- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn, with major indices like the Dow Jones, S&P 500, and Nasdaq Composite facing declines led by large-cap tech stocks such as Nvidia and Tesla, investors are keenly observing alternative opportunities. Despite their vintage name, penny stocks remain an intriguing investment area for those interested in smaller or newer companies that may offer surprising value. By focusing on penny stocks with robust financials and clear growth potential, investors can potentially uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.30 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $103.25M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.84 | $6.43M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.90 | $234.98M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.25 | $8.83M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.85 | $86.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.59 | $49.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.62 | $22.53M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9125 | $76.47M | ★★★★★☆ |

Click here to see the full list of 732 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Talkspace (NasdaqCM:TALK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Talkspace, Inc. is a virtual behavioral healthcare company operating in the United States with a market capitalization of $510.15 million.

Operations: The company generates revenue from its Pharmacy Services segment, totaling $181.29 million.

Market Cap: $510.15M

Talkspace, Inc., with a market cap of US$510.15 million, is making strides in the virtual behavioral healthcare space despite being unprofitable. The company has reduced losses over five years and maintains a strong cash runway exceeding three years due to positive free cash flow. Recent strategic partnerships, such as with Espresa and Wisdo Health, enhance its service offerings and accessibility for workplace wellness and senior mental health care. Talkspace's revenue grew to US$47.4 million in Q3 2024 from US$38.65 million the previous year, marking significant progress towards profitability while trading below estimated fair value by 79.6%.

- Click here to discover the nuances of Talkspace with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Talkspace's future.

Ardelyx (NasdaqGM:ARDX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ardelyx, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing medicines for gastrointestinal and cardiorenal conditions, with a market cap of approximately $1.10 billion.

Operations: The company's revenue segment is primarily derived from the development and commercialization of biopharmaceutical products, totaling $251.85 million.

Market Cap: $1.1B

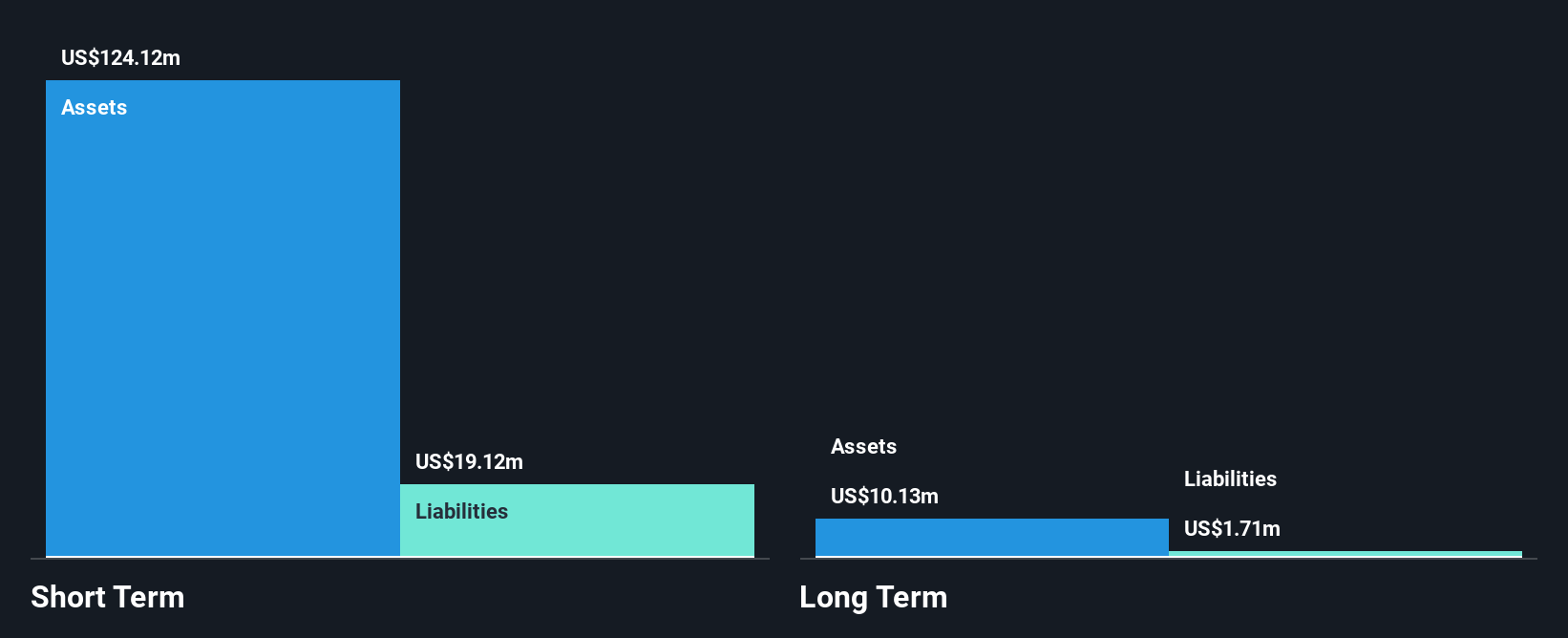

Ardelyx, Inc., with a market cap of US$1.10 billion, remains unprofitable but has shown progress by reducing losses at 10.5% annually over five years. The company is trading at 93% below its estimated fair value and benefits from a reduced debt-to-equity ratio, now at 79%. Ardelyx's recent earnings report highlighted revenue growth to US$98.24 million in Q3 2024 from US$56.39 million the previous year, despite a net loss of US$0.809 million for the quarter. XPHOZAH®, approved for chronic kidney disease patients on dialysis, represents significant potential within its product pipeline amidst ongoing volatility in share price and shareholder dilution concerns.

- Dive into the specifics of Ardelyx here with our thorough balance sheet health report.

- Examine Ardelyx's earnings growth report to understand how analysts expect it to perform.

Yatsen Holding (NYSE:YSG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yatsen Holding Limited, with a market cap of $462.24 million, develops and sells beauty products in China under various brands including Perfect Diary and Little Ondine.

Operations: The company generates CN¥3.32 billion in revenue from its operations within the People's Republic of China.

Market Cap: $462.24M

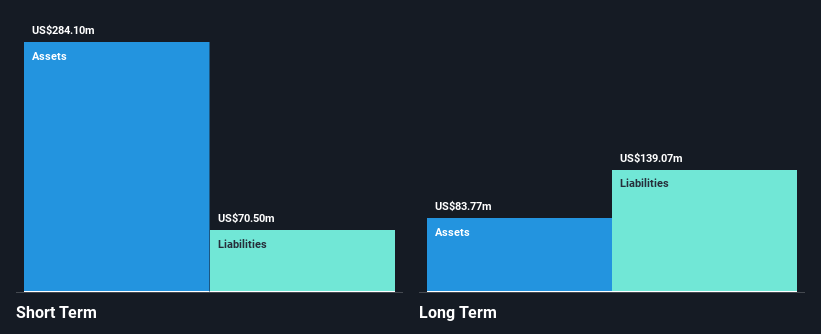

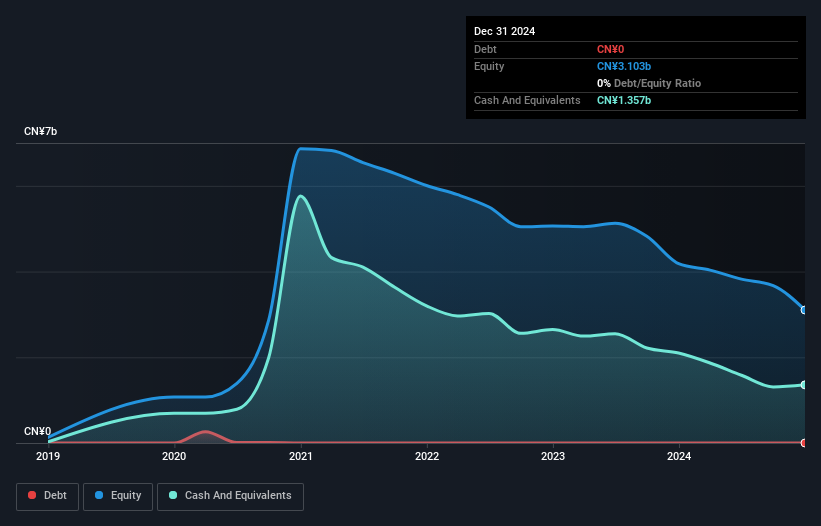

Yatsen Holding Limited, with a market cap of $462.24 million, remains unprofitable but has managed to reduce its losses by 22.9% annually over the past five years. The company's short-term assets of CN¥2.4 billion comfortably cover both its short-term and long-term liabilities, and it is debt-free. Recent earnings showed a decrease in sales to CN¥677.02 million for Q3 2024 from CN¥718.13 million the previous year, though net loss improved to CN¥121.07 million from CN¥196.54 million year-over-year. Financial guidance anticipates stable revenue growth for Q4 2024 amidst executive changes and ongoing operational challenges.

- Navigate through the intricacies of Yatsen Holding with our comprehensive balance sheet health report here.

- Explore Yatsen Holding's analyst forecasts in our growth report.

Summing It All Up

- Embark on your investment journey to our 732 US Penny Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARDX

Ardelyx

A biopharmaceutical company, discovers, develops, and commercializes medicines to treat gastrointestinal and cardiorenal therapeutic areas in the United States and internationally.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives