Those following along with CSX Corporation (NASDAQ:CSX) will no doubt be intrigued by the recent purchase of shares by Stephen Angel, CEO, President & Director of the company, who spent a stonking US$2.0m on stock at an average price of US$36.87. That increased their holding by a full 1,701%, which arguably implies the sort of confidence required for a shy sweet-natured nerd to ask the most popular kid in the school to go out on a date.

The Last 12 Months Of Insider Transactions At CSX

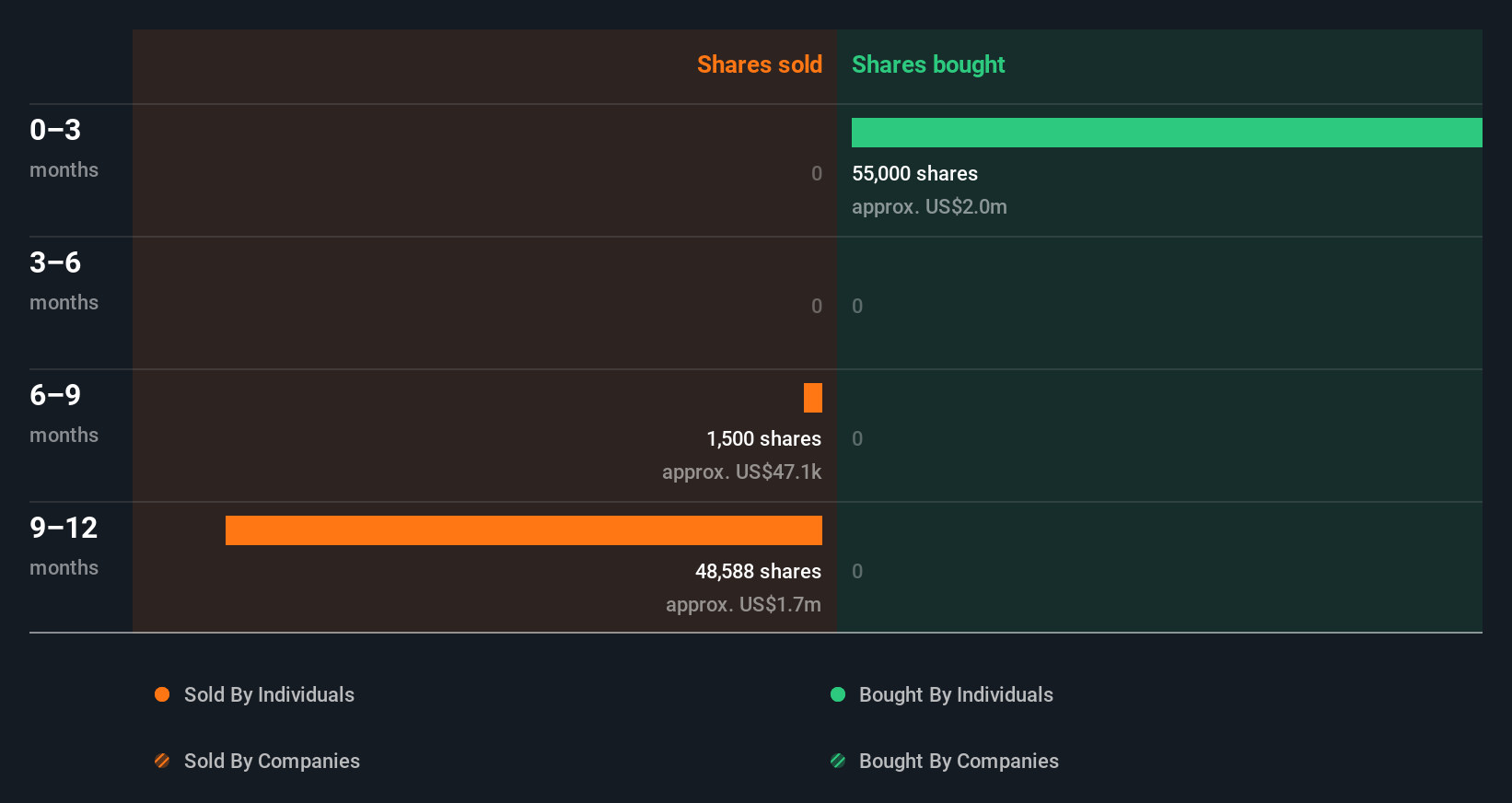

Notably, that recent purchase by Stephen Angel is the biggest insider purchase of CSX shares that we've seen in the last year. That means that an insider was happy to buy shares at above the current price of US$35.68. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. To us, it's very important to consider the price insiders pay for shares. As a general rule, we feel more positive about a stock when an insider has bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price. Stephen Angel was the only individual insider to buy during the last year.

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Check out our latest analysis for CSX

CSX is not the only stock that insiders are buying. For those who like to find small cap companies at attractive valuations, this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership Of CSX

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. CSX insiders own about US$78m worth of shares. That equates to 0.1% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The CSX Insider Transactions Indicate?

It's certainly positive to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. Insiders likely see value in CSX shares, given these transactions (along with notable insider ownership of the company). So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To assist with this, we've discovered 1 warning sign that you should run your eye over to get a better picture of CSX.

But note: CSX may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026