- United States

- /

- Banks

- /

- NasdaqGS:MSBI

Exploring 3 Undervalued Small Caps With Insider Activity In The Market

Reviewed by Simply Wall St

As the U.S. markets show mixed performances with major indices like the Dow and S&P 500 nearing record highs, investors are keenly watching economic indicators such as inflation data and labor market reports that could influence Federal Reserve interest rate decisions. In this environment, small-cap stocks present unique opportunities for investors looking to navigate market volatility, especially when insider activity suggests potential value in these companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shore Bancshares | 10.4x | 2.8x | 41.30% | ★★★★★☆ |

| Wolverine World Wide | 16.2x | 0.8x | 40.00% | ★★★★★☆ |

| First United | 10.1x | 3.0x | 44.40% | ★★★★★☆ |

| Merchants Bancorp | 8.0x | 2.7x | 48.42% | ★★★★★☆ |

| Metropolitan Bank Holding | 12.6x | 3.1x | 30.40% | ★★★★☆☆ |

| New Peoples Bankshares | 9.6x | 2.2x | 40.19% | ★★★★☆☆ |

| S&T Bancorp | 11.5x | 3.9x | 36.94% | ★★★★☆☆ |

| Farmland Partners | 6.5x | 8.0x | -88.62% | ★★★★☆☆ |

| CNB Financial | 18.4x | 3.5x | 44.65% | ★★★☆☆☆ |

| Omega Flex | 17.8x | 2.9x | 3.59% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

ADTRAN Holdings (ADTN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: ADTRAN Holdings specializes in providing network solutions and services, with a market cap of approximately $1.73 billion.

Operations: Network Solutions and Services & Support are the primary revenue streams, generating $851.27 million and $183.83 million respectively. The company has experienced fluctuations in gross profit margin, with a recent figure of 37.57% as of September 2025, indicating variability over time. Operating expenses have consistently been significant, driven largely by R&D and general administrative costs which reached $198.64 million and $223.02 million respectively in the latest period analyzed.

PE: -8.8x

ADTRAN Holdings, a key player in the fiber access and AI-driven network solutions sector, is drawing attention for its potential growth prospects. With revenue forecasted between US$275 million and US$285 million for Q4 2025, the company shows promise despite recent net losses. Their collaboration with Henderson Municipal Power & Light to expand broadband services underscores their technological prowess. Insider confidence is evident as they made significant share purchases in October 2025, suggesting belief in future performance. Although reliant on external borrowing, ADTRAN's innovative offerings like Mosaic One Clarity and partnerships highlight its strategic positioning within the industry.

- Click to explore a detailed breakdown of our findings in ADTRAN Holdings' valuation report.

Understand ADTRAN Holdings' track record by examining our Past report.

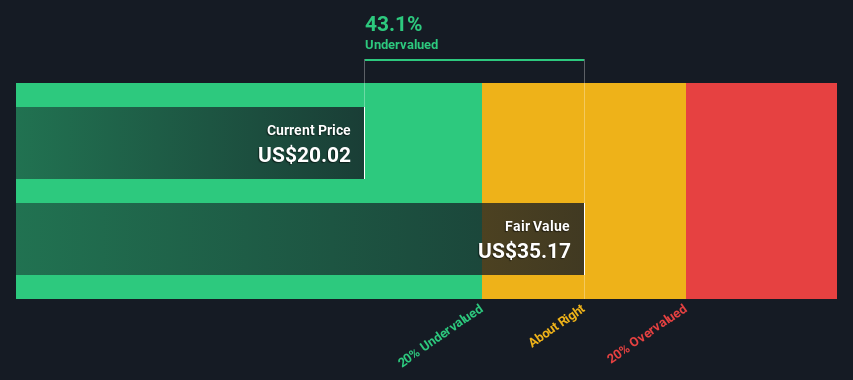

Midland States Bancorp (MSBI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Midland States Bancorp operates as a diversified financial services company with primary activities in banking and wealth management, and it has a market capitalization of approximately $0.5 billion.

Operations: Midland States Bancorp generates revenue primarily from its Banking and Wealth Management segments, with the Banking segment contributing $193.44 million and Wealth Management adding $30.34 million. The company has experienced fluctuations in net income margin, ranging from 0.04% to 30.37% over various periods, indicating variability in profitability despite a consistent gross profit margin of 100%. Operating expenses are a significant part of the cost structure, with general and administrative expenses being the largest component.

PE: -2.7x

Midland States Bancorp, a financial institution with a focus on community banking, has shown insider confidence through recent share purchases. The company reported net interest income of US$61.12 million for Q3 2025, up from US$59.11 million last year, though net income declined to US$7.56 million from US$20.43 million previously. A new buyback program authorizing up to US$25 million in repurchases reflects management's strategic focus on enhancing shareholder value amidst evolving executive leadership and consistent dividend payouts.

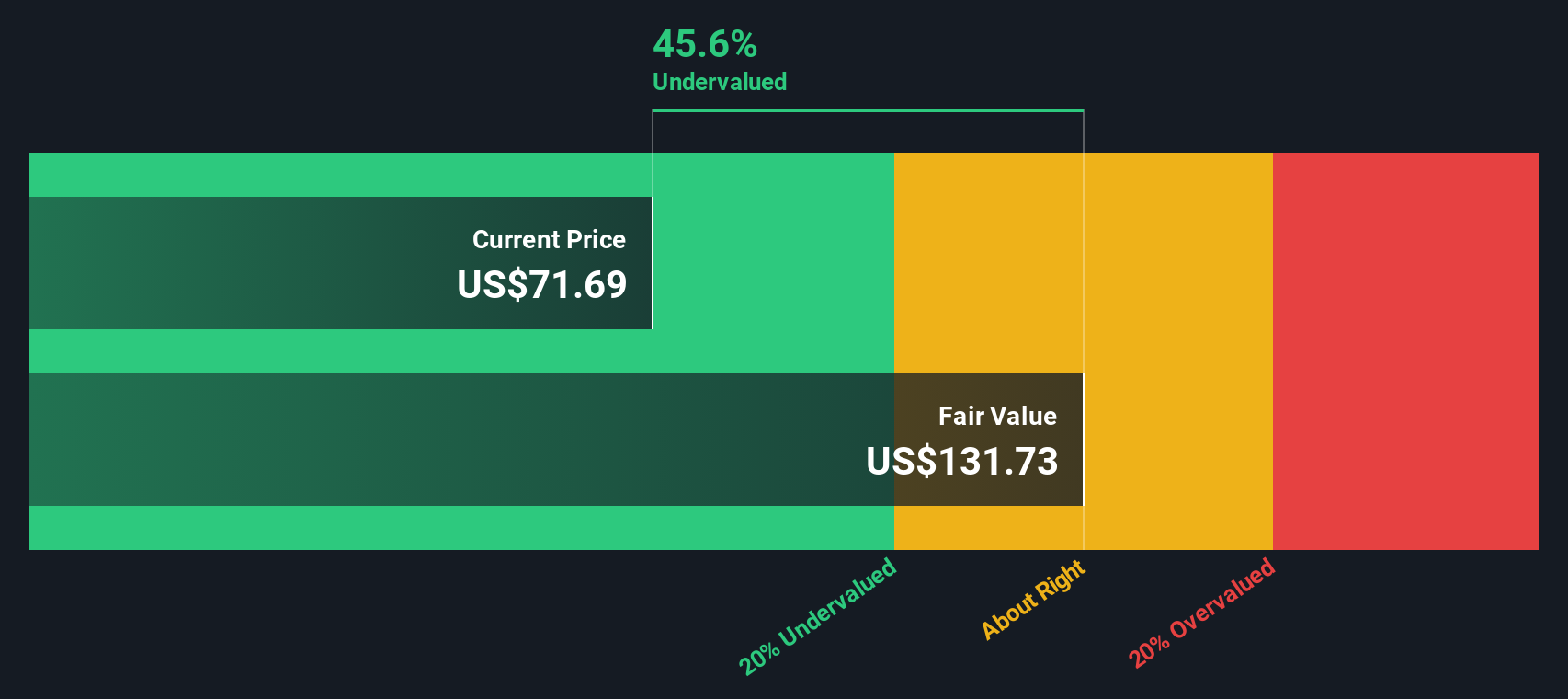

Tompkins Financial (TMP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Tompkins Financial is a diversified financial services company offering banking, insurance, and wealth management services with a market cap of approximately $1.03 billion.

Operations: The company generates revenue primarily from banking, insurance, and wealth management services. Operating expenses are significant, with general and administrative costs being the largest component. The net income margin has shown variability but was at 24.21% in December 2024.

PE: 12.2x

Tompkins Financial, a smaller player in the U.S. market, shows signs of being undervalued despite challenges. Recent earnings for Q3 2025 highlight net interest income at US$63.88 million, up from US$53.19 million last year, and net income rising to US$23.67 million from US$18.64 million. However, earnings are projected to decline by 3.4% annually over the next three years, indicating potential headwinds ahead despite increased dividends and reduced charge-offs this quarter compared to earlier periods in 2025.

- Click here to discover the nuances of Tompkins Financial with our detailed analytical valuation report.

Evaluate Tompkins Financial's historical performance by accessing our past performance report.

Next Steps

- Explore the 76 names from our Undervalued US Small Caps With Insider Buying screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSBI

Midland States Bancorp

Operates as a financial holding company for Midland States Bank that provides various banking products and services to individuals, businesses, municipalities, and other entities.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026