- United States

- /

- Software

- /

- NYSE:RSKD

Accolade And 2 Other US Penny Stocks With Growth Potential

Reviewed by Simply Wall St

As the U.S. stock market experiences a stumble in its recent rally, particularly with technology shares sliding, investors are keenly observing economic indicators and Federal Reserve policies for future direction. Amidst these fluctuations, penny stocks—though an older term—still represent a viable investment area for those interested in smaller or newer companies that might offer growth potential. By focusing on penny stocks with strong financial health and clear growth trajectories, investors can uncover opportunities that may provide both stability and upside potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.802475 | $5.67M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $167.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.72 | $143.18M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.22 | $8.3M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $4.90 | $702.04M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $51.81M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.952 | $85.54M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.84 | $424.98M | ★★★★☆☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Accolade (NasdaqGS:ACCD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Accolade, Inc. develops and provides personalized, technology-enabled solutions to help individuals navigate the healthcare system and workplace benefits in the United States, with a market cap of approximately $303.62 million.

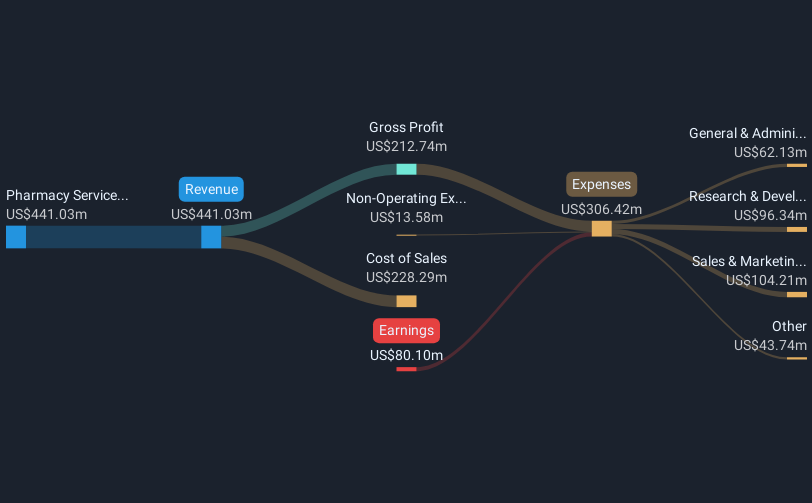

Operations: Accolade's revenue is primarily derived from its Pharmacy Services segment, which generated $441.03 million.

Market Cap: $303.62M

Accolade, Inc., with a market cap of US$303.62 million, presents both opportunities and challenges typical of penny stocks. The company has reported revenue growth, with recent quarterly sales reaching US$106.36 million, but remains unprofitable with a net loss of US$23.93 million for the same period. Its short-term assets exceed liabilities significantly, providing financial stability in the near term. However, shareholder dilution and ongoing losses highlight risks associated with its current valuation and profitability outlook over the next three years. Despite these challenges, Accolade's experienced management team continues to navigate the complex healthcare sector effectively.

- Dive into the specifics of Accolade here with our thorough balance sheet health report.

- Gain insights into Accolade's outlook and expected performance with our report on the company's earnings estimates.

Accuray (NasdaqGS:ARAY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Accuray Incorporated designs, develops, manufactures, and sells radiosurgery and radiation therapy systems for tumor treatment across various global regions, with a market cap of approximately $197.11 million.

Operations: The company's revenue is derived from its proprietary medical devices used in radiation therapy, totaling $444.20 million.

Market Cap: $197.11M

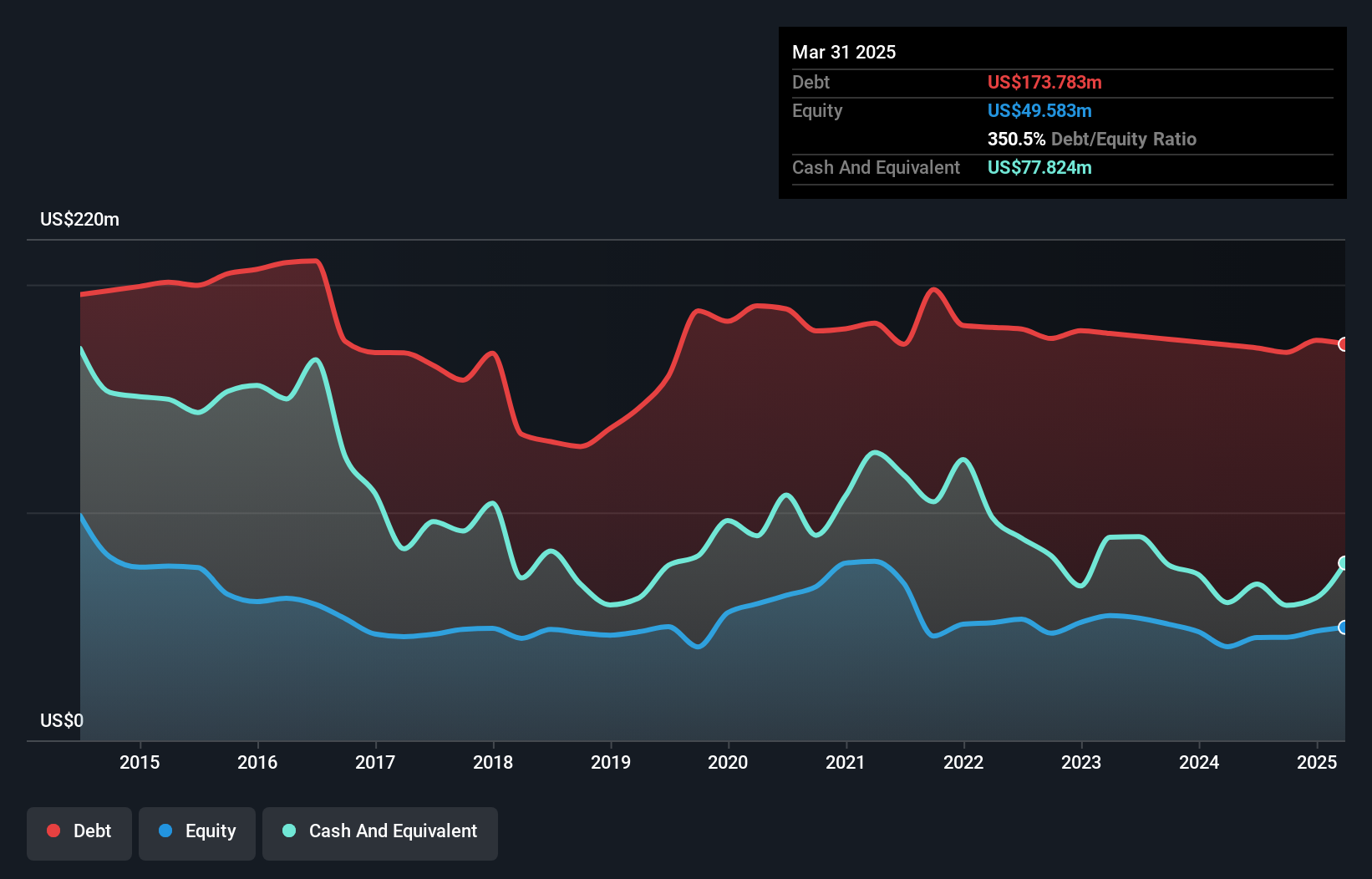

Accuray Incorporated, with a market cap of US$197.11 million, has shown resilience despite ongoing challenges typical of penny stocks. The company reported first-quarter revenue of US$101.55 million but remains unprofitable with a net loss of US$3.95 million. Accuray's short-term assets surpass both its long-term and short-term liabilities, indicating solid financial footing in the near term. However, shareholder dilution and high debt levels pose significant risks to investors. Recent executive changes and raised financial guidance for fiscal 2025 suggest strategic shifts aimed at improving operational performance amidst industry volatility.

- Take a closer look at Accuray's potential here in our financial health report.

- Examine Accuray's earnings growth report to understand how analysts expect it to perform.

Riskified (NYSE:RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. develops an e-commerce risk management platform for online merchants across various regions, with a market cap of approximately $769.42 million.

Operations: The company's revenue is primarily generated from its Security Software & Services segment, amounting to $318.05 million.

Market Cap: $769.42M

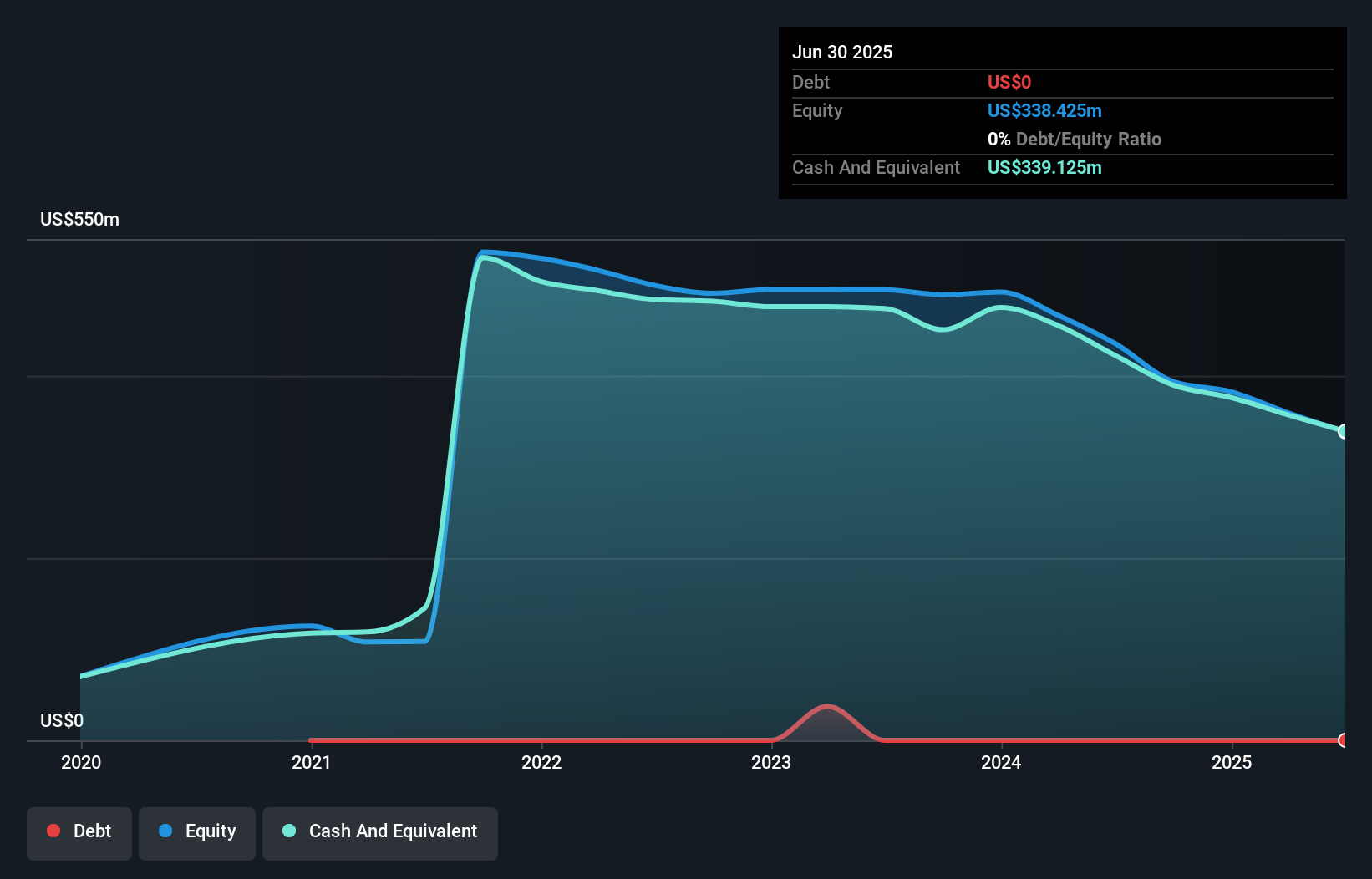

Riskified Ltd., with a market cap of approximately US$769.42 million, has demonstrated financial stability despite being unprofitable. The company reported a third-quarter revenue increase to US$78.85 million and reduced its net loss significantly year-over-year. Riskified maintains a strong cash position, allowing for over three years of runway without debt concerns, and has completed a substantial share buyback program worth US$65 million. The board's seasoned leadership and strategic focus on M&A to enhance growth indicate potential for future expansion, although profitability remains elusive in the near term according to current forecasts.

- Click here and access our complete financial health analysis report to understand the dynamics of Riskified.

- Explore Riskified's analyst forecasts in our growth report.

Summing It All Up

- Unlock more gems! Our US Penny Stocks screener has unearthed 710 more companies for you to explore.Click here to unveil our expertly curated list of 713 US Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSKD

Riskified

Develops and offers an e-commerce risk management platform that allows online merchants to create trusted relationships with consumers in the United States, Europe, the Middle East, Africa, the Asia-Pacific, and the Americas.

Flawless balance sheet and good value.