- United States

- /

- Hospitality

- /

- NYSE:CAVA

CAVA Group (NYSE:CAVA) Posts Sales and Net Income Growth for Q1 2025

Reviewed by Simply Wall St

CAVA Group (NYSE:CAVA) recently announced an increase in sales and net income for the first quarter of 2025, maintaining its earnings guidance for the year. Despite this positive performance, the company's stock experienced a 3% decline over the past month. This movement coincided with a 3% drop in the broader market over the past week, suggesting the decline was part of a larger market trend. CAVA Group's updates on restaurant sales growth and profit margins, while stable, were countered by the downward momentum affecting the market as a whole, contributing additional weight to its share price performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

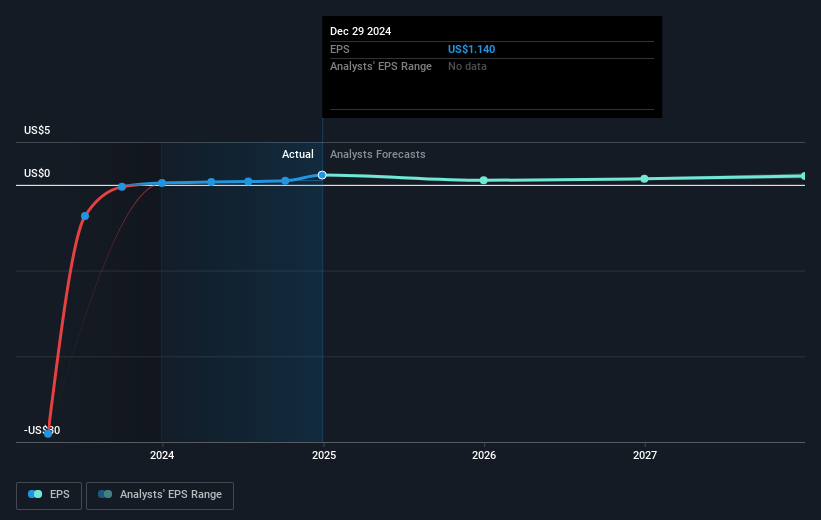

The recent 3% decline in CAVA Group's stock is part of a broader market trend, affecting the company's narrative despite positive earnings news. Over the last year, CAVA Group's total return was a modest 0.60%, which contrasted with the company's significant challenges compared to the US Hospitality industry's 11.6% return. This disparity highlights external pressures and market volatility influencing investor sentiment. However, the company's longer-term initiatives like geographical expansion and menu innovation, including launching grilled steak and entering new markets like Detroit, could drive future revenue growth despite potential margin pressures from increasing costs.

With CAVA Group continuing to invest in technology and marketing to boost operational efficiency and brand awareness, revenue and earnings forecasts remain optimistic yet cautious. Analysts have set a price target of US$115.66, reflecting expectations of long-term value. However, the current share price of US$93.32 indicates a discount to this target, suggesting potential upside if the company successfully navigates the outlined risks, including execution challenges in new markets and increasing operational costs. Investors should weigh these elements in context with broader market conditions to assess CAVA Group's position for growth.

Our valuation report unveils the possibility CAVA Group's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CAVA Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives