- United States

- /

- Hospitality

- /

- NYSE:VIK

3 Stocks Estimated Up To 47.2% Undervalued Offering A 21.5% Discount Opportunity

Reviewed by Simply Wall St

As U.S. markets experience a period of volatility, with the Dow Jones and S&P 500 recently losing ground after a four-day winning streak, investors are keeping a close eye on earnings reports and economic data that could influence market direction. In such an environment, identifying undervalued stocks can present opportunities for those looking to capitalize on potential discounts in the market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mid Penn Bancorp (NasdaqGM:MPB) | $27.77 | $54.03 | 48.6% |

| Trade Desk (NasdaqGM:TTD) | $53.97 | $106.40 | 49.3% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.35 | $18.65 | 49.9% |

| Ready Capital (NYSE:RC) | $4.42 | $8.65 | 48.9% |

| Shift4 Payments (NYSE:FOUR) | $80.28 | $158.86 | 49.5% |

| Veracyte (NasdaqGM:VCYT) | $32.23 | $62.85 | 48.7% |

| Verra Mobility (NasdaqCM:VRRM) | $21.91 | $43.04 | 49.1% |

| StoneCo (NasdaqGS:STNE) | $13.75 | $26.97 | 49% |

| Constellium (NYSE:CSTM) | $9.30 | $18.52 | 49.8% |

| RXO (NYSE:RXO) | $13.48 | $26.56 | 49.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Teradyne (NasdaqGS:TER)

Overview: Teradyne, Inc. is a company that designs, develops, manufactures, and sells automated test systems and robotics products globally with a market cap of $12.40 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Test segment, which accounts for $2.12 billion, followed by the Robotics segment at $364.85 million.

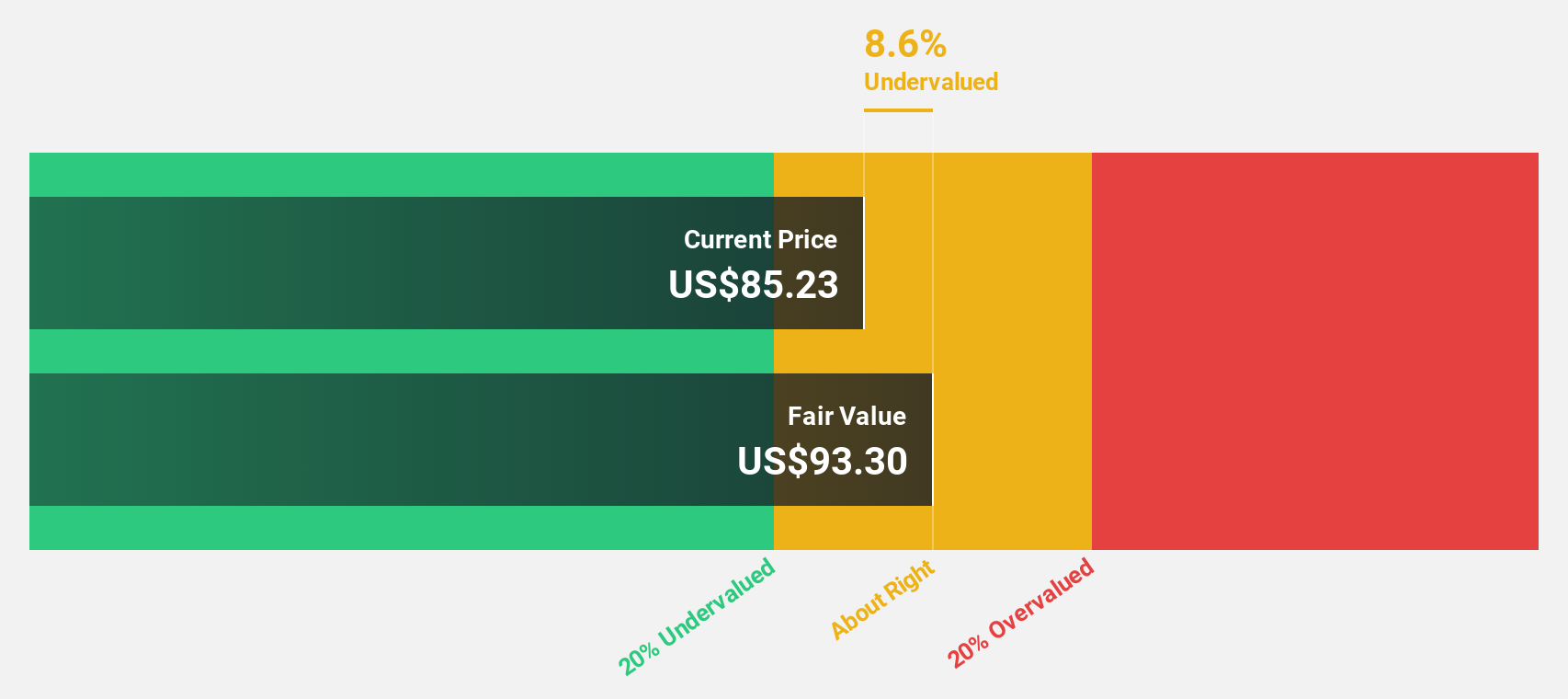

Estimated Discount To Fair Value: 21.5%

Teradyne is trading at US$77.12, 21.5% below its estimated fair value of US$98.2, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow at 16.9% annually, outpacing the broader U.S. market's growth rate of 14.1%. Recent strategic initiatives include a partnership with ficonTEC for silicon photonics testing solutions, which could enhance revenue prospects amid expected annual revenue growth of 11.2%, above the U.S market average.

- Our earnings growth report unveils the potential for significant increases in Teradyne's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Teradyne.

Ciena (NYSE:CIEN)

Overview: Ciena Corporation is a network technology company that offers hardware, software, and services to network operators across multiple regions including the Americas, Europe, the Middle East, Africa, Asia Pacific, Japan, and India; it has a market cap of approximately $9.37 billion.

Operations: The company's revenue is primarily derived from Networking Platforms at $3.06 billion, followed by Global Services at $540.45 million, Platform Software and Services at $363.38 million, and Blue Planet Automation Software and Services at $89.71 million.

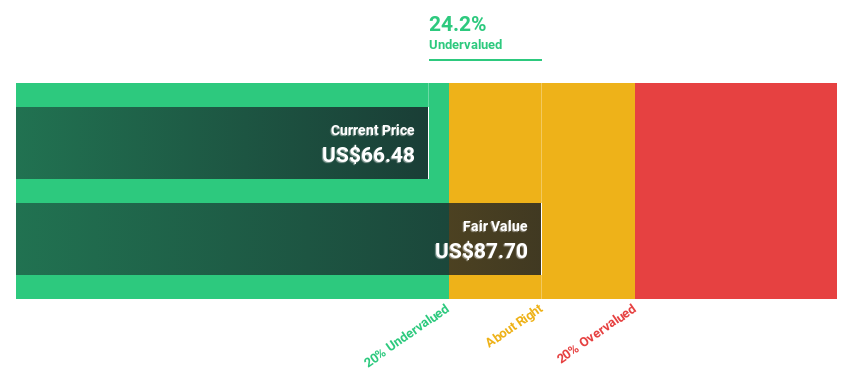

Estimated Discount To Fair Value: 24.8%

Ciena is trading at US$65.94, significantly below its estimated fair value of US$87.7, suggesting it may be undervalued based on cash flows. The company's earnings are expected to grow substantially at 51% annually, surpassing the U.S. market's growth rate of 14.1%. Recent collaborations with Windstream and Lumen Technologies highlight Ciena's role in advancing high-speed network capabilities, potentially bolstering future revenue as demand for AI and cloud services expands.

- Our expertly prepared growth report on Ciena implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Ciena with our comprehensive financial health report here.

Viking Holdings (NYSE:VIK)

Overview: Viking Holdings Ltd operates in passenger shipping and other forms of passenger transport across North America, the United Kingdom, and internationally, with a market cap of $17.96 billion.

Operations: The company's revenue is primarily derived from its Ocean segment, contributing $2.20 billion, and its River segment, generating $2.65 billion.

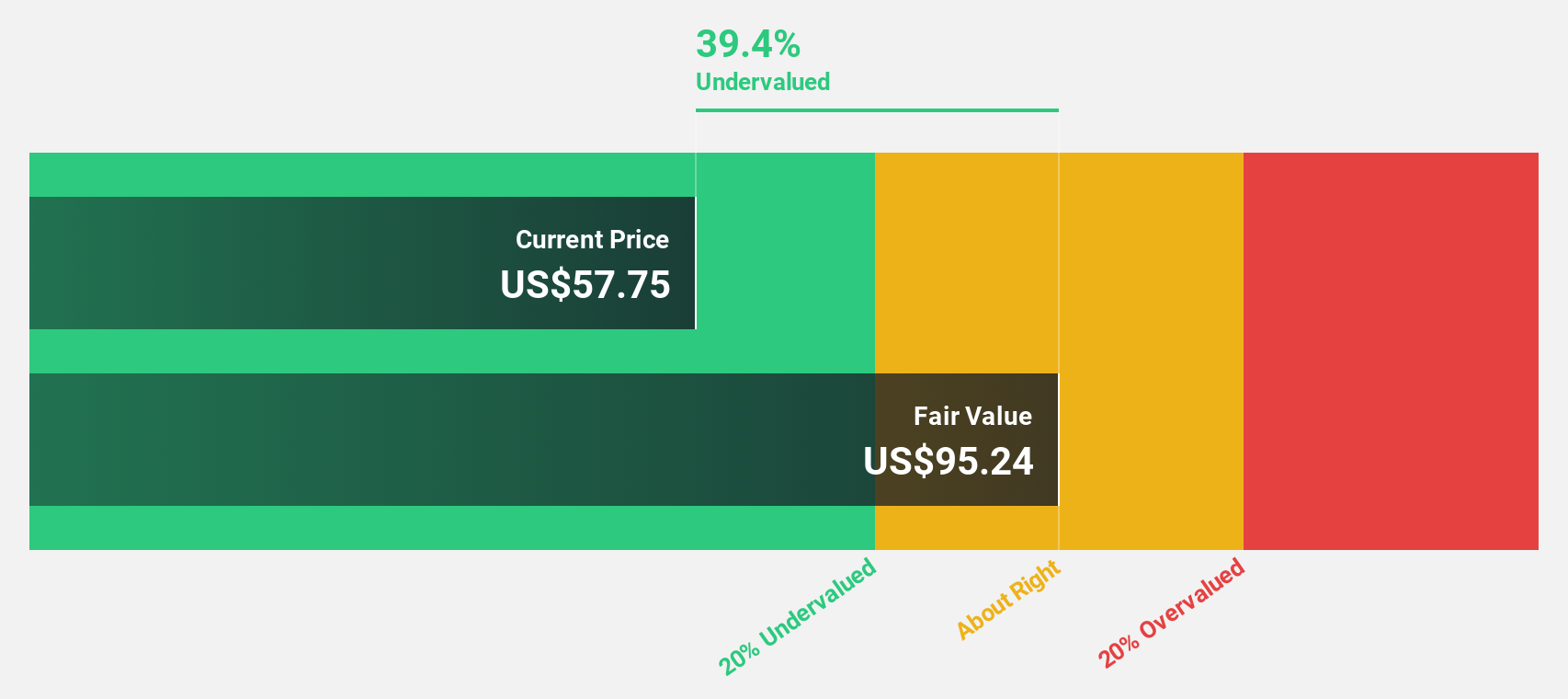

Estimated Discount To Fair Value: 47.2%

Viking Holdings is trading at US$40.55, considerably below its estimated fair value of US$76.81, highlighting potential undervaluation based on cash flows. The company has transitioned to profitability with a net income of US$152.33 million for 2024 and forecasts suggest earnings will grow significantly at 38.6% annually, outpacing the U.S. market's average growth rate of 14.1%. However, Viking carries a high level of debt which may impact financial flexibility despite strong revenue growth projections and innovative fleet expansions like the hydrogen-powered Viking Libra.

- Upon reviewing our latest growth report, Viking Holdings' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Viking Holdings stock in this financial health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 178 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Viking Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives