CarMax (NYSE:KMX) Third Quarter 2025 Results

Key Financial Results

- Revenue: US$6.69b (up 1.8% from 3Q 2024).

- Net income: US$125.4m (up 53% from 3Q 2024).

- Profit margin: 1.9% (up from 1.2% in 3Q 2024). The increase in margin was driven by higher revenue.

- EPS: US$0.81 (up from US$0.52 in 3Q 2024).

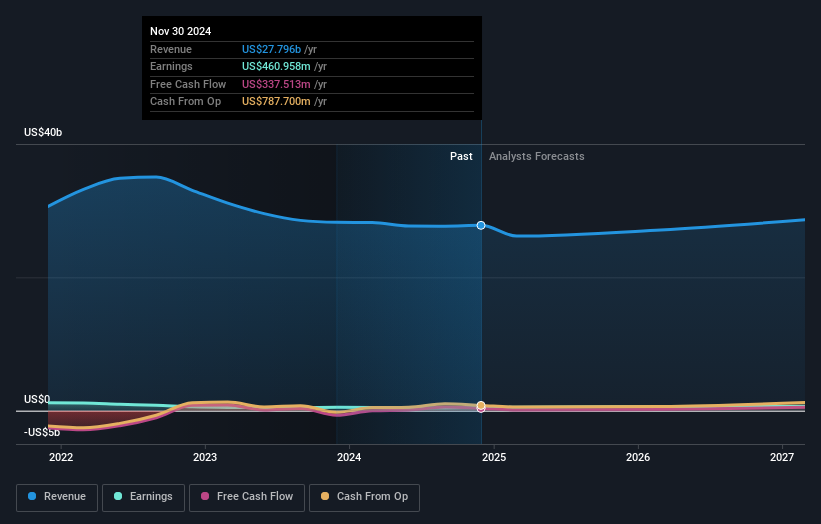

All figures shown in the chart above are for the trailing 12 month (TTM) period

CarMax Revenues and Earnings Beat Expectations

Revenue exceeded analyst estimates by 2.9%. Earnings per share (EPS) also surpassed analyst estimates by 33%.

Looking ahead, revenue is forecast to grow 2.6% p.a. on average during the next 3 years, compared to a 4.7% growth forecast for the Specialty Retail industry in the US.

Performance of the American Specialty Retail industry.

The company's shares are down 2.3% from a week ago.

Risk Analysis

We don't want to rain on the parade too much, but we did also find 1 warning sign for CarMax that you need to be mindful of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

Thanks for your post but some of your calculations are wrong. It is only the actual silver that should be priced at 100/oz, not the zink and lead. The actual silver is about 5 million ounces and the rest is biproducts which cannot be calculated as 100/oz per silver equivalent. Since it would now require alot more zink and lead to create 1 AgEq with the current silver price which means their AgEq would become lower even if the production remains the same. I am still very bullish on the stock and I own it.