- United States

- /

- Marine and Shipping

- /

- NYSE:SB

Top Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences volatility following a weak GDP report and investor anticipation of major tech earnings, dividend stocks continue to attract attention for their potential stability and income generation. In such uncertain times, selecting dividend stocks with a history of consistent payouts can offer investors a reliable source of returns amidst broader economic fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.34% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.58% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.77% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.55% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.07% | ★★★★★☆ |

| United Parcel Service (NYSE:UPS) | 6.74% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.23% | ★★★★★☆ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.27% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.44% | ★★★★★☆ |

| Omega Flex (NasdaqGM:OFLX) | 4.45% | ★★★★★☆ |

Click here to see the full list of 154 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

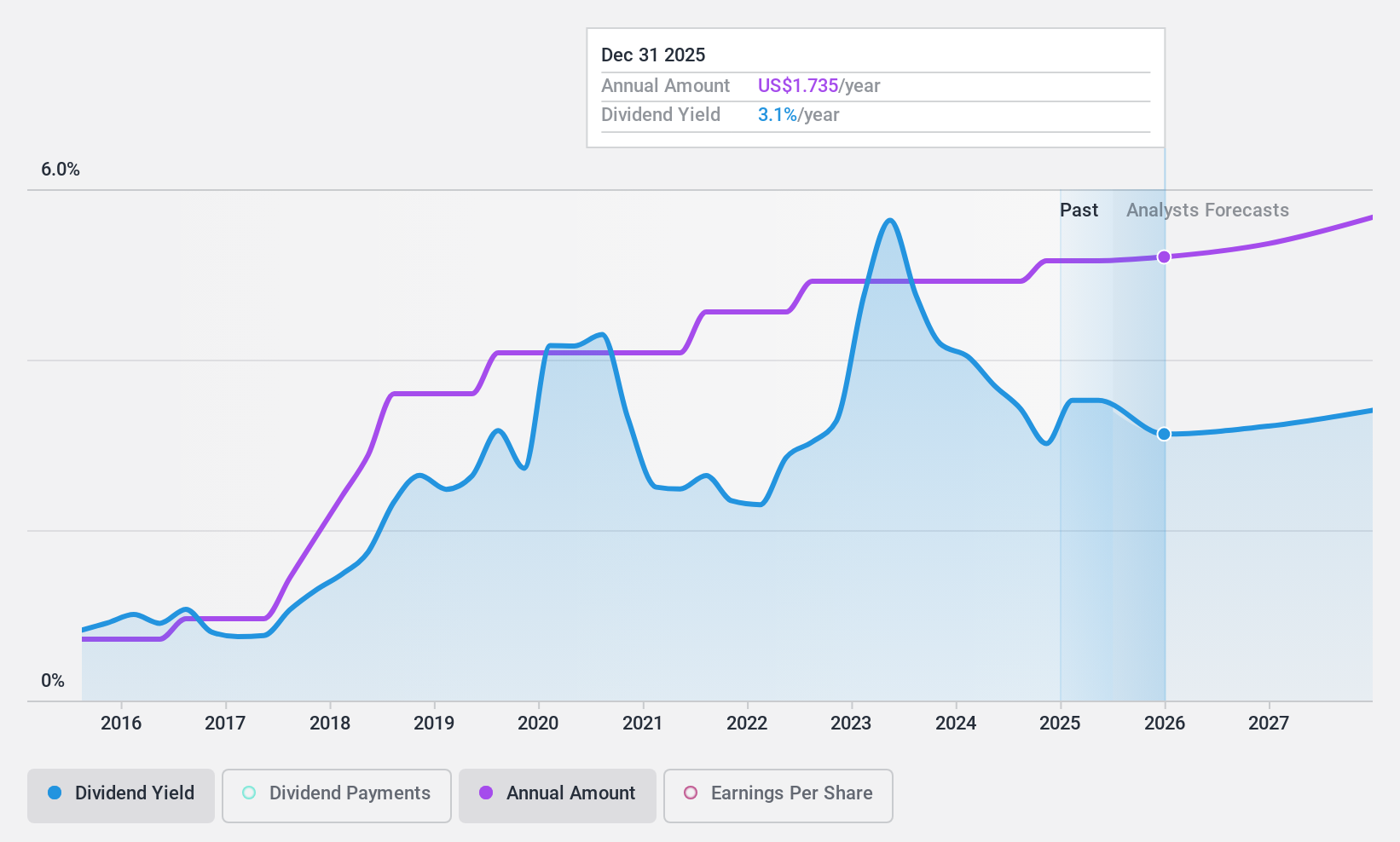

Zions Bancorporation National Association (NasdaqGS:ZION)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zions Bancorporation, National Association offers a range of banking products and services across several Western U.S. states, with a market capitalization of approximately $6.63 billion.

Operations: Zions Bancorporation, National Association generates revenue through a diverse portfolio of banking products and services across multiple Western U.S. states.

Dividend Yield: 3.8%

Zions Bancorporation offers a reliable dividend yield of 3.8%, with payments consistently growing and stable over the past decade, supported by a low payout ratio of 32.8%. Despite trading at 63.2% below its estimated fair value, which may indicate good relative value, its dividend yield is lower compared to the top US payers. Recent earnings growth and strategic share buybacks underscore financial health, but increased net charge-offs warrant attention for potential risks.

- Dive into the specifics of Zions Bancorporation National Association here with our thorough dividend report.

- Upon reviewing our latest valuation report, Zions Bancorporation National Association's share price might be too pessimistic.

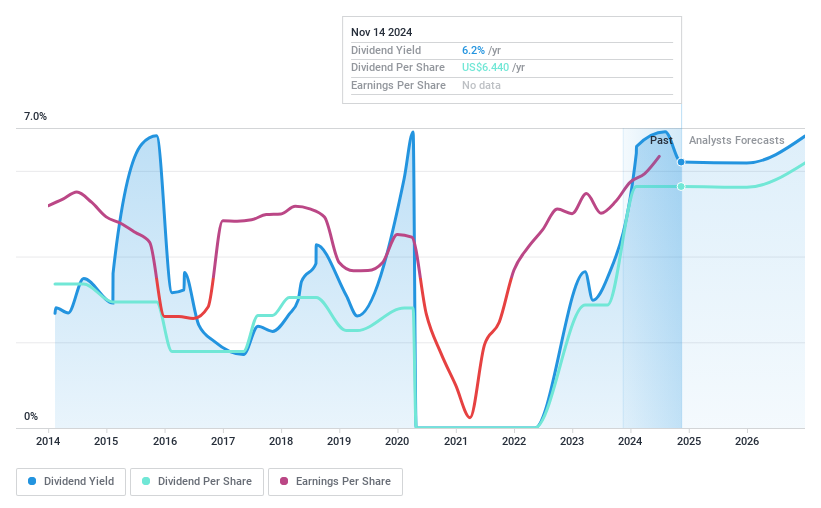

Copa Holdings (NYSE:CPA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Copa Holdings, S.A. operates as an airline providing passenger and cargo services through its subsidiaries, with a market cap of approximately $3.80 billion.

Operations: Copa Holdings generates revenue primarily from its air transportation services, amounting to $3.44 billion.

Dividend Yield: 7.0%

Copa Holdings offers a compelling dividend yield of 7.04%, ranking in the top 25% of US payers, supported by a low payout ratio of 44.2%. Despite an unstable dividend track record, recent affirmations maintain quarterly dividends at US$1.61 per share for 2025. The company trades at a favorable P/E ratio of 6.2x compared to the market's 16.9x and has shown consistent earnings growth, though revenue dipped slightly in the last quarter reported.

- Get an in-depth perspective on Copa Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Copa Holdings is priced lower than what may be justified by its financials.

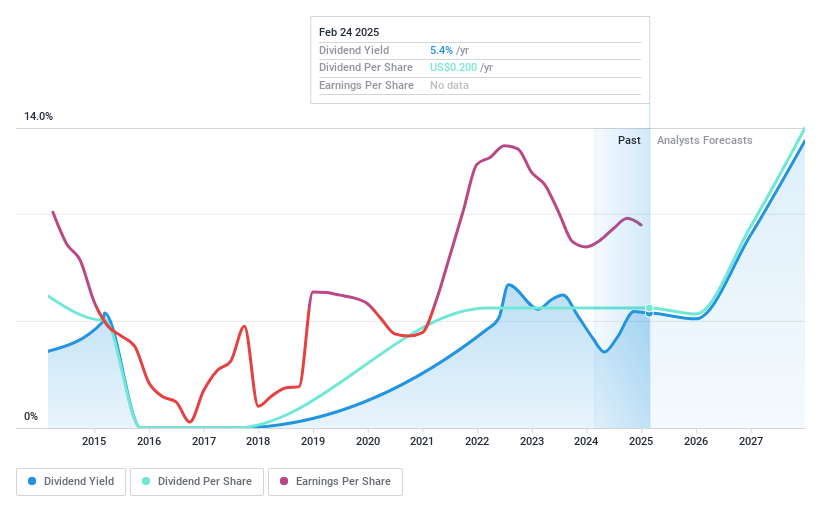

Safe Bulkers (NYSE:SB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc., along with its subsidiaries, offers international marine drybulk transportation services and has a market cap of $354.37 million.

Operations: Safe Bulkers, Inc. generates revenue primarily from its transportation - shipping segment, which amounted to $307.63 million.

Dividend Yield: 5.9%

Safe Bulkers' dividend yield of 5.92% is among the top 25% in the US, yet its sustainability is questionable due to lack of free cash flow coverage and a high debt level. Recent dividends on preferred shares highlight ongoing payouts despite past volatility and unreliable history. The company trades significantly below estimated fair value, with earnings well covering dividends, but recent revenue declines suggest caution for long-term dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Safe Bulkers.

- Our valuation report unveils the possibility Safe Bulkers' shares may be trading at a discount.

Summing It All Up

- Explore the 154 names from our Top US Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SB

Safe Bulkers

Provides marine drybulk transportation services internationally.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives