying stocks that appear undervalued can be particularly appealing during such times, as they offer potential for growth when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trade Desk (TTD) | $50.73 | $96.49 | 47.4% |

| Peapack-Gladstone Financial (PGC) | $28.58 | $56.16 | 49.1% |

| Metropolitan Bank Holding (MCB) | $79.01 | $152.30 | 48.1% |

| McGraw Hill (MH) | $12.60 | $25.04 | 49.7% |

| Investar Holding (ISTR) | $22.905 | $45.39 | 49.5% |

| Horizon Bancorp (HBNC) | $15.95 | $31.46 | 49.3% |

| First Busey (BUSE) | $23.75 | $45.91 | 48.3% |

| e.l.f. Beauty (ELF) | $132.49 | $252.80 | 47.6% |

| Comstock Resources (CRK) | $19.21 | $37.95 | 49.4% |

| AGNC Investment (AGNC) | $10.01 | $19.61 | 49% |

Here we highlight a subset of our preferred stocks from the screener.

First Busey (BUSE)

Overview: First Busey Corporation, with a market cap of $2.03 billion, operates as the bank holding company for Busey Bank, providing retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Operations: The company's revenue segments consist of $435.30 million from banking, $21.76 million from Firs Tech, and $67.69 million from wealth management.

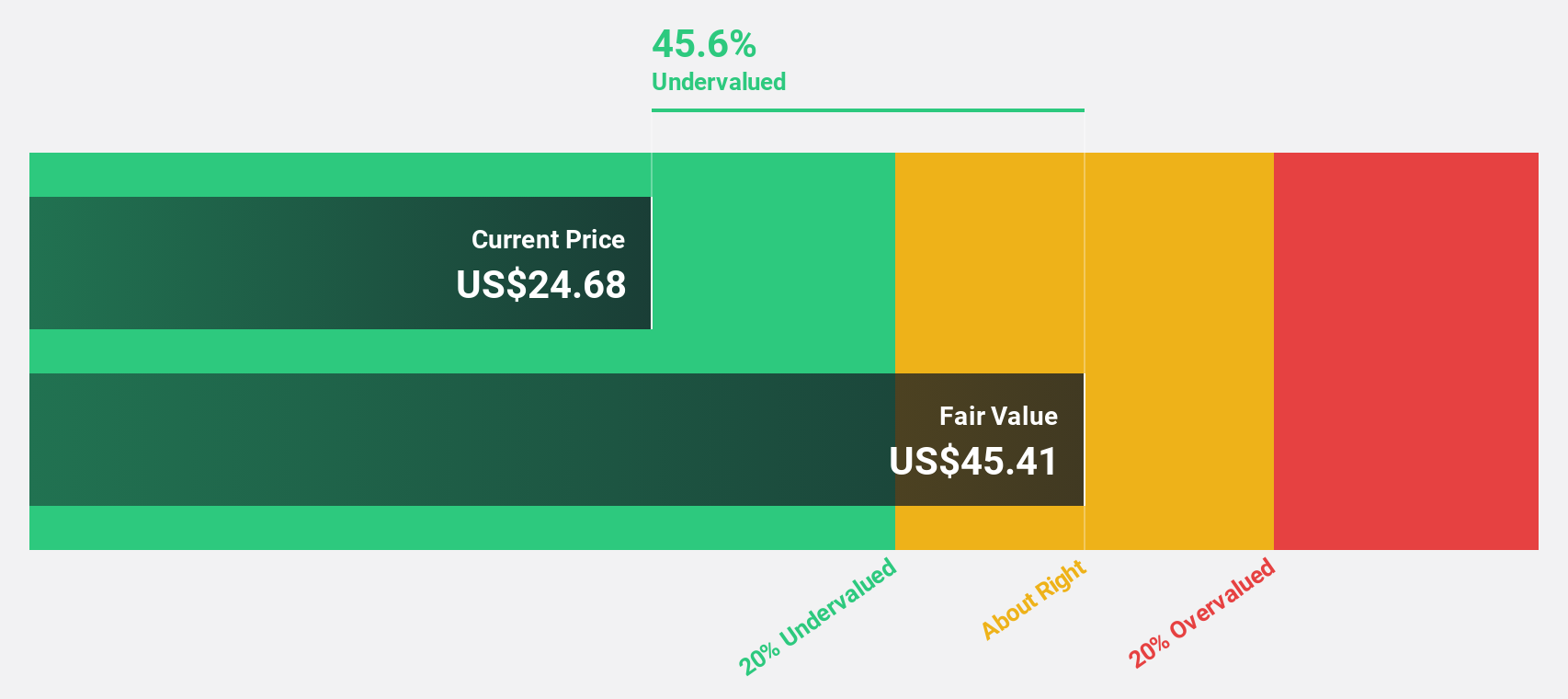

Estimated Discount To Fair Value: 48.3%

First Busey is trading at US$23.75, significantly below its estimated fair value of US$45.91, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow 52.3% annually over the next three years, outpacing the broader U.S. market's growth expectations of 15.5%. Despite a recent decline in profit margins and shareholder dilution, First Busey maintains a reliable dividend yield of 4.21%, with ongoing strategic leadership changes potentially enhancing future financial performance.

- Our growth report here indicates First Busey may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of First Busey.

Granite Construction (GVA)

Overview: Granite Construction Incorporated is a U.S.-based infrastructure contractor with a market cap of approximately $4.67 billion.

Operations: The company's revenue is primarily derived from its Construction segment at $3.45 billion and its Materials segment at $868.44 million.

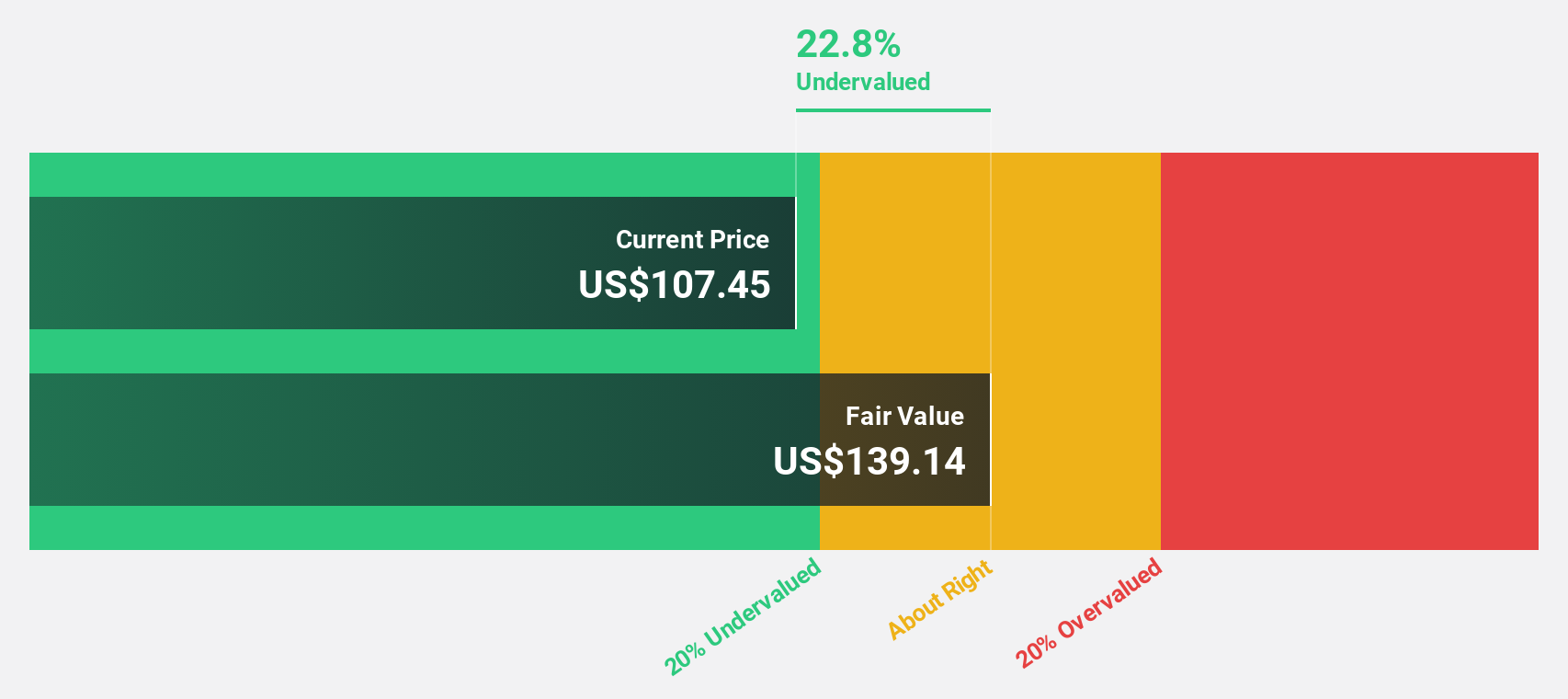

Estimated Discount To Fair Value: 19.9%

Granite Construction, trading at US$107.13, is valued below its estimated fair value of US$133.8, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 36.6% annually over the next three years, surpassing the U.S. market's average growth rate of 15.5%. Despite recent insider selling and a modest dividend yield of $0.13 per share, Granite's robust project pipeline and strategic M&A focus bolster its long-term cash flow prospects.

- Upon reviewing our latest growth report, Granite Construction's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Granite Construction with our comprehensive financial health report here.

Workiva (WK)

Overview: Workiva Inc. provides cloud-based reporting solutions across the Americas and internationally, with a market cap of approximately $4.96 billion.

Operations: The company's revenue segment is primarily derived from data processing, amounting to $806.98 million.

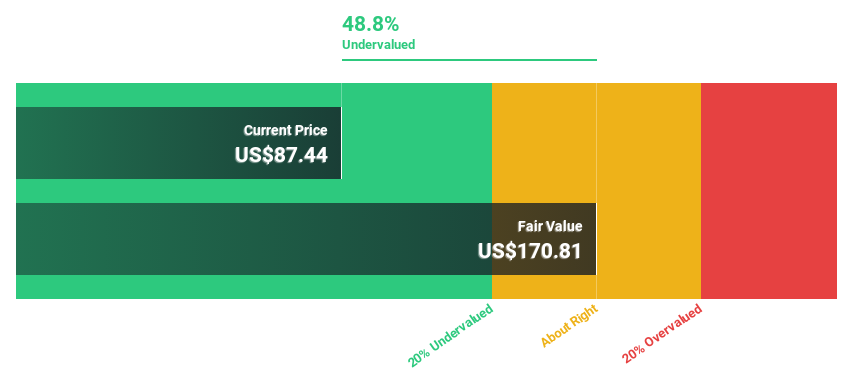

Estimated Discount To Fair Value: 17.5%

Workiva, trading at US$87.48, is valued below its estimated fair value of US$106.01, indicating potential undervaluation based on cash flows. Despite a net loss for the recent quarter and governance concerns raised by Irenic Capital Management, Workiva's revenue growth outpaces the U.S. market average and its innovations in AI-driven platforms enhance operational efficiencies for clients like PwC and Cognizant. The company’s forecasted profitability within three years further supports positive cash flow expectations.

- Our expertly prepared growth report on Workiva implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Workiva's balance sheet health report.

Summing It All Up

- Click through to start exploring the rest of the 178 Undervalued US Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BUSE

First Busey

Operates as the bank holding company for Busey Bank that engages in the provision of retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives