- United States

- /

- Insurance

- /

- NYSE:HCI

3 Stocks That May Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As the U.S. stock market navigates through a government shutdown and unexpected private-sector job losses, major indices like the Nasdaq and S&P 500 continue to show resilience, with recent gains bringing them near record highs. In this fluctuating environment, identifying stocks that may be trading below their estimated fair value can offer investors potential opportunities to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $7.01 | $13.68 | 48.8% |

| Trade Desk (TTD) | $49.01 | $96.49 | 49.2% |

| Northwest Bancshares (NWBI) | $12.39 | $24.41 | 49.2% |

| HCI Group (HCI) | $191.93 | $376.13 | 49% |

| Glaukos (GKOS) | $81.55 | $161.60 | 49.5% |

| GeneDx Holdings (WGS) | $107.74 | $214.80 | 49.8% |

| First Busey (BUSE) | $23.15 | $45.30 | 48.9% |

| Customers Bancorp (CUBI) | $65.37 | $130.43 | 49.9% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.77 | $38.76 | 49% |

| Alnylam Pharmaceuticals (ALNY) | $456.00 | $896.08 | 49.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

HCI Group (HCI)

Overview: HCI Group, Inc. operates in the United States through its subsidiaries, offering property and casualty insurance, insurance management, reinsurance, real estate, and information technology services with a market cap of $2.42 billion.

Operations: The company's revenue segments include $726.94 million from insurance operations, $49.26 million from reciprocal exchange operations, and $11.12 million from real estate.

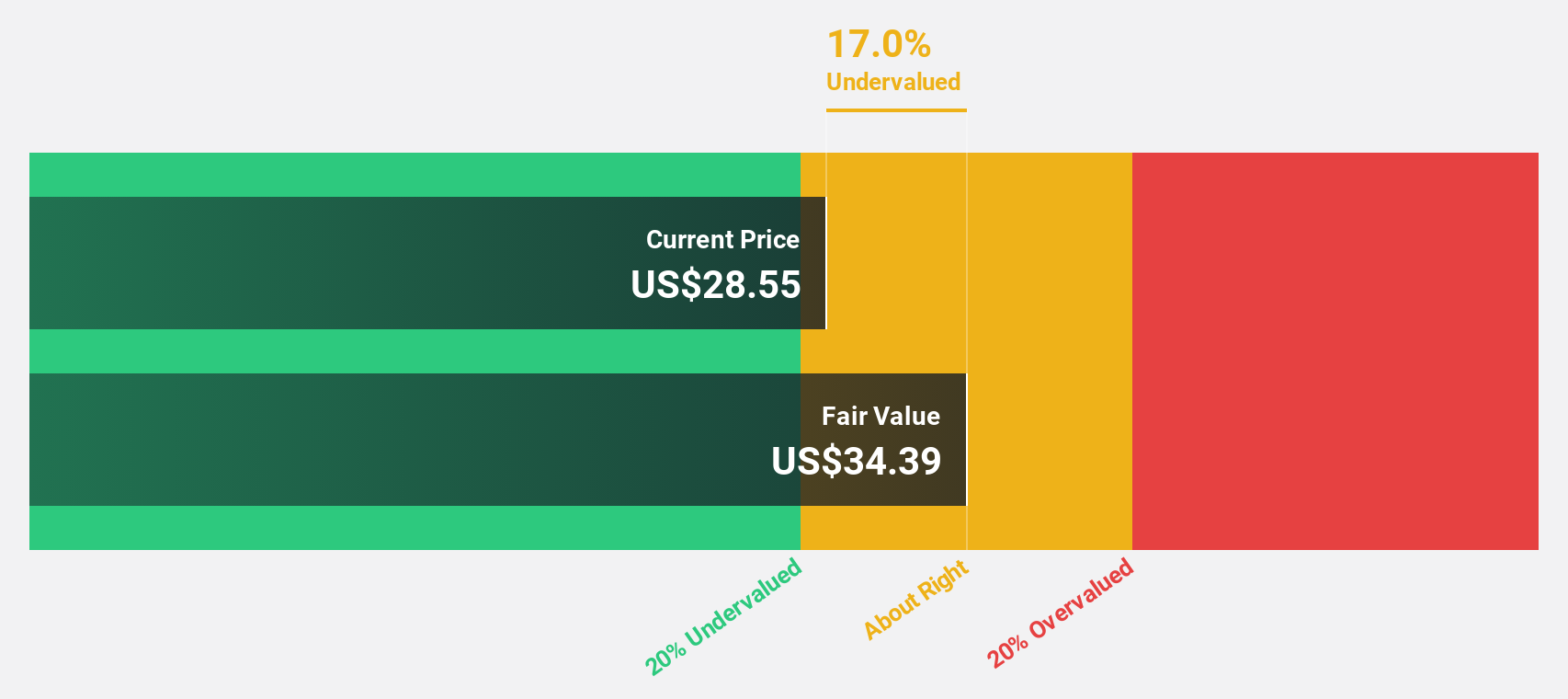

Estimated Discount To Fair Value: 49%

HCI Group is trading at US$191.93, significantly below its estimated fair value of US$376.13, suggesting it is undervalued based on cash flows. The company's earnings are forecast to grow 25.5% annually, outpacing the broader US market's growth rate of 15.4%. Recent financial results show a strong performance with Q2 revenue rising to US$221.92 million and net income increasing to US$66.16 million compared to the previous year.

- Insights from our recent growth report point to a promising forecast for HCI Group's business outlook.

- Navigate through the intricacies of HCI Group with our comprehensive financial health report here.

Mirion Technologies (MIR)

Overview: Mirion Technologies, Inc. offers radiation detection, measurement, analysis, and monitoring products and services across North America, Europe, and the Asia Pacific with a market cap of $5.23 billion.

Operations: The company's revenue is derived from two main segments: Medical, contributing $309.50 million, and Nuclear & Safety, generating $576.50 million.

Estimated Discount To Fair Value: 11.8%

Mirion Technologies is trading at US$23.26, slightly below its fair value estimate of US$26.36, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 103.5% annually, surpassing the broader US market's growth rate of 15.4%. Recent developments include a partnership with the IAEA and successful equity and fixed-income offerings totaling nearly $695 million, which may bolster its financial position and future growth prospects in radiation detection technology.

- Our comprehensive growth report raises the possibility that Mirion Technologies is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Mirion Technologies.

RLX Technology (RLX)

Overview: RLX Technology Inc. develops, manufactures, and sells e-vapor products in China and internationally, with a market cap of approximately $3.06 billion.

Operations: The company's revenue segment primarily consists of Personal Products, generating CN¥2.92 billion.

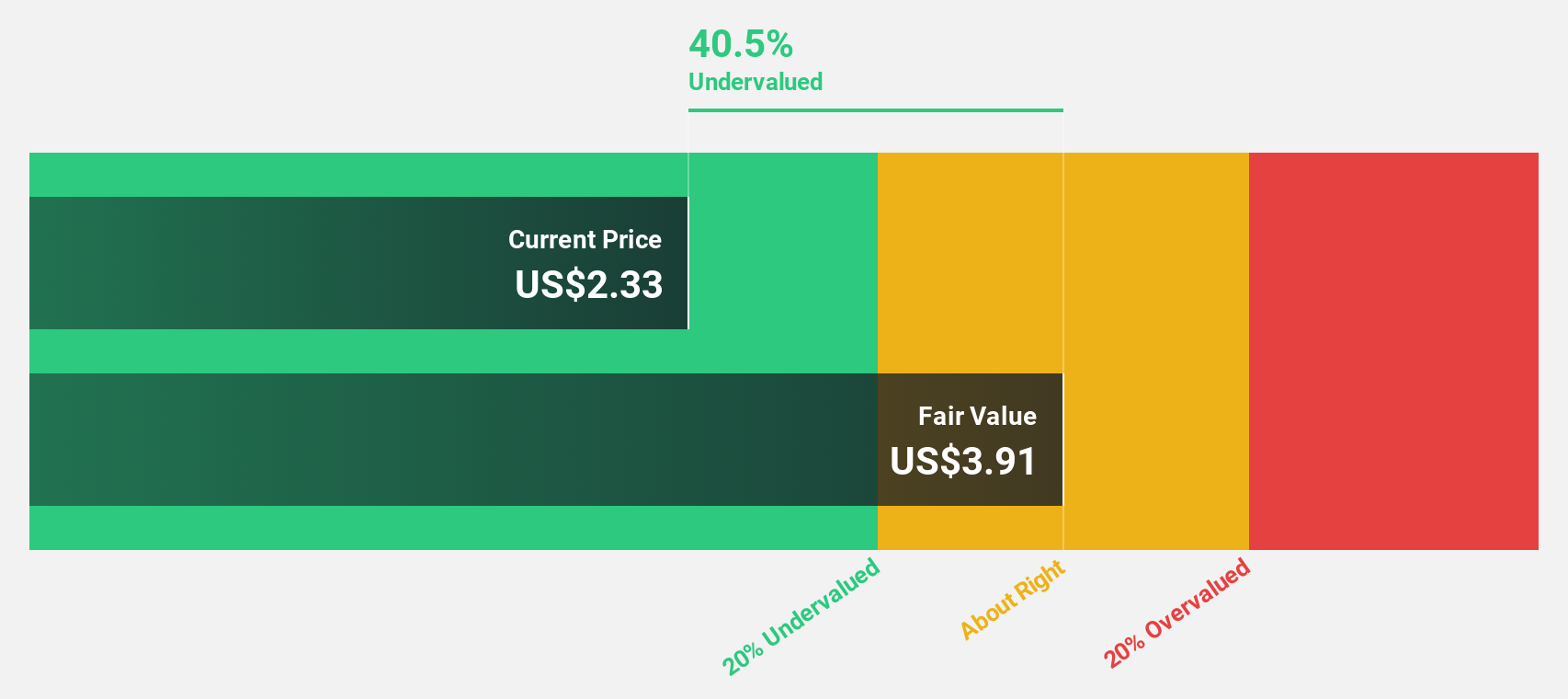

Estimated Discount To Fair Value: 32.2%

RLX Technology, trading at $2.63, is undervalued based on discounted cash flow with an estimated fair value of $3.88. The company's earnings grew by 11.3% last year and are forecast to grow 16.36% annually, outpacing the US market's growth rate of 15.4%. Recent earnings results show significant revenue and net income increases compared to the previous year, suggesting robust financial health despite a low future return on equity forecast of 7.6%.

- The growth report we've compiled suggests that RLX Technology's future prospects could be on the up.

- Dive into the specifics of RLX Technology here with our thorough financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 203 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion