- United States

- /

- Hospitality

- /

- NYSE:SGHC

3 Undervalued Stocks Estimated To Be 33.1% To 39.9% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with tech stocks sliding and retailers in focus amid a slew of earnings reports, investors are keenly watching for insights from Federal Reserve Chair Jerome Powell's upcoming speech. In such a volatile environment, identifying undervalued stocks that are trading significantly below their intrinsic value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $115.93 | $225.65 | 48.6% |

| StoneCo (STNE) | $14.93 | $28.99 | 48.5% |

| Royal Gold (RGLD) | $166.71 | $330.14 | 49.5% |

| Niagen Bioscience (NAGE) | $9.63 | $18.92 | 49.1% |

| Lyft (LYFT) | $15.57 | $30.96 | 49.7% |

| Granite Ridge Resources (GRNT) | $5.19 | $10.24 | 49.3% |

| Fiverr International (FVRR) | $22.96 | $45.45 | 49.5% |

| First Commonwealth Financial (FCF) | $16.74 | $32.97 | 49.2% |

| First Busey (BUSE) | $23.19 | $45.40 | 48.9% |

| Dime Community Bancshares (DCOM) | $28.56 | $56.47 | 49.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Shoals Technologies Group (SHLS)

Overview: Shoals Technologies Group, Inc. offers electrical balance of system solutions and components both domestically and internationally, with a market cap of $1.01 billion.

Operations: The company generates revenue primarily from its electric equipment segment, which accounts for $400.35 million.

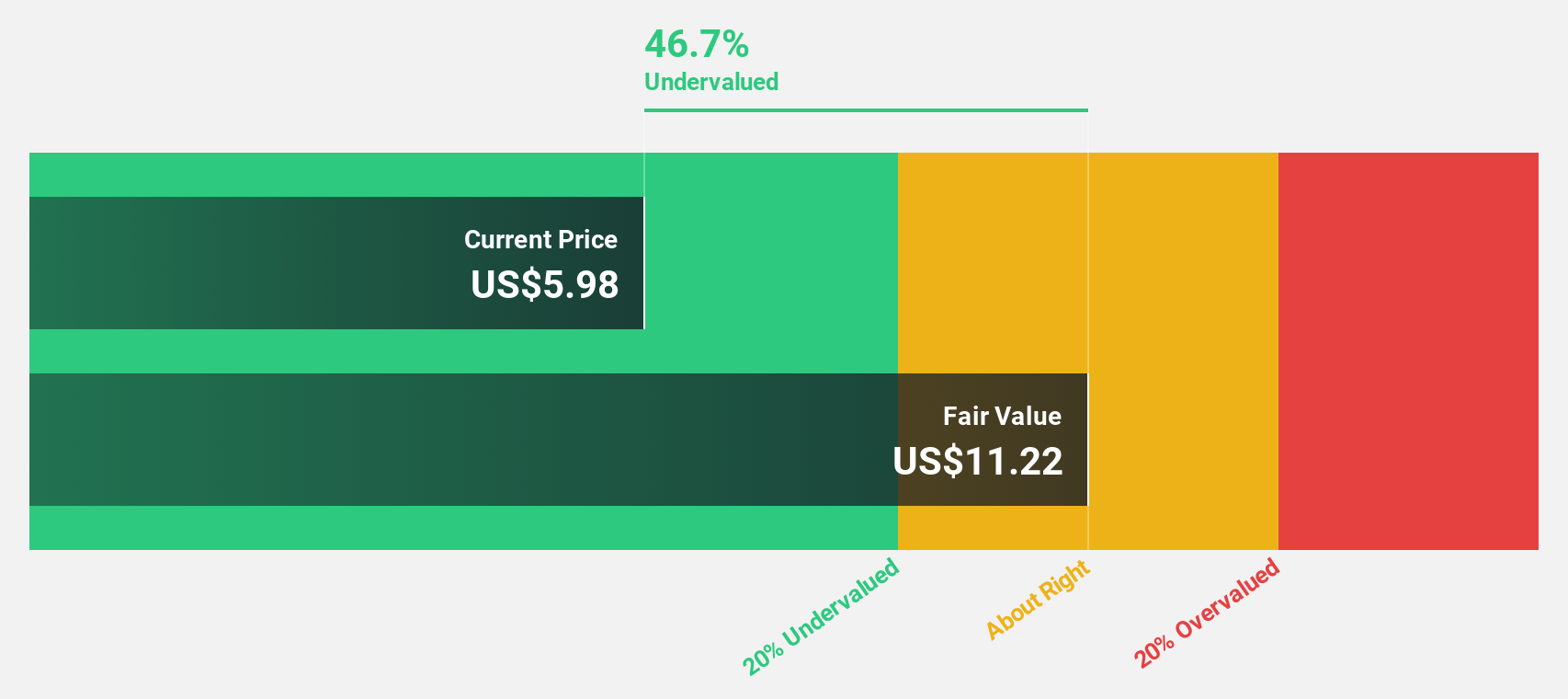

Estimated Discount To Fair Value: 33.1%

Shoals Technologies Group appears undervalued, trading 33.1% below its estimated fair value and more than 20% under discounted cash flow valuations. Despite recent volatility, the company's earnings are projected to grow significantly at 25.7% annually over the next three years, outpacing the US market average. Recent projects like Australia's Maryvale Solar and Energy Storage Project highlight Shoals' strategic expansion in renewable energy infrastructure, potentially enhancing long-term revenue streams despite a forecasted slower revenue growth rate of 11.3%.

- Our expertly prepared growth report on Shoals Technologies Group implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Shoals Technologies Group with our comprehensive financial health report here.

Accelerant Holdings (ARX)

Overview: Accelerant Holdings operates a data-driven risk exchange that connects specialty insurance underwriters with risk capital partners and has a market cap of $6.28 billion.

Operations: The company's revenue segments consist of $317.10 million from underwriting, $165.50 million from MGA operations, and $250.30 million from exchange services.

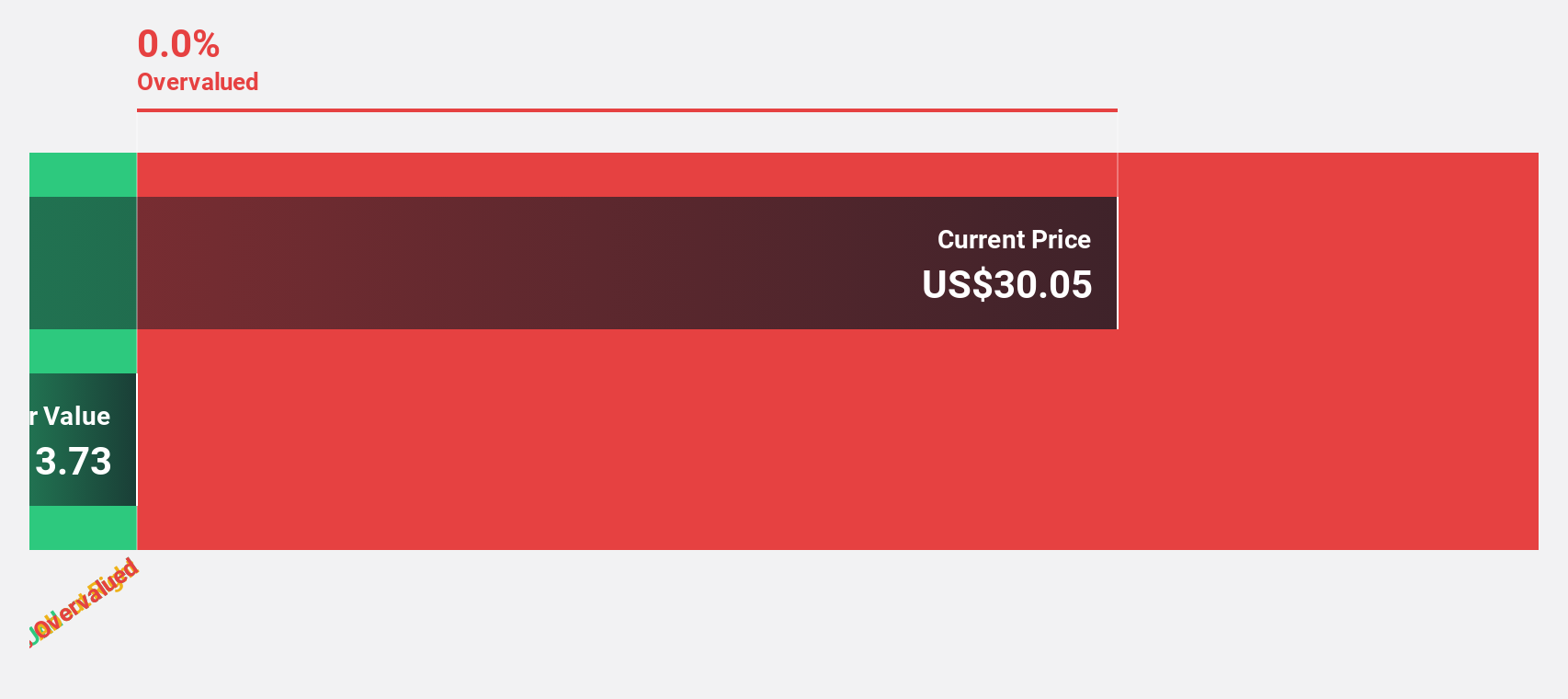

Estimated Discount To Fair Value: 35.1%

Accelerant Holdings is trading 35.1% below its estimated fair value of $45.27, with shares priced at $29.39, indicating undervaluation based on discounted cash flow analysis. The company's earnings are expected to grow significantly at 56.16% annually over the next three years, surpassing the US market average growth rate of 15.1%. Despite high illiquidity in shares and recent IPO activities raising $723 million, Accelerant's revenue is forecast to expand by 17.5% per year.

- Our comprehensive growth report raises the possibility that Accelerant Holdings is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Accelerant Holdings.

Super Group (SGHC) (SGHC)

Overview: Super Group (SGHC) Limited is an online sports betting and gaming operator with a market cap of $5.77 billion.

Operations: The company's revenue segments consist of $756.75 million from Spin and $1.18 billion from Betway.

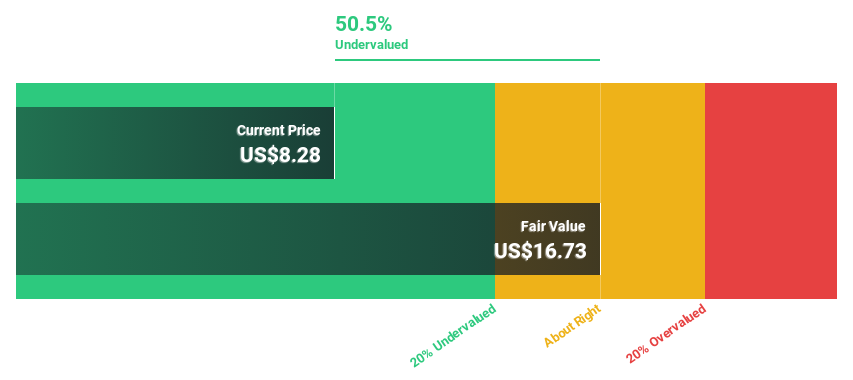

Estimated Discount To Fair Value: 39.9%

Super Group is trading at $11.33, significantly below its estimated fair value of $18.85, highlighting its undervaluation based on discounted cash flow analysis. The company's earnings are projected to grow 26.73% annually, outpacing the US market average of 15.1%. Despite plans to exit U.S. iGaming operations due to regulatory challenges and a one-time restructuring cost of US$30-40 million, revenue guidance was raised above US$2 billion for 2025.

- Upon reviewing our latest growth report, Super Group (SGHC)'s projected financial performance appears quite optimistic.

- Click here to discover the nuances of Super Group (SGHC) with our detailed financial health report.

Make It Happen

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 196 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGHC

Super Group (SGHC)

Operates as an online sports betting and gaming operator.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives