- United States

- /

- Banks

- /

- NasdaqGS:FITB

3 Dividend Stocks To Consider With Yields Up To 3.8%

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has experienced a 13% increase over the last year, with earnings projected to grow by 14% annually. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for investors seeking stability and returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.14% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.92% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.54% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.36% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.90% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.82% | ★★★★★★ |

| Universal (NYSE:UVV) | 5.20% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.14% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.02% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.90% | ★★★★★☆ |

Click here to see the full list of 144 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

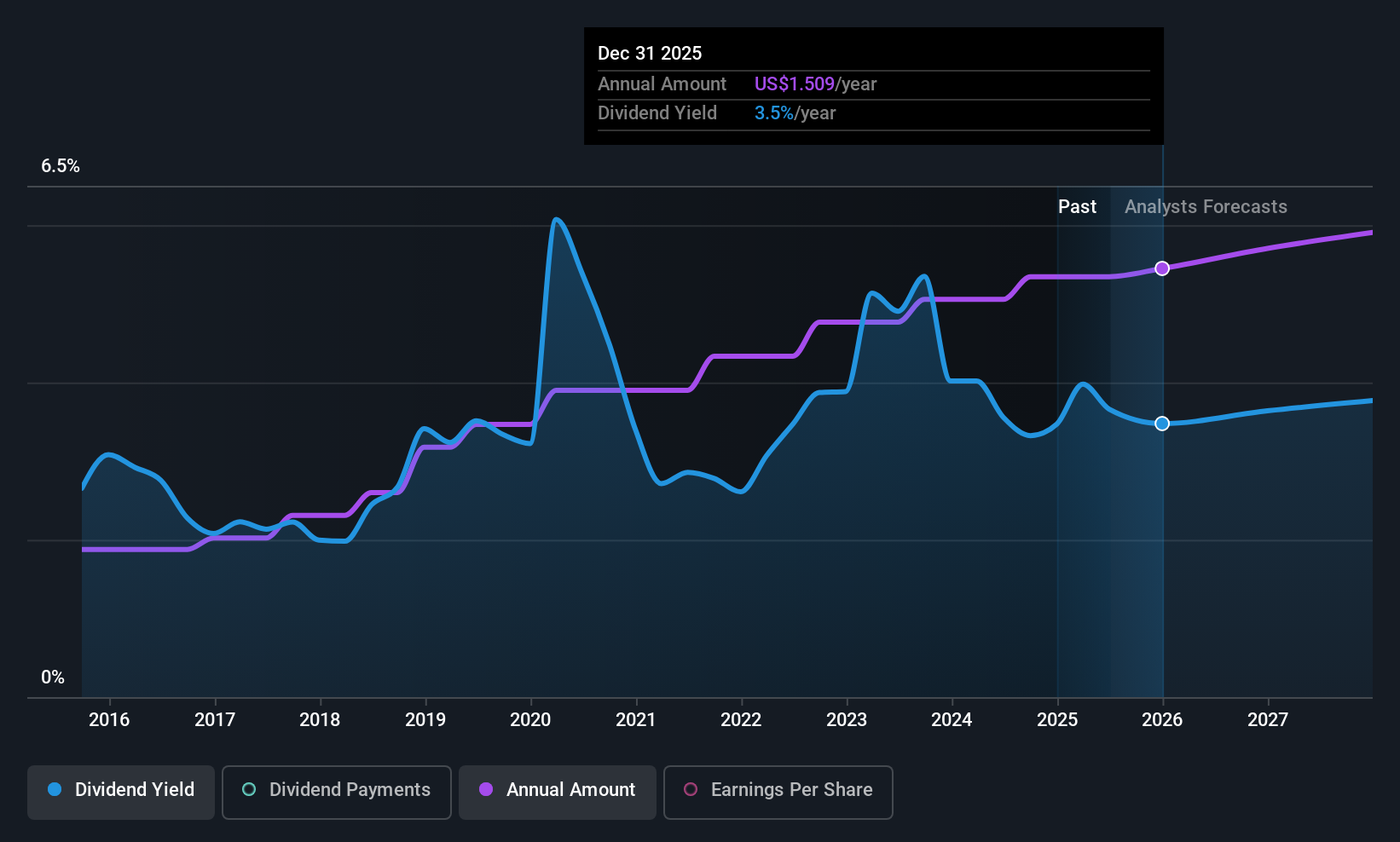

Fifth Third Bancorp (NasdaqGS:FITB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fifth Third Bancorp is a bank holding company for Fifth Third Bank, National Association, offering a variety of financial products and services in the United States, with a market cap of $25.42 billion.

Operations: Fifth Third Bancorp's revenue is primarily derived from Consumer and Small Business Banking ($4.78 billion), Commercial Banking ($3.57 billion), and Wealth and Asset Management ($611 million).

Dividend Yield: 3.8%

Fifth Third Bancorp offers a stable dividend yield of 3.81%, which is well-covered by earnings with a payout ratio of 46%. Despite not being among the top dividend payers, it maintains reliable and growing dividends over the past decade. Recent activities include a strategic expansion into underserved areas, enhancing financial access and community revitalization efforts. However, recent net charge-offs increased to $136 million in Q1 2025 from $110 million the previous year, indicating some financial challenges.

- Dive into the specifics of Fifth Third Bancorp here with our thorough dividend report.

- According our valuation report, there's an indication that Fifth Third Bancorp's share price might be on the cheaper side.

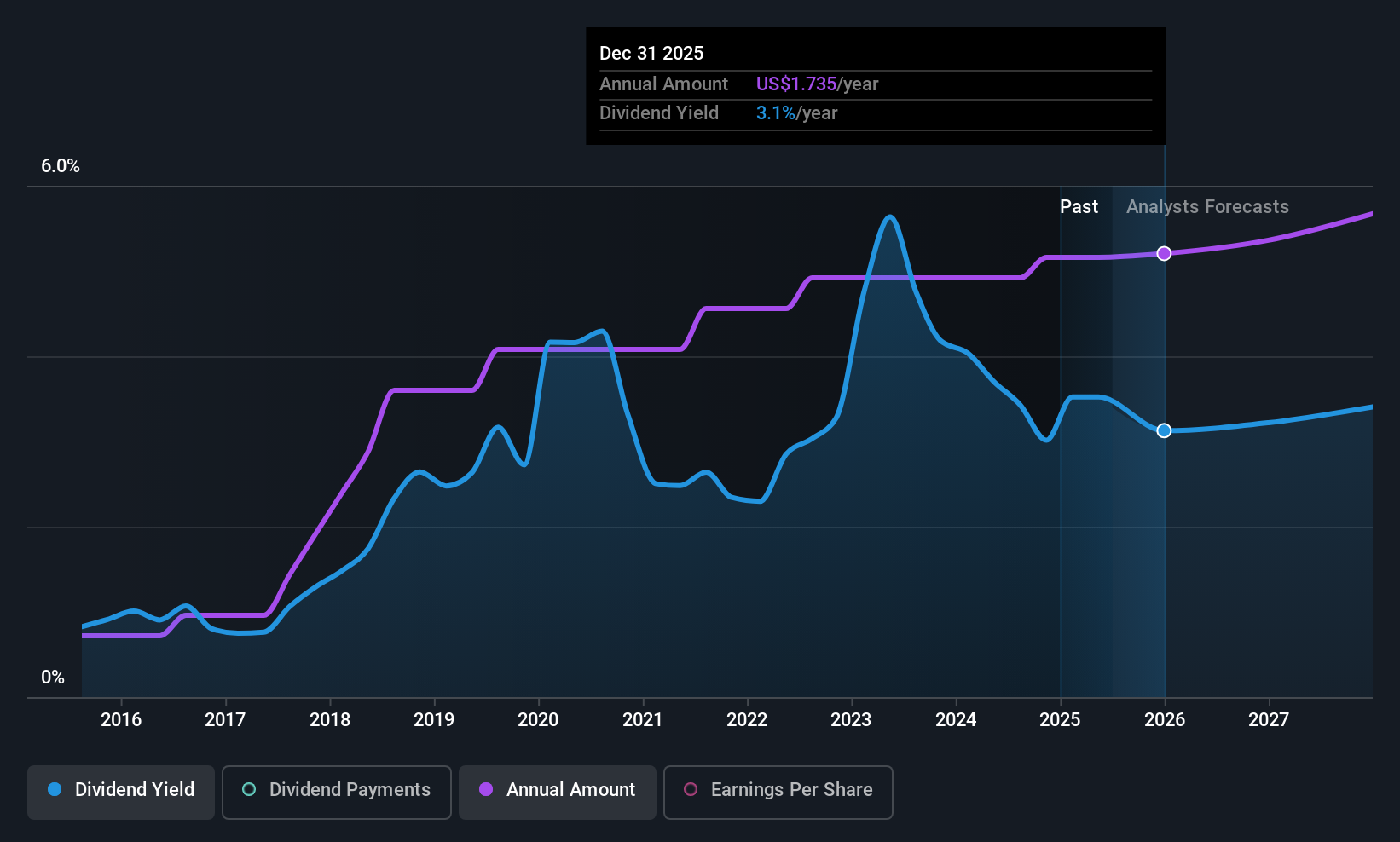

Zions Bancorporation National Association (NasdaqGS:ZION)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zions Bancorporation, National Association offers a range of banking products and services across several western U.S. states, with a market cap of approximately $6.93 billion.

Operations: Zions Bancorporation, National Association's revenue is primarily derived from its banking operations through Zions First National Bank ($882 million), California Bank & Trust ($685 million), Amegy Corporation ($677 million), National Bank of Arizona ($287 million), Nevada State Bank ($259 million), Vectra Bank Colorado ($161 million), and The Commerce Bank of Washington ($72 million).

Dividend Yield: 3.6%

Zions Bancorporation, N.A. offers a reliable dividend yield of 3.56%, supported by a low payout ratio of 32.8%, indicating sustainability and room for growth. Recent dividends have been consistent, with the latest quarterly dividend declared at $0.43 per share, payable in May 2025. The company's earnings have grown significantly over the past year, although recent net charge-offs increased to $16 million in Q1 2025 from $6 million last year, suggesting some financial headwinds.

- Click to explore a detailed breakdown of our findings in Zions Bancorporation National Association's dividend report.

- The analysis detailed in our Zions Bancorporation National Association valuation report hints at an deflated share price compared to its estimated value.

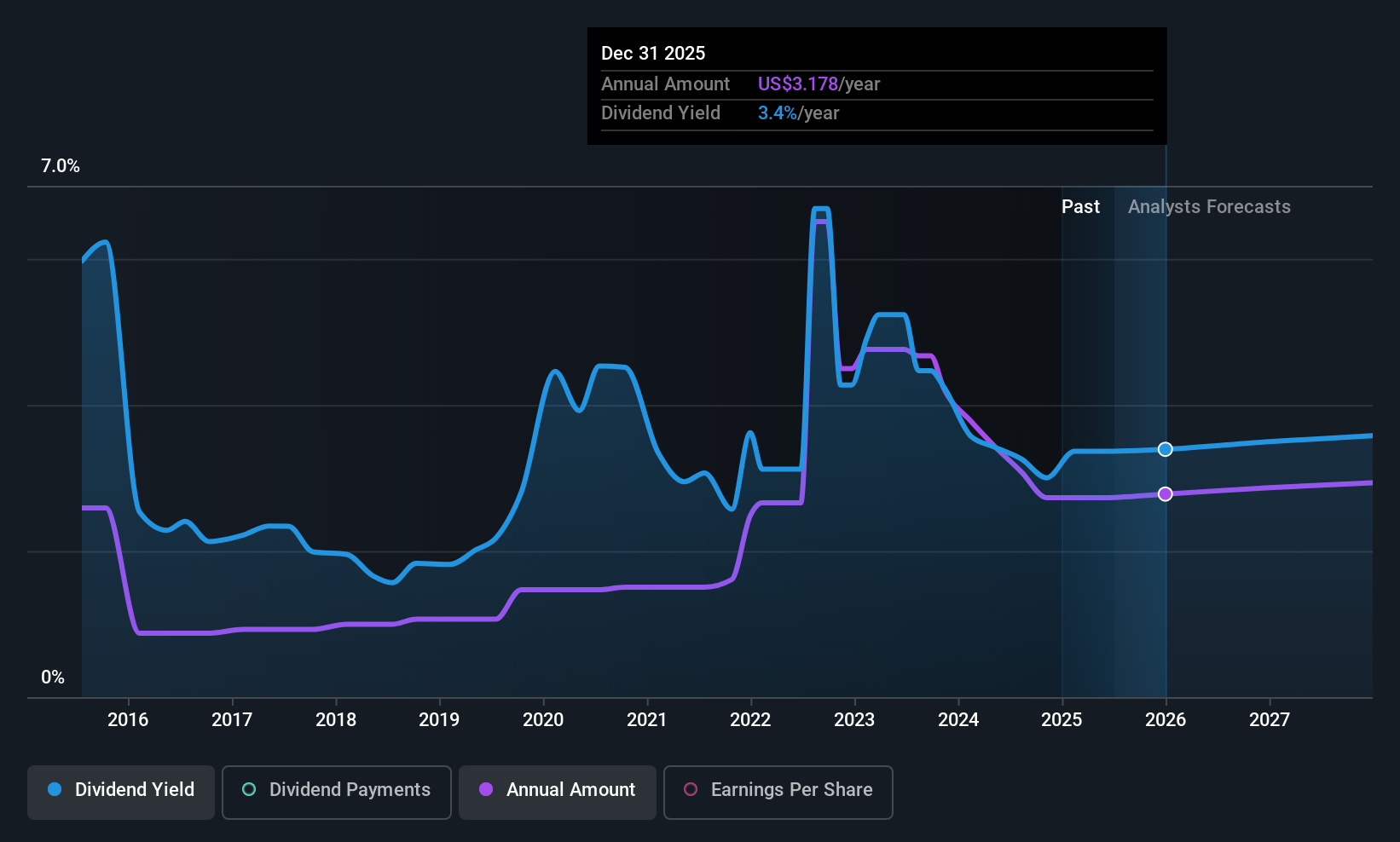

ConocoPhillips (NYSE:COP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConocoPhillips is engaged in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids with a market cap of approximately $109.48 billion.

Operations: ConocoPhillips generates revenue from several key segments, including Alaska ($6.49 billion), Canada ($5.72 billion), Lower 48 ($39.28 billion), Asia Pacific ($2.81 billion), and Europe, Middle East and North Africa ($6.89 billion).

Dividend Yield: 3.5%

ConocoPhillips offers a dividend yield of 3.55%, supported by a payout ratio of 39.4% and a cash payout ratio of 45.4%, indicating dividends are well-covered by earnings and cash flows. However, the dividend history is volatile, with past fluctuations over 20%. Recent earnings showed growth with net income reaching US$2.85 billion in Q1 2025, but shareholder proposals for emissions target removal were rejected, reflecting ongoing governance challenges.

- Unlock comprehensive insights into our analysis of ConocoPhillips stock in this dividend report.

- Our valuation report here indicates ConocoPhillips may be undervalued.

Seize The Opportunity

- Navigate through the entire inventory of 144 Top US Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FITB

Fifth Third Bancorp

Operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion