- United States

- /

- Renewable Energy

- /

- NYSE:VST

Vistra (NYSE:VST) Stock Dips 11% Despite US$2,659M Income Surge

Reviewed by Simply Wall St

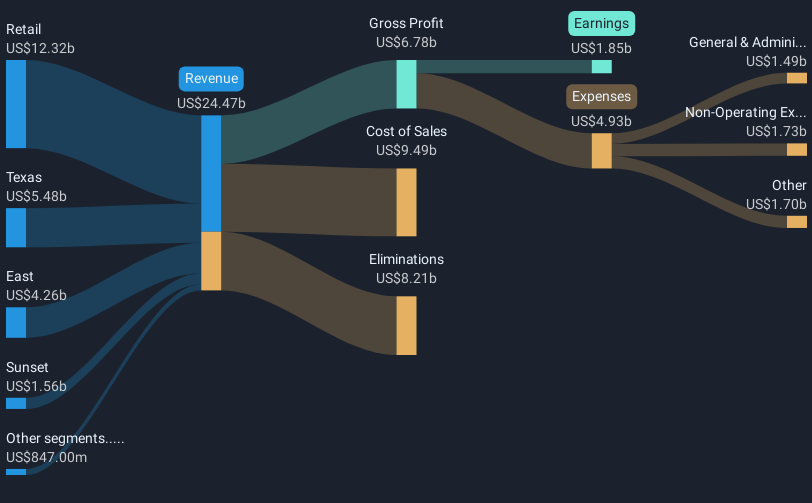

Vistra (NYSE:VST) recently reported impressive earnings growth, with sales increasing to $17,224 million and net income rising to $2,659 million for the year ended December 31, 2024, alongside issuing dividend increases. Despite these robust figures and a new earnings guidance for 2025, the company's stock experienced an 11% decline over the past week. This decrease came amidst a broader market downturn, even as benign inflation data momentarily boosted major indexes. The anticipation of potential tariffs and geopolitical tensions could have overshadowed Vistra's strong financial performance. While the markets ended February with overall declines, reflecting uncertainty across sectors, the tech-heavy Nasdaq saw significant losses due to earnings turbulence like that of Nvidia. Vistra's performance might also have been impacted by such market-wide apprehensions, leading to cautious investor behavior despite its sound financial metrics and future outlook.

Click to explore a detailed breakdown of our findings on Vistra.

Over the past five years, Vistra has delivered very large total returns of 641.98%, a testament to its substantial growth trajectory. One significant driver has been robust earnings growth, consistently averaging 26.5% annually, with the past year alone seeing an accelerated earnings increase of 83.7%, which markedly outpaced the Renewable Energy industry's 5.4% growth. Additionally, Vistra's stock outperformed both the US Renewable Energy industry and the broader US market over the last year.

Key events contributing to Vistra's long-term performance include connecting new utility-scale solar projects in Illinois, expanding its footprint in renewable energy, and successfully managing shareholder returns through regular dividend increases, such as the quarterly dividend raised to US$0.2235 declared in February 2025. Despite some debt financing activities, such as a US$1.25 billion senior secured notes issuance in November 2024, the company effectively navigated its financial position, which bolstered investor confidence and ultimately enhanced shareholder returns.

- Learn how Vistra's intrinsic value compares to its market price with our detailed valuation report.

- Uncover the uncertainties that could impact Vistra's future growth—read our risk evaluation here.

- Invested in Vistra? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Vistra, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and good value.