- United States

- /

- Food

- /

- NYSE:ADM

Highlighting Archer-Daniels-Midland And 2 More Excellent Dividend Stocks

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq reach record highs amid a market rebound, investors are paying close attention to dividend stocks as a reliable source of income in an ever-evolving economic landscape. In this environment, stocks like Archer-Daniels-Midland offer potential stability and consistent returns through dividends, making them attractive options for those seeking to balance growth with income.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 10.84% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.47% | ★★★★★☆ |

| PACCAR (PCAR) | 4.51% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.79% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.93% | ★★★★★★ |

| Ennis (EBF) | 5.66% | ★★★★★★ |

| Employers Holdings (EIG) | 3.02% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.85% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.62% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.55% | ★★★★★☆ |

Click here to see the full list of 128 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

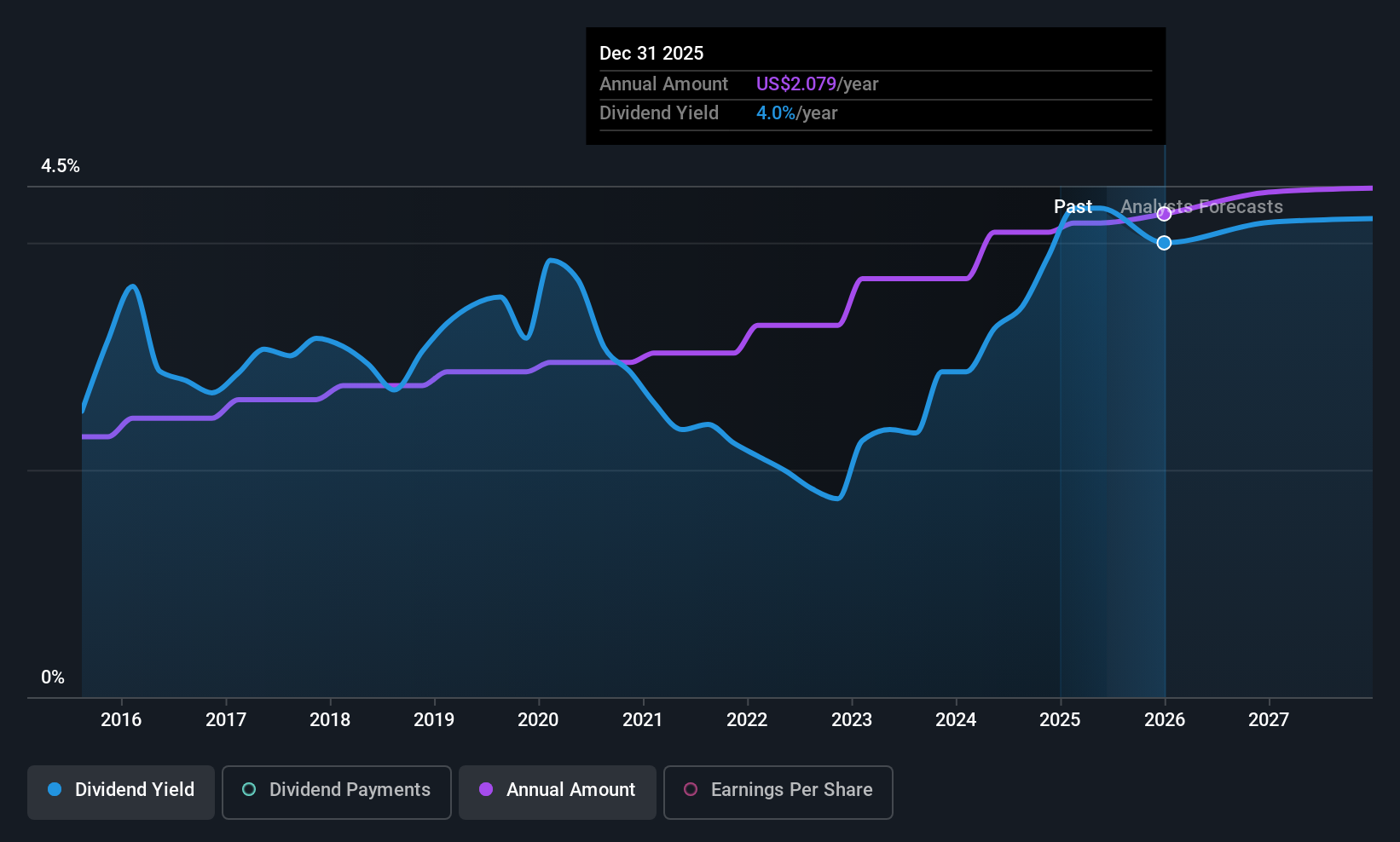

Archer-Daniels-Midland (ADM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Archer-Daniels-Midland Company is involved in the procurement, transportation, storage, processing, and merchandising of agricultural commodities and related products, with a market cap of $30.22 billion.

Operations: Archer-Daniels-Midland Company's revenue is primarily derived from its AG Services and Oilseeds segment at $65.69 billion, followed by Carbohydrate Solutions at $11.88 billion, and Nutrition at $7.49 billion.

Dividend Yield: 3.3%

Archer-Daniels-Midland (ADM) offers a reliable dividend history with stable growth over the past decade, supported by its earnings and cash flows. The payout ratio of 88.6% indicates dividends are covered by earnings, while a low cash payout ratio of 23.9% shows strong cash flow support. Recent strategic alliances, such as the joint venture with Alltech in animal feed and collaborations on regenerative agriculture, align with ADM's focus on sustainable practices but may impact profit margins temporarily due to restructuring efforts.

- Navigate through the intricacies of Archer-Daniels-Midland with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Archer-Daniels-Midland is priced higher than what may be justified by its financials.

Copa Holdings (CPA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Copa Holdings, S.A. operates through its subsidiaries to offer airline passenger and cargo transport services, with a market cap of approximately $4.98 billion.

Operations: Copa Holdings generates revenue primarily from its air transportation services, amounting to $3.48 billion.

Dividend Yield: 5.2%

Copa Holdings offers a dividend yield of 5.17%, ranking in the top 25% of US dividend payers, although its dividends have been volatile and not consistently covered by cash flows, with a high cash payout ratio of 109%. Despite this, recent earnings growth and improved load factors suggest operational strength. The company reported net income growth to US$148.91 million for Q2 2025, indicating potential earnings support for future dividends amidst capacity expansion plans.

- Click here to discover the nuances of Copa Holdings with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Copa Holdings' current price could be quite moderate.

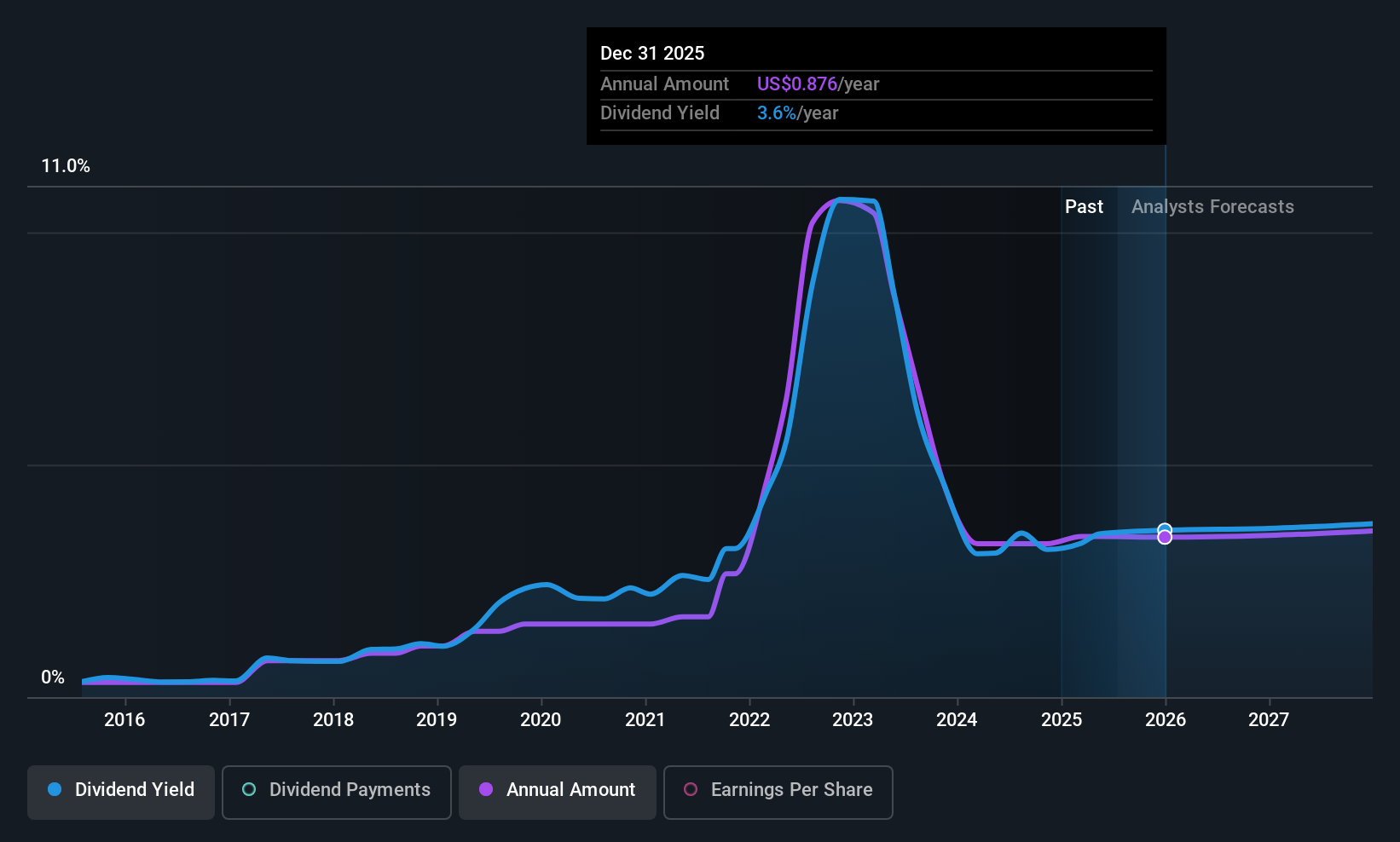

Coterra Energy (CTRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coterra Energy Inc. is an independent oil and gas company focused on the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States with a market cap of $18.72 billion.

Operations: Coterra Energy Inc. generates its revenue from the development, exploitation, exploration, and production of natural gas and oil, amounting to $6.23 billion.

Dividend Yield: 3.6%

Coterra Energy's dividend is well-supported by earnings and cash flows, with payout ratios of 40.8% and 45.4%, respectively. While the dividend yield of 3.63% is below the top quartile in the US market, recent earnings growth reinforces its sustainability. However, Coterra has an unstable dividend track record over the past decade despite some increases. Recent executive changes may influence future financial strategies, but current dividends remain consistent with a quarterly payout of US$0.22 per share.

- Dive into the specifics of Coterra Energy here with our thorough dividend report.

- Our valuation report unveils the possibility Coterra Energy's shares may be trading at a discount.

Taking Advantage

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 125 more companies for you to explore.Click here to unveil our expertly curated list of 128 Top US Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives