- United States

- /

- Software

- /

- NYSE:WK

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In May 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable upswing, driven by strong earnings reports from major technology companies and ongoing discussions around tariffs, investors are increasingly focused on identifying opportunities within this fluctuating landscape. In such an environment, finding stocks that are trading below their intrinsic value can be particularly appealing, as they may offer potential for growth when broader market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trade Desk (NasdaqGM:TTD) | $53.63 | $106.20 | 49.5% |

| Lantheus Holdings (NasdaqGM:LNTH) | $104.34 | $204.26 | 48.9% |

| First Bancorp (NasdaqGS:FBNC) | $40.46 | $79.05 | 48.8% |

| SharkNinja (NYSE:SN) | $80.50 | $160.80 | 49.9% |

| Curbline Properties (NYSE:CURB) | $22.89 | $45.17 | 49.3% |

| Tenable Holdings (NasdaqGS:TENB) | $30.57 | $60.24 | 49.3% |

| BigCommerce Holdings (NasdaqGM:BIGC) | $5.18 | $10.35 | 49.9% |

| Verra Mobility (NasdaqCM:VRRM) | $21.80 | $43.13 | 49.5% |

| CBIZ (NYSE:CBZ) | $68.10 | $133.65 | 49% |

| Roku (NasdaqGS:ROKU) | $68.18 | $135.82 | 49.8% |

Here's a peek at a few of the choices from the screener.

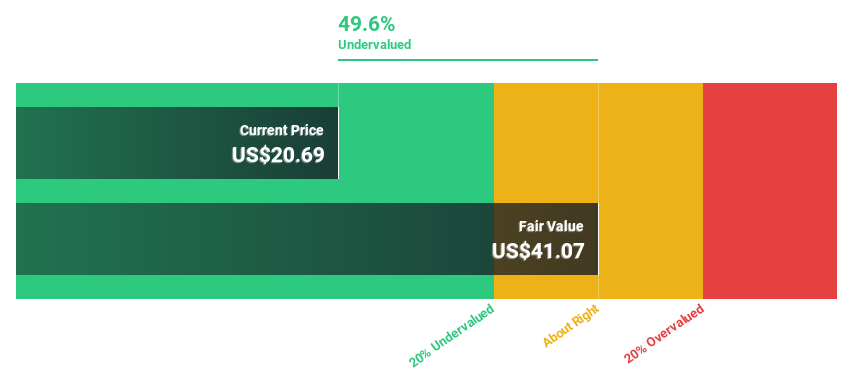

Inspire Medical Systems (NYSE:INSP)

Overview: Inspire Medical Systems, Inc. is a medical technology company that develops and commercializes minimally invasive solutions for obstructive sleep apnea, with a market cap of approximately $4.76 billion.

Operations: The company's revenue segment is primarily derived from Patient Monitoring Equipment, totaling $802.80 million.

Estimated Discount To Fair Value: 28.9%

Inspire Medical Systems is trading at US$158.38, significantly below its estimated fair value of US$222.77, highlighting potential undervaluation based on cash flows. The company recently turned profitable with net income reaching US$53.51 million for 2024, reversing a previous loss. Earnings are projected to grow substantially at 26% annually over the next three years, outpacing the broader U.S. market's growth rate of 14.2%.

- According our earnings growth report, there's an indication that Inspire Medical Systems might be ready to expand.

- Click here to discover the nuances of Inspire Medical Systems with our detailed financial health report.

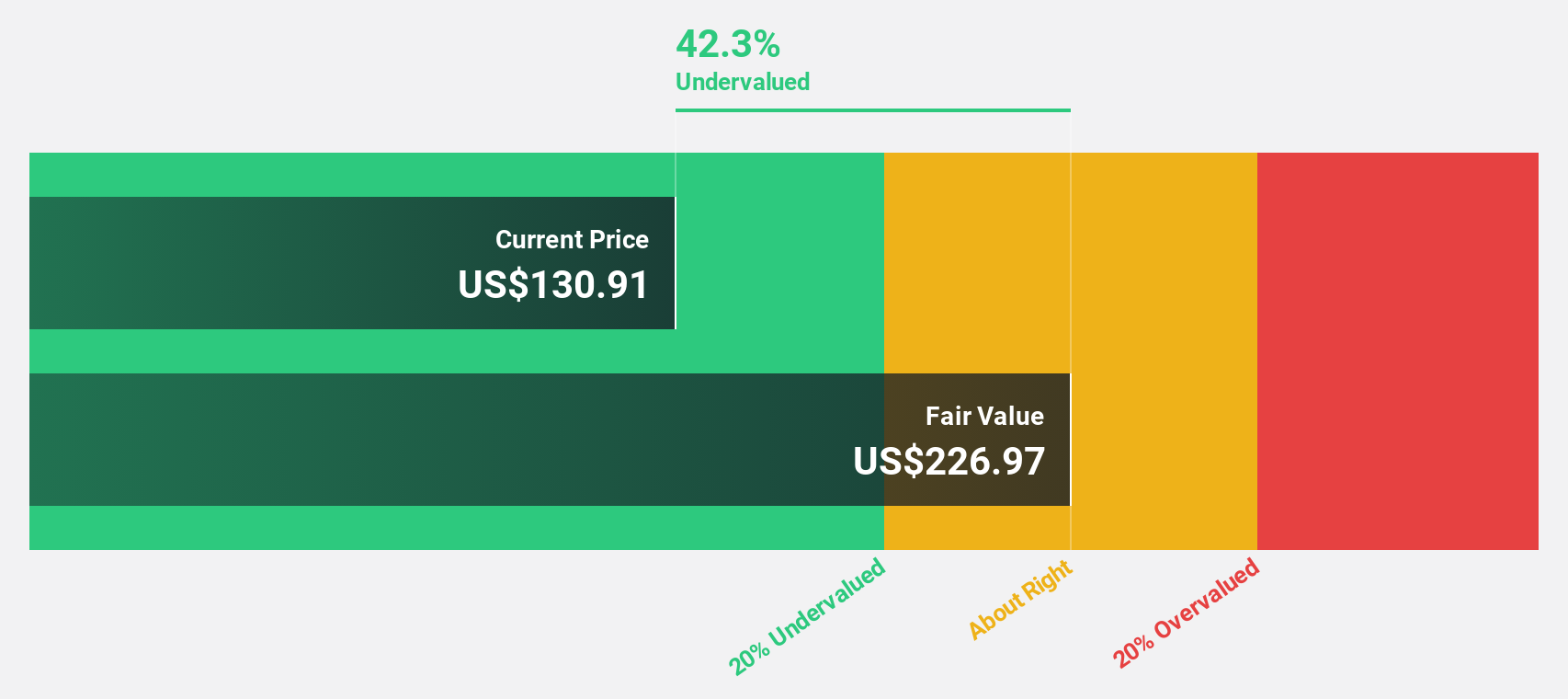

MINISO Group Holding (NYSE:MNSO)

Overview: MINISO Group Holding Limited is an investment holding company that operates in the retail and wholesale sectors, offering lifestyle and pop toy products across China, other parts of Asia, the Americas, Europe, Indonesia, and internationally with a market cap of approximately $5.40 billion.

Operations: The company's revenue is primarily derived from the MINISO Brand (excluding Africa and Germany) with CN¥16.02 billion and the TOP TOY Brand contributing CN¥997.38 million.

Estimated Discount To Fair Value: 48.2%

MINISO Group Holding is trading at US$18.03, significantly below its estimated fair value of US$34.83, suggesting undervaluation based on cash flows. Despite a dividend not well covered by free cash flows, earnings are forecast to grow at 18.94% annually, outpacing the U.S. market's growth rate of 13.7%. Recent share buybacks further indicate management's confidence in the company's value and future prospects amidst ongoing revenue growth and strategic expense control efforts.

- The analysis detailed in our MINISO Group Holding growth report hints at robust future financial performance.

- Take a closer look at MINISO Group Holding's balance sheet health here in our report.

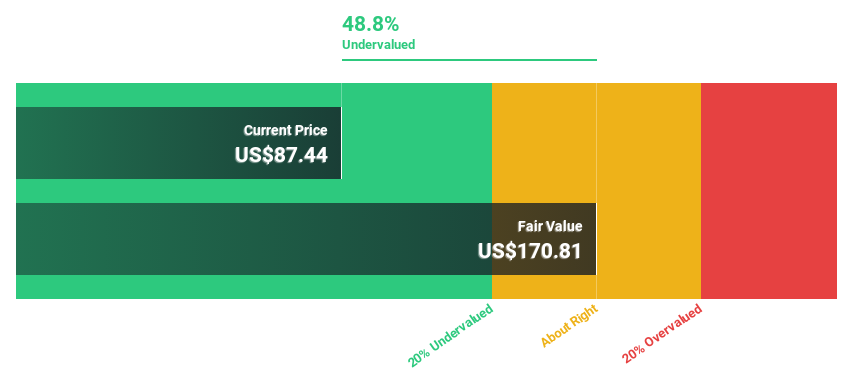

Workiva (NYSE:WK)

Overview: Workiva Inc., along with its subsidiaries, offers cloud-based reporting solutions globally and has a market cap of approximately $4.15 billion.

Operations: Workiva's revenue primarily comes from its data processing segment, which generated approximately $738.68 million.

Estimated Discount To Fair Value: 26.5%

Workiva, trading at US$75.27, is significantly undervalued compared to its fair value estimate of US$102.46, reflecting a more than 20% discount based on cash flows. Despite a net loss last year, revenue grew to US$738.68 million and is projected to increase by 13.7% annually, surpassing the U.S. market's average growth rate of 8.2%. Expected profitability within three years and high forecasted return on equity further enhance its investment appeal.

- In light of our recent growth report, it seems possible that Workiva's financial performance will exceed current levels.

- Get an in-depth perspective on Workiva's balance sheet by reading our health report here.

Taking Advantage

- Access the full spectrum of 189 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives