- United States

- /

- Software

- /

- NYSE:U

As Unity Software's (NYSE: U) Share Price Rises, Insider Selling Continues

Shares of Unity Software ( NYSE: U ) have now risen some 80% since the May low, and are just 16% below last December's all-time high. Shareholders and potential investors may want to take note of the fact that company insiders have continued to sell shares as the share price has risen.

In the last two weeks, three company insiders have lodged intent to sell forms , for a total of 278K shares of Unity Software. Amongst the insiders are CEO John Riccitiello who intends to sell 217K shares, or about 6% of his holding. Insiders currently own 2.1% of the company, or just over 6 million shares. In the last 12 months they have sold another 1.4 million shares.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Unity Software

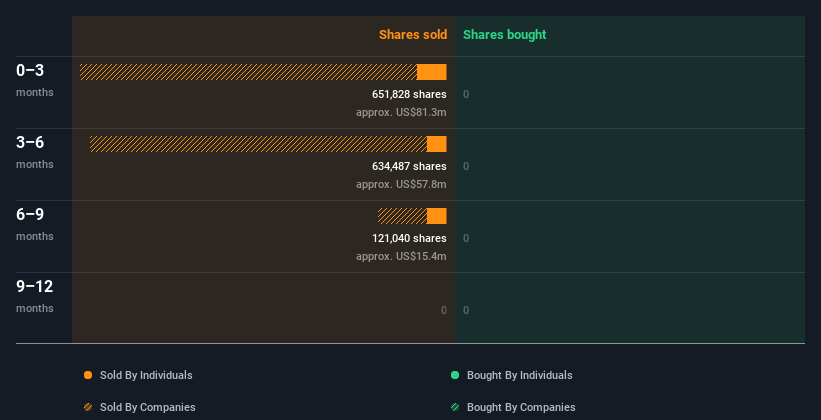

Unity Software Insider Transactions Over The Last Year

Insiders in Unity Software didn't buy any shares in the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date! You will notice that the largest insider sales have been made by private equity funds that owned shares before Unity’s IPO.

It’s always nice to see some big insider buys when considering investing in a company. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership of Unity Software

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Unity Software insiders own about US$809m worth of shares (which is 2.1% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Unity Software Insider Transactions Indicate?

Unity has only been listed for around a year, and it's understandable that insiders may want to diversify their investments. But the consistent selling by insiders may indicate that people close to the company believe the share is fully valued. Notably, some large sales occurred below $100.

It’s difficult to place a value on a company like Unity, but at a price-to-sales ratio of 42X, the current price is discounting a lot of future growth. The company’s revenues are growing in the mid 40% range, but with an operating margin of minus 52%, the company needs a lot more scale to become profitable. Cash flows are expected to remain in negative territory until 2024 at the earliest.

On the positive side, Unity serves several rapidly growing markets - so it is feasible that growth may accelerate in the future. The company also has a strong balance sheet, with enough cash to handle the cash burn, and no debt.

Unity also has relatively strong support from institutions, and it would be good to see this increasing as private equity funds decrease their holdings. Our analysis of Unity Software includes an ownership breakdown to help you keep track of the major shareholder groups.

Of course, you might find a fantastic investment by looking elsewhere . So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)