- United States

- /

- Luxury

- /

- NasdaqGS:CROX

3 Stocks Estimated To Be Up To 42.7% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, with major indices like the S&P 500 and Dow Jones Industrial Average marking multiple months of gains, investors are keeping a close eye on potential government shutdowns and their impact on economic stability. Amid this environment of cautious optimism, identifying undervalued stocks becomes crucial for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $7.01 | $13.68 | 48.8% |

| Trade Desk (TTD) | $49.01 | $96.49 | 49.2% |

| Northwest Bancshares (NWBI) | $12.39 | $24.41 | 49.2% |

| HCI Group (HCI) | $191.93 | $376.13 | 49% |

| Glaukos (GKOS) | $81.55 | $161.60 | 49.5% |

| GeneDx Holdings (WGS) | $107.74 | $214.80 | 49.8% |

| First Busey (BUSE) | $23.15 | $45.30 | 48.9% |

| Customers Bancorp (CUBI) | $65.37 | $130.43 | 49.9% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.77 | $38.76 | 49% |

| Alnylam Pharmaceuticals (ALNY) | $456.00 | $896.08 | 49.1% |

Let's explore several standout options from the results in the screener.

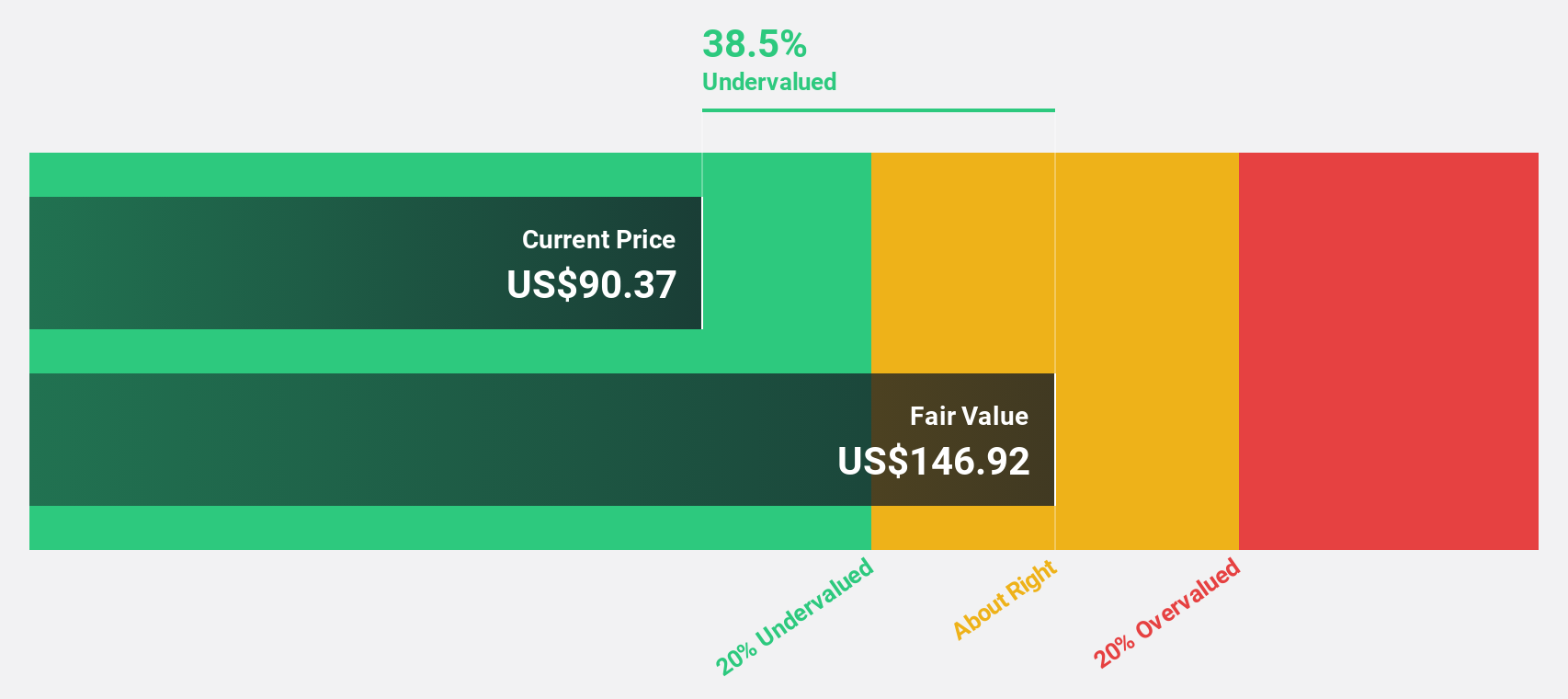

Crocs (CROX)

Overview: Crocs, Inc., along with its subsidiaries, is involved in the design, development, manufacturing, marketing, distribution, and sale of casual lifestyle footwear and accessories under the Crocs and HEYDUDE brands worldwide with a market cap of approximately $4.56 billion.

Operations: The company's revenue is primarily derived from its Crocs Brand, generating $3.34 billion, and the Heydude Brand, contributing $797.32 million.

Estimated Discount To Fair Value: 42.7%

Crocs is trading at US$83.55, significantly below its fair value estimate of US$145.82, suggesting it may be undervalued based on cash flows. Despite a high debt level and declining revenue forecasts, its earnings are expected to grow substantially faster than the market at 64.3% annually over the next three years. Recent executive changes include Patraic Reagan as CFO, potentially strengthening financial strategies amid ongoing share buybacks totaling $2.58 billion since 2013.

- Our comprehensive growth report raises the possibility that Crocs is poised for substantial financial growth.

- Take a closer look at Crocs' balance sheet health here in our report.

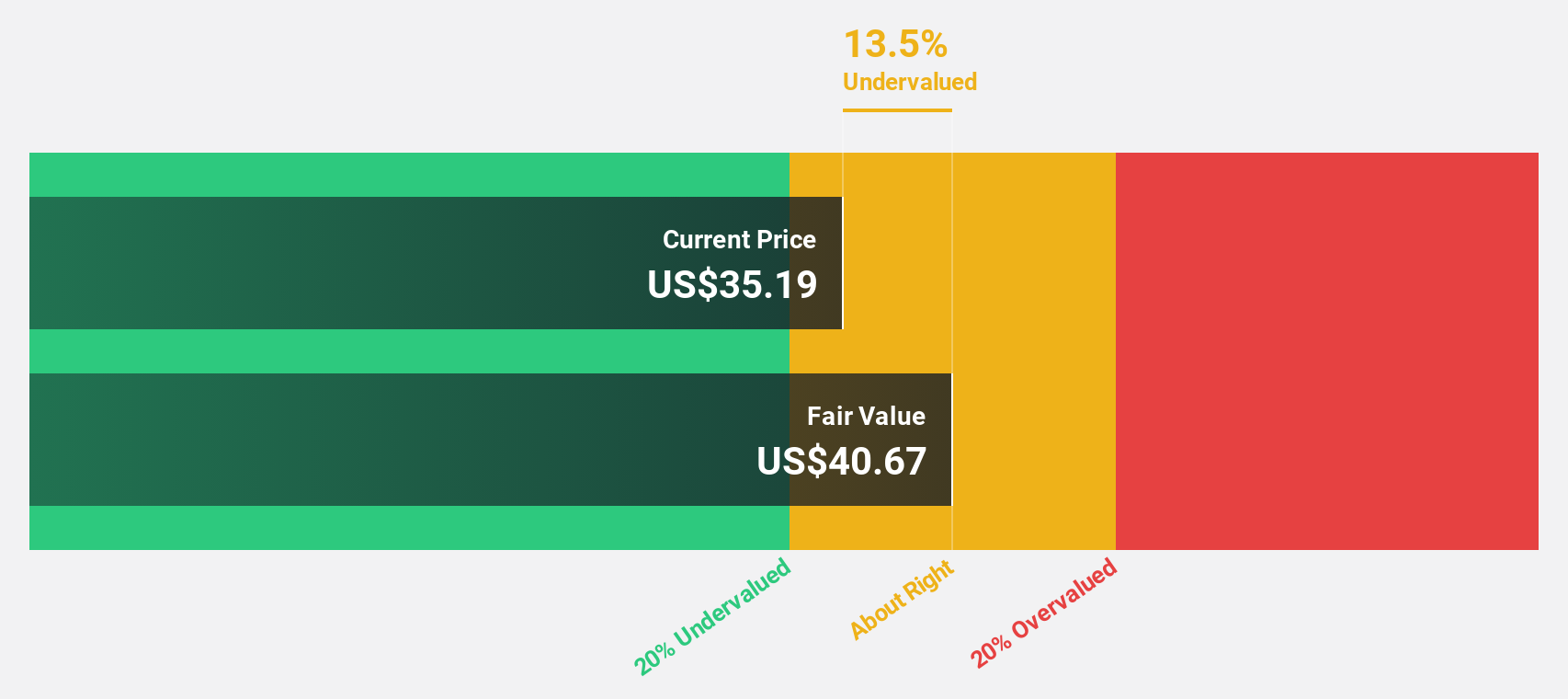

Amer Sports (AS)

Overview: Amer Sports, Inc. designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories across various regions including Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan and the Asia Pacific with a market cap of $19.19 billion.

Operations: The company's revenue segments comprise $2.44 billion from Technical Apparel, $2.04 billion from Outdoor Performance, and $1.22 billion from Ball & Racquet Sports.

Estimated Discount To Fair Value: 16%

Amer Sports, trading at US$34.75, is undervalued based on cash flows with a fair value estimate of US$41.38. The company has become profitable this year and forecasts annual earnings growth of 29.7%, outpacing the market's 15.4%. Recent guidance updates show revenue growth in the high 20s percentage for Q3 2025, and executive transitions include Andrew Page as interim President & CEO of Wilson, maintaining stability amid leadership changes.

- The growth report we've compiled suggests that Amer Sports' future prospects could be on the up.

- Navigate through the intricacies of Amer Sports with our comprehensive financial health report here.

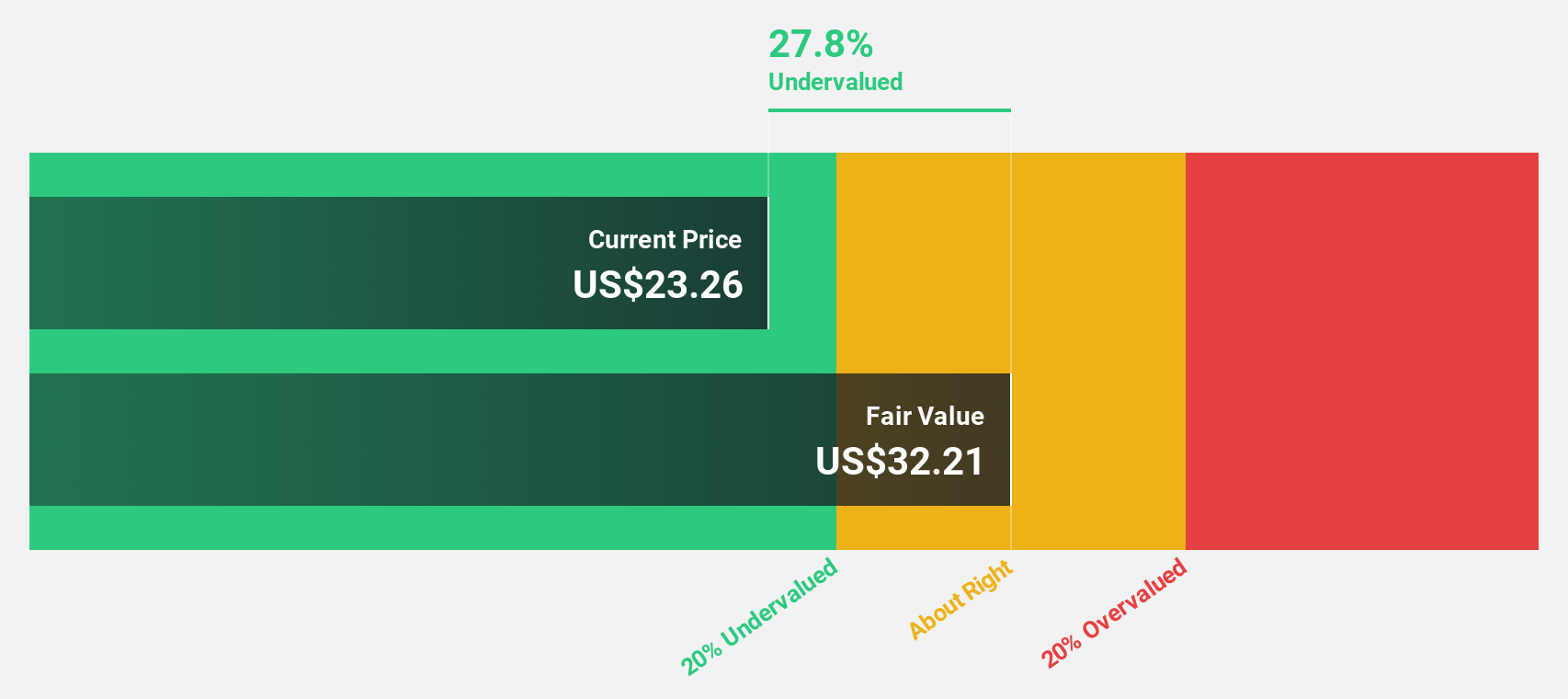

Comstock Resources (CRK)

Overview: Comstock Resources, Inc. is an independent energy company focused on the acquisition, exploration, development, and production of natural gas and oil properties in the United States with a market cap of $5.93 billion.

Operations: Comstock Resources generates its revenue primarily through the exploration and production of oil and gas, amounting to $1.65 billion.

Estimated Discount To Fair Value: 36.5%

Comstock Resources is trading at US$19.83, significantly undervalued with a fair value estimate of US$31.22. Despite declining production, the company reported a substantial revenue increase to US$470.26 million for Q2 2025, with net income rebounding from a loss to US$124.84 million year-over-year. Revenue growth is projected at 11.4% annually, outpacing the broader market's 9.7%. However, interest payments remain inadequately covered by earnings despite expected profitability within three years.

- In light of our recent growth report, it seems possible that Comstock Resources' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Comstock Resources stock in this financial health report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 203 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion