- United States

- /

- Hospitality

- /

- NYSE:LTH

3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 47.5%

Reviewed by Simply Wall St

As the major U.S. stock indexes hit record highs, buoyed by steady inflation data and hopes of imminent interest rate cuts, investors are increasingly looking for opportunities to capitalize on undervalued stocks. In this environment, identifying stocks trading below their intrinsic value can offer a strategic advantage, as they may provide potential growth when market conditions shift.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Perfect (PERF) | $1.87 | $3.65 | 48.8% |

| Peapack-Gladstone Financial (PGC) | $28.85 | $56.54 | 49% |

| Northwest Bancshares (NWBI) | $12.49 | $24.41 | 48.8% |

| Niagen Bioscience (NAGE) | $9.60 | $18.66 | 48.6% |

| Metropolitan Bank Holding (MCB) | $78.02 | $150.26 | 48.1% |

| McGraw Hill (MH) | $14.46 | $28.77 | 49.7% |

| Investar Holding (ISTR) | $22.88 | $45.15 | 49.3% |

| Horizon Bancorp (HBNC) | $16.37 | $31.83 | 48.6% |

| AGNC Investment (AGNC) | $10.25 | $20.41 | 49.8% |

| Advanced Flower Capital (AFCG) | $4.50 | $8.76 | 48.6% |

Let's take a closer look at a couple of our picks from the screened companies.

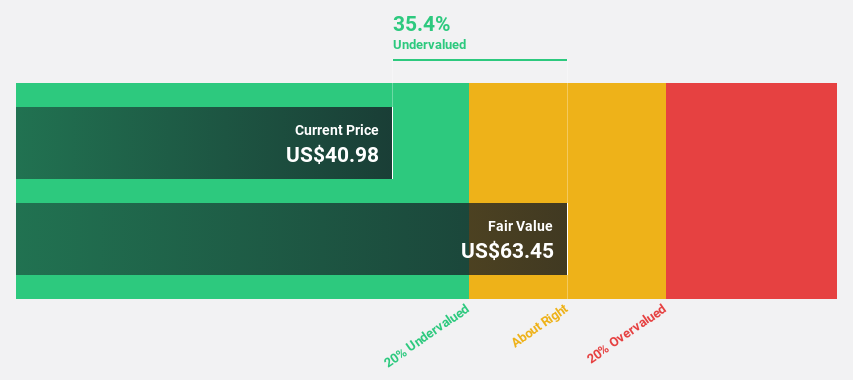

Duolingo (DUOL)

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of approximately $12.53 billion.

Operations: The company generates revenue primarily from its educational software segment, which amounts to $885.15 million.

Estimated Discount To Fair Value: 47.5%

Duolingo is trading at US$285.91, which is 47.5% below its estimated fair value of US$544.91, indicating it may be undervalued based on discounted cash flows. The company reported Q2 2025 sales of US$252.27 million and net income of US$44.78 million, showing substantial growth from the previous year. With expected annual earnings growth of 31.8%, Duolingo's revenue and profit are projected to outpace the broader U.S market significantly over the next three years.

- Our comprehensive growth report raises the possibility that Duolingo is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Duolingo's balance sheet health report.

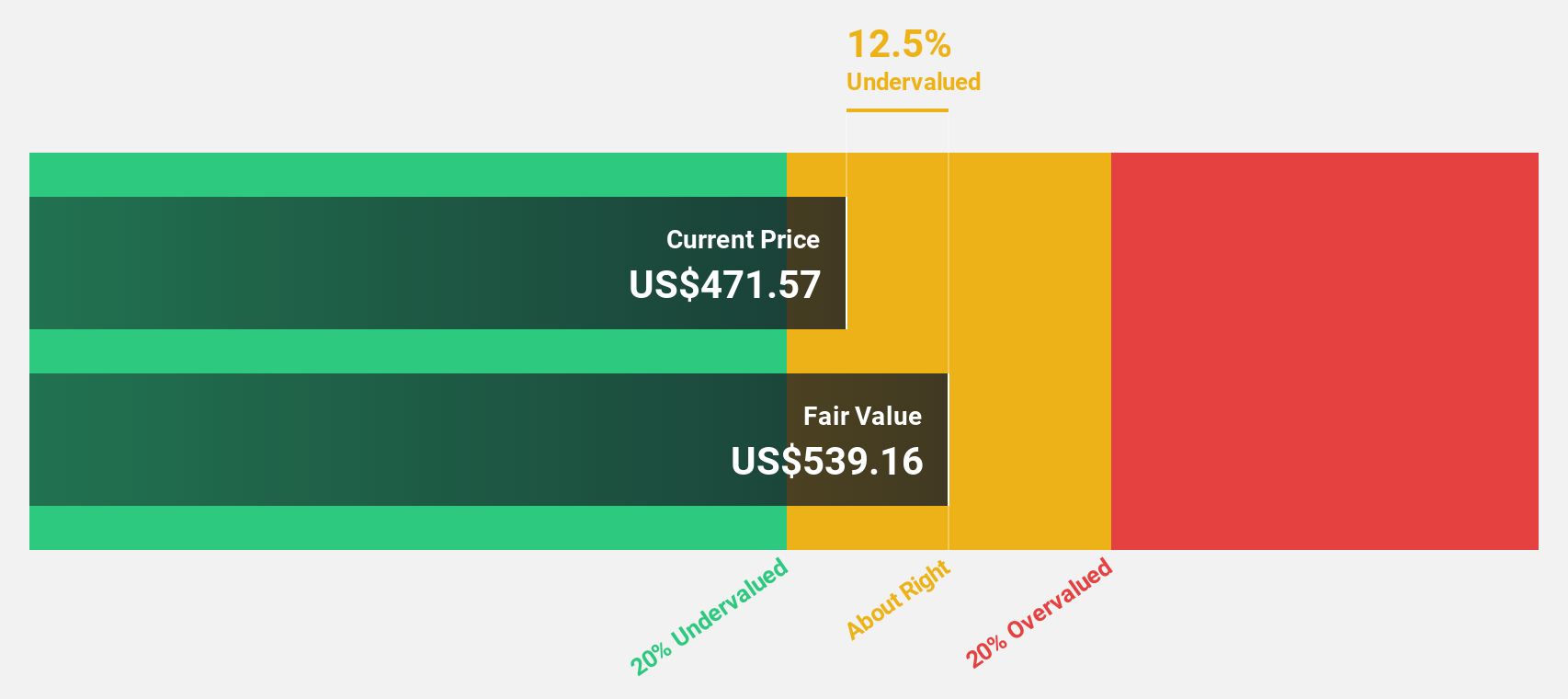

ON Semiconductor (ON)

Overview: ON Semiconductor Corporation offers intelligent sensing and power solutions across various international markets, including Hong Kong, Singapore, the United Kingdom, and the United States, with a market cap of approximately $19.88 billion.

Operations: The company's revenue is primarily derived from three segments: Power Solutions Group (PSG) at $2.98 billion, Intelligent Sensing Group (ISG) at $1.03 billion, and Analog & Mixed-Signal Group (AMG) at $2.39 billion.

Estimated Discount To Fair Value: 20.9%

ON Semiconductor is currently trading at US$48.13, below its estimated fair value of US$60.81, suggesting it may be undervalued based on discounted cash flows by over 20%. Despite a decline in Q2 2025 net income to US$170.3 million from the previous year's US$338.2 million, earnings are projected to grow significantly at 40.3% annually over the next three years, surpassing market expectations while revenue growth remains modest at 5.4% per year.

- Our growth report here indicates ON Semiconductor may be poised for an improving outlook.

- Click here to discover the nuances of ON Semiconductor with our detailed financial health report.

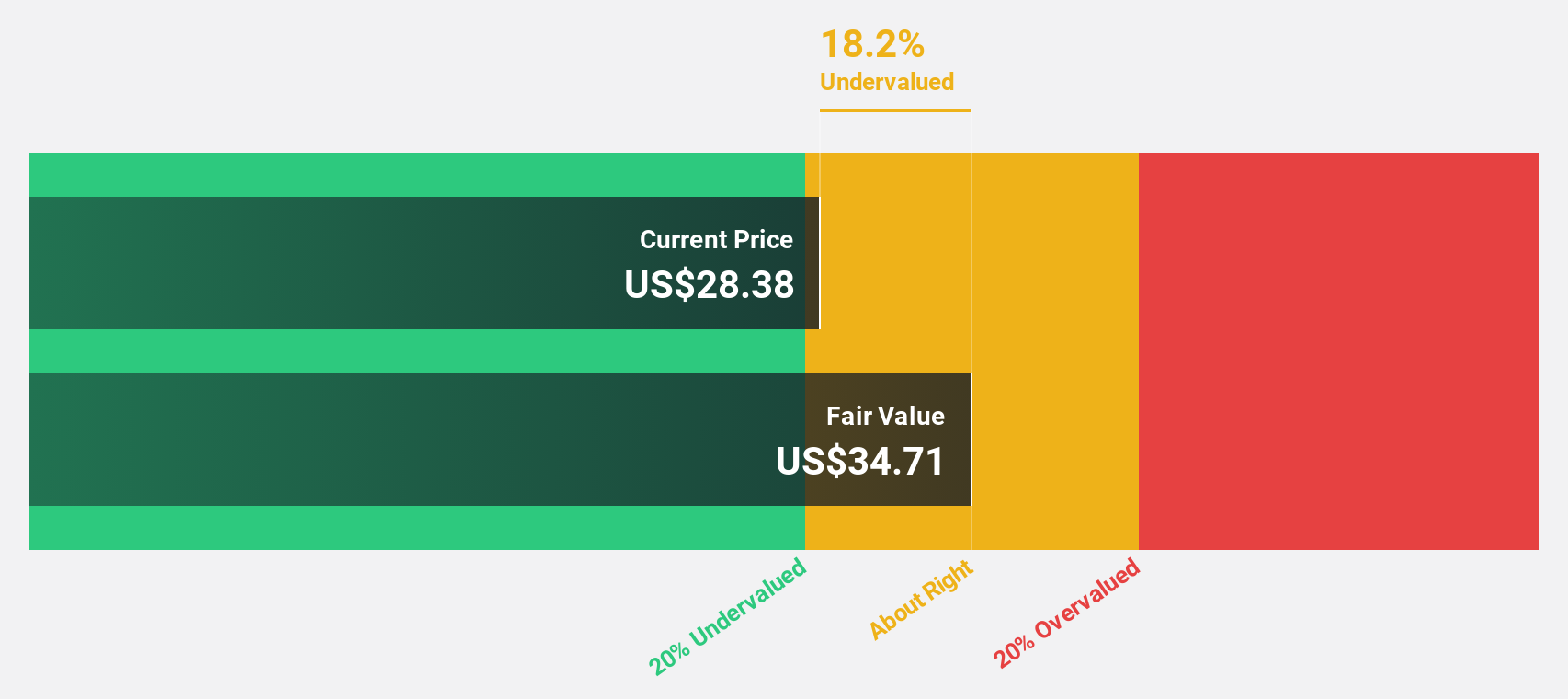

Life Time Group Holdings (LTH)

Overview: Life Time Group Holdings, Inc. operates health, fitness, and wellness centers for individual members in the United States and Canada with a market cap of approximately $6.30 billion.

Operations: The company's revenue is primarily generated from personal services, totaling $2.82 billion.

Estimated Discount To Fair Value: 17.3%

Life Time Group Holdings, trading at US$28.50, is below its estimated fair value of US$34.45, indicating potential undervaluation based on cash flows. The company reported robust earnings growth of 107.4% over the past year and anticipates a further 22.5% annual increase, outpacing the broader market's forecasted growth rate. Despite high debt levels, Life Time's strategic expansions and innovative offerings like LT Games and Work Lounges may enhance future cash flow prospects amidst a competitive fitness industry landscape.

- In light of our recent growth report, it seems possible that Life Time Group Holdings' financial performance will exceed current levels.

- Dive into the specifics of Life Time Group Holdings here with our thorough financial health report.

Summing It All Up

- Explore the 195 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives