- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

3 Stocks Estimated To Be Up To 44.4% Undervalued Offering Potential Investment Opportunities

Reviewed by Simply Wall St

As the U.S. markets surge with renewed optimism following Federal Reserve Chair Jerome Powell's signal of potential rate cuts, investors are keenly observing opportunities that may arise from these shifting economic conditions. In this context, identifying undervalued stocks becomes crucial, as they can offer significant potential for growth when market sentiments and interest rates align favorably.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $131.82 | $261.75 | 49.6% |

| SolarEdge Technologies (SEDG) | $34.30 | $67.51 | 49.2% |

| Peapack-Gladstone Financial (PGC) | $28.46 | $55.84 | 49% |

| Northwest Bancshares (NWBI) | $12.64 | $24.41 | 48.2% |

| Metropolitan Bank Holding (MCB) | $76.92 | $150.26 | 48.8% |

| Investar Holding (ISTR) | $23.42 | $46.20 | 49.3% |

| Fiverr International (FVRR) | $23.62 | $45.40 | 48% |

| Excelerate Energy (EE) | $24.51 | $46.79 | 47.6% |

| e.l.f. Beauty (ELF) | $118.15 | $224.96 | 47.5% |

| Customers Bancorp (CUBI) | $68.72 | $133.79 | 48.6% |

Let's dive into some prime choices out of the screener.

Corpay (CPAY)

Overview: Corpay, Inc. is a payments company that facilitates the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers across the United States, Brazil, the United Kingdom, and internationally with a market cap of $23.39 billion.

Operations: Corpay's revenue is primarily derived from three segments: Vehicle Payments at $2.02 billion, Corporate Payments at $1.41 billion, and Lodging Payments at $484.93 million.

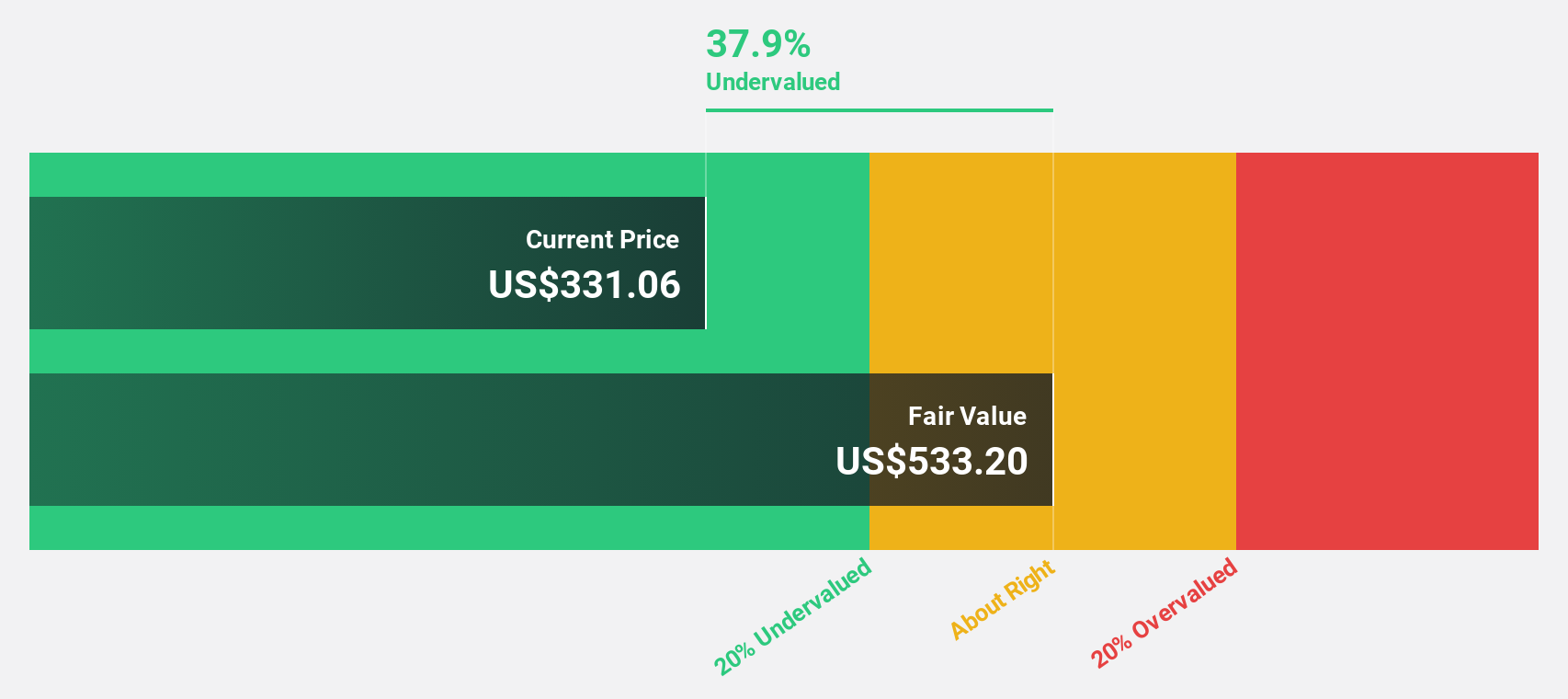

Estimated Discount To Fair Value: 39.6%

Corpay's stock appears undervalued based on cash flow analysis, trading at US$331.19, which is 39.6% below its estimated fair value of US$548.36. Despite a high debt level, Corpay's earnings are projected to grow faster than the U.S. market at 17.2% annually compared to 15%. Recent strategic partnerships and raised earnings guidance for 2025 reinforce potential growth, with expected net income between US$1,171 million and US$1,211 million for the year.

- The analysis detailed in our Corpay growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Corpay.

EQT (EQT)

Overview: EQT Corporation is involved in the production, gathering, and transmission of natural gas, with a market cap of $32.43 billion.

Operations: The company's revenue segments include $6.70 billion from production and $1.28 billion from gathering of natural gas.

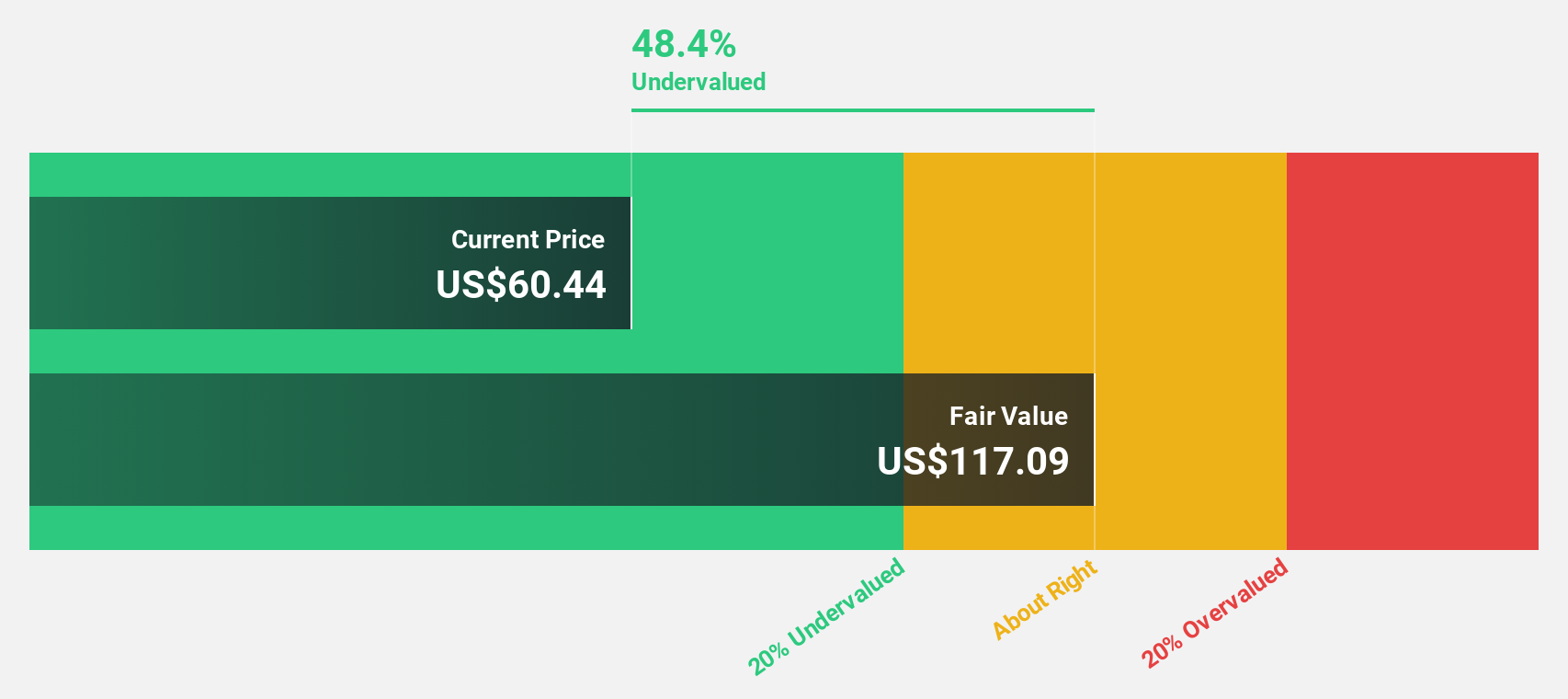

Estimated Discount To Fair Value: 44.4%

EQT is trading at US$51.97, significantly below its fair value estimate of US$93.49, highlighting its undervaluation based on cash flows. Despite recent index exclusions, the company's earnings have shown robust growth and are expected to continue outpacing the U.S. market at 25.8% annually. Recent financial maneuvers include a shelf registration of over $1 billion and an exclusive natural gas supply partnership for a major energy project, underscoring strategic positioning for future growth.

- Our earnings growth report unveils the potential for significant increases in EQT's future results.

- Dive into the specifics of EQT here with our thorough financial health report.

MINISO Group Holding (MNSO)

Overview: MINISO Group Holding Limited is an investment holding company that operates in the retail and wholesale sectors, offering design-led lifestyle and pop toy products across China, Asia, the Americas, Europe, Indonesia, and internationally with a market cap of approximately $8.14 billion.

Operations: The company's revenue segments include the TOP TOY Brand, which generated CN¥1.33 billion.

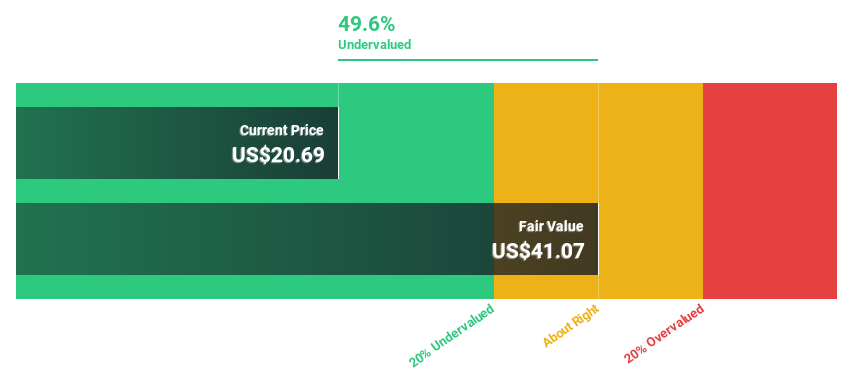

Estimated Discount To Fair Value: 15.8%

MINISO Group Holding is trading at US$26.63, below its fair value estimate of US$31.64, suggesting undervaluation based on cash flows. Recent earnings show increased sales but decreased net income year-over-year. The company has expanded its European presence with a flagship Amsterdam store and completed significant share buybacks worth HKD 468.89 million. Despite a semi-annual dividend of USD 0.2796 per share, dividends are not well covered by free cash flows, indicating potential sustainability concerns amidst expected profit growth outpacing the U.S. market.

- Our comprehensive growth report raises the possibility that MINISO Group Holding is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of MINISO Group Holding stock in this financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 195 Undervalued US Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives