Key Takeaways

- Regulatory restrictions and data privacy measures threaten Trade Desk's ability to effectively target ads and demonstrate ROI, slowing future revenue momentum.

- Intensifying competition, media fragmentation, and reliance on third-party platforms could limit market share, compress margins, and restrict long-term growth prospects.

- Rapid AI integration, digital ad shift, transparent supply chains, international expansion, and strong partnerships reinforce Trade Desk's market leadership and support sustained growth and margins.

Catalysts

About Trade Desk- Operates as a technology company in the United States and internationally.

- Intensifying regulatory scrutiny over data privacy, the continued phase-out of third-party cookies, and stricter identifier restrictions by Apple and Google are expected to undermine Trade Desk's targeting and attribution capabilities, leading to potential declines in ad effectiveness and lower campaign ROI, which will ultimately slow revenue growth.

- The ongoing shift of digital ad budgets toward walled gardens such as Meta, Amazon, and Google could reduce the open internet's share of global ad spend, directly limiting Trade Desk's addressable market and diminishing the long-term trajectory for top-line expansion.

- Heavy reliance on connected TV ad growth leaves the company vulnerable if major CTV platforms decide to build their own demand-side platforms, move to direct ad sales, or impose unfavorable terms on independent players, risking significant deceleration in Trade Desk's revenue growth and margin expansion.

- Media fragmentation across more channels and formats is making it harder to aggregate scalable, high-quality inventory, which drives up operational costs, reduces platform efficiency, and compresses net margins over time even as the company invests heavily in AI and supply chain innovation.

- Rising competition from both incumbent ad tech firms and new entrants-especially those offering proprietary data or differentiated AI solutions-could drive pricing pressure as agencies demand more transparency and value, forcing Trade Desk to lower platform fees and further eroding gross margins and earnings in future quarters.

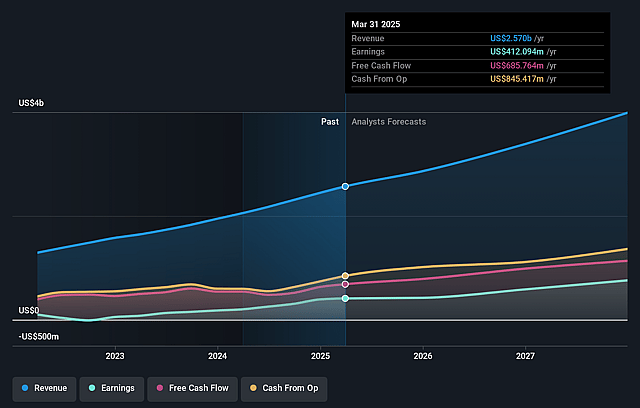

Trade Desk Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Trade Desk compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Trade Desk's revenue will grow by 9.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.6% today to 21.0% in 3 years time.

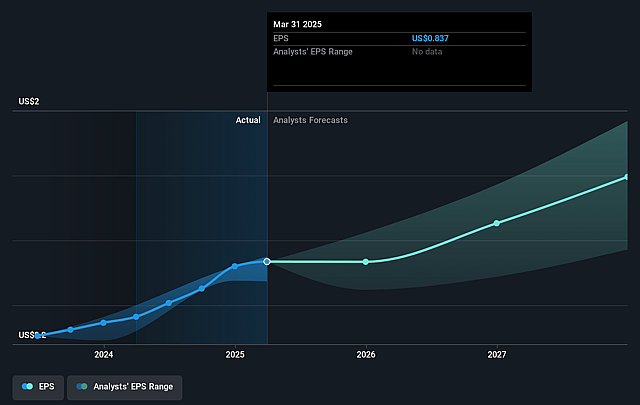

- The bearish analysts expect earnings to reach $738.7 million (and earnings per share of $1.05) by about August 2028, up from $417.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 41.9x on those 2028 earnings, down from 63.6x today. This future PE is greater than the current PE for the US Media industry at 20.7x.

- Analysts expect the number of shares outstanding to decline by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Trade Desk Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid adoption and integration of AI-powered optimizations in the Kokai platform are driving significantly improved campaign performance, with 20%+ gains in key metrics and faster spending growth from clients using the platform, which is likely to result in higher net revenue retention and stronger revenue growth for The Trade Desk.

- The ongoing shift of advertising budgets from linear TV to digital channels, especially connected TV, supports a growing addressable market for programmatic ad buying; Trade Desk's leadership and deep partnerships in CTV position it to benefit disproportionately, potentially boosting long-term revenue and operating margins.

- Trade Desk's focus on building a transparent, efficient, and objective supply chain-with innovations like OpenPath, Sincera, and Deal Desk-strengthens relationships with premium publishers and large advertisers, which can lead to increased share of advertising spend and higher gross margins over time.

- Secular trends such as the globalization of digital advertising and the increasing use of data-driven, measurable ad solutions are expanding opportunities outside North America, where Trade Desk is already seeing faster international growth, offering a future pathway to sustained top line growth and earnings expansion.

- The company's expanding ecosystem of partnerships with top content providers, retailers, and data sources-combined with its neutral, independent positioning outside of walled gardens-continues to attract both advertisers and publishers, solidifying Trade Desk's market leadership and supporting healthy long-term earnings and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Trade Desk is $52.23, which represents two standard deviations below the consensus price target of $85.64. This valuation is based on what can be assumed as the expectations of Trade Desk's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $47.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $738.7 million, and it would be trading on a PE ratio of 41.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $54.23, the bearish analyst price target of $52.23 is 3.8% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.