- United States

- /

- Professional Services

- /

- NYSE:EFX

3 Stocks Estimated To Be Trading At Discounts Of Up To 44% Below Intrinsic Value

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite reach new all-time highs, buoyed by strong job growth and a rally in tech stocks, investors are keenly observing market dynamics for potential opportunities. In such an environment, identifying undervalued stocks that trade below their intrinsic value can be a strategic move for those looking to capitalize on discrepancies between market price and fundamental worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $25.53 | $51.03 | 50% |

| SharkNinja (SN) | $106.36 | $209.63 | 49.3% |

| Privia Health Group (PRVA) | $21.92 | $43.37 | 49.5% |

| Mid Penn Bancorp (MPB) | $29.49 | $57.45 | 48.7% |

| MAC Copper (MTAL) | $12.09 | $23.93 | 49.5% |

| Lyft (LYFT) | $15.71 | $31.22 | 49.7% |

| Insteel Industries (IIIN) | $39.03 | $76.82 | 49.2% |

| Carter Bankshares (CARE) | $17.88 | $35.50 | 49.6% |

| Camden National (CAC) | $42.59 | $83.04 | 48.7% |

| Acadia Realty Trust (AKR) | $18.51 | $36.55 | 49.4% |

Let's dive into some prime choices out of the screener.

Independent Bank (INDB)

Overview: Independent Bank Corp. is the bank holding company for Rockland Trust Company, offering commercial banking products and services to individuals and small-to-medium sized businesses in the United States, with a market cap of $3.27 billion.

Operations: The company generates revenue of $654.16 million from its community banking segment, providing financial services to individuals and small-to-medium sized enterprises in the U.S.

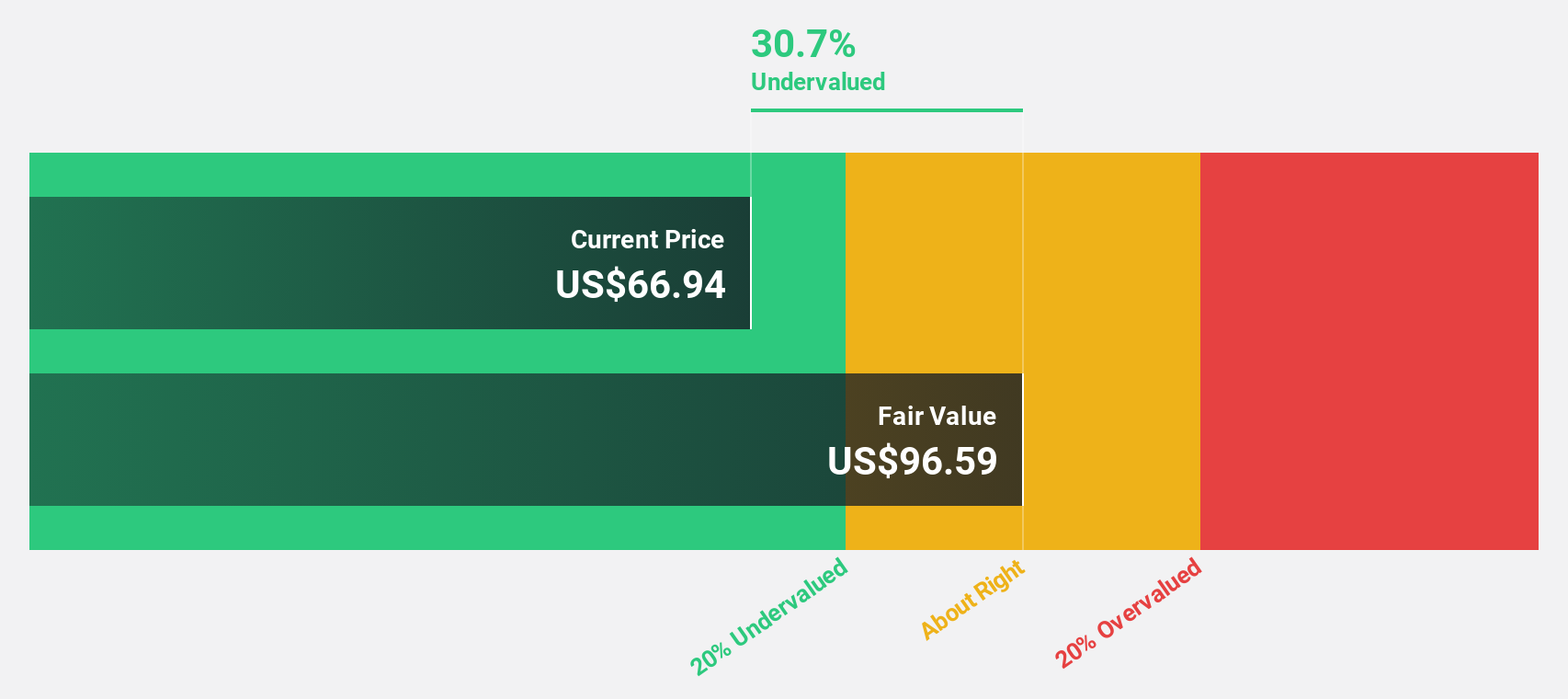

Estimated Discount To Fair Value: 31.5%

Independent Bank is trading at US$66.15, significantly below its estimated fair value of US$96.59, indicating potential undervaluation based on cash flows. The bank's earnings and revenue are forecast to grow significantly faster than the US market over the next three years, despite recent shareholder dilution. Recent board appointments and a confirmed dividend of $0.59 per share may also support investor confidence in its strategic direction and financial stability amidst ongoing growth prospects.

- Upon reviewing our latest growth report, Independent Bank's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Independent Bank.

Zillow Group (ZG)

Overview: Zillow Group, Inc. operates real estate brands through mobile applications and websites in the United States, with a market cap of approximately $17.14 billion.

Operations: The company generates revenue primarily from its Internet, Media & Technology (IMT) segment, excluding mortgages, which amounts to $2.31 billion.

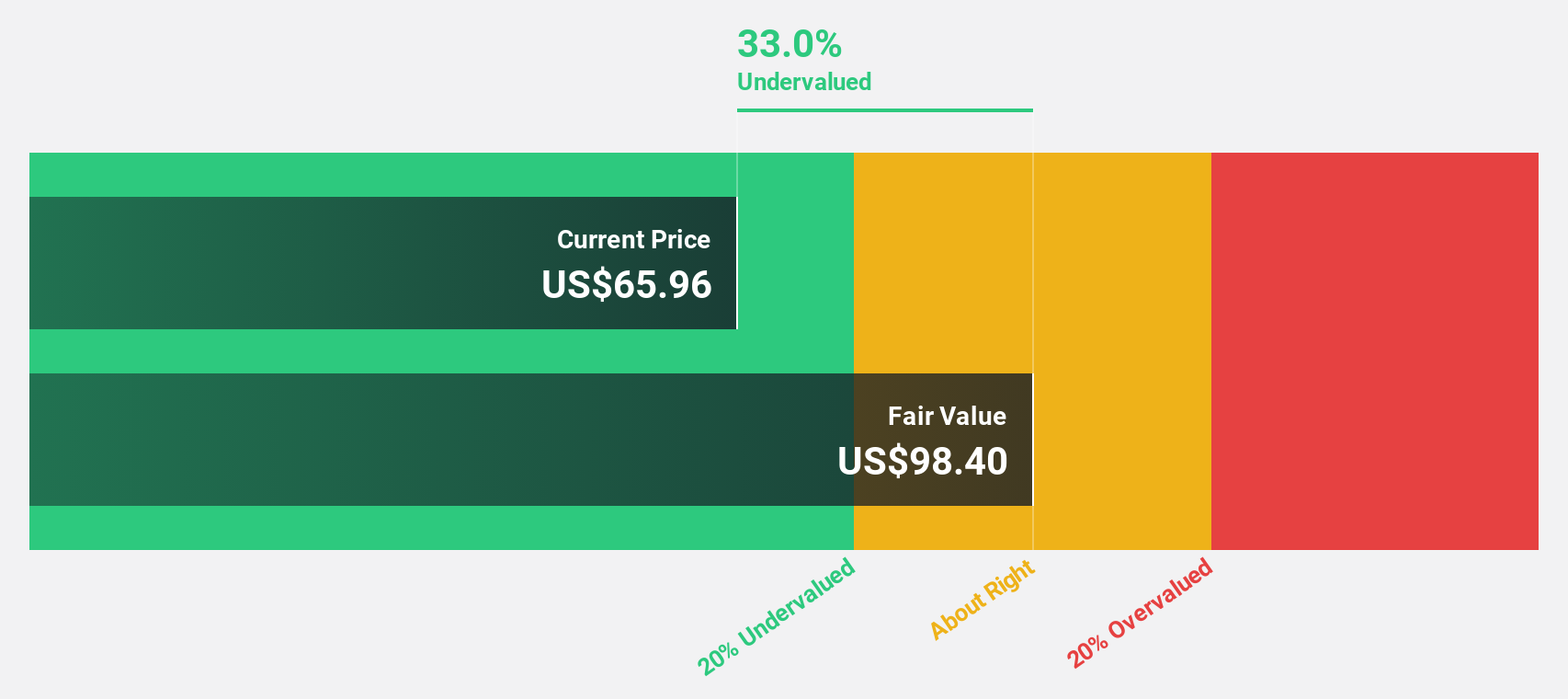

Estimated Discount To Fair Value: 34.1%

Zillow Group is trading at US$68.95, considerably below its estimated fair value of US$104.55, suggesting potential undervaluation based on cash flows. The company is expected to become profitable within three years with earnings growth forecasted at 52.91% annually. Recent partnerships and product innovations, such as the Redfin rentals collaboration and Zillow Showcase, are driving significant revenue growth in their Rentals segment, which is projected to grow by approximately 40% in 2025.

- According our earnings growth report, there's an indication that Zillow Group might be ready to expand.

- Unlock comprehensive insights into our analysis of Zillow Group stock in this financial health report.

Equifax (EFX)

Overview: Equifax Inc. is a data, analytics, and technology company with a market cap of $32.78 billion.

Operations: Equifax Inc.'s revenue is derived from three main segments: International at $1.36 billion, Workforce Solutions at $2.45 billion, and U.S. Information Solutions at $1.93 billion.

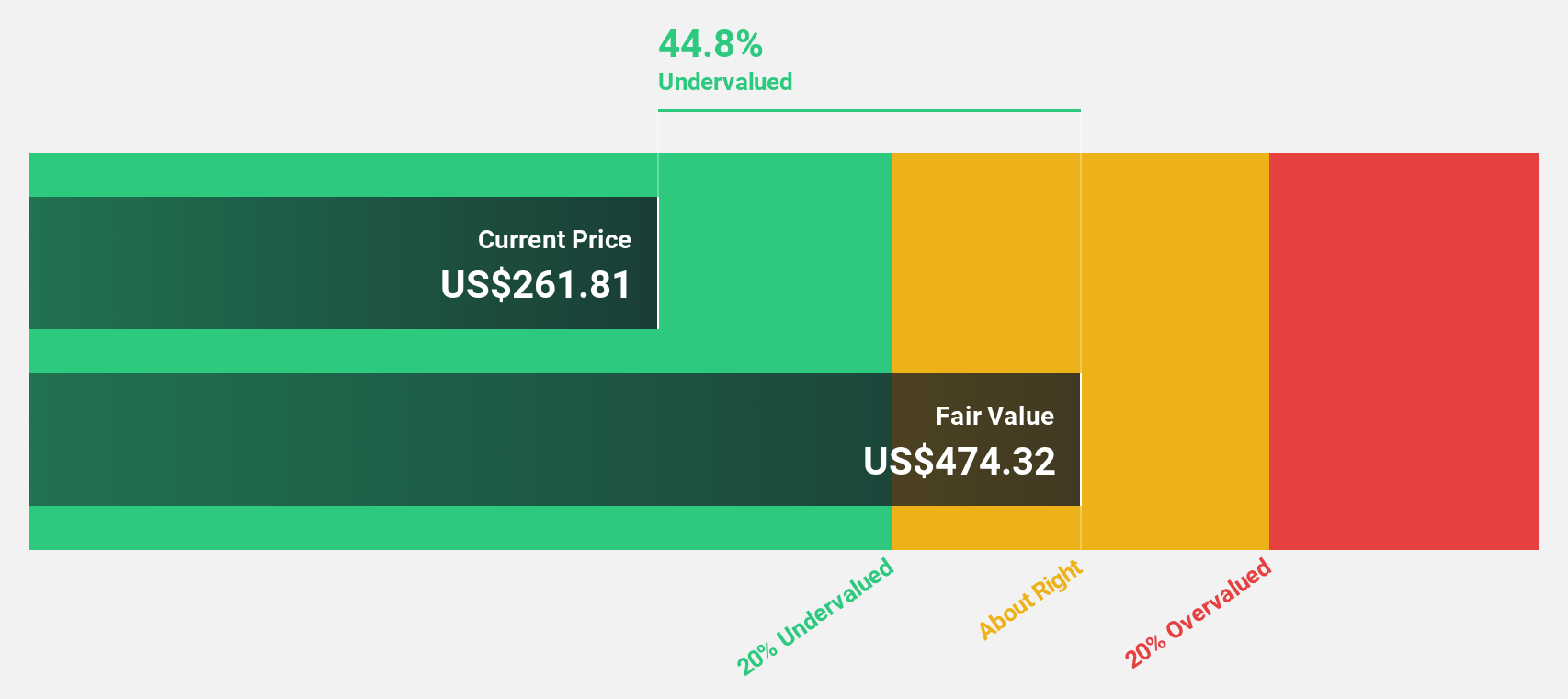

Estimated Discount To Fair Value: 44%

Equifax is trading at US$262.37, significantly below its estimated fair value of US$468.91, indicating potential undervaluation based on cash flows. Earnings are forecast to grow 21.2% annually, exceeding the market average. Despite a high debt level, recent innovations like Complete Income and Optimal Path enhance product offerings and operational efficiency in income verification and credit score management, potentially supporting future revenue growth beyond the projected 9.3% annual increase.

- The analysis detailed in our Equifax growth report hints at robust future financial performance.

- Dive into the specifics of Equifax here with our thorough financial health report.

Make It Happen

- Access the full spectrum of 178 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives