Key Takeaways

- AI advancements and unique data assets are expected to accelerate campaign efficiency, revenue growth, and global expansion opportunities across new client segments and markets.

- Industry shifts and regulatory changes strengthen Trade Desk's competitive position, fostering platform adoption, recurring revenue, and long-term client retention.

- Growing regulatory, competitive, and industry pressures threaten Trade Desk's revenue growth, margins, and market relevance as digital advertising consolidates and major players fortify data access.

Catalysts

About Trade Desk- Operates as a technology company in the United States and internationally.

- Analyst consensus sees AI and the Kokai platform delivering improvements in campaign KPIs and ad spend efficiency, but this likely underestimates the AI flywheel effect-Trade Desk's unique and massive data set, now coupled with agentic AI, positions the company to compound campaign performance gains and unlock new, faster revenue growth trajectories as adoption accelerates.

- While analyst consensus expects operational restructuring and senior talent additions to bring long-term margin benefits, the reorganization and rapidly accelerating product velocity could drive a step-change in both net margins and future earnings by enabling the platform to scale profitably into new markets and client segments ahead of current forecasts.

- Trade Desk is poised to become the dominant independent gatekeeper for the entire open Internet as Google and Meta retreat to proprietary walled gardens and Amazon's inherent conflicts limit its addressable base-this power shift should result in an outsized share of the growing CTV, retail media, and omnichannel digital ad market, driving sustained revenue outperformance well above industry growth rates.

- As global privacy regulation further accelerates the decline of third-party cookies, unified open identity solutions like Trade Desk's UID2 are positioned to rapidly become the de facto standard for digital advertising, giving TTD increased platform stickiness, boosting recurring revenue, and fortifying long-term client relationships even as the industry undergoes foundational transformation.

- International expansion is still early, but rapid ramp-up-especially as mobile penetration and digital ad budgets in emerging markets take off-creates significant untapped growth potential that could dramatically increase both total addressable market and annual revenue, while further diversifying earnings streams.

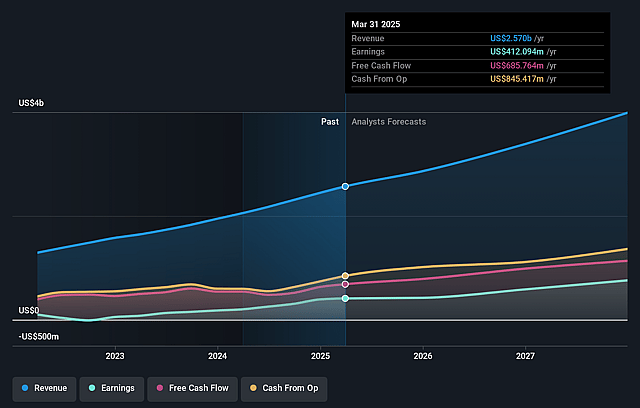

Trade Desk Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Trade Desk compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Trade Desk's revenue will grow by 21.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.6% today to 22.4% in 3 years time.

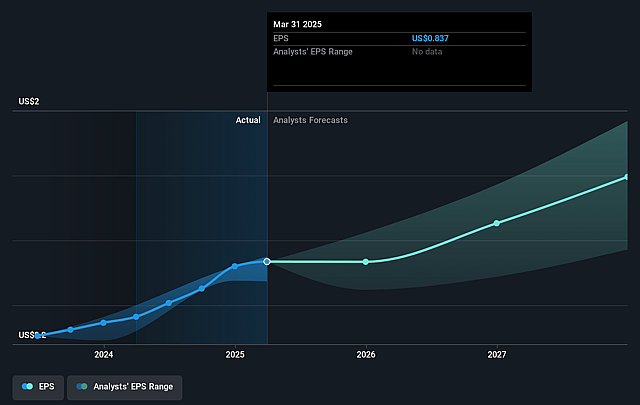

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $2.14) by about September 2028, up from $417.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 59.7x on those 2028 earnings, down from 61.4x today. This future PE is greater than the current PE for the US Media industry at 20.3x.

- Analysts expect the number of shares outstanding to decline by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Trade Desk Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on the open Internet leaves it exposed to ongoing privacy regulation and increasing restrictions on consumer data use, which could undermine the core value proposition for targeted programmatic advertising, causing a long-term drag on revenues if advertisers see reduced ad effectiveness.

- Trade Desk's growth is heavily concentrated in Connected TV and retail media; any deceleration in CTV ad growth or sector saturation, as well as cyclical downturns in these verticals, could significantly slow company-wide revenue expansion and increase earnings volatility.

- Competition is intensifying, with major players like Google, Amazon, and others either cementing their walled garden ecosystems or expanding their direct offerings, which could restrict data access, drive pricing pressure, compress take rates, and erode the company's gross margins and net earnings over time.

- Persistent high investment requirements in R&D and sales and marketing are necessary to maintain platform leadership as the pace of change accelerates, potentially capping operating leverage and limiting the expansion of long-term net profit margins.

- Industry trends toward media consolidation and vertical integration, as well as the emergence of in-house and AI-powered ad tech by major brands and retail media networks, threaten to bypass independent DSPs like Trade Desk, shrinking its addressable market and putting long-term revenue and growth at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Trade Desk is $111.31, which represents two standard deviations above the consensus price target of $75.39. This valuation is based on what can be assumed as the expectations of Trade Desk's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 59.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $52.4, the bullish analyst price target of $111.31 is 52.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.