- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

Is It Too Late To Consider CompoSecure (CMPO) After Its Recent Share Price Surge

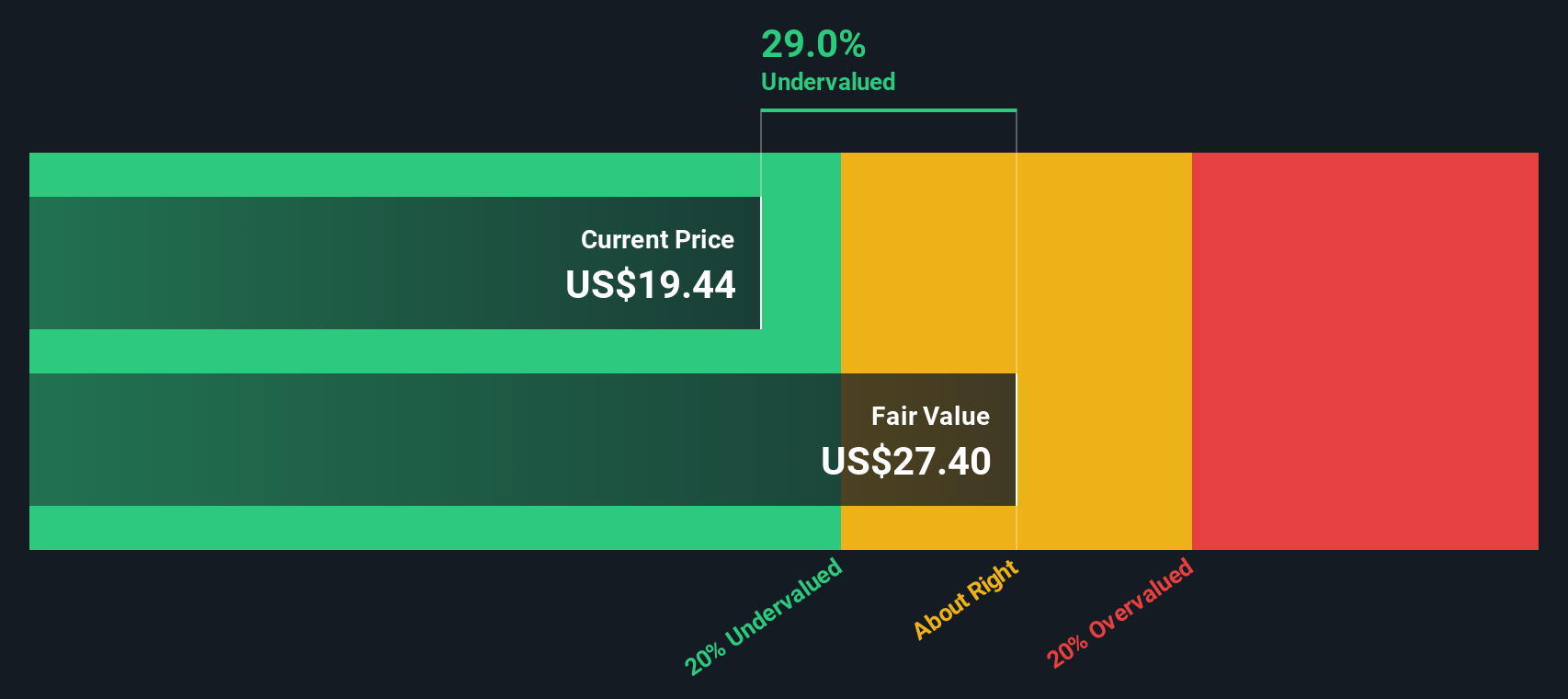

- If you are wondering whether CompoSecure's share price still reflects fair value after its recent run, this article will walk through what the current market price might be implying about the business.

- The stock last closed at US$25.15, with returns of 29.7% over the past 30 days, 34.7% year to date, 97.7% over the past year, and a very large gain over three years that is a little more than 4x.

- Recent coverage has highlighted CompoSecure's position in secure payment and authentication products, with particular attention on its premium metal payment card offering and related technology partnerships. This context helps frame why the market may be reassessing the business and its risk profile at the current share price.

- Despite this strong share price history, CompoSecure currently has a valuation score of 0 out of 6. We will look at what different valuation methods say about the stock, and then circle back at the end to a broader way of thinking about whether the current price really makes sense.

CompoSecure scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CompoSecure Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of a company’s future cash flows and discounts them back to today’s value to arrive at an estimate of what the business might be worth per share.

For CompoSecure, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month Free Cash Flow is about $21.9 million. Analyst estimates and extrapolated figures from Simply Wall St project Free Cash Flow reaching $209.1 million in 2035, with intermediate projection points such as $124 million in 2026 and $139 million in 2027, all in US$.

When these projected cash flows are discounted back, the model arrives at an estimated intrinsic value of about $10.75 per share. Compared with the recent share price of $25.15, this DCF output implies the stock is around 134.0% above the model’s estimate of fair value. On this measure alone, the valuation appears rich.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CompoSecure may be overvalued by 134.0%. Discover 879 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CompoSecure Price vs Sales

For a business where earnings can be less consistent, the P/S ratio is often a useful cross check, because it looks at what you are paying for each dollar of revenue rather than profit, which can swing around more.

In general, higher growth expectations and lower perceived risk justify a higher “normal” multiple, while slower growth or higher uncertainty usually support a lower one. For CompoSecure, the current P/S ratio is 45.30x, compared with the Tech industry average of 1.91x and a peer group average of 2.69x.

Simply Wall St’s Fair Ratio framework suggests a P/S of 8.93x for CompoSecure. This proprietary metric aims to estimate what the P/S could be given factors such as earnings growth, industry, profit margins, market cap and company specific risks. Because it adjusts for these elements rather than relying only on broad peer or industry comparisons, it can provide a more tailored view of what might be reasonable for this particular business.

Comparing the Fair Ratio of 8.93x with the actual 45.30x suggests CompoSecure’s current price is well above what this model would indicate.

Result: OVERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1428 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CompoSecure Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simply your own story about CompoSecure that links what you believe about its products, growth prospects and risks to a set of numbers like future revenue, earnings, margins and an assumed fair value.

On Simply Wall St, Narratives live in the Community page and give you a clear chain from company story to financial forecast to a fair value estimate that you can compare directly with the current share price to decide whether you think CompoSecure might be trading above or below what it is worth.

Because Narratives on the platform are updated when new information such as news or earnings is added, you can see how your fair value and others on the Community page shift as the facts change rather than relying on a one off model.

For example, one CompoSecure Narrative on the Community page might assume a relatively low fair value based on cautious revenue expectations and margins, while another could point to a higher fair value based on a more optimistic view of future contracts and product adoption. This shows how different investors can reasonably reach different conclusions from the same stock.

Do you think there's more to the story for CompoSecure? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Salesforce's Market Dominance and AI Pivot Will Drive Earnings Re-acceleration

IREN's Trump Card: How Federal Policy Could Unlock Massive Value in AI Infrastructure

ESPN’s NFL Power Play: How Disney’s Sports Engine Could Drive the Next Leg of Stock Growth

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!