- United States

- /

- Banks

- /

- NasdaqGS:TCBI

Discover Three Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences modest gains amid ongoing trade policy uncertainties, investors are keenly observing how these developments might impact their portfolios. In this environment, identifying stocks that may be trading below their estimated value can provide opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SharkNinja (SN) | $105.55 | $210.92 | 50% |

| Roku (ROKU) | $88.14 | $173.21 | 49.1% |

| Robert Half (RHI) | $42.53 | $83.11 | 48.8% |

| Hess Midstream (HESM) | $37.96 | $73.34 | 48.2% |

| e.l.f. Beauty (ELF) | $116.99 | $230.48 | 49.2% |

| ConnectOne Bancorp (CNOB) | $24.66 | $47.49 | 48.1% |

| Carter Bankshares (CARE) | $17.95 | $35.50 | 49.4% |

| Camden National (CAC) | $43.34 | $83.12 | 47.9% |

| Atlantic Union Bankshares (AUB) | $33.32 | $65.54 | 49.2% |

| ACNB (ACNB) | $43.97 | $84.28 | 47.8% |

We'll examine a selection from our screener results.

Five9 (FIVN)

Overview: Five9, Inc., along with its subsidiaries, offers intelligent cloud software solutions for contact centers globally and has a market cap of approximately $2.12 billion.

Operations: The company's revenue is primarily generated from its Internet Software & Services segment, amounting to $1.07 billion.

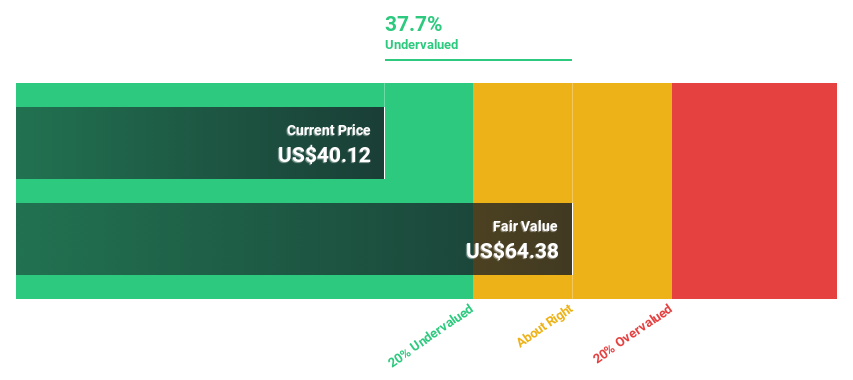

Estimated Discount To Fair Value: 37.1%

Five9, Inc. is trading at US$29.13, significantly below its estimated fair value of US$46.33, suggesting it may be undervalued based on cash flows. Despite recent index exclusions, Five9's innovative AI developments and integration with Salesforce enhance its customer experience offerings. The company reported a modest net income for Q1 2025 and forecasts revenue growth slower than the market average but expects substantial earnings growth over the next three years as profitability improves.

- Our growth report here indicates Five9 may be poised for an improving outlook.

- Dive into the specifics of Five9 here with our thorough financial health report.

Li Auto (LI)

Overview: Li Auto Inc. operates in the energy vehicle market in the People's Republic of China with a market cap of approximately $27.10 billion.

Operations: The company generates revenue primarily from its Auto Manufacturers segment, totaling CN¥144.75 billion.

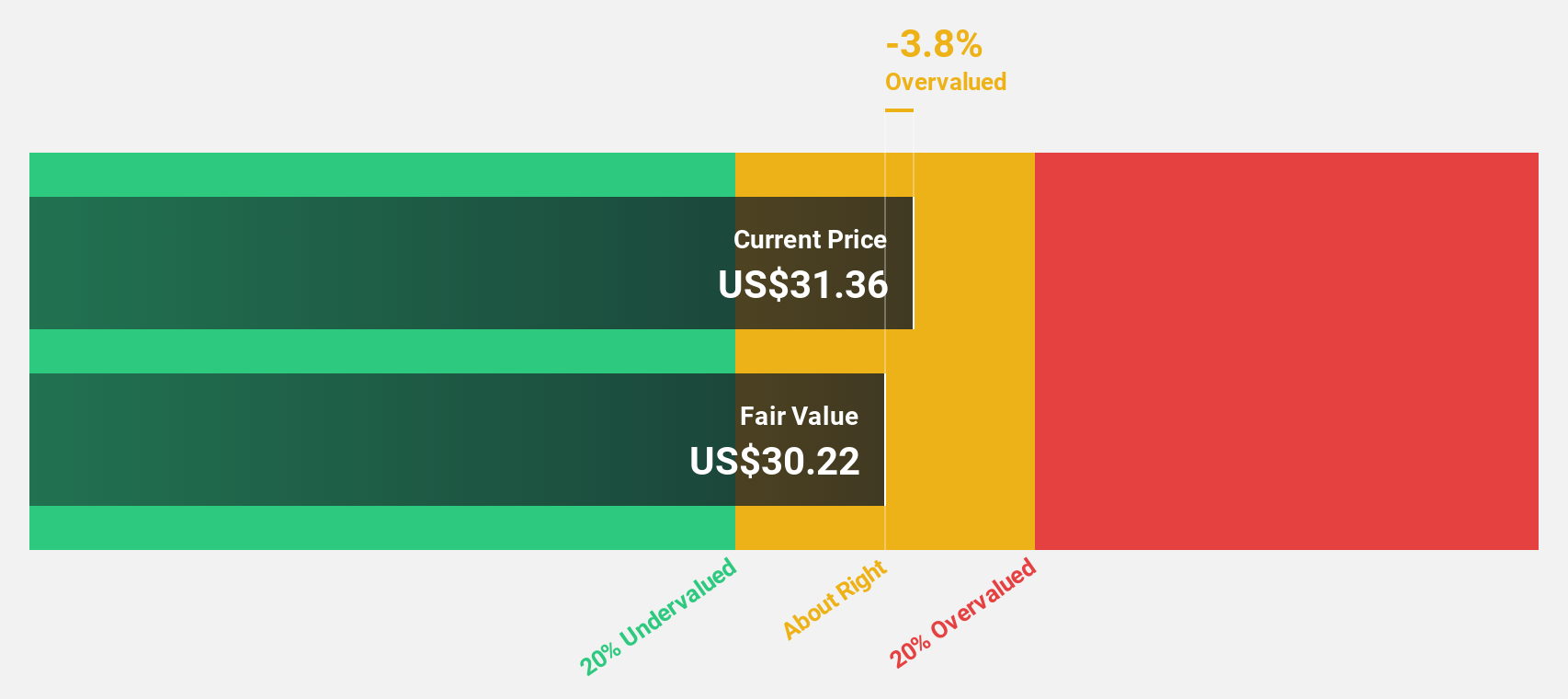

Estimated Discount To Fair Value: 11%

Li Auto is trading at US$26.98, slightly below its fair value estimate of US$30.3, indicating potential undervaluation based on cash flows. Despite a revised delivery outlook due to a sales system upgrade, Li Auto's earnings are forecasted to grow significantly over the next three years, outpacing the broader US market. However, profit margins have declined from last year and ongoing legal issues could impact investor sentiment. Analysts anticipate a 24.2% increase in stock price.

- According our earnings growth report, there's an indication that Li Auto might be ready to expand.

- Navigate through the intricacies of Li Auto with our comprehensive financial health report here.

Texas Capital Bancshares (TCBI)

Overview: Texas Capital Bancshares, Inc., the bank holding company for Texas Capital Bank, is a full-service financial services firm providing customized solutions to businesses, entrepreneurs, and individual customers with a market cap of approximately $3.92 billion.

Operations: The primary revenue segment for Texas Capital Bancshares is Banking, which generated $891.50 million.

Estimated Discount To Fair Value: 28.1%

Texas Capital Bancshares, trading at US$86.22, is considered undervalued with a fair value estimate of US$119.97. The company has shown strong earnings growth, forecasted to rise significantly over the next three years, surpassing the broader US market's growth rate. Recent additions to multiple Russell Growth Indexes could enhance visibility and investor interest. However, profit margins have decreased from 16% last year to 9.1%, which may warrant attention from investors focused on profitability metrics.

- The analysis detailed in our Texas Capital Bancshares growth report hints at robust future financial performance.

- Take a closer look at Texas Capital Bancshares' balance sheet health here in our report.

Next Steps

- Reveal the 176 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives