- United States

- /

- Transportation

- /

- NasdaqGS:FIP

FTAI Infrastructure Inc.'s (NASDAQ:FIP) Subdued P/S Might Signal An Opportunity

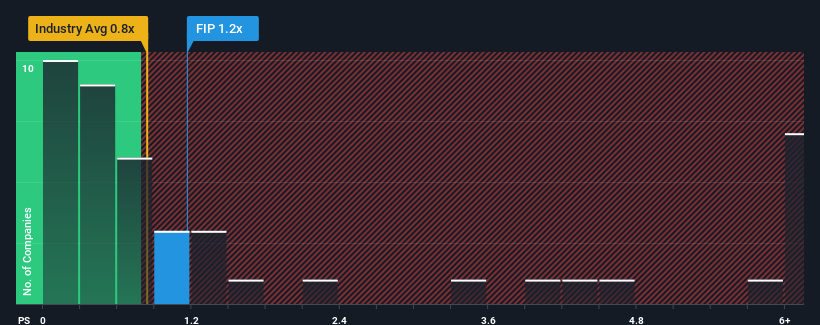

There wouldn't be many who think FTAI Infrastructure Inc.'s (NASDAQ:FIP) price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S for the Transportation industry in the United States is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for FTAI Infrastructure

What Does FTAI Infrastructure's P/S Mean For Shareholders?

FTAI Infrastructure certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think FTAI Infrastructure's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For FTAI Infrastructure?

The only time you'd be comfortable seeing a P/S like FTAI Infrastructure's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 57% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 7.4%, which is noticeably less attractive.

With this information, we find it interesting that FTAI Infrastructure is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On FTAI Infrastructure's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, FTAI Infrastructure's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for FTAI Infrastructure (2 shouldn't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on FTAI Infrastructure, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FIP

FTAI Infrastructure

Engages in the acquiring, developing, and operating assets and businesses that represent infrastructure for customers in the transportation, energy, and industrial products industries in North America.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026