- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Stock Dips 14% Following 2025 Earnings Guidance

Reviewed by Simply Wall St

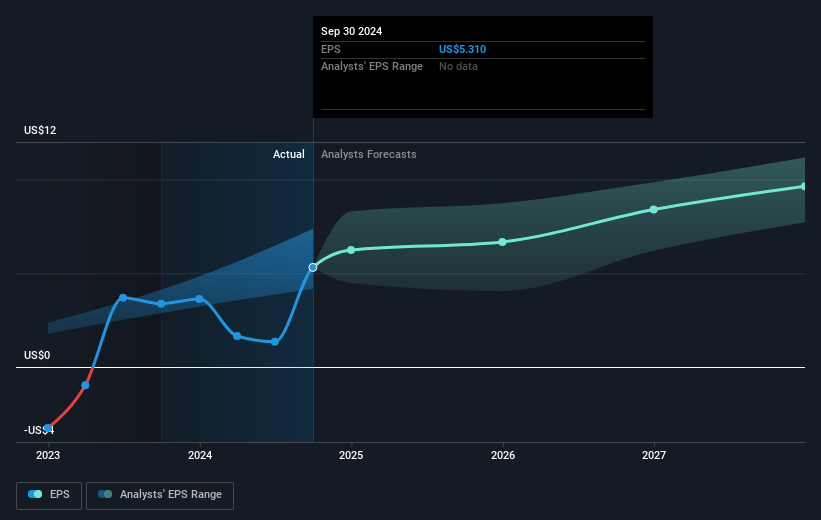

Vistra (NYSE:VST) is navigating a challenging period as a series of recent developments have impacted its share price, which experienced a 14% decline last week. The announcement of their 2025 earnings guidance with a range of $2,220 million to $2,690 million, alongside a rise in 2024 net income to $2,659 million, was overshadowed by a lawsuit regarding the Moss Landing Battery Plant fire, raising concerns about potential liabilities. Despite an active share buyback program, totaling 38% of shares repurchased, market conditions and external factors, including sector-wide selling amid tariff uncertainties, weighed heavily on Vistra's stock. Broader market unease, partially driven by tech stock declines and tariff jitters, further compounded negative investor sentiment for the company. As the Dow Jones and major indexes have been affected by these economic pressures, shareholders continue to evaluate Vistra's positioning in light of both corporate strategies and external market conditions.

Get an in-depth perspective on Vistra's performance by reading our analysis here.

Vistra's shares have delivered an extremely large total return of 712.76% over the past five years, including both share price appreciation and dividends. This impressive performance is underscored by its profitability, with earnings growing by 26.5% annually. Notably, Vistra's return exceeded the US Renewable Energy industry, which advanced 36.8% in the past year. Amidst this progress, substantial earnings growth of 83.7% was recorded in the previous fiscal year, highlighting a robust operational performance.

The company's aggressive share buyback program has been a key driver, repurchasing 38% of its shares since October 2021. Additionally, Vistra declared steady dividends and announced a quarterly dividend of US$0.2235 per share in February 2025. Despite these achievements, insider selling in the recent quarter might have introduced some volatility. Meanwhile, the company’s trading price of US$126.87 remains below its estimated fair value, suggesting potential market mispricing.

- See whether Vistra's current market price aligns with its intrinsic value in our detailed report

- Understand the uncertainties surrounding Vistra's market positioning with our detailed risk analysis report.

- Are you invested in Vistra already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Vistra, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and good value.