- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

August 2025's Noteworthy Stocks Estimated Below Market Value

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with major indices like the S&P 500 and Nasdaq nearing record levels, investors are closely monitoring economic indicators and Federal Reserve signals for potential interest rate cuts. In this buoyant environment, identifying undervalued stocks becomes crucial for those looking to capitalize on opportunities that may not yet reflect their intrinsic value amidst a thriving market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $136.38 | $261.96 | 47.9% |

| Willdan Group (WLDN) | $116.26 | $231.90 | 49.9% |

| Peapack-Gladstone Financial (PGC) | $28.79 | $55.84 | 48.4% |

| Northwest Bancshares (NWBI) | $12.73 | $24.41 | 47.9% |

| Niagen Bioscience (NAGE) | $9.765 | $18.90 | 48.3% |

| Lyft (LYFT) | $16.25 | $30.98 | 47.5% |

| Investar Holding (ISTR) | $23.27 | $45.93 | 49.3% |

| Gold Royalty (GROY) | $3.29 | $6.56 | 49.8% |

| Fiverr International (FVRR) | $23.19 | $45.27 | 48.8% |

| Excelerate Energy (EE) | $24.44 | $46.89 | 47.9% |

We're going to check out a few of the best picks from our screener tool.

DoorDash (DASH)

Overview: DoorDash, Inc. operates a commerce platform linking merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of $106.28 billion.

Operations: The company's revenue segment includes Internet Information Providers, generating $11.90 billion.

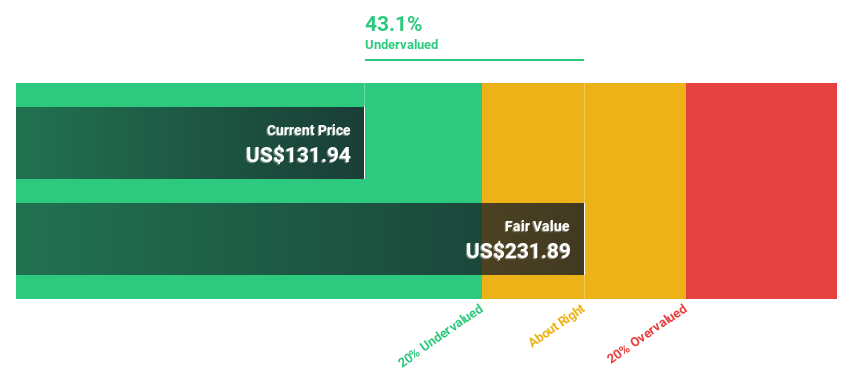

Estimated Discount To Fair Value: 32.6%

DoorDash's current trading price of US$245.65 is significantly below its estimated fair value of US$364.35, highlighting potential undervaluation based on discounted cash flow analysis. Recent earnings reports show a strong turnaround with a net income of US$285 million for the second quarter, reversing previous losses. Strategic partnerships and expansions in delivery services, including drone and AI-driven supply chain optimizations, bolster growth prospects despite recent index exclusions from value benchmarks.

- Our comprehensive growth report raises the possibility that DoorDash is poised for substantial financial growth.

- Click here to discover the nuances of DoorDash with our detailed financial health report.

Jabil (JBL)

Overview: Jabil Inc. is a global provider of manufacturing services and solutions, with a market cap of $22.31 billion.

Operations: Jabil's revenue segments include Electronics Manufacturing Services at $20.39 billion and Diversified Manufacturing Services at $13.83 billion.

Estimated Discount To Fair Value: 25.3%

Jabil's stock, priced at US$207.9, trades 25.3% below its fair value estimate of US$278.36, indicating potential undervaluation based on cash flow analysis. Despite a forecasted revenue growth rate of 6.2% per year—slower than the market—the company's earnings are expected to grow significantly at 24.7% annually, surpassing the U.S. market average. Recent strategic moves include a US$1 billion share buyback program and an expanded collaboration with Endeavour Energy LLC to enhance AI infrastructure capabilities.

- The analysis detailed in our Jabil growth report hints at robust future financial performance.

- Take a closer look at Jabil's balance sheet health here in our report.

Vertiv Holdings Co (VRT)

Overview: Vertiv Holdings Co specializes in designing, manufacturing, and servicing critical digital infrastructure technologies for data centers, communication networks, and commercial and industrial environments globally, with a market cap of $49.38 billion.

Operations: The company's revenue segments are comprised of $5.31 billion from the Americas, $2.17 billion from the Asia Pacific, and $2.43 billion from Europe, the Middle East, and Africa.

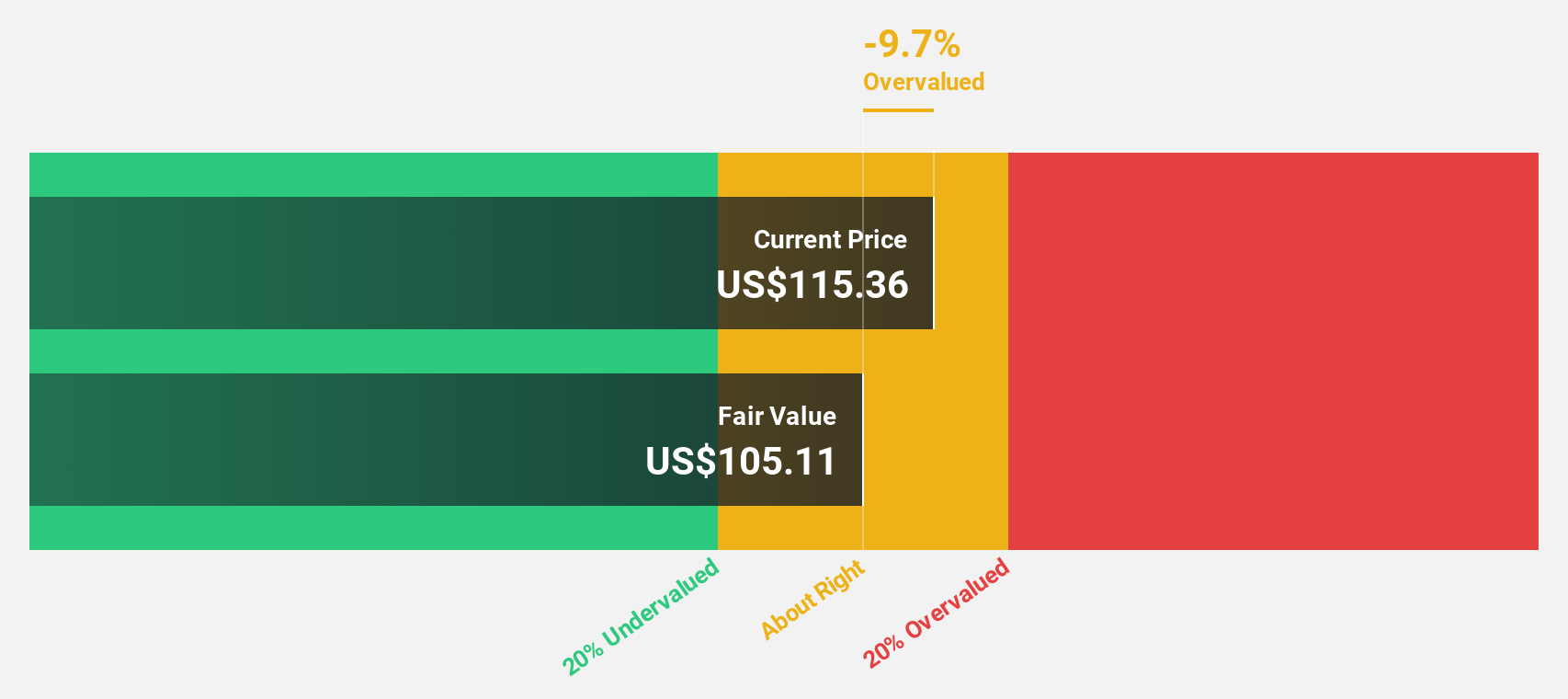

Estimated Discount To Fair Value: 13.4%

Vertiv Holdings Co, trading at US$129.31, is undervalued with a fair value estimate of US$149.3 based on discounted cash flow analysis. Earnings grew by 62.8% last year and are forecast to grow 23.96% annually, outpacing the market's growth rate. Recent product innovations like Vertiv™ OneCore enhance its data center offerings, while insider selling raises caution. Analysts agree on a potential stock price rise of 21.7%, reflecting positive sentiment despite challenges in insider activity and market conditions.

- Insights from our recent growth report point to a promising forecast for Vertiv Holdings Co's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Vertiv Holdings Co.

Key Takeaways

- Investigate our full lineup of 193 Undervalued US Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)