- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has shown robust performance recently, with a 3.2% increase over the past week and a 24% rise in the last year, while earnings are projected to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that not only capitalize on current technological trends but also demonstrate strong potential for sustained earnings growth.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 62.05% | 20.47% | ★★★★★★ |

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 55.24% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Bitdeer Technologies Group | 50.44% | 122.48% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young audiences in China, with a market capitalization of $7.26 billion.

Operations: The company generates revenue primarily from internet information services, amounting to CN¥25.45 billion. The focus is on engaging young audiences in China through a diverse range of online entertainment offerings.

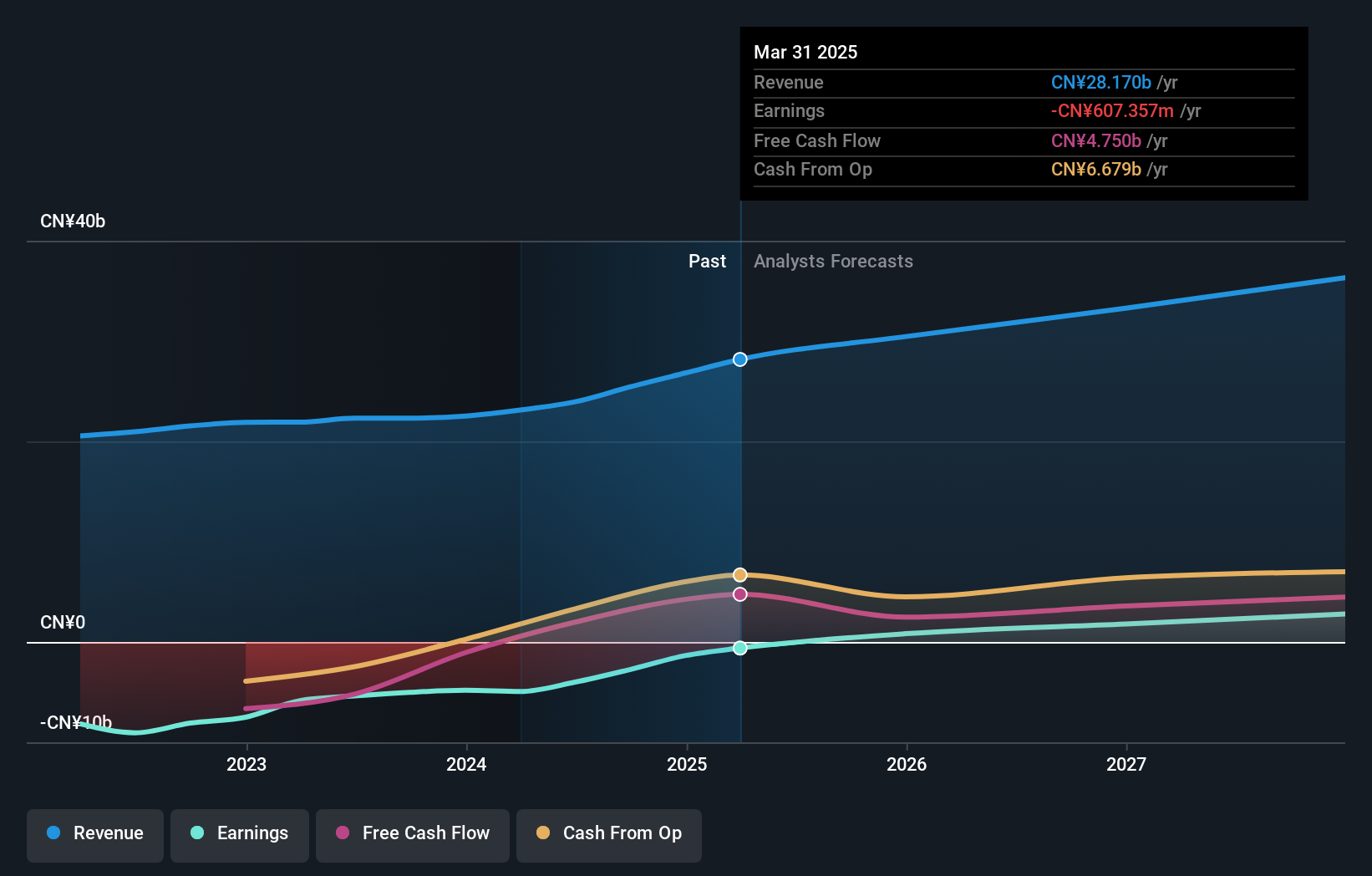

Bilibili's recent financial performance and strategic maneuvers reflect a nuanced trajectory in the high-growth tech sector. In Q3 2024, the company significantly reduced its net loss to CNY 79.52 million from CNY 1,351.44 million year-over-year, alongside a robust revenue increase to CNY 7.31 billion from CNY 5.81 billion, signaling improving operational efficiency and market expansion. Notably, Bilibili has committed to a $200 million share repurchase program, underpinning confidence in its financial health and future prospects despite current unprofitability. This move, coupled with an expected annual earnings growth of 65%, positions Bilibili intriguingly as it navigates towards profitability within three years amidst competitive pressures in the interactive media landscape.

- Get an in-depth perspective on Bilibili's performance by reading our health report here.

Explore historical data to track Bilibili's performance over time in our Past section.

Clearwater Analytics Holdings (NYSE:CWAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clearwater Analytics Holdings, Inc. offers a SaaS solution for automated investment data services to various sectors globally, with a market cap of $6.95 billion.

Operations: Clearwater Analytics Holdings generates revenue primarily through its SaaS solution, which automates investment data aggregation, reconciliation, accounting, and reporting for a diverse clientele including insurers and institutional investors. The company reported revenue of $424.36 million from this segment.

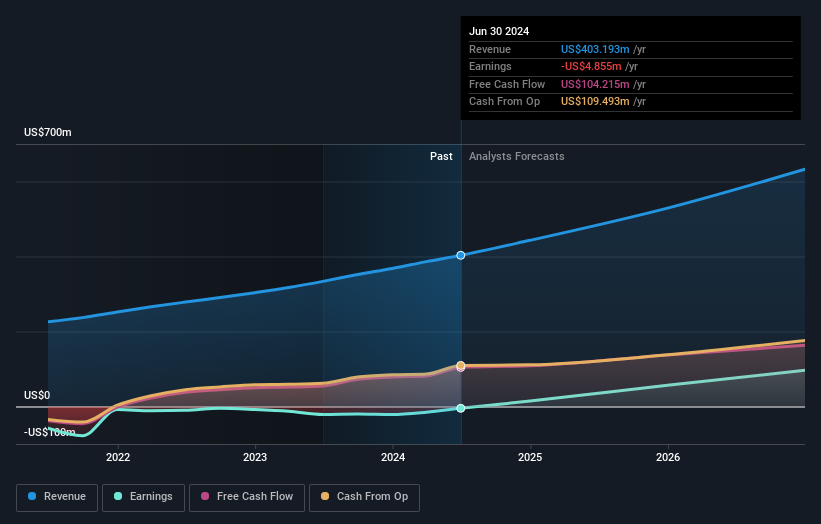

Clearwater Analytics Holdings has demonstrated a robust growth trajectory, with revenue forecasted to expand by 17.2% annually, outpacing the US market's 9% growth rate. This performance is underpinned by strategic client acquisitions like the Alameda County Employees' Retirement Association, leveraging its AI-enhanced platform for complex asset management. Moreover, Clearwater's earnings are expected to surge by an impressive 101.7% per year over the next three years, reflecting strong operational efficiency and market confidence in its financial health and innovative solutions in investment data management.

- Take a closer look at Clearwater Analytics Holdings' potential here in our health report.

Understand Clearwater Analytics Holdings' track record by examining our Past report.

Zeta Global Holdings (NYSE:ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $4.41 billion.

Operations: Zeta Global generates revenue primarily from its Internet Software & Services segment, totaling $901.40 million. The company focuses on providing data-driven solutions that enhance consumer intelligence and marketing automation for enterprises across various regions.

Zeta Global Holdings is navigating a transformative path in the high-growth tech sector, underscored by an ambitious revenue growth forecast of 15.8% annually, outstripping the broader US market's average of 9%. This growth is propelled by strategic leadership changes, notably with Pamela Lord's appointment enhancing their CRM capabilities, which could further invigorate Zeta's client engagement strategies. Despite current unprofitability, Zeta's aggressive R&D investment and expected profitability within three years reflect a proactive stance towards innovation and market expansion. The company’s recent legal challenges and allegations regarding data integrity practices have indeed cast shadows on its operational ethos; however, with robust annual earnings growth projected at 125.6%, Zeta appears poised to redefine its market standing through strategic realignments and technological advancements.

- Unlock comprehensive insights into our analysis of Zeta Global Holdings stock in this health report.

Summing It All Up

- Click here to access our complete index of 229 US High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet and good value.