- United States

- /

- Communications

- /

- NasdaqGS:EXTR

3 Stocks Estimated To Be Trading Below Intrinsic Value In August 2025

Reviewed by Simply Wall St

In August 2025, the U.S. stock market is experiencing a pullback from recent record highs, with major indices like the Dow Jones and S&P 500 retreating as technology stocks face pressure. Amid this environment, investors are keenly focused on identifying stocks that may be trading below their intrinsic value, offering potential opportunities despite broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Willdan Group (WLDN) | $116.18 | $231.93 | 49.9% |

| Udemy (UDMY) | $6.96 | $13.21 | 47.3% |

| Peapack-Gladstone Financial (PGC) | $28.90 | $56.54 | 48.9% |

| Northwest Bancshares (NWBI) | $12.63 | $24.41 | 48.3% |

| Niagen Bioscience (NAGE) | $9.82 | $18.89 | 48% |

| Lyft (LYFT) | $16.135 | $30.98 | 47.9% |

| Investar Holding (ISTR) | $23.61 | $45.80 | 48.4% |

| Gold Royalty (GROY) | $3.28 | $6.55 | 49.9% |

| Fiverr International (FVRR) | $23.62 | $45.28 | 47.8% |

| AGNC Investment (AGNC) | $9.79 | $18.63 | 47.5% |

Here's a peek at a few of the choices from the screener.

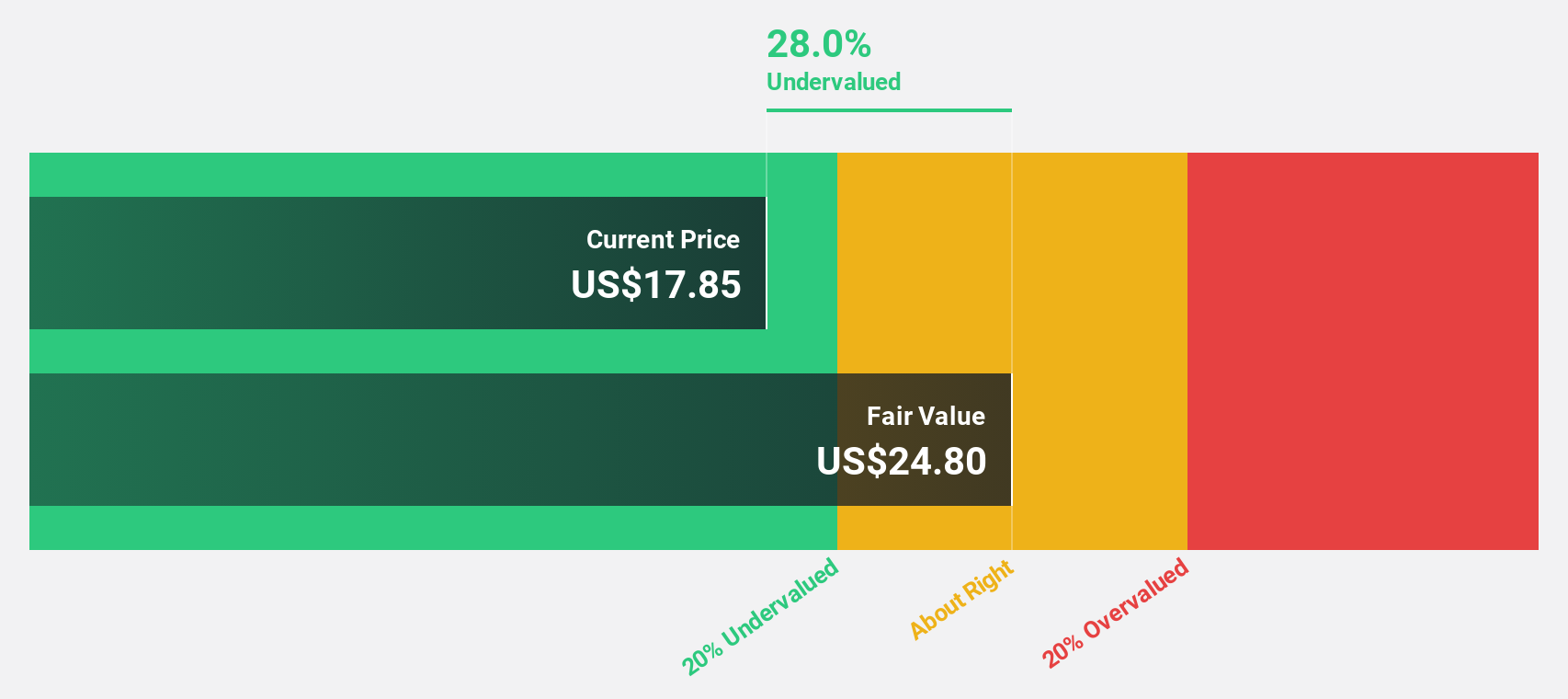

Phibro Animal Health (PAHC)

Overview: Phibro Animal Health Corporation is a company that focuses on animal health and mineral nutrition, operating in the United States, Israel, Brazil, Ireland, and internationally, with a market cap of approximately $1.31 billion.

Operations: Phibro Animal Health generates its revenue primarily through its operations in animal health and mineral nutrition across various international markets, including the United States, Israel, Brazil, and Ireland.

Estimated Discount To Fair Value: 45.6%

Phibro Animal Health appears undervalued, trading at US$38.46 against a fair value estimate of US$70.71, with significant earnings growth expected over the next three years. Recent results show substantial profit increases, with net income rising to US$48.26 million for fiscal 2025 from US$2.42 million the previous year. However, revenue growth is forecasted to be slower than the market average and operating cash flow does not adequately cover debt obligations.

- The analysis detailed in our Phibro Animal Health growth report hints at robust future financial performance.

- Click here to discover the nuances of Phibro Animal Health with our detailed financial health report.

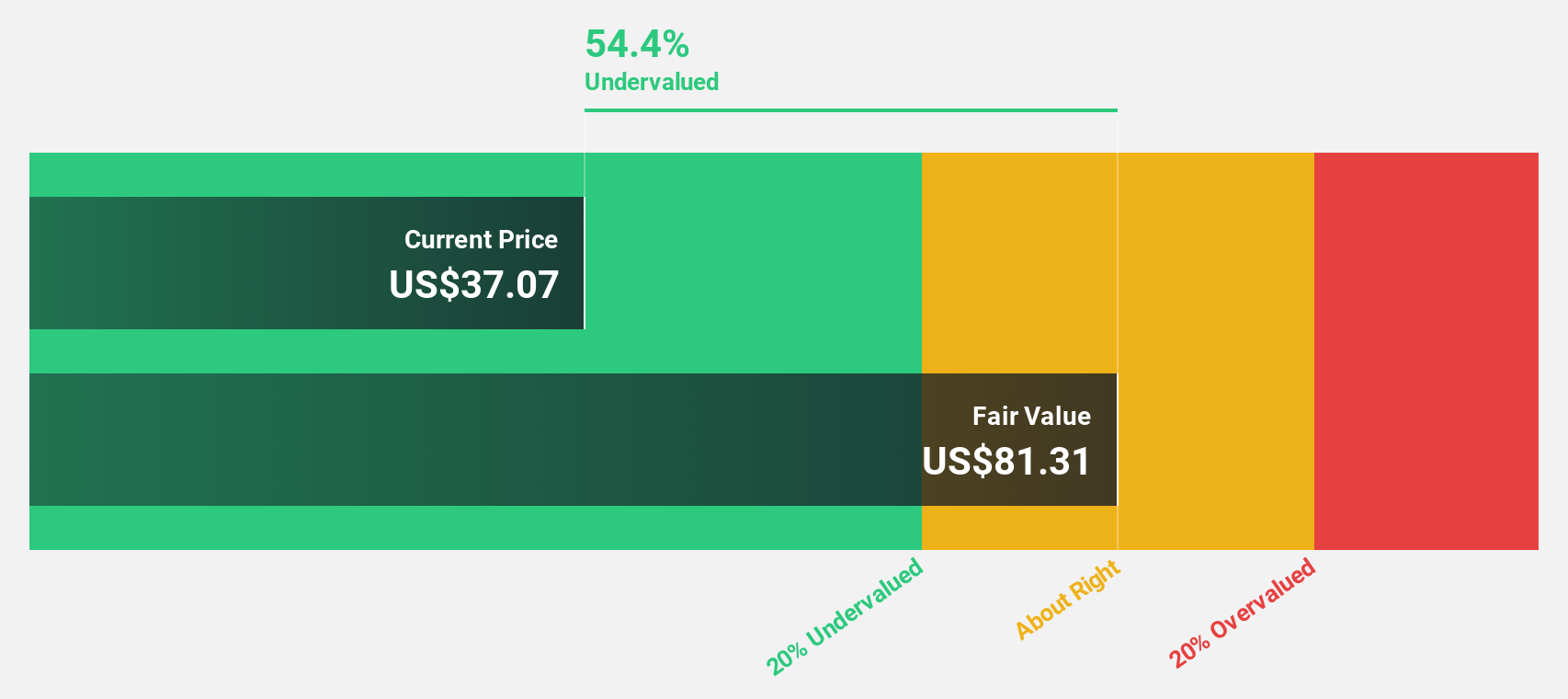

Extreme Networks (EXTR)

Overview: Extreme Networks, Inc. develops, markets, and sells infrastructure equipment and related software across various global regions, with a market cap of approximately $2.84 billion.

Operations: The company's revenue segment is primarily derived from the development and marketing of network infrastructure equipment and related software, totaling $1.14 billion.

Estimated Discount To Fair Value: 21.4%

Extreme Networks trades at US$22.08, below its estimated fair value of US$28.08, with earnings expected to grow significantly over the next three years. Recent results show a reduced net loss of US$7.47 million for fiscal 2025 compared to the previous year’s larger loss, despite slower revenue growth than the market average. The company has also completed a share buyback program worth US$25 million and launched Extreme Platform ONE™, enhancing network management capabilities through AI integration.

- Our expertly prepared growth report on Extreme Networks implies its future financial outlook may be stronger than recent results.

- Take a closer look at Extreme Networks' balance sheet health here in our report.

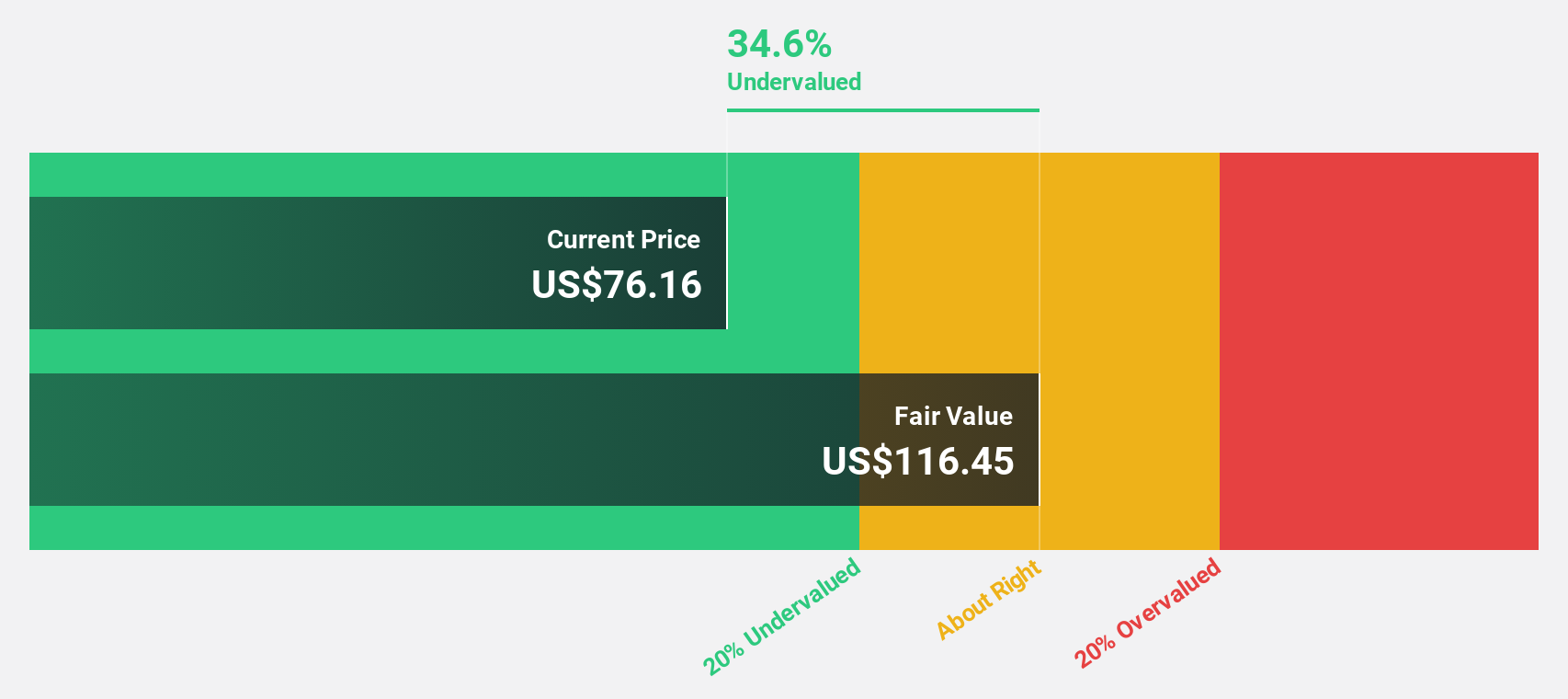

Griffon (GFF)

Overview: Griffon Corporation, with a market cap of approximately $3.64 billion, operates through its subsidiaries to offer consumer and professional as well as home and building products across the United States, Europe, Canada, Australia, and internationally.

Operations: Griffon's revenue is derived from two main segments: Home and Building Products, which generated $1.57 billion, and Consumer and Professional Products, contributing $946.97 million.

Estimated Discount To Fair Value: 33.3%

Griffon Corporation, trading at US$77.71, is significantly undervalued with an estimated fair value of US$116.46 and earnings projected to grow faster than the market over the next three years. Despite high debt levels and a recent net loss of US$120.14 million due to impairments, Griffon's share buyback program completed 25.72% repurchases for US$581.55 million, which may support future stock performance amidst slower revenue growth forecasts compared to the broader market.

- Our comprehensive growth report raises the possibility that Griffon is poised for substantial financial growth.

- Get an in-depth perspective on Griffon's balance sheet by reading our health report here.

Make It Happen

- Navigate through the entire inventory of 190 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Extreme Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXTR

Extreme Networks

Develops, markets, and sells network infrastructure equipment and related software in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)