- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Discovering 3 Stocks Including Capital One Financial That May Be Trading Below Fair Value Estimates

Reviewed by Simply Wall St

In recent days, the U.S. stock market has experienced fluctuations, with major indexes like the S&P 500 and Nasdaq reaching new highs before closing lower, while gold prices have surged to unprecedented levels. Amidst these market dynamics, identifying stocks that may be trading below their fair value can present intriguing opportunities for investors seeking to capitalize on potential undervaluation in a volatile environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SolarEdge Technologies (SEDG) | $35.55 | $68.92 | 48.4% |

| SLM (SLM) | $27.04 | $53.43 | 49.4% |

| Metropolitan Bank Holding (MCB) | $75.96 | $150.26 | 49.4% |

| Investar Holding (ISTR) | $22.95 | $45.33 | 49.4% |

| Hess Midstream (HESM) | $33.33 | $66.31 | 49.7% |

| Glaukos (GKOS) | $84.09 | $161.72 | 48% |

| First Commonwealth Financial (FCF) | $16.83 | $32.97 | 49% |

| First Busey (BUSE) | $23.18 | $45.30 | 48.8% |

| Alnylam Pharmaceuticals (ALNY) | $459.58 | $883.80 | 48% |

| AGNC Investment (AGNC) | $9.99 | $19.26 | 48.1% |

Here we highlight a subset of our preferred stocks from the screener.

Capital One Financial (COF)

Overview: Capital One Financial Corporation is a financial services holding company that offers a range of financial products and services in the United States, Canada, and the United Kingdom with a market cap of approximately $136.76 billion.

Operations: Capital One's revenue segments include Credit Card services generating $13.38 billion, Consumer Banking contributing $7.80 billion, and Commercial Banking adding $3.46 billion.

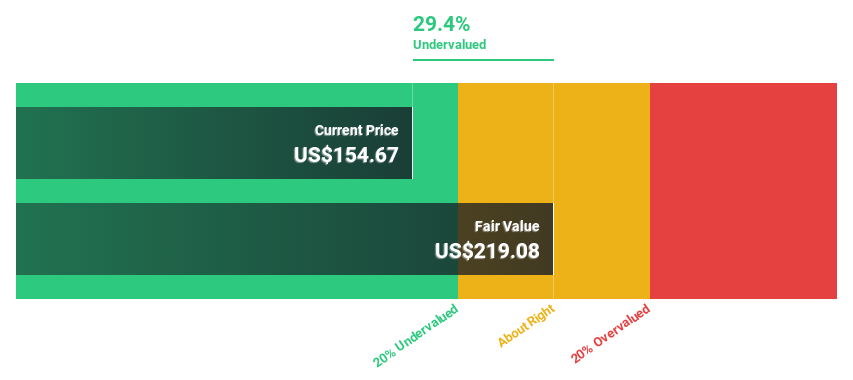

Estimated Discount To Fair Value: 22.8%

Capital One Financial is trading at US$213.69, significantly below its estimated fair value of US$276.71, suggesting it may be undervalued based on cash flows. Despite a recent net loss and substantial shareholder dilution, the company has completed fixed-income offerings totaling US$2.75 billion to bolster liquidity. Forecasts indicate robust revenue growth of 22.2% annually, outpacing the broader market and supporting future profitability expectations within three years despite low expected return on equity.

- Our expertly prepared growth report on Capital One Financial implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Capital One Financial stock in this financial health report.

Modine Manufacturing (MOD)

Overview: Modine Manufacturing Company designs, engineers, tests, manufactures, and sells mission-critical thermal solutions globally and has a market cap of approximately $8.08 billion.

Operations: Modine Manufacturing generates revenue through its Climate Solutions segment, which accounts for $1.48 billion, and its Performance Technologies segment, contributing $1.14 billion.

Estimated Discount To Fair Value: 10.9%

Modine Manufacturing, trading at US$149.82, is undervalued relative to its estimated fair value of US$168.11. Despite significant insider selling recently, the company's earnings are forecasted to grow significantly at 31.6% annually over the next three years, surpassing market expectations. Recent strategic expansions in U.S. and APAC regions aim to capitalize on rising data center cooling demand, supported by a substantial US$100 million investment enhancing manufacturing capacity and product development capabilities across multiple sites.

- The analysis detailed in our Modine Manufacturing growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Modine Manufacturing.

Pure Storage (PSTG)

Overview: Pure Storage, Inc. offers data storage and management technologies, products, and services globally with a market cap of approximately $29.69 billion.

Operations: The company's revenue is primarily derived from its computer storage devices segment, which generated $3.35 billion.

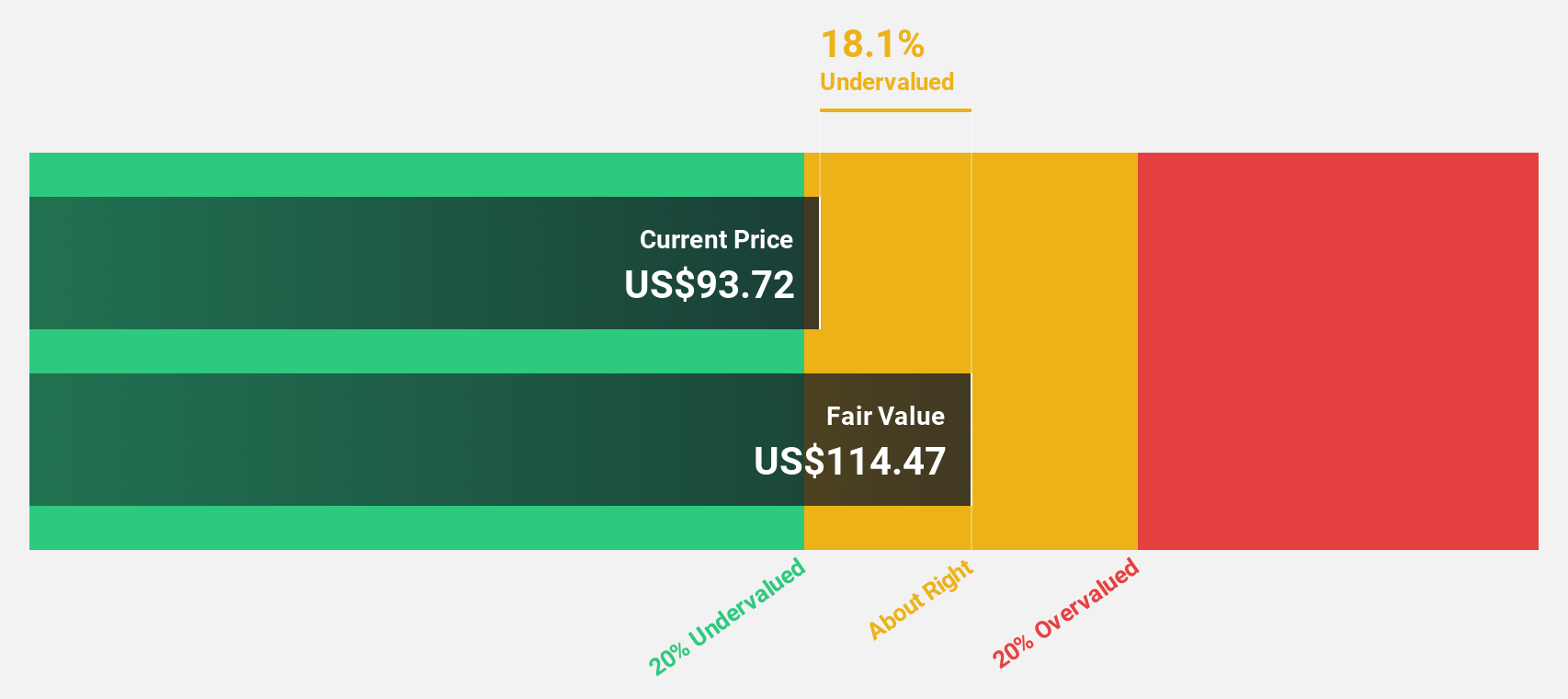

Estimated Discount To Fair Value: 14.5%

Pure Storage, trading at US$87.9, is undervalued relative to its estimated fair value of US$102.83. Despite recent insider selling, the company projects robust earnings growth of 33.75% annually over the next three years, outpacing market averages. Recent innovations enhance its platform's AI capabilities and cyber resilience, positioning it well for future demand in data management solutions while maintaining a strong financial trajectory with increased revenue guidance for fiscal 2026.

- The growth report we've compiled suggests that Pure Storage's future prospects could be on the up.

- Dive into the specifics of Pure Storage here with our thorough financial health report.

Taking Advantage

- Embark on your investment journey to our 196 Undervalued US Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives