Over the last 7 days, the United States market has risen by 3.9%, contributing to a 12% increase over the past year, with earnings expected to grow by 14% per annum in the coming years. In this favorable environment, identifying promising small-cap stocks that offer potential for growth can be key to uncovering hidden opportunities within an expanding market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Photronics (NasdaqGS:PLAB)

Simply Wall St Value Rating: ★★★★★★

Overview: Photronics, Inc. operates as a manufacturer and seller of photomask products and services across various regions including the United States, Taiwan, China, Korea, and Europe with a market cap of approximately $1.24 billion.

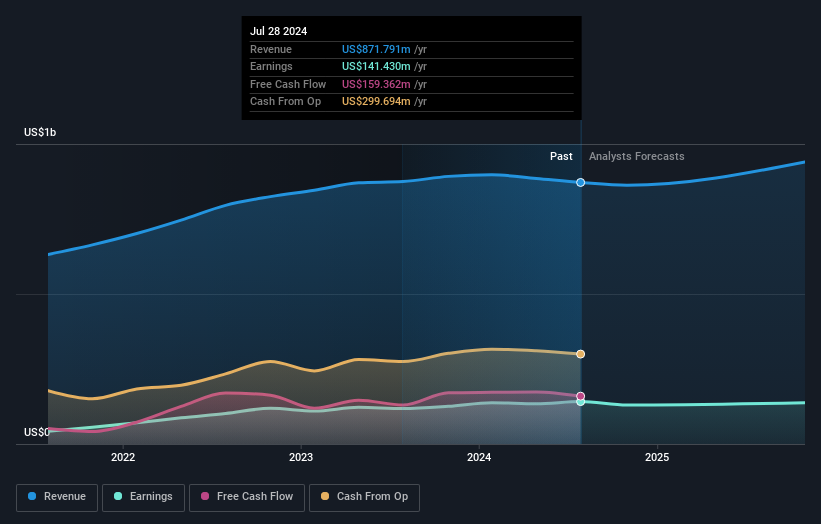

Operations: Photronics generates revenue primarily through the manufacture of photomasks, with reported sales of $862.75 million.

Photronics, a nimble player in the semiconductor space, is making waves with its strategic pivot towards high-end integrated circuit markets. Its earnings grew by 7.2% last year, outpacing the industry average of 2%, while trading at a notable 42.7% below estimated fair value suggests potential upside. With no debt on its books and free cash flow standing strong at US$175 million recently, Photronics is well-positioned for future growth despite risks like European sales softness and geopolitical tensions. The recent appointment of Adam Lewis as Lead Independent Director could also signal fresh strategic initiatives for this promising company.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation offers communications and payment services across the United States, the United Kingdom, and internationally, with a market cap of approximately $1.40 billion.

Operations: IDT generates revenue from four main segments: Traditional Communications ($878.90 million), Fintech ($140.08 million), National Retail Solutions (NRS) ($117.26 million), and Net2phone ($85.15 million).

IDT, a telecom player with no debt, has seen its earnings surge by 116% over the past year, outperforming industry growth. Trading at 54% below estimated fair value, it presents potential upside. The company repurchased 179,338 shares recently for $8.5 million and increased its dividend to $0.06 per share. With net income rising to $20.27 million in Q2 from $14.43 million last year and basic EPS up to $0.81 from $0.57, IDT's financials reflect robust performance despite significant insider selling in recent months and reliance on BOSS Money for working capital needs.

Natural Grocers by Vitamin Cottage (NYSE:NGVC)

Simply Wall St Value Rating: ★★★★☆☆

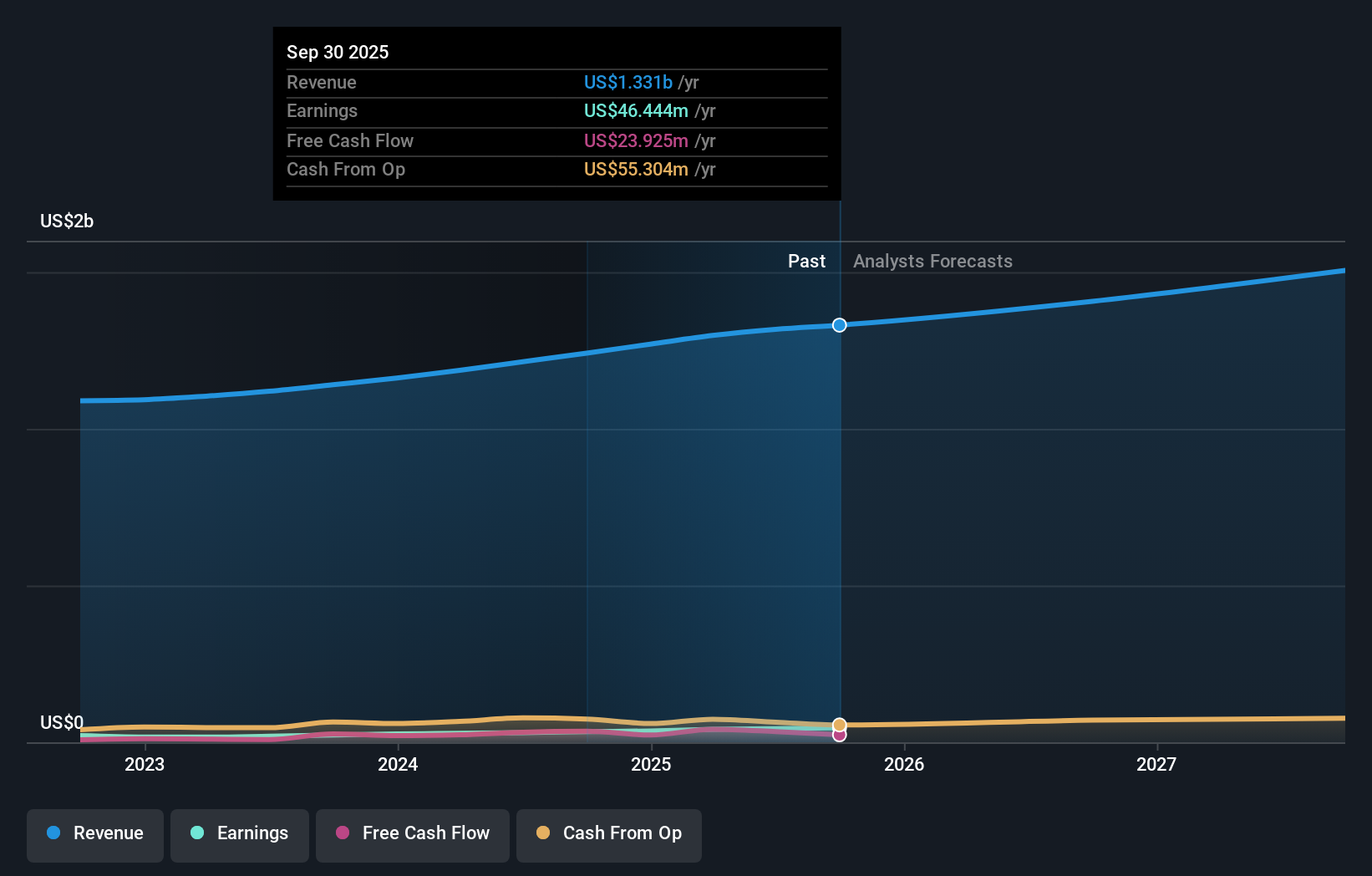

Overview: Natural Grocers by Vitamin Cottage, Inc. operates as a retailer of natural and organic groceries and dietary supplements across the United States, with a market capitalization of approximately $1.37 billion.

Operations: NGVC generates revenue primarily through its natural and organic retail stores, which contributed approximately $1.30 billion. The company's market capitalization stands at around $1.37 billion.

Natural Grocers by Vitamin Cottage, a nimble player in the organic retail sector, boasts impressive earnings growth of 43.9% over the past year, significantly outpacing the Consumer Retailing industry's 3.9%. The company is debt-free and maintains positive free cash flow, highlighting its robust financial health. Recent developments include a strategic partnership with Contented Hen for specialty eggs and an expanded house brand skincare line, underscoring its commitment to product diversification. With raised earnings guidance projecting diluted EPS between $1.78 and $1.86 for fiscal 2025, Natural Grocers continues to enhance its market presence while rewarding shareholders with quarterly dividends of US$0.12 per share.

Seize The Opportunity

- Dive into all 281 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade IDT, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDT

IDT

Provides communications and payment services in the United States, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives