- United States

- /

- Transportation

- /

- NYSE:XPO

We Ran A Stock Scan For Earnings Growth And XPO (NYSE:XPO) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in XPO (NYSE:XPO). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide XPO with the means to add long-term value to shareholders.

How Fast Is XPO Growing Its Earnings Per Share?

Over the last three years, XPO has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. To the delight of shareholders, XPO's EPS soared from US$2.09 to US$3.30, over the last year. That's a fantastic gain of 58%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. XPO reported flat revenue and EBIT margins over the last year. That's not bad, but it doesn't point to ongoing future growth, either.

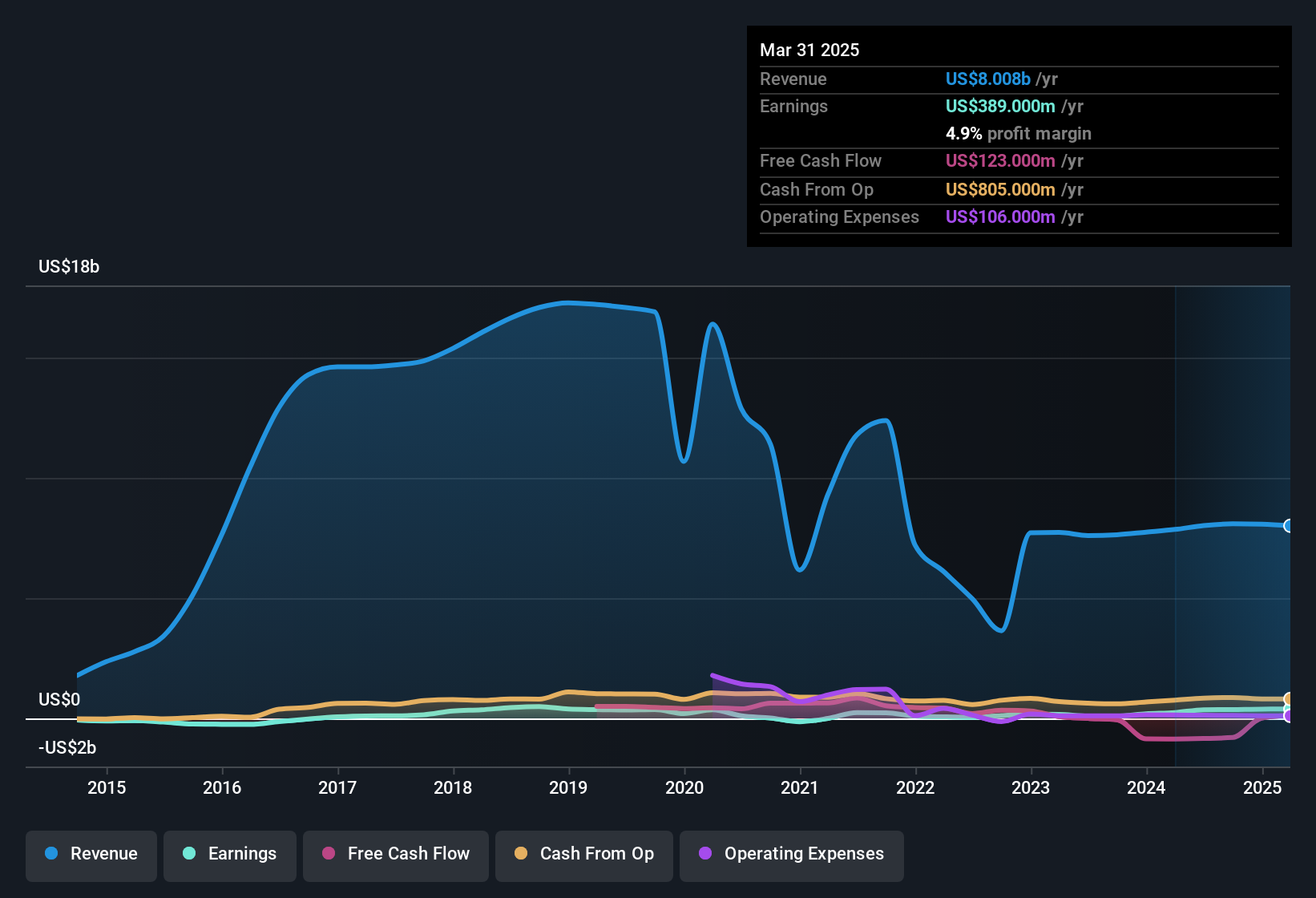

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

View our latest analysis for XPO

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for XPO's future EPS 100% free.

Are XPO Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

XPO top brass are certainly in sync, not having sold any shares, over the last year. But more importantly, Chief Operating Officer David Bates spent US$200k acquiring shares, doing so at an average price of US$106. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Along with the insider buying, another encouraging sign for XPO is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$290m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is XPO Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into XPO's strong EPS growth. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. So it's fair to say that this stock may well deserve a spot on your watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for XPO you should know about.

The good news is that XPO is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives